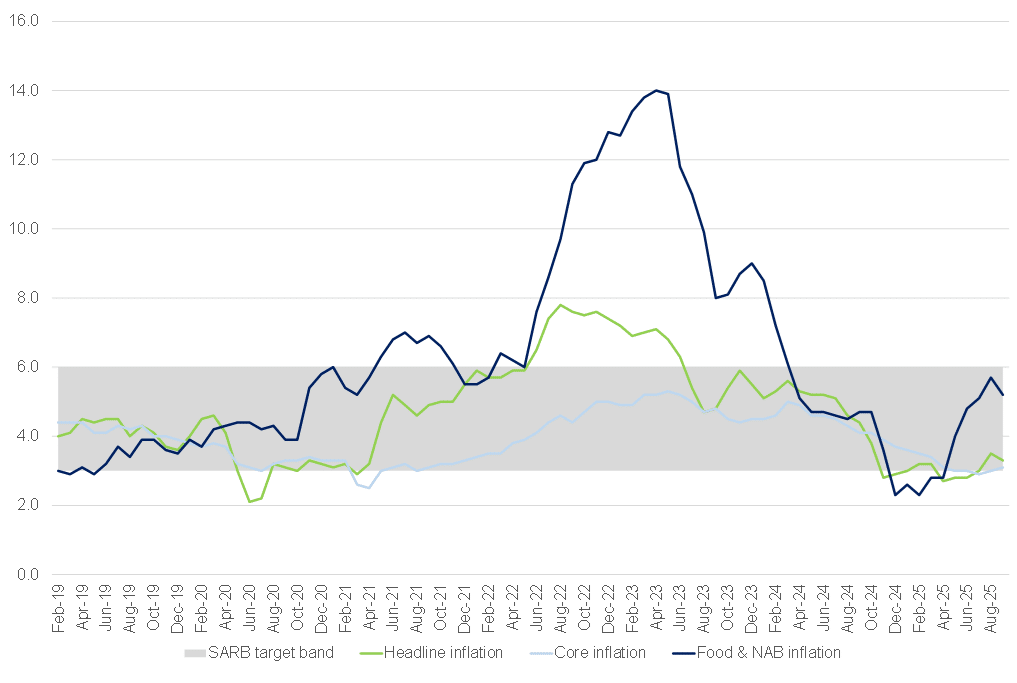

South Africa’s (SA) headline consumer price inflation eased slightly in August, pulling back to 3.3% YoY from 3.5% in July. Softer food and fuel costs took some of the pressure off the index, with the monthly print showing a 0.1% decline. Four of the thirteen categories in the CPI basket registered decreases over the month, including food and non-alcoholic beverages, furnishings and household equipment, transport, and information and communication. Core inflation, which accounts for nearly three-quarters of the basket, remains very close to where the South African Reserve Bank (SARB) would prefer inflation to be anchored. Since March 2025, it has fluctuated only narrowly between 2.9% and 3.1% YoY. In August, the seasonally adjusted annualised three-month moving average rose modestly to 2.8% from 2.5% in the preceding two months, suggesting underlying stability with only a slight upward drift.

Figure 1: SA inflation, YoY % change

Source: Stats SA, Anchor

The most notable feature of the latest release was the performance of food prices, which came in lower than anticipated at 5.2% YoY from 5.7% YoY in July. Average food prices fell by 0.1% MoM in August, helped in particular by a sharp 3.1% decline in vegetable costs, now up 9.3% YoY, and a 0.3% decline in grain product prices, which remain only 1.5% higher than a year ago. Meat prices, however, rose by 0.4% in the month and are still running more than 11% above last year’s levels. Several factors continue to shape this category. On the one hand, favourable weather has supported vegetable and grain production, helping to contain prices. On the other hand, earlier disruptions from Avian flu outbreaks abroad and panic buying during SA’s foot-and-mouth disease scare drove temporary spikes in meat prices. These have since unwound as red-meat exports were redirected back into the domestic market and poultry imports recovered. Looking forward, food inflation may be tempered further by the expected arrival of La Niña conditions during the summer months, which should benefit crop production.

Fuel prices also added to the disinflationary picture. Annual fuel inflation declined by 5.7% in August, compared with 5.5% in July, while prices dropped by a further 0.8% MoM after a steeper 2.6% fall previously. The trend reflects the combined effects of a stronger rand and relatively subdued international oil prices. Additional declines in fuel costs are likely in September, providing some near-term relief to consumers and businesses alike.

Nevertheless, the broader trajectory of inflation suggests that the brief episode of sub-3% readings is now firmly behind us. Inflation is already half a percentage point higher than it was three months ago and is expected to climb further in the coming months. While August’s downside surprise may be seen as a dovish signal, it must be interpreted against a backdrop of both actual and expected inflation levels that continue to well exceed the SARB’s new preferred anchor of 3%.

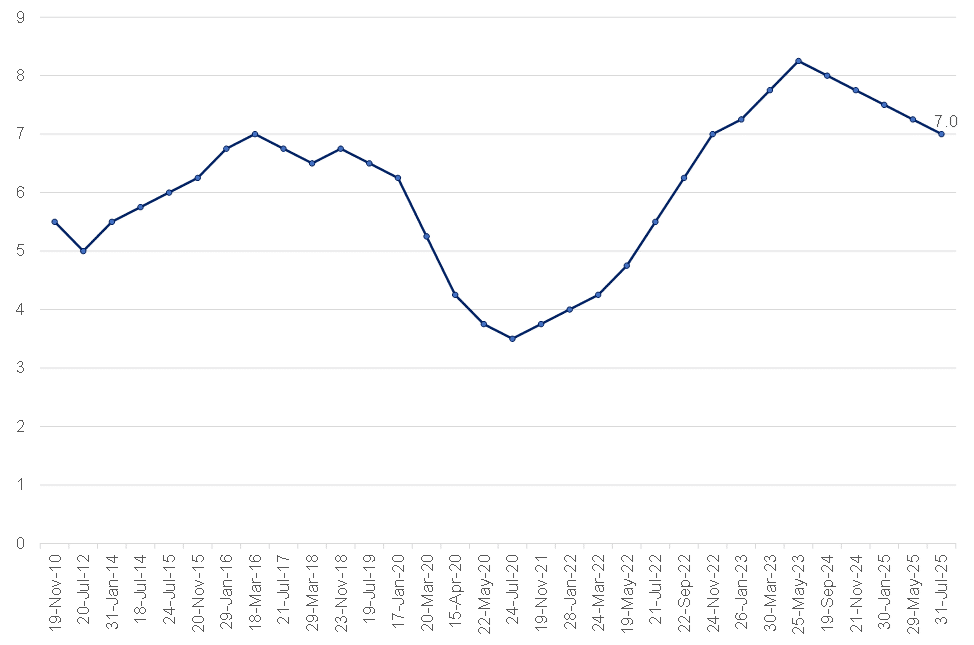

Against this backdrop, and in line with expectations, the SARB’s Monetary Policy Committee (MPC) opted to keep the repo rate unchanged at 7%. The decision was not unanimous: four members favoured a hold, while two voted for a 25-bp cut. Since September last year, the central bank has already lowered rates by a cumulative 125 bpts, and the current stance reflects a deliberate pause to assess how these cuts filter through to the economy, the evolution of inflation expectations, and the balance of inflation risks.

On the inflation front, the SARB now anticipates a further rise in headline inflation over the next few months, with a peak of around 4%. The central bank’s forecast has been revised to reflect higher electricity price inflation, with the expected increase now closer to 8% rather than 6% following the recent pricing adjustment by the National Energy Regulator of South Africa (NERSA). NERSA announced significantly higher electricity price adjustments for Eskom customers for the 2026/2027 and 2027/2028 financial years due to a regulatory error in its initial calculations. This is yet another reminder of the dysfunction in administered pricing, which continues to erode household purchasing power and constrain economic growth. Food and services inflation are also projected to be higher than before, though the assumption of a stronger rand partially offsets the impact. On balance, the Bank now expects headline inflation to average 3.4% in 2025 and 3.6% in 2026, before gradually converging to 3% in 2027.

The growth outlook has also shifted. At its previous meeting on 31 July, the SARB had flagged improving conditions for second-quarter activity, and the subsequent GDP release confirmed this with the strongest quarterly performance in two years. Encouraged by this outcome, we have revised our own growth forecast higher, from 0.9% to 1.2% for 2025. Even so, the broader picture remains one of modest recovery. Export prospects are weaker, weighed down by higher tariffs. While cyclical indicators such as credit extension look supportive, the economy cannot achieve robust growth without a much stronger investment drive. Structural reforms continue to provide some momentum, but their impact will take time to fully materialise.

Figure 2: The history of the SARB MPC’s repo rate changes, %

Source: SARB, Anchor

Looking ahead, the key challenge remains inflation expectations. While these have eased to historic lows, they still sit well above the SARB’s preferred 3% anchor. This misalignment underscores the difficulty of shifting entrenched price-setting behaviour in an economy that for years has been conditioned to target the 4.5% midpoint of the official range. We continue to expect that the National Treasury will formally announce a lowering of the target in due course, but this will not automatically translate into an immediate adjustment to 3% across the economy. For now, not all firms and households will recalibrate their pricing decisions in line with the Bank’s new preference. This gap between the preferred anchor and actual expectations highlights why the SARB must remain both vigilant and patient as it works to entrench a lower inflation dynamic.