As South African (SA) investors increasingly seek growth and diversification beyond domestic borders, Namibia is quietly reasserting itself as a compelling destination. While long considered politically stable and economically intertwined with SA, Namibia is now entering a new phase of strategic importance, anchored in promising oil discoveries, expanding infrastructure, and a pivot toward green energy. For SA investors in particular, the country presents a rare convergence of familiarity and frontier opportunity.

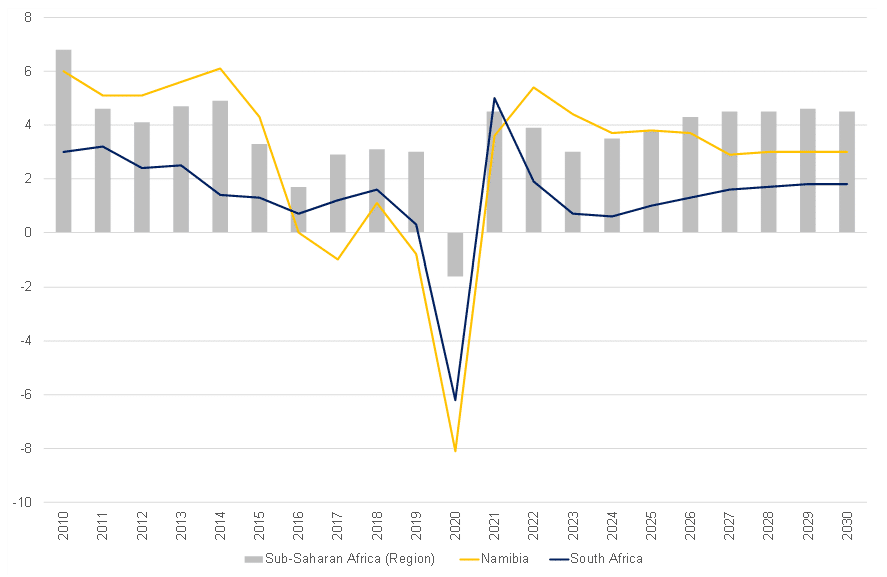

Namibia’s economic recovery post-COVID-19 has been gradual but meaningful. After a weather-induced slowdown in 2023, the Namibian economy expanded by 3.7% YoY in 2024, slightly exceeding earlier expectations of 3.5% growth. The country’s growth outlook remains favourable, though slightly trimmed from previous estimates. The latest IMF projections peg YoY GDP growth at 3.8% for 2025 (4.0% previously) and 3.7% for 2026 (see Figure 1). These revisions reflect mounting global trade uncertainty and ongoing weakness in Namibia’s diamond sector. Still, the headline figures mask a more dynamic domestic story, underpinned by renewed activity in agriculture, uranium mining, and infrastructure.

Figure 1: GDP growth forecasts, %

Source: IMF, Anchor

A key support for growth over the near term is the recovery of the country’s agricultural sector. A severe drought in 2024 triggered a 2.7% YoY contraction in agriculture, but improved rainfall this year is expected to restore output and improve food security. This rebound will have spillover effects on rural incomes, domestic demand, and food-related manufacturing.

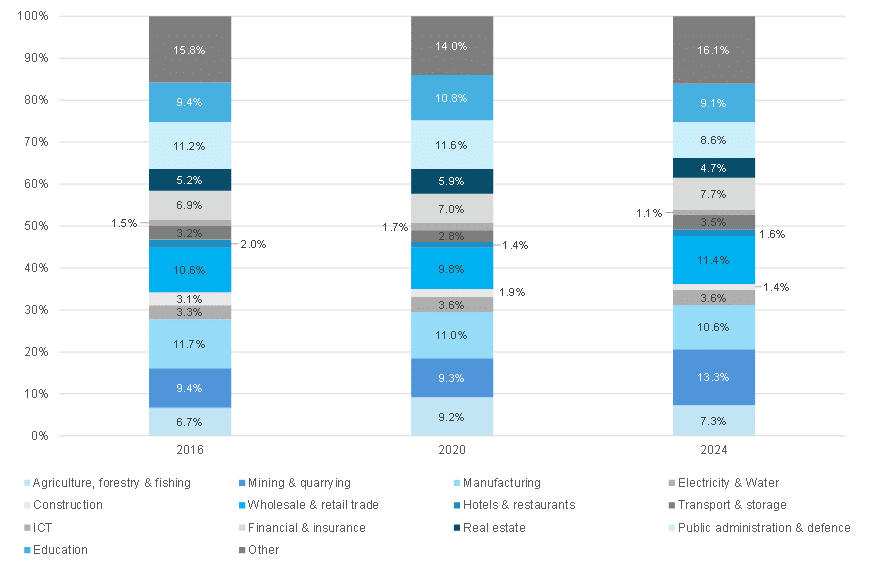

Uranium mining, another vital pillar of the economy, remains robust. Global demand for uranium—fuelled by a resurgence of interest in nuclear energy—has buoyed prices and reinforced Namibia’s position as one of the world’s top producers. Additionally, the mining and quarrying sector more broadly is likely to remain buoyant. Exploration and production activity is resuming across several commodities, helping to offset continued softness in the diamond sector, which has been impacted by shifting consumer demand and a growing preference for lab-grown alternatives.

Figure 2: Breakdown of Namibia’s economy by sector (as % of GDP)

Source: Namibia Statistics Agency, Anchor

One of the most talked-about developments is the growing interest in offshore oil. In early 2025, Shell announced a c. US$400mn write-down on one of its offshore oil discoveries in Namibia due to what it termed “challenging” geological conditions and technical difficulties, including high gas content, deeming it commercially unviable. Yet this has not discouraged broader investment. TotalEnergies and other oil majors continue to commit resources to Namibia’s offshore basins, with the Ministry of Mines and Energy expecting a final investment decision (FID) on TotalEnergies’ Venus oil discovery by late 2026. Should the development proceed as planned, first oil could be achieved by 2030, potentially transforming Namibia’s fiscal and export profile.

In parallel, Namibia is making significant strides in its green hydrogen ambitions. A major milestone was achieved in early 2025 when the HyIron Oshivela project produced its first green hydrogen using 12 MW of electrolyser capacity. The broader Hyphen Hydrogen Energy initiative (a planned US$10bn investment) aims to export up to one million tonnes of green ammonia p.a. by 2028, targeting energy-hungry markets in Europe, Japan, and South Korea. These developments underscore Namibia’s strategy to leverage its world-class solar and wind resources. With the second-highest solar radiation in the world, Namibia is ideally positioned to emerge as a global leader in clean energy and contribute to climate resilience at home and abroad.

Infrastructure is another area showing significant promise. Namibia has consistently ranked among the top performers in Africa for road quality, according to the World Economic Forum. The expansion of the Walvis Bay Port in 2019 and plans to rehabilitate and extend key railway lines have positioned the country as a logistics gateway for the region. Improved links from Walvis Bay to landlocked neighbours such as Botswana and Zambia are expected to enhance trade flow and reduce supply chain bottlenecks. The Namibian government is also investing in energy and water infrastructure, including upgrades to the Ruacana Power Station. This hydropower plant is set to benefit from increased rainfall this year.

Namibia’s infrastructure push is complemented by supportive fiscal and monetary policy. The accommodative policy stance that began in 2H24 continues, supported by a favourable inflation outlook. This macro backdrop, combined with a recently implemented minimum wage increase and rising government capital expenditure, as proposed in the FY25/FY26 national budget, should sustain household consumption and spur growth in sectors like retail, construction, and manufacturing.

For SA investors, Namibia’s appeal lies in both its economic fundamentals and structural familiarity. The Namibian dollar’s 1:1 peg with the South African rand eliminates foreign exchange volatility. This, coupled with the two countries’ deep trade and institutional ties, anchored in the Southern African Customs Union (SACU) and the Southern African Development Community (SADC) Free Trade Area (FTA), creates a predictable policy environment. Namibia’s tax regime is also relatively attractive, with a top personal income tax rate of 37% (compared to SA’s 45%) and full repatriation of capital and profits. A well-functioning judicial system, strong protection of property rights, and high-quality physical and telecommunications infrastructure further bolster investor confidence.

Namibia’s political stability continues to reinforce its reputation as an investment-safe jurisdiction. The recent passing of former President Hage Geingob was handled through a smooth constitutional transition, underscoring the relative soundness of Namibia’s democratic institutions. The country is actively courting foreign direct investment, particularly in sectors aligned with its Vision 2030 strategy (a strategic framework aimed at transforming Namibia into a “prosperous and industrialised nation” by 2030) and green industrialisation goals, providing a secure environment for investors.

Still, Namibia is not without its vulnerabilities. The economy remains sensitive to climate volatility, particularly drought and water scarcity. External risks- including geopolitical tensions, commodity price fluctuations, and any disruption to the US-SA trade relationship (e.g. the African Growth and Opportunity Act [AGOA] eligibility)—could have knock-on effects, given Namibia’s close economic linkages to SA. Structural issues such as high unemployment (27%–33%) and inequality (*Gini coefficient ~59) remain unresolved and may temper inclusive growth outcomes.

Moreover, Namibia’s recent reclassification by the World Bank from an upper-middle-income country to a lower-middle-income country has significant implications. The change, based on declining per capita gross national income (GNI), has sparked conflicting reactions. Some policymakers and commentators see the downgrade as a strategic advantage, unlocking access to concessional loans, development grants, and preferential trade agreements. However, this line of reasoning, while superficially pragmatic, misses the broader economic picture and, in doing so, risks masking a deeper structural problem. While concessional finance may offer short-term liquidity, it is often accompanied by external conditionalities, donor-driven priorities, and narrowly defined benchmarks that may not align with Namibia’s long-term national development agenda.

Industrialisation is not born from pity or preferential trade rules—it is built on resilience, long-term investment, and bold policymaking. If Namibia is serious about industrial transformation, it must focus on strengthening infrastructure, deepening technological capabilities, building out educational pipelines, and investing in productive domestic value chains. These are the foundations of economic sovereignty. And while donor funding may complement these efforts, it cannot replace the need for homegrown capital formation and investor confidence. This reality makes the current growth outlook and structural reform momentum even more critical. Namibia’s ability to position itself as an investable, self-reliant economy will define whether it breaks out of the middle-income trap or settles into a cycle of stagnation disguised by external financing.

For long-term investors, particularly SA investors seeking growth beyond their domestic borders, Namibia offers a compelling mix of familiarity and frontier potential. On one hand, it is a structurally stable, policy-driven economy with high potential for energy-led growth, regional integration, and environmental, social, and governance (ESG) aligned investment. On the other hand, it faces real macroeconomic and institutional tests, including income stagnation, fiscal vulnerabilities, and the pitfalls of premature aid dependence.

Yet these hurdles are not insurmountable. If Namibia can sustain fiscal discipline, deepen domestic investment in infrastructure and industry, and manage its resource windfalls transparently, it stands to unlock a new phase of inclusive, export-led growth. The country’s blend of macroeconomic prudence, renewable energy leadership, expanding logistics infrastructure, and stable institutional foundations positions it as more than just a peripheral frontier market. Namibia is evolving into a long-term growth story- one grounded in regional integration and global relevance.

*The Gini coefficient is a statistical measure of economic inequality in a country, ranging from 0 to 1. A value of 0 indicates perfect equality, while a value of 1 (or more) represents higher inequality.