US and global markets concluded a tumultuous 2018, and a very difficult year for investors, as the major stock indices posted their worst yearly performances since the global financial crisis (GFC). The ongoing trade disputes between the US and China, slowing US growth (as the stimulus from President Donald Trump’s unfunded tax cuts wears off), stretched valuations, rate hikes, unrelenting geopolitical issues and US political uncertainty saw severe global market volatility for most of 2018. Trump’s populist posturing seems finally to be catching up with him as his administration represented a revolving door of appointments, dubious policies and his closest allies fell under an avalanche of indictments with the shadow of prosecution at the hands of Special Counsel Robert Mueller hanging over the president himself. Trump’s petulant behaviour is also set to be stymied by the incoming majority House Democrats. In addition, his trade war against China and continued criticism of Federal Reserve (Fed) Chair Jerome Powell (his own choice for the post), seems to have backfired as a steep stock sell-off continued in December and US markets closed 2018 significantly lower. A US government shutdown also began on 22 December – the prolonged dispute is primarily due to Trump’s demand for billions of dollars to fund his ridiculous election promise of building a wall along the US-Mexico border.

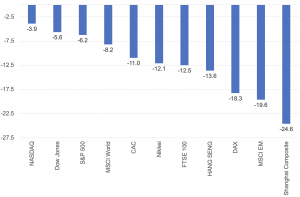

Meanwhile, the Fed’s December Federal Open Market Committee (FOMC) meeting raised the benchmark interest rate a quarter-point (the ninth hike of this cycle) but lowered its projections for future rate hikes (and its 2019 US growth forecast). Among the major US indices, a 9.2% MoM decline in December was enough to leave the S&P 500 down 6.2% YoY, with energy counters the worst performing S&P sector in 2018. The price of Brent crude oil continued a slide in December that saw it get close to $50/bbl – down over 40% from its October high and c. 20% YoY. Oil’s slump came despite the Organisation of the Petroleum Exporting Countries (OPEC) agreeing in early December to higher-than-expected production cuts and the US reporting larger-than-expected inventory drawdowns during the month. Fears around the impact of slowing economic growth on the demand for oil, seemingly outweighed the positive supply news. Meanwhile, the Dow Jones Industrial Average fell by 5.6% YoY and the tech-heavy NASDAQ dropped 3.9% – its worst year in a decade and snapping a six-year winning streak, according to CNBC. Tech stocks including Apple (-11.7 MoM), Amazon (-11.1% MoM), Netflix (-6.5% MoM) and Alphabet (Google; -5.8% MoM), which drove the Nasdaq higher for the last couple of years, pulled the index lower in December. Unfortunately, as the adage goes, when the US sneezes the world catches a cold and with US markets faltering towards year-end, global markets (with the exception of a few major markets including India and Brazil) followed suit, closing the year in negative territory.

European bourses also closed broadly lower for the year. This as Brexit remained the biggest worry for the region’s markets and halfway through last year the fourth-largest economy in the eurozone, Italy’s 2019 draft budget was in serious breach of EU spending rules, leading to an unprecedented rebuke from the EU. Violent protests also gripped France late last year and German Chancellor Angela Merkel decided not to seek re-election as CDU party leader, likely taking comfort from her intention to remain chancellor until Germany’s next federal election in three years. YoY, Germany’s DAX dropped by 18.3% YoY, while France’s CAC fell 11.0% YoY. Meanwhile, UK Prime Minister Theresa May had to cancel a planned parliamentary vote on the Brexit deal she’d negotiated with her European counterparts once it became obvious she didn’t have the support to get the deal approved. May survived a bid by her party to remove her as leader a few days later, but with c. 40% of her own party voting against her. The UK’s FTSE 100 dropped by 12.5% YoY as concerns over a no-deal Brexit increased. In terms of economic data, Germany and Italy’s economies unexpectedly contracted in 3Q18, with the German contraction (due to factory closures in its automotive sector) being the first since 2015. The eurozone purchasing managers’ index (PMI) also reached its lowest level since February 2016, and France’s PMI fell in December for the first time in two years.

In Asia, China’s benchmark Shanghai Composite Index, which entered a bear market around June, recorded a 24.6% drop in 2018 as the world’s second-largest economy felt the effects of a gloomy trade outlook and Beijing attempted to rein in risky lending after debt levels rose rapidly. CNBCreports that all 10 sectors of the Shanghai Composite were down significantly in 2018, with IT being the worst performer (-34% YoY) and even the best-performing sector, utilities, dropping by 11% YoY. Chinese 3Q18 growth (at 6.5% YoY) was also the lowest in c. 10 years. Hong Kong’s Hang Seng Index retreated by 13.6% for the year. Although Trump and China’s Xi Jinping declared a 90-day cease-fire at the start of December, commentators remained extremely skeptical about the chances of the two countries agreeing to a comprehensive trade pact. Finally, Japan’s Nikkei declined by 12.1% YoY with commentators noting that Japan is another casualty of the China/ US trade war (in September a Refinitiv poll found that one-third of Japanese companies are concerned about the prospects for their exports from China and the lower Chinese demand).

Select global indices performances 2018, YoY % Change:

Source: Bloomberg, Reuters, Yahoo Finance, Anchor