The last month has seen the most brutal stock market crash that most investors have experienced. Since 18 February this year, the FTSE JSE All Share Index has declined by 35%. In comparison, the 2008 crash saw a 41% drop over nine months of extended hell. So, is it time to buy the crash? It’s brave and perhaps a little foolhardy to make any predictions amid the current madness but, for investors who can stomach further volatility, some once-in-a-lifetime buying opportunities are surfacing. Of course, it can get worse before it gets better, but unfortunately nobody is clever enough to time the exact bottom.

Importantly, and as Figure 1 below shows, the market always recovers. Even if there was another 10% drop, eventually markets snap back and capitulating now is, in all probability, exactly the wrong thing to do.

Figure 1: The FTSE JSE All Share Index performance, 2000 to date

Source: Bloomberg, Anchor

Wednesday (18 March) was particularly devastating on the JSE, with many share prices of credible companies falling by 10%-30%. This was particularly painful in the banking and property sectors and in those shares where the market is questioning whether balance sheets are strong enough to weather the current storm. On the day, some of the big movers were Nepi Rockcastle (-30%), FirstRand (-15%), Absa (-12%), Bidcorp (-13%), Impala Platinum (-24%), MTN (-13%), PSG (-26%) and Redefine (-20%). Devastating.

It seems very unlikely that these price drops are justified, and many shares are pricing-in Armageddon. While the 2008 crash was started by toxic lending in big global banks, this time around it’s about an expected sharp drop in demand due to COVID-19 fears and consumer hibernation. For many companies, this sharp drop in turnover will lead to losses and, for those that started the crisis overgeared, there can be a permanent loss of value (by having to have rights issues or having to sell their crown jewels at the wrong time). Some companies will face bankruptcy, and this is where authorities are stepping in to provide support.

Share prices are beginning to factor in the global consumer freeze lasting a very, very long time. Nevertheless, this will pass and things will return to normal, but the big question is when? If global trends follow China and the rate of infections slows due to “social distancing” and other measures, this will signal the start of a return to normality.

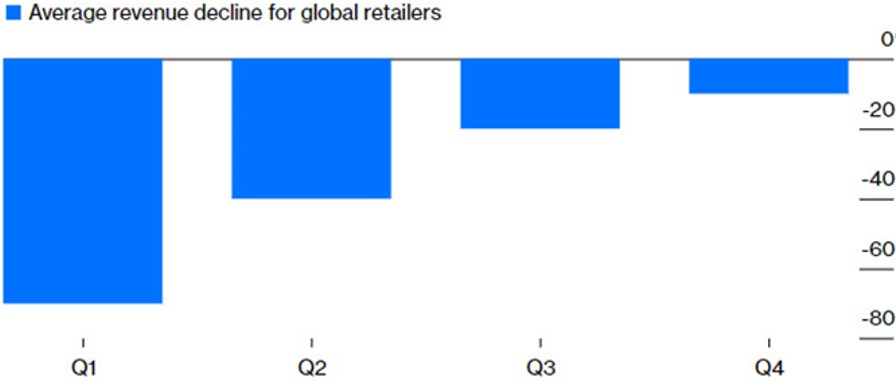

Figure 2 below shows the current and expected drop in sales for global retailers:

Figure 2: Ghost Malls: Sales are set to fall sharply as retailers close stores (%)

Source: SW Retail Advisors

Note that Q1 and Q2 are maximum estimated fall.

However, in this article we are focussing on SA shares. The 35% drop in the SA market is particularly severe for two reasons – first, the market has gone sideways for five years and the starting point was already cheap; and second, the rand has weakened by 18% YTD against the US dollar and about half of company earnings on the JSE are not rand-denominated. In comparison, the 31% drop in the S&P was from a high starting point at the beginning of the year (where returns last year were close to 30%).

In attempting to identify good entry points for SA shares, we have separated the opportunities into two categories. We certainly believe that investors should be focussed on quality companies and should emerge from this market move invested in the best companies.

Lower risk, with balance sheets to survive a period of low demand

These shares have typically not fallen as much, but many of them offer substantial returns when the world starts to return to normal.

- Naspers: Currently Naspers is at the greatest discount it has ever traded at (50%) and Tencent experienced a strong growth spurt prior to COVID-19 and now COVID-19 is helping the company as its huge gaming segment (and digital entertainment in general) benefits from people staying at home. Tencent’s turnover grew by 25% YoY, according to yesterday’s results.

- Transaction Capital: The company has been a strong compounder over the past few years and is set to continue this trajectory. It is currently trading at an 11x historic PE. The SA taxi industry has had little impact from the virus as people simply still need to travel.

- MTN: Absurdly cheap and the share price has declined from over R90/share to R38/share this year. This company has strong, effectively annuity, earnings. Fears over the oil price impact on its Nigerian operations has dominated, but at this price you are getting Nigeria for free! We value SA alone at around R60/share. MTN also has a growing dividend in the region of R5, which equates to a 13% dividend yield.

- Discovery: The share price has fallen from R125 to R78 this year and we believe its prospects still look promising in an ever-changing environment. Discovery is a very high-quality company.

- Bidcorp: This global food services business is an exceptionally high-quality business but could face a tough next six months as restaurant demand vaporises. However, Bidcorp has a fair component of non-discretionary activity (hospitals, schools, army, prisons, etc.). Delivery companies also source food from Bidcorp. The share price has fallen from over R340/share to under R200/share and the balance sheet (debt of 1x EBITDA) can easily handle a short-term hiccup.

- FirstRand: This is the quality SA banking play and its share price has dropped from over R60 to R36 this year. It now trades at a dividend yield of over 8%.

- Retail shares: This is a particularly tough space, and many share prices are down 40% or more. The real value is in Truworths, which is trading at an historic PE of 5.8x and a dividend yield of 12% (plus a share buyback programme) – we believe this share can perform strongly. For those who favour higher quality and just cannot get themselves to buy Truworths, Mr Price also looks enticing at a 11x historic PE and 12.8% of its market cap is in cash. The more expensive drug retailers (Dis-Chem and Clicks) have come off less, but also present attractive entry points.

- Smaller caps: Our base case is to buy bigger high-quality companies, but two smaller-cap companies stand out – Alviva and Curro. Alviva, which made R3.50 in earnings last year and is trading at less than R6/share. Earnings might decline to R2 this year, but that’s still a 3x PE on low earnings! We are comfortable with the balance sheet and, while this is a small-cap share, it does R15bn in turnover and demand for IT hardware and services is not going to disappear. Curro’s valuation is also approaching the absurd. In our view, this company can deliver HEPS of over R1.50 in a few years and is now trading at R6/share.

Shares of companies with higher levels of operational or balance sheet risk, but we think will handle a reasonable period of disruption

These shares have more upside than the first category, but need to be carefully monitored on an ongoing basis.

- Investec: Investec is just too cheap. It is trading at less than 0.5x book and that without adding its increased stake in Ninety One Plc (N91).

- Sibanye/Impala Platinum/Northam Platinum: This is more risky territory and demand has fallen off a cliff as global new car sales have declined by close to 10% YTD and by over 80% in China. However, if the world recovers, the global shortage of palladium will see prices rise again and these miners are trading at 2x–4x spot PE valuations.

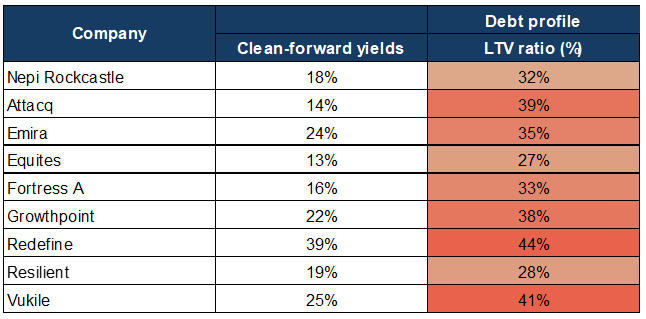

- Property shares: The property market has been decimated and share prices of big property companies are down 40%-70%. The market is still trying to digest the impact of mall visits declining and subsequent retail tenant profit pressures. This could impact short-term dividends materially in some cases, but the worst-case scenario appears to be priced in. Balance sheets are important and in Figure 3 below we show clean forward dividend yields, many of which have never been seen at these levels before. Our pick is Growthpoint, which is the quality choice and trading at a forward 22% yield.

Figure 3: Property shares

Source: Bloomberg, Anchor

It is clear to us that there are currently very attractive entry points into quality businesses on the market. These businesses could very well get cheaper still, but we believe that in SA we have reached the point of starting to deploy new capital in a measured fashion.

Bonds

Global markets are reacting to the COVID-19 virus far quicker and harsher than we could have imagined in our worst nightmares. While this started as an equity sell-off in the US, it quickly became a liquidity squeeze that has seen the US Federal Reserve institute over $1trn in emergency liquidity lines to US financial institutions. Unfortunately, getting the cash from banks, that can access the liquidity lines, to market participants that are facing margin calls and investor redemptions is not that easy. For now, it seems that the liquidity pressures in the US are abating. At the time of a margin call you sell what you can to meet the margin requirement. That means US treasuries, which is why US yields have started to push higher. You also sell riskier investments, where you can find an exit. The SA bond markets are some of the most liquid and developed in emerging markets (EMs) and, as a result, we have seen investors selling over R45bn of local bonds. This is an incredible volume of bonds for the SA markets to absorb in a mere two weeks. Market makers are obliged to show prices for the bonds and, at a time of desperate sellers, it doesn’t matter how ridiculous the price, the bonds are being sold.

The market has completely lost sight of fundamentals as the flow of bonds keeps driving bond prices lower. At one stage on Wednesday, six-year government bonds were trading at a yield of 11%. That is the equivalent of CPI plus 6.5% from a six-year government bond. This is even more ridiculous when you consider that SA fuel prices and CPI are set to drop significantly from next month. Only two short weeks ago, clients were asking how they could earn a guaranteed income of 10%. Now the government will guarantee you a return of up to 11% for six-year investments. We find this to be an incredibly attractive opportunity to lock-in high yields at a low risk for clients and we have been gradually increasing our exposure to government bonds. We are doing this in a staged and measured process over time as yields have been getting ever more attractive in the last few weeks. We do not expect this opportunity to persist for too long and we believe that fundamentals will again dominate once the forced selling out of the US stops. Until then, we expect bond prices to remain under pressure thus giving us an opportunity to really lock into the attractive guaranteed returns currently on offer.