With some exceptions (e.g., China, Japan, etc.), most major global markets had a positive July. US markets ended the month with solid gains, although market volatility picked up towards the end of the month amid concerns about the momentum of the US economic recovery in the face of the spreading Delta variant. Added to that, China’s clampdown on technology (tech) businesses and lofty expectations for US corporate earnings weighed on sentiment. Nevertheless, the blue-chip S&P 500 notched up its sixth-straight positive month in July (+2.3% MoM/+17.0% YTD), while the tech-heavy Nasdaq added 1.2% MoM (+13.8% YTD), and the Dow Jones rose by 1.3% MoM (+14.1% YTD). The US Federal Reserve (Fed) held its benchmark interest rate near zero, with Fed Chair Jerome Powell saying that, while the US economy has come a long way since the pandemic-induced recession, it still has “some ways to go” before the Fed will consider adjusting its easy monetary policy.

On the US economic data front, 2Q21 GDP accelerated by 6.5% QoQ annualised, as economic activity continued to normalise post pandemic. Ignoring the 33% QoQ jump in US GDP growth in 3Q20, as the US bounced back from its worst-ever quarterly contraction in economic activity at the start of the pandemic (2Q20: -31.2% QoQ), 2Q21 was the strongest quarterly GDP rise in c. 20 years. Still, the number was nevertheless well below consensus economists’ forecasts of an 8.4% QoQ print. The Conference Board’s July consumer confidence soared to a 17-month high at 129.1 – households’ spending plans rose despite lingering concerns about higher inflation, suggesting that the US economy maintained its strong growth clip early in 3Q21. June core personal consumption expenditure (PCE) inflation advanced by 0.5% MoM, following May’s 0.4% MoM gain, while YoY June core PCE (the Fed’s preferred inflation gauge, which strips out volatile food and energy prices) jumped 3.5%, its highest level since 1992 and up from May’s 3.4% YoY gain.

Elsewhere, Europe’s largest economy, Germany’s DAX advanced by 0.1% MoM (+13.3% YTD), while the eurozone’s second-biggest economy, France’s CAC Index ended June 1.6% higher (+19.1% YTD). In terms of economic data, the eurozone emerged from a W-shaped recession in 2Q21, with stronger-than-expected growth of 2.0% QoQ (vs a 0.3% QoQ decline in 1Q21), according to the latest Eurostat data. This as COVID-19 restrictions eased, consumers started spending their built-up savings, and major companies reported stronger results. Other data released last week show eurozone unemployment at 7.7% in June, down from 8.0% in May, while inflation rose to 2.2% in July vs June’s 1.9% print.

The UK’s FTSE 100 Index ended July slightly lower (-0.1% MoM/+8.9% YTD), breaking a five-month consecutive winning streak. In economic data, the UK’s May GDP grew 0.8% MoM, weaker-than-expected and down from April’s 2% MoM surge. Meanwhile, UK trade numbers showed a further recovery in May as exports to the EU rose to the highest level since October 2019. However, imports from the EU remained weak. On 19 July, the UK lifted nearly all COVID-19 restrictions despite high infection rates (and rising). CNBC reports that to date, 87.9% of UK adults have received the first dose of a vaccine and 68.3% have received both doses. Having both doses greatly reduces the risk of infection and hospitalisation.

In Asia, the surge in regulatory risks in China on the back of a government crackdown on tech stocks resulted in a month of huge losses for that market. Hong Kong’s Hang Seng Index fell 9.9% MoM (-4.7% YTD), its worst month since August 2018. Three of the five most valuable shares in the Hang Seng are tech companies domiciled in mainland China – Alibaba, Baidu, and Bilibili. Meanwhile, China’s Shanghai Composite Index closed 5.4% lower MoM (-2.2% YTD). Investors remained cautious even after China’s regulators said its policy actions were meant to the improve the sector, with the country’s state-run media attempting to shore up sentiment by reporting that China remains open and supportive of its companies seeking a listing in offshore markets. In terms of economic data, China’s official manufacturing purchasing managers’ index (PMI) slowed in July, contracting to 50.4 from June’s 50.9 print (the 50-point mark separates expansion from contraction). Reuters writes that this was the slowest pace in 17 months as higher raw material costs, equipment maintenance, and extreme weather weighed on business activity.

In Japan, the Nikkei closed 5.2% lower MoM (-0.6% YTD) as uncertainty around the country’s economic rebound increased following a significant nationwide rise in COVID-19 cases and government’s decision to expand the pandemic state of emergency to four more prefectures. On the economic data front, Japan reported relatively strong 2Q21 data, before government started tightening COVID-19 restrictions once again as cases surged, with retail sales, industrial production, and employment all rebounding strongly in June.

On the commodity front, oil prices continued to march higher in July (+1.6% MoM/+47.4% YTD) as investors hoped that vaccinations would alleviate a resurgence of COVID-19 infections globally and keep oil demand growing faster than supply. After falling 7.2% MoM in June, gold gained 2.5% MoM in July (-4.4% YTD), on renewed signs that the US Fed may not taper economic support and hike rates in the near term. The yellow metal jumped c. 1.4% on 29 July after comments made by Fed Chair Powell that the Fed was “ways away” from considering interest rate hikes. Iron ore was down c. 10% MoM but is still 24.3% higher YTD. The price of palladium, which is used in catalytic converters to curb emissions by internal combustion vehicles, was down 4.3% MoM (+8.7% YTD) and the platinum price fell 2.2% MoM (-1.9% YTD).

On the JSE, South Africa’s (SA’s) FTSE JSE All Share Index recorded strong gains – up 4.1% MoM (+16.1% YTD) as commodity, metals, and materials counters drove the JSE higher. The Resi10 soared 11.8% MoM (+22.8% YTD), while the Indi-25 eked out a 0.9% MoM advance (+13.0% YTD). Financials were down 1.5% MoM (+7.0% YTD), while the SA Listed Property Index retreated by 1.1% MoM following its impressive performance in June. Still, the index remains 14.2% higher YTD. Looking at the top-20 shares by market cap, BHP Group, the biggest company on the JSE by market cap, jumped 12.2% MoM, while Kumba Iron Ore, Anglo American Platinum (Amplats), and Anglo American soared 21.5%, 16.3%, and 14.8% MoM, respectively. Richemont (+7.91% MoM) and Glencore (+7.88% MoM) also posted impressive gains. The regulatory crackdown in China weighed on Naspers and Prosus (the second-biggest share on the JSE) especially and these counters were down 5.9% and 7.3% MoM, in sympathy with the Tencent share price drop. MoM, the rand was 2.2% lower vs the greenback but on a YTD basis the local unit has strengthened by 0.6% vs the US dollar.

In SA, July 2021 will be remembered for the worst looting and unrest in the country’s history. The unrest engulfed KwaZulu-Natal (KZN) and parts of Gauteng during the week of 12 July in what appeared to be an insurrection aimed at undermining an already fragile economy and, in turn, President Cyril Ramaphosa’s administration. The riots followed the incarceration of former President Jacob Zuma, who faces a 15-month sentence on contempt-of-court charges after failing to abide by an order to testify at the state capture commission. It seems clear to us that this was a preplanned and coordinated attack on the very fibre of our young democracy. The eventual outcome was that the rule of law prevailed, the government has acknowledged the independence of the judiciary and, even in the face of strong political pressure to pardon the former president, politicians have not interfered with the judiciary.

In local economic data, June annual headline inflation, as measured by the consumer price index (CPI), came in at 4.9% YoY – down from May’s 5.2% print. Accommodation inflation edged higher, but we highlight that Stats SA records housing rentals every quarter, with the latest survey taking place in June (2Q21). This component accounts for a sizeable chunk (17%) of the inflation basket and includes actual and imputed rentals. Fuel also recorded its third-consecutive month of double-digit inflation, but these relatively high rates come off the low base in 2Q20, when fuel prices were depressed. This latest print continues to indicate that the current higher inflation numbers are indeed transitory and will continue to trend downwards for the remainder of this year as the low-base effects dissipate. As expected, at its July meeting, the SA Reserve Bank (SARB) kept interest rates unchanged at 3.5%. Overall, the tone of the statement was balanced in our view, despite a better-than-forecast 1Q21 economic growth rate of 4.6%, the SARB cited concerns around the impact of the recent unrest and its ensuing economic damage on investor confidence and job creation. As a result, it estimates that the unrest has fully negated the better 1Q21 growth, resulting in an unchanged 2021 GDP growth estimate of 4.2%. Overall, the SARB assessed the risks to SA’s medium-term domestic growth outlook to be balanced. June’s trade balance grew to a better-than-expected R57.7bn surplus vs a revised R54bn surplus in May. Exports increased 2% MoM to R166.5bn, mainly due to strong commodity prices, while imports declined slightly to R108.9bn.

On the pandemic front, the country moved to adjusted alert Level 3 on 26 July (from the amended Level-4 lockdown), as COVID-19 cases decreased. The restrictions that were lifted include that the sale of alcohol at retail outlets for offsite consumption will be permitted between 10AM and 6PM, Monday to Thursday and alcohol sales for on-site consumption will be allowed as per licence conditions up to 8PM. In addition, interprovincial travel could resume; non-essential establishments, such as restaurants, gyms, and fitness centres, can once again operate but must close by 9PM; gatherings are allowed but limited to 50 people indoors and 100 outdoors, with only 50 people allowed to attend funerals etc. The latest Department of Health data show that on 31 July, the total number of confirmed COVID-19 cases since the start of the pandemic stood at 2.45mn vs end-June’s 1.97mn. To 31 July, 7.56mn people have been vaccinated.

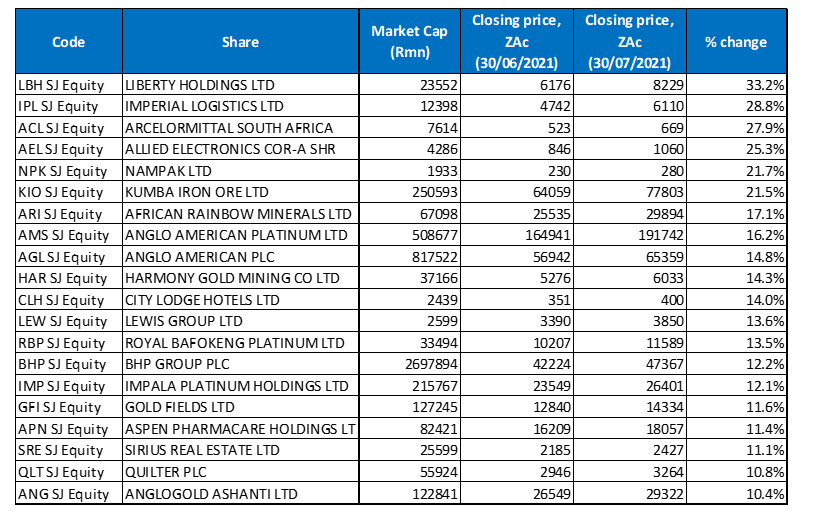

Figure 1: July 2021’s 20 best-performing shares, MoM % change

Source: Anchor, Bloomberg

Liberty Holdings (+33.2% MoM) was July’s best-performing counter as its share price jumped after Standard Bank said that it intended to acquire all the shares it does not already own in the company (it has a 54% stake in Liberty) for R11bn. Following the announcement, the Liberty share price at one stage leapt to a one-year high of R85/share on 15 July before retreating to close the month at R82.29/share. The deal is subject to shareholder and regulatory approvals and will result in the delisting of Liberty.

Another company which saw its share price rocket after a buyout offer is Imperial Logistics (+28.8% MoM), July’s second best-performing share. Dubai’s global supply chain Group, DP World said it would pay up to R12.73bn (c. US$887mn) to acquire all the shares in the company. Imperial Logistics, which provides logistical support across healthcare, consumer, automotive, chemicals, and industrial commodities, and has operations across 26 countries in Africa and Europe, will be delisted after the acquisition.

Imperial Logistics was followed by ArcelorMittal SA (AMSA; +27.9% MoM) – last month’s third best-performing share. The company returned to profitability in the six months to end-June (1H21), benefiting from higher steel prices that were lifted by the opening of the global economy and low supply-chain inventories. AMSA said in a statement that average international steel prices rose 79% in US dollar terms (and 42% in rand terms) during the period under review. The company reported earnings before interest, taxes, depreciation, and amortisation (EBITDA) of R3.2bn, the strongest in a decade (in 1H20 it suffered a loss of R1.25bn). Revenue soared 55% YoY to R18.6bn due to a 10% rise in total steel sales volumes and a 42% increase in net realised steel sales prices.

Allied Electronics (Altron; +25.3% MoM), packaging Group Nampak (+21.7%), Kumba Iron Ore (+21.5%), and African Rainbow Minerals (ARM: +17.1% MoM) followed AMSA. Nampak’s share price jumped 13.4% on Friday (30 July), its best level since February 2021, after the company said in a voluntary trading update that it had seen a major improvement in its quarter ending 30 June. According to Nampak, cash preservation and strong demand for its products meant that revenue was up c. 25% in the nine months to June. Nampak said it will release more detailed information in September, adding that it had remained within lenders’ covenants during the period.

Meanwhile, Kumba posted record 1H21 earnings, buoyed by soaring iron ore prices. Diluted HEPS nearly tripled to R73/share, while free cash flow (FCF) was much stronger YoY, at R112/share. Kumba’s formal dividend policy is to pay out 50% to 75% of earnings but, since the end of 2016, Kumba has paid out 92% of its earnings via dividends. That trend continued in these results and Kumba declared a dividend (R72.60/share) equal to 100% of record HEPS. As at 31 December 2020, Kumba had R23bn or c. R71/share of net cash on its balance sheet. The combination of excess cash and strong cash generation makes it likely that close to 100% of its earnings will continue to be paid out via dividends going forward.

Amplats (+16.2% MoM) posted record 1H21 earnings in July on the back of higher platinum group metal (PGM) prices, with adjusted EBITDA soaring 385% YoY to R63.3bn. The Group generated R176/share in diluted HEPS, all of which (and more) was converted into FCF of R182/share. The company said it would pay a R175/share interim dividend vs the R10.23/share paid in 1H20. Amplats’ formal dividend policy is to pay out at least 40% of earnings as a dividend. It started the year with R20bn or R74/share of net cash on its balance sheet and the Group’s strong balance sheet and FCF generation has allowed it to declare a dividend equal to c. 100% of earnings.

With a MoM gain of 14.8%, Amplats was closely following by Anglo American which also posted a record 1H21 profit on the back of bumper commodity prices. EPS totalled US$4.30/share of which US$3.31/share will be paid out in dividends and share buybacks. EBITDA totalled US$12.1bn – a record, according to Anglo’s CEO Mark Cutifani. The results were driven by strong PGM prices, iron ore, copper, and an improvement at De Beers. Of the US$12.1bn in EBITDA, US$7.9bn was on the back of commodity prices that were 62% higher YoY. By business segment, c. 75% of EBITDA was due to contributions from Kumba and Minas Rio’s iron ore businesses (US$4.91bn), and Amplats (US$4.38bn). As of 30 June, net debt totalled US$2bn – down US$3.5bn or 74% YoY because of attributable FCF of US$5.4bn.

Finally, Harmony Gold, which was June’s worst-performing share with a 28.7% MoM decline, rebounded in July, gaining 14.4% MoM, buoyed by the stronger gold price. In addition, the gold miner released a strategic update in early July, where it stated that, in addition to meeting its revised production guidance, it had also made advances with its Wafi-Golpu project in PNG, while the purchase of Mponeng from AngloGold Ashanti had been “a game-changer”. CEO Peter Steenkamp noted that Harmony managed “… to grow our gold ounces and de-risk our portfolio, while expanding our margins and improving our cash flows well into the future,”. He added that not only was Harmony now the “…largest gold producer in SA by volume, but we have a substantial surface source business with an exciting pipeline of both brownfield and greenfield opportunities, ….”.

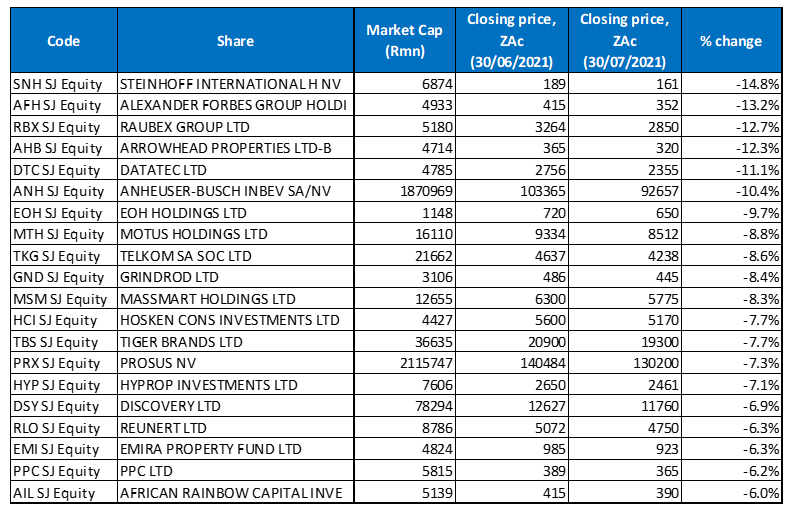

Figure 2: July 2021’s 20 worst-performing shares, MoM % change

Source: Anchor, Bloomberg

Steinhoff (-14.8% MoM) was July’s worst-performing share, following a court blow to the company’s settlement plans. In early July, a ruling by the Western Cape High Court threatened the company’s multibillion-rand settlement process after voiding Steinhoff’s guarantee of a 2014 bond, a main component of the firm’s settlement plan. The High Court also found that Steinhoff had violated the Companies Act when it restructured its debt in 2019 — a move which was critical to the Group’s plans for settling lawsuits. The claimants, Trevo Capital, successfully argued that Steinhoff had breached the Companies Act in a 2019 transaction in which it provided financial assistance to a related company. However, later in the month, Business Day reported that Steinhoff had increased the settlement offer (by 66%) it made to convince litigants to drop claims against it, with the company saying that it had achieved a better financial performance recently which enabled it to do so. The proposed increase is solely for market purchase claimants, who are ordinary shareholders, and asset managers who represent pension funds that owned Steinhoff shares. Alexander Forbes (-13.2%) was July’s second-worst performer and was followed by construction Group Raubex (-12.7%) in third spot.

Raubex was followed by Arrowhead Properties Ltd -B- (-12.3% MoM) and Datatec (-11.1% MoM). Arrowhead’s decline can most likely be attributed to the damage to some of their properties during the July unrest. In addition, Arrowhead had recorded a strong run in May (+1.5% MoM) and especially in June (when the share price was up by 9% MoM), following the potential pursuit from Fairvest (Fairvest offered to “acquire” Arrowhead B units).

Anheuser Busch InBev (AB InBev) was down 10.4% MoM. The company reported 2Q21 (to 30 June 2021) results on 29 July, which showed that sales rose 21% YoY and volumes were up 28% YoY, beating Bloomberg consensus analyst expectations of 19% sales growth and 24% volume growth YoY, respectively. However, profit missed consensus forecasts as raw material costs dragged gross profit margins lower. Revenues (in the company’s reporting currency – US dollars) are also still lagging, particularly in South America, where weak currencies have had a massive impact on revenue. The company maintained its FY21 guidance (of 8%-12% YoY EBITDA growth), but the share price fell c. 5% in US dollar terms on the day of the results announcement, as investors were likely hoping to see its guidance raised as the operating environment improved.

In July, Business Day reported that EOH Holdings (-9.7% MoM) could be blacklisted from doing business with the government as punishment for a tender fraud scandal that surfaced three years ago. Such a ban would be a major setback for EOH, which has been on a massive clean-up campaign under current CEO Stephen van Coller, after revelations surfaced of dodgy deals between its employees and public sector officials. About 20% of EOH’s annual revenue comes from the government. EOH also said in July that it is pursuing R6.4bn in lawsuits against four of its former directors for alleged involvement in fraudulent tenders.

Rounding out the ten worst-performing shares were Motus Holdings, Telkom, and Grindrod with MoM declines of 8.8%, 8.6% and 8.4%, respectively. Telkom’s share price took a hit after the company announced that CEO Sipho Maseko would step down at the end of June 2022, after more than eight years at the helm of SA’ third-biggest telecoms provider. Maseko, who is also an executive director of the Group, was brought to Telkom in 2013, when it was facing declining fixed-line voice revenue, the bulk of its business back then, as consumers were moving to mobile and data services. Under Maseko’s leadership, the mobile business grew to become the third largest in the country, with over 15mn customers, generating R20bn in revenue, according to Telkom.

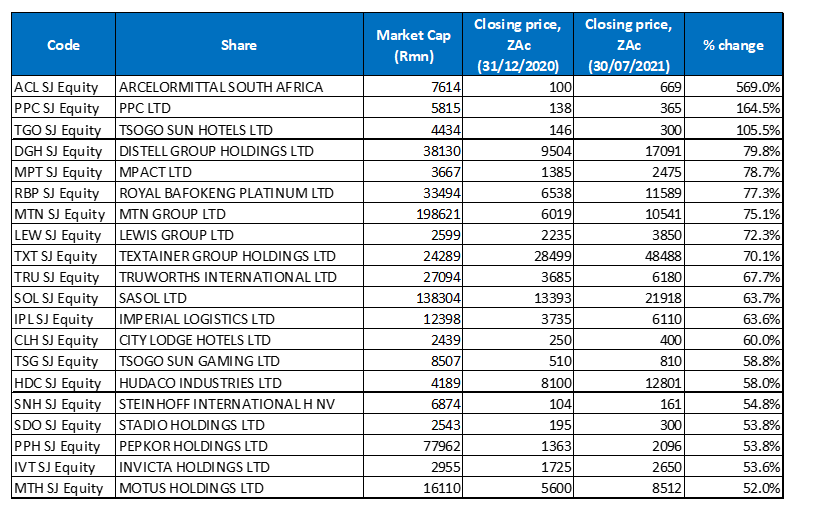

Figure 3: Top-20 July 2021, YTD

Source: Anchor, Bloomberg

Sixteen out of July’s top-20 YTD best-performing shares were unchanged from those in the year to end June, with the new entrants being Lewis Group (+72.3% YTD), Imperial Logistics (+63.6% YTD), City Lodge Hotels (+60.0% YTD), and Pepkor Holdings (+53.8%). These counters replaced Arrowhead, Foschini, Dis-Chem Pharmacies and Transaction Capital in July.

Still, the top-three best performing shares YTD were unchanged from June, with AMSA (+569.0% YTD) again taking the top spot, after its share price gained 27.9% in July. PPC (+164.5 YTD) remained in second position, despite a 6.2% MoM decline last month, while Tsogo Sun Hotels (+105.5% YTD), had another good run in July (it was up 6.0% MoM), as the lockdown level was eased late in the month.

Distell’s 2.3% MoM gain in July helped it move to fourth position in the rankings for the year to end July, with a 79.8% YTD gain, while the fifth position YTD is now occupied by Mpact (+78.7% YTD) – down from fourth spot previously. Mpact was followed by Royal Bafokeng Platinum (+77.3% YTD), and MTN Group (+75.1% YTD), which remained in seventh spot.

Furniture retailer, Lewis Group (+72.3% YTD) was the new entrant among the ten best-performing shares YTD, after its share price rose 13.6% MoM in July. Lewis released a voluntary update last month on the impact of the civil unrest on the Group’s operations. It said that 58 stores were looted and damaged and are currently not able to trade, including 54 stores in the ‘traditional’ segment across the Lewis, Beares, and Best Home & Electric brands and four UFO stores. At the height of the unrest, over 260 stores across the Group were closed as a precautionary measure to ensure the safety of employees and customers, and to minimise losses. Lewis has SA Special Risk Insurance Association (SASRIA) cover for losses arising from the riots.

Textainer Group (+70.1% YTD) and Truworths International (+67.7% YTD) rounded out the ten best-performing shares YTD. Truworths’ share price gained 7.1% in July after its African business (largely made up of its SA operations) posted better-than-expected FY21 sales growth of 5.5% YoY to R13bn. This was especially surprising considering the ongoing impact of the COVID-19 pandemic on the smart casual clothing retail trade as the work-from-home trend continues. Unfortunately, its UK business (Office), continued to underperform. Truworths Africa’s like-for-like (LfL) store retail sales rose 4.3% YoY, while the UK-based Office segment’s LfL retail sales declined 17.2% YoY to GBP192.8mn, because of prolonged store closures in the UK.

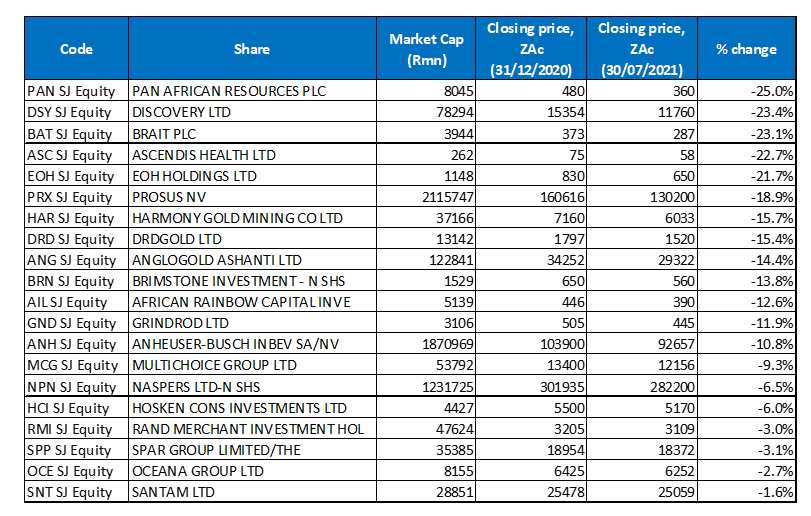

Figure 4: Bottom-20 July 2021, YTD

Source: Anchor, Bloomberg

Looking at the YTD worst performers, 15 of the 20-worst performing counters for the year to end June, once again featured among the 10 worst performers for the year to end July. Pan African Resources (-25.0% YTD) took the title of the worst-performing share YTD for a second month running, despite July’s much stronger gold price. It was followed by Discovery (-23.4% YTD) in second spot and investment Group, Brait (-23.1%), remaining in third position.

Perennial underperformer, Ascendis Health remained in fourth position, with a YTD decline of 22.7% after the share price was unchanged MoM in July. EOH Holdings (-21.7% YTD and discussed earlier) remained the fifth worst-performing share YTD.

It was a tough month for Prosus (down 7.3% MoM and 18.9% lower YTD), after China’s regulators cracked down on tech counters and online education in the private sector, impacting Tencent, the largest investment in the Group. Tencent’s share price is down c. 42% from the all-time high it reached in February this year.

Harmony (-15.7% YTD) gained some ground YTD, moving up from the second-worst performing share YTD to seventh position as the gold price firmed and the share rose by an impressive 14.4% MoM in July. DRDGold, AngloGold Ashanti, and Brimstone Investments, rounded out the ten worst-performing shares YTD, with share price declines of 15.4%, 14.4% and 13.8%, respectively.