South Africa’s (SA) consumer price inflation (CPI) edged higher in July, underscoring the fragile balance between moderating price pressures earlier in the year and new cost escalations. Headline CPI rose to 3.5% YoY in July, up from 3.0% in June, marking the highest print since September 2024 (3.8%). On a MoM basis, prices increased by a notable 0.9%, primarily driven by food costs, municipal tariff adjustments, and higher fuel prices.

Food inflation remains the most significant pressure point. Annual inflation for food and non-alcoholic beverages accelerated to 5.7% YoY in July, from 5.1% in June, with meat, vegetables, and “other food” categories fuelling the uptick. Meat prices, particularly beef, are under considerable strain, climbing 10.5% YoY in July- the steepest pace since early 2025. This reflects ongoing disruptions from foot-and-mouth disease (FMD), which has reduced supply and kept costs elevated. Looking ahead, further outbreaks of animal diseases, including avian flu, could prolong these price pressures well into the third quarter. While global supply interventions (particularly from Brazil) may help stabilise markets later in the year, the immediate risk is that persistently high food prices continue to erode the spending power of lower-income households, who spend a disproportionately larger share of their income on food.

Utility tariffs delivered another sharp blow to consumers in July, when municipalities enacted their annual price adjustments. Water tariffs rose 12.1% in 2025, the largest increase since 2018, while electricity tariffs climbed 10.6%. Although the electricity hike is marginally lower than the 2024 adjustment (+11.5%), the cumulative effect of years of above-inflation electricity increases continues to weigh heavily on households and businesses. This year, new categories such as refuse collection (up 6.6%) and sewage removal (up 6.5%) were formally added to the CPI basket, further embedding the burden of essential services in inflation data. On top of this, new levies introduced by the cities of Tshwane and Cape Town added yet more strain, though these are currently being contested in court. Until a resolution is reached, however, they remain an additional source of upward pressure on household utility bills.

After four consecutive months of decline, fuel prices shifted direction in July, rising by 2.6% MoM. This uptick narrowed the annual rate from -11.2% in June to -5.5% in July. While fuel inflation remains negative compared with a year ago, the impact of favourable base effects is fading, signalling a possible return to upward pressure in the months ahead.

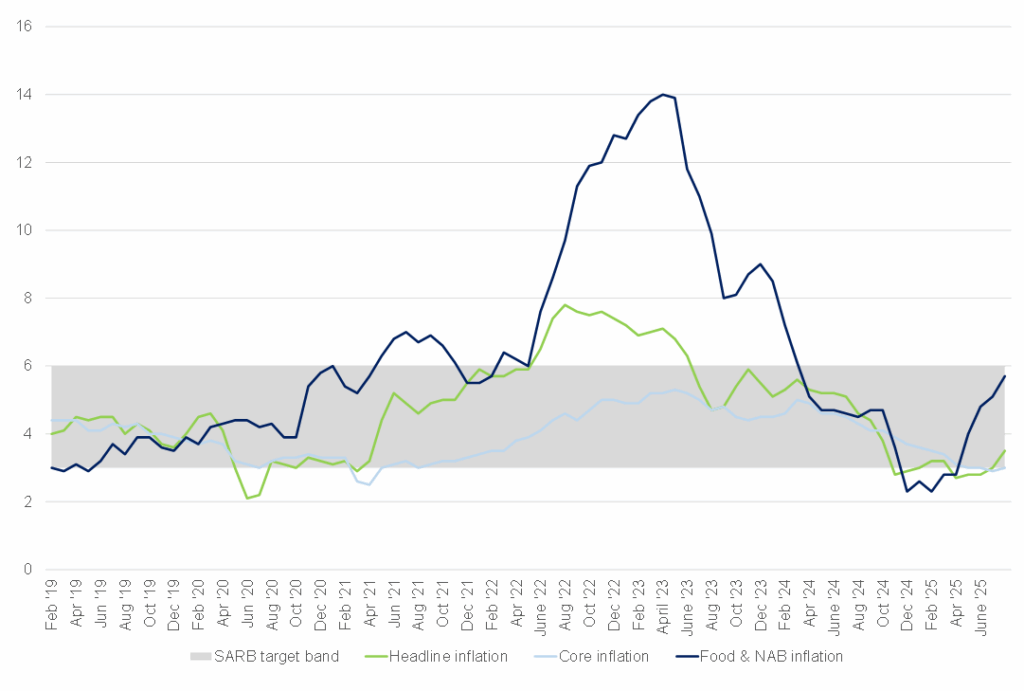

Figure 1: SA inflation, YoY % change

Source: Stats SA, Anchor

Taken together, these dynamics confirm that inflation is now on an upward trajectory. SA’s inflation averaged 3.0% in 1H25, firmly at the bottom end of the South African Reserve Bank’s (SARB) target band of 3%–6%. However, the July print confirms expectations that inflation would trend higher in the second half of the year. With food and fuel costs edging up from a low base and higher utility tariffs coming into effect, both the SARB and independent forecasts see inflation averaging closer to 3.7% in 2H25.

This comes at a time when the SARB has taken the bold step of officially adopting a 3% inflation preference, signalling its intention to anchor inflation expectations firmly at the lower bound of its previous target range. If inflation oscillates between 3% and 4%, as expected, the SARB could allow for a measured easing cycle. However, the balance of risks remains tilted to the upside, particularly given the persistence of food and administered price pressures. For South African households, the latest data underscore the squeeze on real disposable incomes. Elevated food costs disproportionately affect low-income groups, while higher municipal tariffs raise the fixed cost of living for all households, leaving less room for discretionary spending. This erosion of purchasing power dampens consumer confidence and slows retail demand, both of which are critical drivers of growth in an already fragile domestic economy.

Looking forward, several dynamics will shape the inflation trajectory in the coming quarters. Global oil prices remain a key swing factor, with geopolitical risks remaining an ever-present threat to push fuel costs higher. Concurrently, domestic food inflation could remain elevated if disease outbreaks in livestock and poultry persist, or if weather disruptions linked to El Niño affect crop yields. Municipal tariffs will continue to provide a structural floor for inflation, regardless of broader price trends. Against this backdrop, the SARB’s new inflation preference of 3% has sparked debate. Critics argue that the bar may be set unrealistically low given SA’s structural cost pressures (such as electricity shortages, high administered prices, and volatile food costs) that are largely beyond the reach of monetary policy. However, proponents counter that anchoring expectations at 3% could, over the long run, lower risk premiums, improve investment confidence, and reduce the vulnerability of households to inflation shocks.

Ultimately, the coming quarters will test the credibility of the SARB’s new framework. Should inflation stabilise around 3%–4% as expected, the central bank will have some room to ease policy gradually, helping support a weak economy. However, if food, fuel, and utility costs prove stickier than anticipated, the SARB may find itself constrained, forced to maintain tighter conditions even as growth remains sluggish. July’s inflation print is therefore more than a statistical blip- it is a reminder of the delicate trade-offs facing SA as it navigates the intersection of cost-of-living pressures, monetary policy credibility, and long-term economic recovery.