A year can be a long time in capital markets, with 2020 serving as a prime example! Once this article is published, it will be just over a year since the S&P 500 bottomed out on 23 March 2020 – having dropped by 34% since its peak (reached on 19 February 2020). Since then, the world’s bellwether equity index has gone on to rebound by 76% (as at the time of writing), surpassing last year’s all-time high by a significant 15%.

The scale of the COVID-19 pandemic-induced initial sell-off, the resultant global fiscal and monetary response, and the subsequent rally, have left heads spinning. Essentially, we have borne witness to a full cycle in the space of just 12 months – which the last time around took five and a half years to play out. Understandably, most market strategists have since pulled their total return expectations for the equity market in the year ahead down to the low single-digits.

Our view on the market’s prospects for 2021 is similar (see our market return expectations on page 4 of The Navigator – Anchor Strategy and Asset Allocation 2Q21), however we still see an opportunity to beat the performance of the broader market through a more proactive and selective approach to portfolio construction.

To avoid last year’s drawdown, or to benefit fully from the recovery that followed, would have required decisive and committed action from investors – the very same type of behaviour that often results in the destruction rather than the creation of value. Indeed, if you made no changes to your portfolio throughout the crisis, there is a good chance that you are now even better off than before.

Nevertheless, it is also difficult to ignore the more tactical investment opportunities that were created by the violent swings in investor sentiment as the pandemic progressed through its various stages. Many technology companies were perfectly positioned for a global lockdown, and their stock prices saw a severalfold increase. On the opposite end of the spectrum, hospitality businesses were priced as if they were facing their end. Unwavering optimism, and excessive pessimism, acted on opposite ends of the market simultaneously, creating pockets of opportunity that would yield returns far in excess of the broader equity market (and may still).

Although the start of 2021 has brought with it a degree of “normalisation” on both ends – that is, growth stocks have experienced somewhat of a pullback, and the physical economy stocks have rebounded meaningfully – the disparate pockets of stretched optimism and obstinate pessimism are still evident.

It is in this context that we have identified several tactical investment opportunities which, collectively, stand a good chance of beating the likely anaemic performance of global equity markets in aggregate over the next 12 months. In this article, we will take you through how we are currently leveraging this for our clients through Anchor’s 2021 Tactical Portfolio – which can be implemented as a segregated portfolio or as a carve-out in an existing solution.

TAKING A CALCULATED RISK ON A TRAVEL REVIVAL…

No sector was as obviously, or badly, impacted by the pandemic as the travel and hospitality industry. The abrupt and sweeping halt to the physical movement of people across the world would ground the global aircraft fleet, reduce hotel occupancy rates to zero, and cause cruise line bookings to evaporate.

Many businesses in this sector suddenly found themselves with no revenue, inflexible operating costs, and shrinking balance sheets – a formula that would likely end in near-term bankruptcy. Naturally, their stock prices would reflect this fast-approaching cliff’s edge, with share prices falling anywhere from 70%-90% in 2020.

Fortunately, rapid central bank intervention kept funding lines open (e.g., Norwegian Cruise Lines recently raised US$850mn in debt funding through senior unsecured notes at a rate of 5.9%) and global pharma has started distributing effective vaccines with government spearheaded vaccination programmes already underway in many countries.

Although near-term holidaying and business travel activity levels are still near all-time lows, we are starting to see signs of green shoots. Delta Airlines, the US’ largest domestic carrier, is set to end its pandemic policy on 1 May and will start booking middle seats again. Norwegian Cruise Lines’ cumulative bookings for 1H22 are actually ahead of 1H19 levels (pre-pandemic!), and its planned 2023 Around the World in 180 Days voyage sold out within one day of opening for sale to the general public on 27 January this year – with more than one-third of those bookings coming from first-time customers.

While many of these stocks have retraced a significant proportion of last year’s losses, they are still not pricing in normality – and the magnitude of their underperformance relative to the rest of the market over the past year is material.

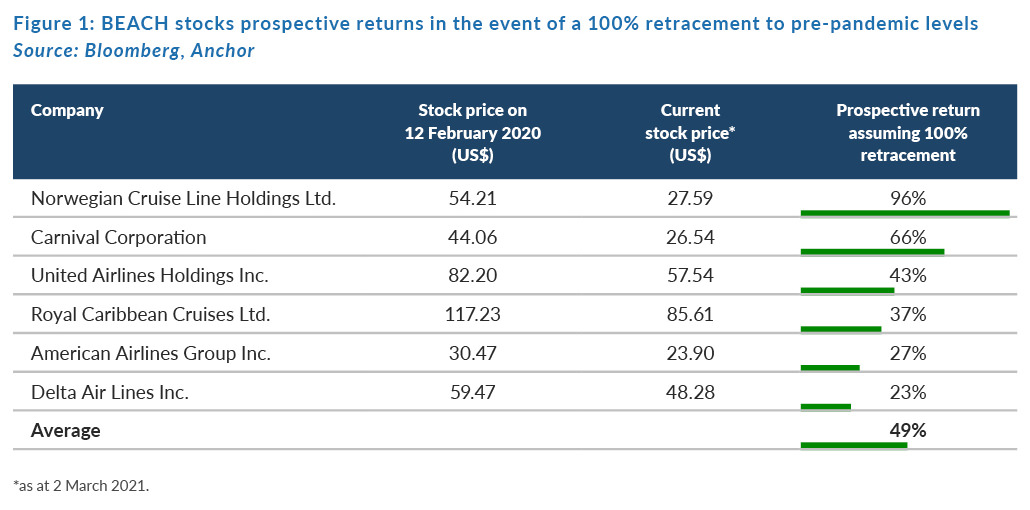

If one were to calculate the prospective returns in this sector, in the event of a complete retracement to February 2020 levels, the opportunity even on a risk-adjusted basis looks attractive. Even if these stocks retrace just half of their drawdown from last year until now, the resultant return will almost certainly beat the market.

None of these businesses are obvious investment opportunities at this point. They continue to face very real liquidity constraints should lockdowns persist. However, should our lives start to return to normal over the next year and should people start to move again – these stocks will very likely deliver strong double-digit returns from here.

Renowned business strategist Scott Galloway predicts that, once the pandemic subsides, the world may well experience a repetition of the early twentieth century’s Roaring Twenties – a period of mass consumerism, when the world spent excessively on experiences, travel, and the pleasures a free post-war world had to offer. We share this view and hence, on a risk-adjusted basis, we view a basket of suppressed travel and hospitality-related stocks as a good tactical opportunity.

BUYING INTO THE WEAKNESS ACROSS US FINANCIALS…

There is no doubt that the macroeconomic conditions that befell the US banking sector last year were less than ideal. Global lockdowns resulted in furloughs and layoffs (the US unemployment rate briefly spiked to its highest level since 1948 at 14.8%), raising concern among investors over the magnitude of credit book impairments that US banks would need to make. Additionally, the monetary response from the US Fed meant banks’ net interest margins (the profit earned from lending money) would compress in absolute terms.

Consumer credit providers looked to be in an even worse position given the unsecured nature of their loan books, and markets responded by pricing in gigantic reductions in book values.

As we have highlighted previously, however, the combined response from the US Federal Government and the Fed was both rapid and meaningful – with payroll protection programmes keeping US consumers afloat, while QE ensured access to capital for banks and credit providers.

The point here is, as one looks forward, the trajectory of the profitability of US financial institutions is now pointed back towards a level of normality – a factor that we do not believe is fully priced into the sector, as yet.

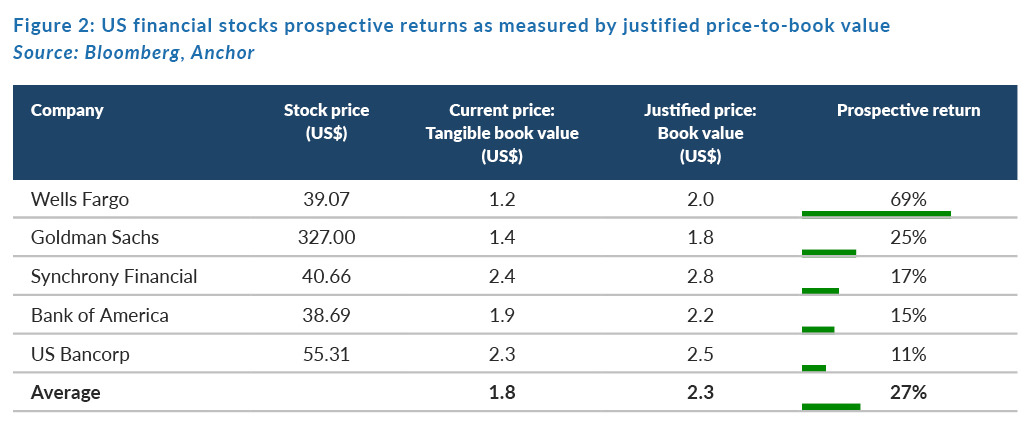

In fact, looking at the basket of US financial services firms in Figure 2 below, it appears to us as though they are still trading at meaningful discounts to their intrinsic values, assuming normalised levels of profitability.

Again, in the context of what will very likely be a flattish equity market over the next year, the prospect of healthy double-digit returns is appealing. Investing in a financial sector that still exhibits fundamental value (at a time when other parts of the market exhibit the opposite!), makes sense to us from a tactical perspective.

BIG TECH’S BIG UNDERPERFORMANCE…

The pandemic was not the exclusive driver of markets last year, with a global wave of anti-trust initiatives sweeping across the tech sector in response to an increasingly concentrated and uncompetitive landscape. While we have previously highlighted the negative investor sentiment stemming from government-driven anti-trust action in the tech sector earlier this year (see The Navigator – Anchor’s Strategy and Asset Allocation, 1Q21, dated 14 January 2021), the relative underperformance of big tech as compared to the broader tech sector has continued and, in some cases, has become even more pronounced.

Alibaba has not yet recovered from the brutal and intentionally embarrassing termination of Ant Group’s (formerly Ant Financial and Alipay) IPO, Tencent’s fintech operations have fallen into similar regulatory crosshairs and Facebook has only recently started to recover after falling out of favour with investors over its handling of misinformation and user data.

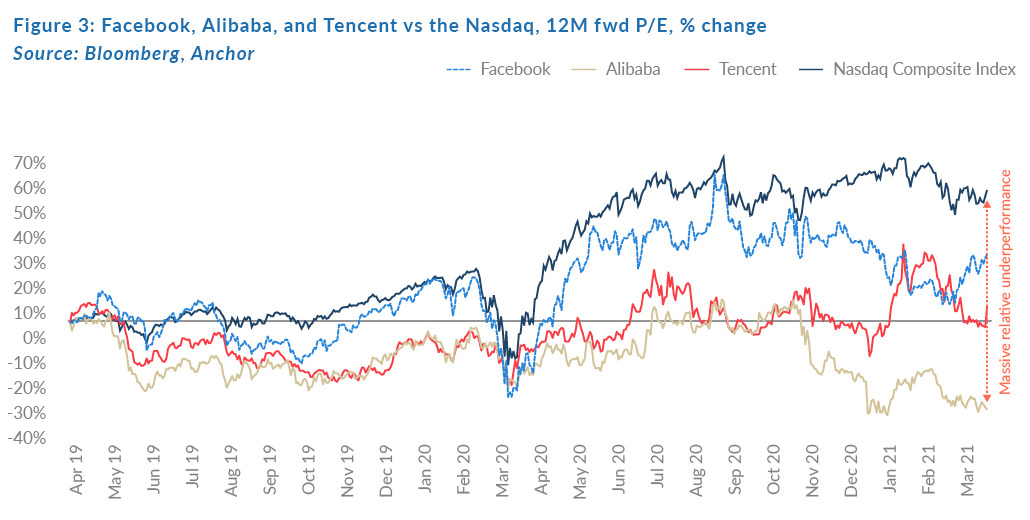

A great way to visualise the relative weakness across these counters is to chart the change in their forward earnings multiple as compared to the change in the broader tech sector’s forward earnings multiple (represented in Figure 3 by the Nasdaq Composite Index) over the past two years.

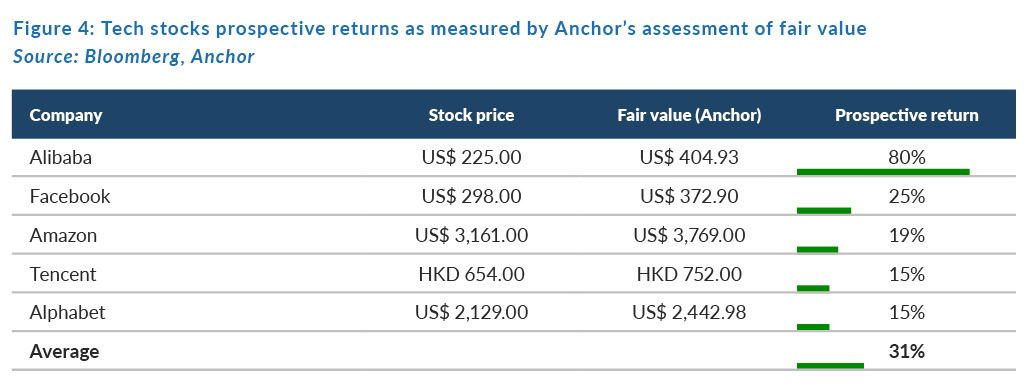

The relative weakness in their share prices stands in stark contrast to the stellar results reported by the underlying businesses, which have performed extremely well. Alibaba, Tencent, and Facebook grew their revenues by 36%, 26%, and 33% YoY, respectively, for 4Q20 on a comparable period that predated the pandemic! The point to make here is that not only do these shares exhibit relative value, but they also exhibit absolute value.

As the ratings of many companies in the tech sector stand out as being optimistic, or even vulnerable to correction, big tech looks like it is set up to beat the market over the next 12 to 18 months. We forecast very healthy double-digit returns from here, and we have positioned our portfolios accordingly.

RIDING THE MOMENTUM IN COMMODITIES…

Cyclical businesses have cyclical share prices, and the producers of hard commodities are one of the best examples. The complex interplay between longer-term structural supply and demand issues, and shorter-term shock factors, can be difficult to predict and can drive massive shifts in commodity prices in a short space of time. On top of commodity price volatility, the profitability of the producers of these commodities is generally leveraged to these movements – often creating significant trading opportunities.

Although we are c. one-year into the trade already, both iron ore and the platinum-group metal (PGM) prices are trending upward on the back of such a shift in market dynamics.

After years of underinvestment in production capacity by PGM producers in the face of weak prices, there was always the potential for a demand-side pickup to squeeze prices higher. As more stringent carbon emissions requirements across the globe necessitate ever-higher metal loadings in catalytic converters, this scenario has begun to play out.

Separately, a material proportion of the significant fiscal response to the 2020 COVID-19 pandemic by governments around the world has taken the form of infrastructure spending. The US alone has just passed a US$2trn infrastructure bill, with China’s additional infrastructure spending announced under their “Made in China 2025” national strategic plan estimated to total between US$2trn and US$2.5trn. This has created a surge in demand for base metals, including iron ore.

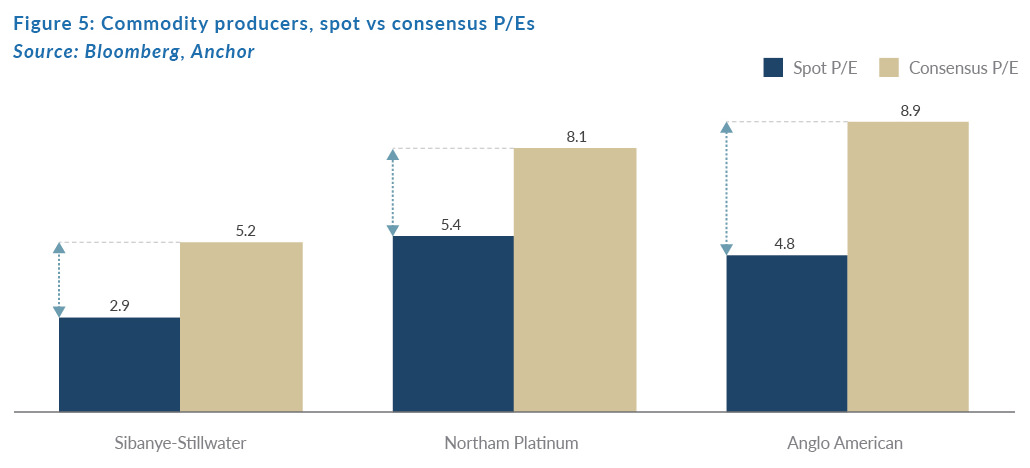

From an investor’s perspective, the important takeaway here is that the share prices of the producers of these commodities have not caught up to the appreciation in the prices of these commodities. In fact, analyst estimates are still well behind the numbers that producers such as Sibanye-Stillwater, Northam Platinum, or Anglo American will achieve should spot metal prices simply hold at their current levels. This implies a high level of market scepticism around the sustainability of current commodity price levels.

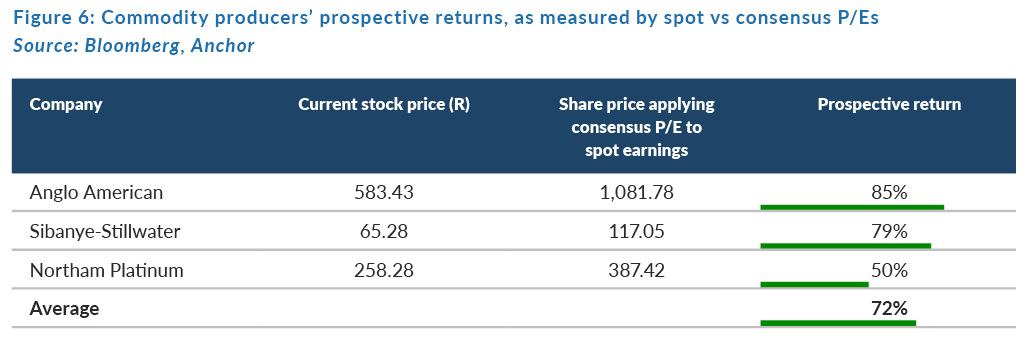

Figure 5 shows the significant difference between the earnings multiples at which these producers trade based on spot prices, as compared to the valuations implied by analysts’ estimates. The point to make here is, the longer commodity prices stay at current levels – the more likely it is that producer share prices will adjust upward as spot earnings multiples converge with consensus multiples.

Based on the principle described above, the potential upside to the producers identified in Figure 6 below is meaningful and hence we have included these counters in our tactical positioning.

Bear in mind that should iron ore or PGM prices turn down, the impact on these shares could be equally pronounced in the opposite direction. However, for now, the underlying supply/demand fundamentals seem supportive of the trade.

A TACTICAL APPROACH TO DIVERGENT SECTOR PERFORMANCES…

Although our total return expectations from global equity markets this year are subdued in aggregate, we expect to see divergent performances at a sector level. Your experience as an investor will be determined by your relative positioning in this context, and hence we believe an active, tactical approach will ultimately outperform the broader equity market over the next 12–18 months.

Low interest rates and thematic rotation were powerfully supportive forces at the growth end of the market in 2020, which may well normalise as the physical economy continues to recover into 2021.

While investment opportunities are not as plentiful or obvious as they were in the midst of the chaos last year, the aftereffects have not fully dissipated, and the associated price dislocations still appear to be attractive.

Our tactical investment approach to the year ahead incorporates the opportunities we have covered in this article and will continue to adapt to evolving market conditions.

For more information on Anchor’s 2021 Tactical Portfolio, please contact your relationship manager.