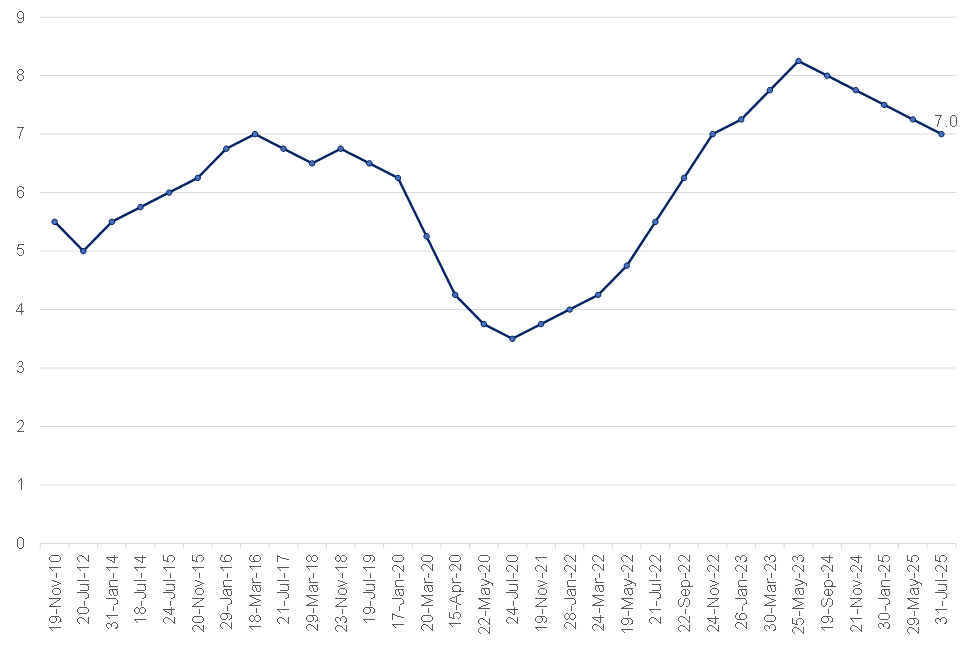

The South African Reserve Bank’s (SARB) Monetary Policy Committee (MPC) voted unanimously to lower the repo rate by 25 bpts, bringing it down from 7.25% to 7.00%. The prime lending rate now stands at 10.50%. This marks the third repo rate cut this year, bringing the total reduction to 75 bpts for 2025. The repo rate is now the lowest since end-2022, reflective of the central bank’s response to a persistently subdued inflation backdrop and a stagnant domestic growth environment.

Figure 1: The history of the SARB MPC’s repo rate changes, %

Source: SARB, Anchor

June headline inflation printed at 3.0% YoY, with core inflation at 2.9%—both at the lower bound of the SARB’s 3%–6% inflation target range. Inflation expectations have softened meaningfully, with the Bureau for Economic Research’s (BER) 2Q25 survey showing forecasts clustering at around 4.5% across all horizons. Meanwhile, SA real GDP grew by a meagre 0.1% in 1Q25, confirming earlier concerns about weak domestic activity. Although second-quarter data suggest a modest improvement, the SARB has revised its 2025 GDP growth forecast down to 0.9% (previous 1.0%), citing persistent domestic constraints and escalating global trade risks, particularly the potential imposition of 30% US tariffs on South African agricultural and manufacturing exports. The revision now aligns with the IMF’s forecast of 1% growth for SA this year, underscoring the limited momentum in the domestic economy.

While the decision to cut was framed as a response to these economic headwinds, the SARB has maintained a cautious tone. Governor Lesetja Kganyago warned that external risks- including the imminent imposition of 30% US tariffs – could reintroduce inflationary pressure and disrupt growth prospects. Nonetheless, this cut signals a shift in the policy stance toward providing measured support to the real economy.

Beyond the immediate rate cut, the SARB signalled a more profound structural shift in SA’s inflation targeting regime. For the first time, the MPC explicitly stated a preference for inflation to settle at 3%, aligning with the lower bound of the current 3%–6% target range. This move reflects the Bank’s growing concern that the existing target is both too high and too wide to anchor expectations and foster macroeconomic stability effectively. While the MPC’s May meeting introduced the idea, this July decision goes further: future policy forecasts will now incorporate a 3% inflation objective. The SARB’s modelling suggests this lower target will unlock space for deeper interest rate cuts—up to five more over the medium term—bringing the policy rate below 6%. This would represent a significant structural shift in domestic monetary policy.

This adjustment is grounded in both domestic and international considerations. From a macroeconomic efficiency standpoint, lower inflation reduces distortions in relative prices, supports better resource allocation, and enhances economic productivity. In SA’s case, the inflation-growth relationship has been consistently negative (unlike in some other developing countries), weakening the argument that higher inflation can stimulate meaningful output growth. A lower inflation target also has implications for international competitiveness. Persistently high inflation has contributed to structural currency depreciation and elevated long-term borrowing costs, eroding SA’s position in global markets. By anchoring inflation more firmly, the SARB hopes to reduce risk premia and bolster investor confidence. In global comparative terms, SA’s inflation target is high relative to both advanced economies and peer emerging markets (EMs). Countries that have successfully transitioned to lower targets have generally experienced lower term premia and more stable macroeconomic environments.

However, the path to a reformed inflation framework is not without obstacles. Key structural constraints limit the SARB’s control over inflation: administered prices (such as electricity, water, and fuel) make up over 30% of the CPI basket and have consistently outpaced headline inflation. These price dynamics are primarily outside the scope of monetary policy. Inflation expectations also remain imperfectly anchored. Unlike in advanced economies, where expectations are forward-looking, South African households and businesses tend to adjust slowly and are reactive to recent inflation trends. This backward-looking behaviour is particularly evident in wage-setting, especially in the public sector, where increases often exceed productivity and are poorly aligned with the inflation target.

Without broad support, the burden of disinflation may fall disproportionately on the private sector via tighter monetary policy, at a time when economic growth remains fragile. There is also a risk that premature tightening could stall recovery or lead to fiscal slippage if tax revenues decline faster than spending is adjusted. Ultimately, while the case for a lower inflation target is compelling in theory, offering long-term economic and fiscal rewards, its success hinges on credible communication, policy alignment, and a carefully managed transition. The SARB itself acknowledges that timing is critical. While an earlier opportunity to lower the target may have been missed during the pre-COVID-19 disinflation period, current conditions (namely, headline inflation at the bottom of the range and a stronger rand) offer a renewed window. That said, the stickiness of expectations and uncertainty over fiscal and structural reforms imply that the short-term costs of disinflation could be higher than models suggest.

Looking ahead, we see scope for one additional 25-bpt rate cut in 2026, should inflation remain contained and external conditions stable. However, the ability of monetary policy alone to meaningfully lift SA’s economic trajectory remains limited. While lower interest rates can offer short-term relief—easing debt burdens and marginally improving consumer sentiment—they cannot address the country’s deep-seated structural constraints. Ultimately, sustained improvements in economic performance—and in confidence—will depend on the implementation of credible, growth-enhancing structural reforms.

Achieving growth rates of 3% or higher, as needed to reduce unemployment and poverty meaningfully, requires more than cyclical monetary easing. It demands policy certainty, efficient public infrastructure, functional institutions, and a coherent national growth strategy that complements the SARB’s evolving monetary policy framework. Without such reforms, the effectiveness of lower interest rates will be limited, serving as a temporary support rather than a catalyst for transformation.