South Africa’s (SA) post-pandemic economy has seen a surge in gambling and betting activity, transforming a once-niche pastime into a mainstream industry. Recent data from the National Gambling Board (NGB) and Statistics South Africa (Stats SA) point to a sustained increase in both formal-sector turnover and household spending on gambling-related activities. While this expansion of the sector supports employment and contributes to tax revenue, it also reflects deeper structural and financial dynamics- from shifting consumption patterns and digital monetisation to household vulnerability and regulatory lag. What was once a niche pastime has become a mainstream economic force and now, increasingly, a social concern.

According to the NGB, gross gambling revenue surged to R59.3bn in 2023/2024, up 25.7% from R47.2bn the previous year. This marks a sharp rebound from the COVID-19 pandemic trough of R23.3bn in 2020/2021- itself an increase of over 150% in just three years. The composition of the industry has changed dramatically. In 2009/2010, casinos commanded 84% of the total gambling market share, while betting accounted for just 10%. The pandemic accelerated a historic reversal: betting has since dethroned casinos to become the dominant form of gambling, fuelled by the rise of digital platforms, mobile accessibility, and sports sponsorships that blur the lines between entertainment and wagering.

A recent Stats SA report on the personal services industry showed that bookmaker and online gambling services recorded the fastest income growth of all tracked activities between 2018 and 2023. Income from these services rose from R10.1bn in 2018 to an astronomical R152.6bn in 2023. This expansion underscores the increasing integration of gambling within SA’s digital payments architecture. E-wallets, mobile money platforms, and card-based payment systems now facilitate billions of rand in low-value, high-frequency transactions.

From a financial market perspective, this has bolstered transaction volumes for banks and payment processors, contributing to liquidity within the formal financial system. However, it also channels a growing share of consumer liquidity into non-productive, speculative activities, raising concerns about longer-term household balance sheet health. The NGB further notes that R1.1trn was wagered across the industry in 2023/2024 (up 40% YoY) while total gambling turnover in 2024/2025 reached an estimated R1.5trn. Approximately 14,000 formal jobs were created in the sector, with spillovers into advertising, telecommunications, and information technology services.

Yet, these gains come with critical caveats. The same digital accessibility driving growth is also amplifying social risks, particularly as a source of financial strain among vulnerable groups such as the youth and low-income households. In effect, gambling has become both a revenue generator and an extractor, circulating vast sums within the economy but often at the expense of household financial stability. As such, this transformation is not just a consumer story; it represents a significant redistribution of discretionary spending within the local economy. What was once spent on entertainment, travel, or leisure is increasingly being channelled into betting platforms, both domestic and offshore.

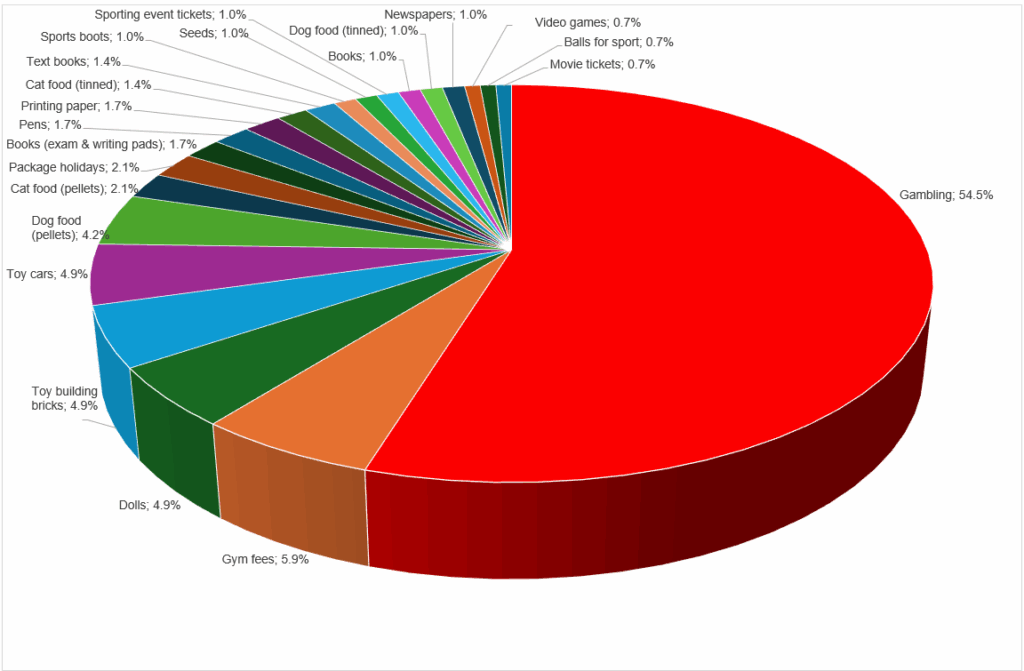

The latest Consumer Price Index (CPI) basket revision for 2025 reflects the growing importance of gambling in household spending patterns. Classified under “recreation, sport and culture,” gambling now accounts for 1.6% of total household expenditure, ranking as the 12th-largest weighted category — ahead of several durable goods and just below beer.

Within its group, gambling constitutes over 50% of all spending, far exceeding other recreational activities such as gym fees or cultural participation. The sector’s inclusion and growing weight in the CPI basket introduces a non-trivial link to inflation dynamics, as price changes in gambling-related products and services can now influence overall headline inflation.

Figure 1: Breakdown of consumer products and services in the recreation, sport and culture category of the consumer inflation basket

Source: Stats SA, Anchor

This rise in spending also signals behavioural displacement under tight economic conditions: households appear increasingly willing to allocate discretionary income toward gambling despite elevated living costs and stagnating real wage growth. From a macro-financial standpoint, this suggests a reallocation of liquidity away from savings and investment, which could weigh on long-term capital formation and financial resilience.

From a financial market perspective, the gambling boom illustrates broader shifts in household liquidity utilisation, consumer leverage, and sectoral earnings patterns:

- Liquidity flows and payments: The surge in online betting supports transaction activity across payment intermediaries, fintechs, and commercial banks. This contributes positively to service-sector turnover but does not translate into productive investment.

- Consumption substitution: Increased gambling expenditure may suppress spending on durable goods and savings products, indirectly affecting retail and consumer credit portfolios.

- Corporate exposure: Listed gaming, leisure, and telecom companies benefit from near-term transactional volume growth, while potential regulatory tightening poses a medium-term earnings risk.

- Credit and vulnerability: Elevated gambling among lower-income households, including students, reportedly using their National Student Financial Aid Scheme (NSFAS) allowances for online betting, as highlighted by a recent Daily Maverick investigation. This raises the risk of consumer over-indebtedness and erosion of household balance sheet stability.

- Inflation link: Gambling’s inclusion in the CPI basket introduces a minor but growing channel through which service-sector price dynamics could feed into inflation expectations.

In aggregate, while the sector contributes positively to turnover and employment, the redistribution of liquidity from savings and consumption toward speculative activities presents a latent financial fragility risk- one that could manifest through softer household credit performance or reduced savings rates.

The National Gambling Act (2004), enacted before the emergence of online platforms, has not kept pace with online betting’s evolution. An unimplemented 2012 amendment to restrict online gambling advertising has created a significant regulatory gap. Investigations by amaBhungane and other media outlets have revealed extensive digital advertising contraventions, including algorithm-driven marketing, influencer campaigns, and unmoderated sponsorships targeting minors. Prominent figures such as Siphiwe Tshabalala and Dricus du Plessis have promoted betting brands like Betway, which also sponsors SA Rugby (Springboks) and the Premier Soccer League (PSL).

Similarly, Hollywoodbets sponsors high-profile sporting events such as the Durban July. These partnerships highlight the extent to which gambling has become embedded in South African sports and entertainment ecosystems, complicating regulatory oversight and ethical standards. For investors, regulatory uncertainty introduces potential operational and reputational risk components within the consumer services and fintech segments. A future tightening of advertising standards or online gaming restrictions could materially affect profitability and valuation for firms exposed to gambling-linked revenues.

SA’s gambling boom encapsulates a broader tension in the modern economy: the collision between digital innovation, consumer aspiration, and weak regulation. It also signals deeper structural challenges intrinsic to the domestic economy, from fragile financial literacy to the commercialisation of vulnerability.

If left unchecked, the nation’s gambling and digital “betting boom” could morph from an engine of growth into a drag on household resilience. Balancing these forces will require updated regulation, stronger financial education, and a renewed focus on responsible gambling as a matter of both social policy and economic stability. In the absence of more decisive policy intervention and financial literacy initiatives, the industry’s expansion risks entrenching a pattern of consumption-led liquidity extraction, rather than contributing to inclusive, long-term economic resilience. Sustainable returns will depend not just on market momentum, but on the sector’s ability to balance innovation with responsibility.