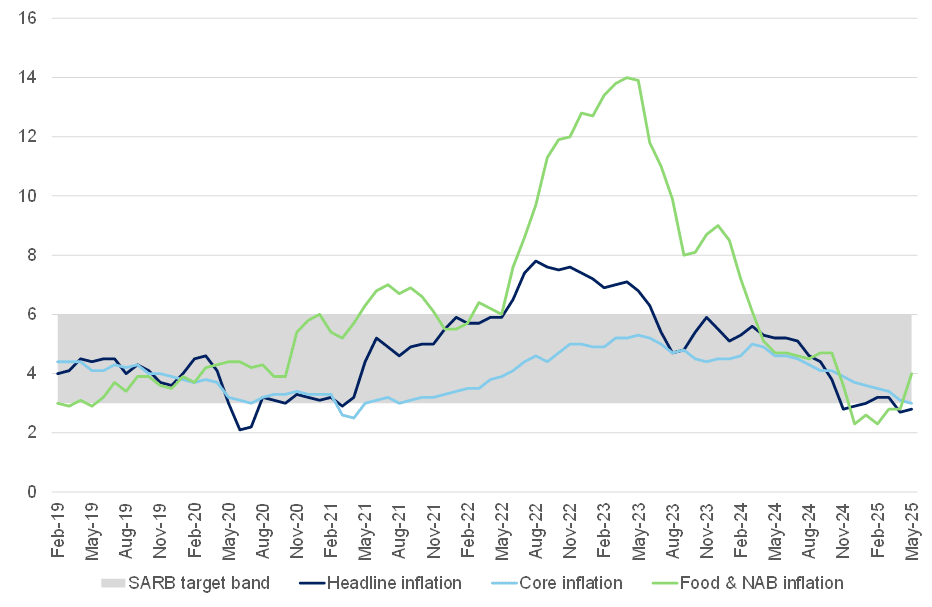

South Africa’s (SA) May headline consumer inflation (CPI) held steady at 2.8% YoY, unchanged from April. While fuel disinflation continued to exert downward pressure, this was counterbalanced by a modest rise in food prices and a stable core inflation print. On a monthly basis, inflation eased to 0.1% from 0.2% in April, signalling some short-term cooling. Underlying metrics also pointed to a softening trend: the 3-month annualised inflation rate slowed to 0.3% (from 0.5%), while the 6-month rate decelerated to 1.9% (from 2.9%). These data suggest that demand-side price pressures remain muted — a theme further reinforced by the unchanged core CPI (which strips out volatile components such as food and energy to offer a clearer picture of underlying price dynamics) coming in at 3.0% YoY. Durable goods categories, particularly furnishings and household equipment, remain deep in deflation, with price declines persisting for over 17 consecutive months. Transport services, including private operations, also continued their deflationary trend for a ninth straight month.

Figure 1: SA inflation, YoY % change

Source: Stats SA, Anchor

Despite these broader disinflationary forces, food inflation has re-emerged as a growing concern. The food and non-alcoholic beverages (FNAB) category was the only major group to contribute positively to the monthly CPI change, rising by 1.1% MoM and accelerating to 4.8% YoY — the highest annual rate since March 2024. This uptick was driven primarily by a sharp increase in meat prices, particularly beef, where inflation rose from 3.0% in April to 4.4% in May. The rise reflects the lagged impact of supply-side shocks, including a widespread outbreak of foot-and-mouth disease and elevated feed costs. Fruit and vegetable prices also recorded double-digit annual increases, amplifying the upward pressure on the food basket.

In contrast, fuel inflation provided significant relief. Prices declined by 1.1% MoM and plunged 14.9% YoY — the largest annual drop since October 2024. Petrol is now 15.9% cheaper than a year ago, while diesel prices have fallen by 12.6%. This trend is expected to continue into June, with pump prices forecast to decline further. However, downside support from fuel may prove temporary. Renewed geopolitical tensions in the Middle East, coupled with a weakening rand, have begun to push global oil prices higher, raising the risk that domestic fuel costs could soon reverse direction.

For consumers, the inflation landscape remains a mixed bag. On one hand, sustained fuel disinflation and weak core inflation suggest continued affordability in some areas, especially for durable goods and transport services. On the other hand, rising food costs — a non-discretionary expenditure — disproportionately affect lower-income households and could erode real purchasing power if the trend persists.

From a monetary policy perspective, the May print reinforces the narrative of subdued inflationary pressure, supporting the case for a more accommodating South African Reserve Bank (SARB) interest rate stance. Nevertheless, the road ahead is far from clear. The upcoming July SARB Monetary Policy Committee (MPC) meeting will take place soon after the conclusion of the “Liberation Day” pause period on US tariffs. This introduces heightened uncertainty as the MPC is likely to maintain a risk-averse approach in the face of unclear trade dynamics and potential energy price shocks. While headline CPI remains well below the midpoint of the SARB’s 3%–6% target band, the evolving geopolitical and trade backdrop (especially the possibility of reciprocal tariffs or further oil price shocks) complicates the policy outlook. For now, we expect the MPC to hold rates steady in July. However, a resolution in trade tensions could open the door to a more dovish bias later in the year, provided inflation expectations remain well-anchored.