South Africa’s (SA) headline consumer price inflation rose slightly to 3.4% YoY in September, from 3.3% YoY in August, while the monthly change in the consumer price index (CPI) registered 0.2%. Although the movement appears modest, it underscores a continued balancing act within the inflation basket- with renewed price pressures in some categories offset by disinflationary trends in others. Inflation accelerated most notably in transport and restaurants & accommodation, whereas food & non-alcoholic beverages (NAB), alcoholic beverages & tobacco, and furnishings, household equipment & routine maintenance recorded slower price growth. The food and NAB category was mixed in September: meat and maize meal prices remained elevated, while milk, eggs, and white rice experienced price declines. These variations reflect a combination of seasonal and structural forces, from lingering supply-side constraints in the livestock industry to easing global grain costs and improving trade flows.

September is typically a busy survey month for Stats SA, with several categories undergoing quarterly price adjustments. The modest monthly rise in the CPI was primarily driven by housing and utilities, as well as restaurants and accommodation services. Within the housing category, the quarterly survey of rental costs (a key barometer of underlying demand-side inflation) drew particular attention. After a sluggish post-COVID-19 lockdown recovery, rental inflation trended higher, suggesting gradual normalisation in the residential property market.

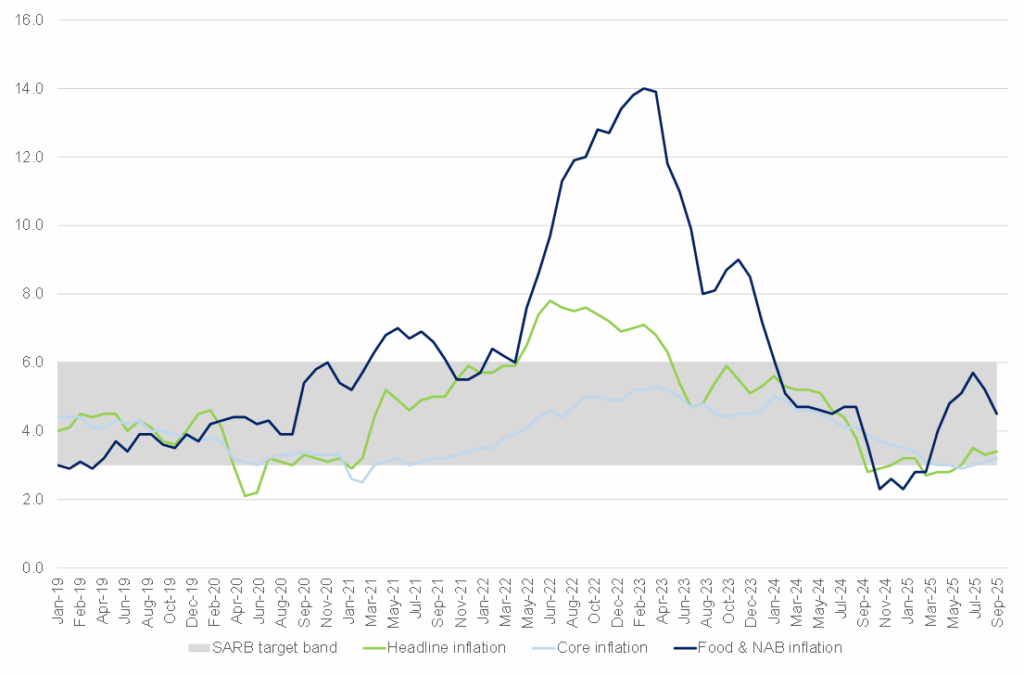

Core inflation, which excludes the more volatile categories of food, fuel, and energy, rose slightly to 3.2% YoY from 3.1%. This mild uptick indicates a slow firming in underlying price trends, consistent with early signs of stabilising demand. In contrast, food inflation, a major component of the CPI basket, continued to ease, declining to 4.4% YoY in September from 5.2% previously. As a result, the food and NAB category, which carries a weight of nearly 17% in the CPI, contributed 0.8 ppts to headline inflation, down from 0.9 ppts in August. The moderation in local food prices broadly mirrors global agricultural trends, as reflected in the FAO Food Price Index, which rose 3.4% YoY in September amid stabilising supply conditions and lower commodity price volatility.

However, the moderation in food inflation masks significant variations across subcategories. Meat inflation remains particularly elevated, surging 11.7% YoY, the highest annual rate since January 2018 (13.4%). Although MoM increases in beef prices have slowed, price levels remain high, with stewing beef up 32.2% YoY. Other categories, including pork and lamb, also recorded substantial annual gains. At the same time, chicken prices rose more gradually, with individually quick frozen (IQF) chicken climbing to 5.0% from 4.4% in August, supported by a 1.1% monthly increase. Continued disease outbreaks, feed cost pressures, and logistics challenges remain key constraints on price normalisation in this segment. Looking ahead, the potential impact of La Niña conditions expected in the coming summer months may help alleviate pressure on agricultural output and moderate food inflation into early 2026. Nonetheless, structural challenges such as high input costs, climate variability, and energy-related disruptions continue to pose upside risks.

The transport category once again provided a counterweight, recording its thirteenth consecutive month of deflation, with an annual rate of –0.1% in September. The modest ZAc4/litre petrol price reduction had a negligible impact on the monthly inflation outcome. Similarly, the small movement in early October is likely to have little effect on near-term inflation. The persistence of transport-related deflation has been instrumental in anchoring headline inflation and helping keep price growth comfortably within the South African Reserve Bank’s (SARB) target band.

Figure 1: SA inflation, YoY % change

Source: Stats SA, Anchor

Looking ahead, while inflation expectations have moderated steadily in recent quarters, most surveyed outcomes and market forecasts (excluding the SARB’s own projections) remain above the 3% level that the Bank is increasingly signalling as its long-term anchor – effectively the lower end of its existing 3%–6% target band. The next Bureau of Economic Research (BER) Inflation Expectations Survey, due after the November Monetary Policy Committee (MPC) meeting, will provide valuable insight into whether this disinflation trend is gaining traction among households, businesses, and analysts. There is a possibility that the SARB could take what some might describe as a “leap of faith” and assume that expectations will continue to drift lower, allowing it to start an earlier rate-easing cycle. However, given the Bank’s well-established preference for caution and data dependence, it is more likely to wait for firmer evidence that inflation is sustainably converging towards 3% before cutting rates further. We continue to believe that this process may take longer than the SARB’s internal models currently suggest, particularly considering persistent price stickiness in food, housing, and services.

Market pricing, meanwhile, reflects some degree of optimism. Forward rate agreements (FRAs) — financial contracts used to speculate on short-term interest rate movements — still imply roughly a 60% probability of a 25-bpt rate cut at the MPC’s final meeting of this year. However, should the SARB opt to maintain its current stance in November, that anticipated easing is likely to be pushed out to 1Q26, most likely January or March.

In short, the near-term policy outlook hinges on whether the SARB chooses to prioritise the credibility of its newly emphasised 3% objective or respond pre-emptively to the improving inflation landscape. For now, prudence – rather than premature optimism- appears to be the guiding principle.