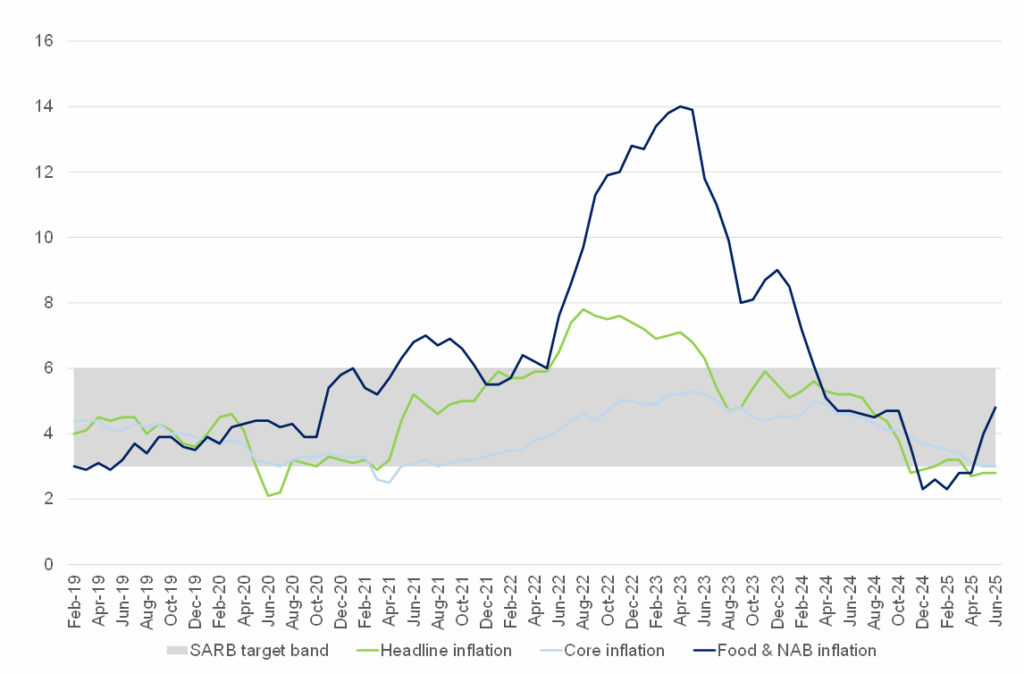

June headline inflation rose slightly to 3.0% YoY, from 2.8% in May, remaining at the lower bound of the South African Reserve Bank’s (SARB) 3%–6% inflation target. MoM, inflation ticked up to 0.3% from 0.2% in May, primarily driven by food inflation. More broadly, underlying inflation momentum showed some acceleration: the three-month rate rose by 0.5% and the six-month measure by 2.1%. This suggests a gradual upward trend in inflation rather than temporary volatility, though pressures remain contained overall. Fuel price dynamics played a key role. Although pump prices fell marginally in June (-0.4% MoM), the pace of annual fuel deflation slowed to -11.2% YoY from -14.9% YoY in May due to base effects. This marked slowdown contributed notably to the uptick in headline inflation. Fuel deflation is expected to moderate further following the ZAc52/litre rise in July (+3.1% MoM), driven by a weaker rand and higher global oil prices. This will likely push monthly CPI higher in the coming print and may have second-round effects on transport and logistics costs.

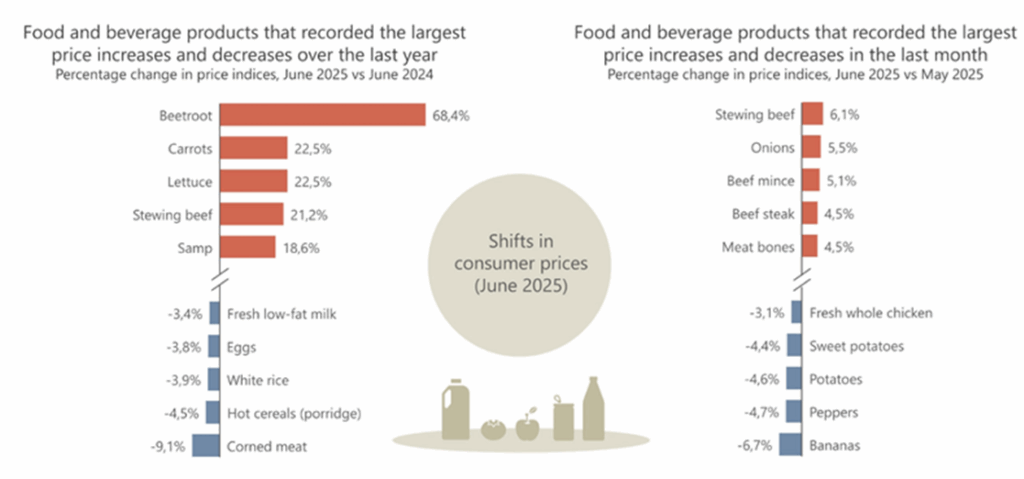

Food and non-alcoholic beverage (FNAB) inflation also rose, increasing to 5.1% YoY in June from 4.8% in May. This was primarily due to a sharp increase in meat prices (2.2% MoM and 6.6% YoY, up from 4.4%), which offset easing inflation in bread and cereals (which slowed to 3.0% YoY from 4.5%). Looking ahead, disruptions linked to animal disease outbreaks (such as avian flu and foot-and-mouth disease [FMD]) could keep meat prices elevated through 3Q25. Interventions in Brazil are only expected to have an effect later in the year. Persistent food inflation poses a risk to low-income households and could temper real disposable incomes.

Core inflation (which strips out volatile components such as food and energy to offer a clearer picture of underlying price dynamics) edged slightly lower to 2.9% YoY in June from 3.0% previously. This was driven by continued easing in core goods prices, especially for durable and semi-durable goods, which reflects both weak domestic demand and a muted exchange rate pass-through. Services inflation inched up to 3.7% YoY, underpinned by a modest rise in rental inflation, while insurance pressures softened. These dynamics- combined with rand strength, subdued rental trends and softening inflation expectations- point to limited underlying inflationary pressure and signal weak pricing power in the economy.

Figure 1: SA inflation rates, YoY % change

Source: Stats SA, Anchor

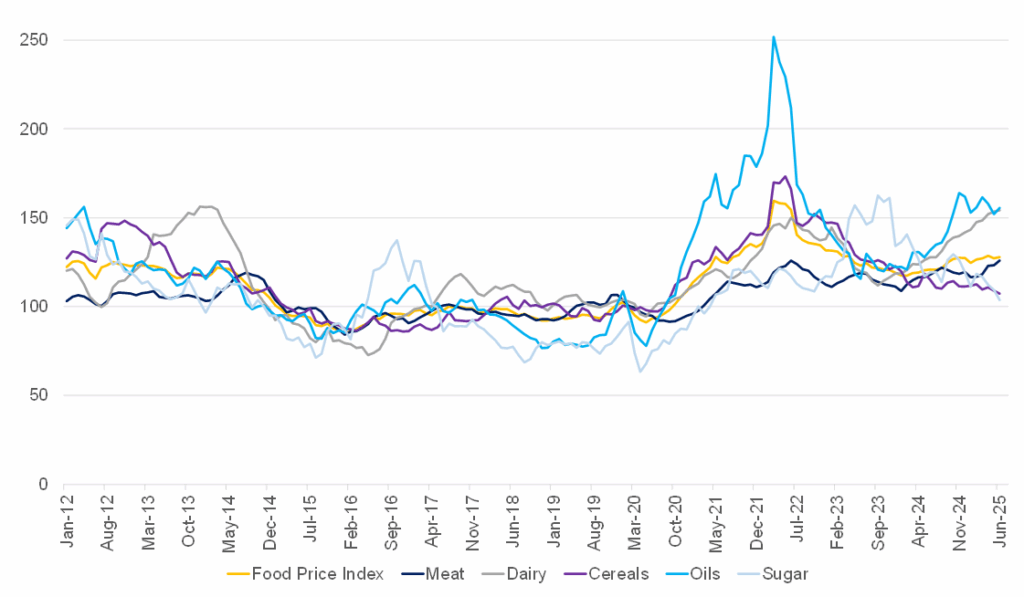

In its June 2025 report, the Food and Agriculture Organization (FAO) of the United Nations noted that the Global Food Price Index (FFPI) averaged 128.0 points in June 2025, marking a 0.5% increase from May. While international prices for cereals and sugar declined, these drops were more than offset by rising prices for dairy, meat, and vegetable oils. The index, which reflects monthly changes in the international prices of key globally traded food commodities, was 5.8% higher than in June 2024, though it remained significantly below its March 2022 peak.

Figure 2: FAO Global Food Price Index, January 2012 to June 2025

Source: FAO, Anchor

On a more commodity-specific basis, global grain prices continued their downward trend, with the FAO Cereal Price Index declining by 1.5% MoM and 6.8% YoY. This was largely attributed to falling maize prices, driven by strong supply fundamentals. Brazil’s safrinha crop (meaning “little harvest” in Portuguese) is its main maize harvest and the second corn crop planted in the same agricultural year, primarily after the main soybean harvest. This year, it reported robust yields. Argentina also continued to supply the market in large volumes. In the US, while tight ending stocks from the previous season had initially raised concerns, improved crop conditions and expectations for a larger upcoming harvest helped ease market tensions. Wheat prices saw a temporary uptick due to exceptionally warm conditions in parts of Russia, the EU, and the US, which initially raised fears about crop stress. However, as weather conditions improved later in the month and forecasts pointed to a bumper 2025/2026 crop from the Northern Hemisphere, prices stabilised.

South African (SA) maize prices mirrored global trends, with both white and yellow maize prices falling in June. White maize declined by 2.8% MoM and 9.7% YoY, while yellow maize dipped slightly by 0.6% MoM but remained higher than a year ago. The Crop Estimates Committee’s (CEC) fifth forecast for the 2024/2025 summer crop season projected a 26.3% increase in white maize production and a 5% rise in yellow maize output compared to the previous season. Although maize deliveries in June lagged last year’s pace due to a delayed start to the season, delivery momentum has improved on a monthly basis.

The meat and livestock sector experienced significant price pressures, with the FAO Meat Price Index rising by 2.1% MoM and 6.7% YoY. Beef prices reached record highs, primarily due to limited export availability from Brazil and strong demand from the US, which also lifted cattle prices in Australia. Despite dry conditions in Southeastern Australia, demand from the US sustained high prices. Pork prices also increased, supported by stable supply and consistent import demand, particularly from China, where demand for offal remained strong. Seasonal consumption in the EU further boosted pork production, while limited beef and poultry supplies added to demand. In contrast, poultry prices continued to decline due to a temporary oversupply in Brazil following export restrictions linked to highly pathogenic avian influenza (HPAI). These restrictions are now easing, which is expected to rebalance inventories.

In SA, meat prices also largely followed global trends, although a stronger rand tempered the impact on poultry. Beef carcass prices surged by 12.9% MoM and 38.3% YoY in June. Slaughter volumes declined by 8.9%, mainly due to the ongoing outbreak of FMD, which led to quarantine measures at key facilities, including Karan Beef—SA’s largest feedlot operator. Weak demand for stock replenishment was evident in falling weaner calf prices, a trend shaped by movement restrictions and market uncertainty. In response, the Department of Agriculture has launched a national vaccination campaign, investing over R70mn in vaccines sourced from the Botswana Vaccine Institute to curb the spread of FMD.

The poultry sector also faced renewed challenges, with new HPAI cases detected in June on farms in the North West and Mpumalanga provinces. These were the first confirmed cases since mid-September 2024, ending a nine-month, disease-free period. The outbreaks resulted in approximately 1,500 bird deaths and around 100,000 birds classified as susceptible, according to data from the World Animal Health Information System (WAHIS). Previous poultry supply constraints, including production challenges at Daybreak Foods and a temporary ban on imports from Brazil, contributed to upward pressure on prices. Although the ban has now been lifted (excluding products produced during the suspension), local poultry prices continued to reflect tight conditions. The price of individually quick frozen (IQF) chicken pieces rose by 1.2% MoM and 21.3% YoY.

The vegetable oils segment remained a source of global inflationary pressure, with the FAO’s Vegetable Oil Price Index staying elevated due to strong demand for palm oil. This has significant implications for SA, which relies heavily on palm oil imports for both food and industrial purposes. However, local production of oils such as canola and sunflower seed is expected to offset some of the upward price pressure. A decent domestic sunflower seed harvest should help stabilise supply in the coming months. In fresh produce markets, prices for staple vegetables such as potatoes and onions declined in June. Potato prices reached their lowest levels since December 2022, driven by a second consecutive month of high stock levels and weakening quality. Perishable stock build-up tends to prompt discounted pricing to move inventory quickly, which was evident in recent market trends.

Figure 3: Food and beverage products that registered notable price changes

Source: Stats SA

From a broader macroeconomic perspective, a relatively stronger rand has helped cushion the impact of higher international food prices. However, uncertainty over political developments in the US may influence currency markets and import costs in the months to come. Optimistic forecasts for the 2024/2025 summer crop season, including expectations of ample grains and a strong fruit harvest, are likely to relieve pricing pressure on consumer goods and animal feed inputs. Looking ahead, while SA continues to grapple with structural challenges in its livestock and biosecurity systems, the outlook for food price inflation appears to be improving. As supply chains normalise and domestic production gains momentum, consumers are likely to see a gradual easing of price pressures. However, vigilance remains essential, particularly in managing the risks posed by recurring animal disease outbreaks, energy costs, and global trade dynamics.