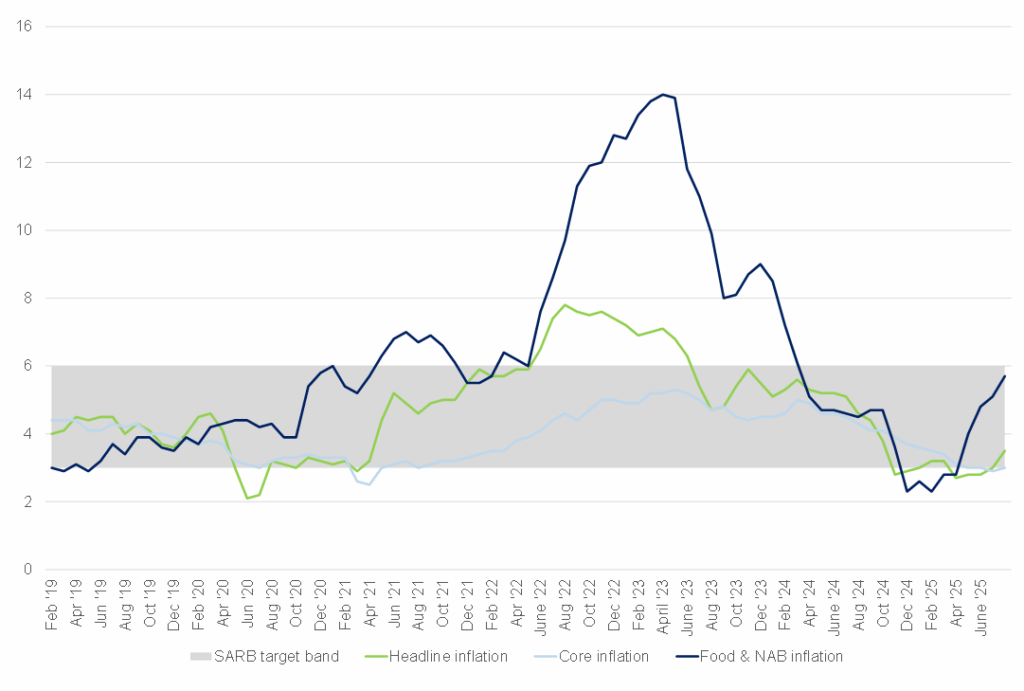

South Africa’s (SA) consumer price inflation (CPI) edged higher in July, underscoring the fragile balance between moderating price pressures earlier in the year and new cost escalations. Headline CPI rose to 3.5% YoY in July, up from 3.0% in June, marking the highest print since September 2024 (3.8%). On a MoM basis, prices increased by a notable 0.9%, reflecting a combination of municipal tariff adjustments, higher fuel prices, and rising food costs. Utility tariffs delivered another sharp blow to consumers in July, when municipalities enacted their annual price adjustments. Water tariffs rose 12.1% in 2025, the largest increase since 2018, while electricity tariffs climbed 10.6%. Although the electricity hike is marginally lower than the 2024 adjustment (+11.5%), the cumulative effect of years of above-inflation electricity increases continues to weigh heavily on households and businesses. This year, new categories such as refuse collection (up 6.6%) and sewage removal (up 6.5%) were formally added to the CPI basket, further embedding the burden of essential services in inflation data. On top of this, new levies introduced in Tshwane and Cape Town added extra pressure. Both are being challenged in court, with the Pretoria High Court ruling in favour of lobby group AfriForum earlier this month against the City of Tshwane and declaring the municipality’s R194/month cleaning levy unlawful. On 25 August, the same court dismissed the metro’s application for leave to appeal. The case against Cape Town’s new rates and tariffs will be heard later this month, but until it is resolved, it remains an added burden on household utility bills.

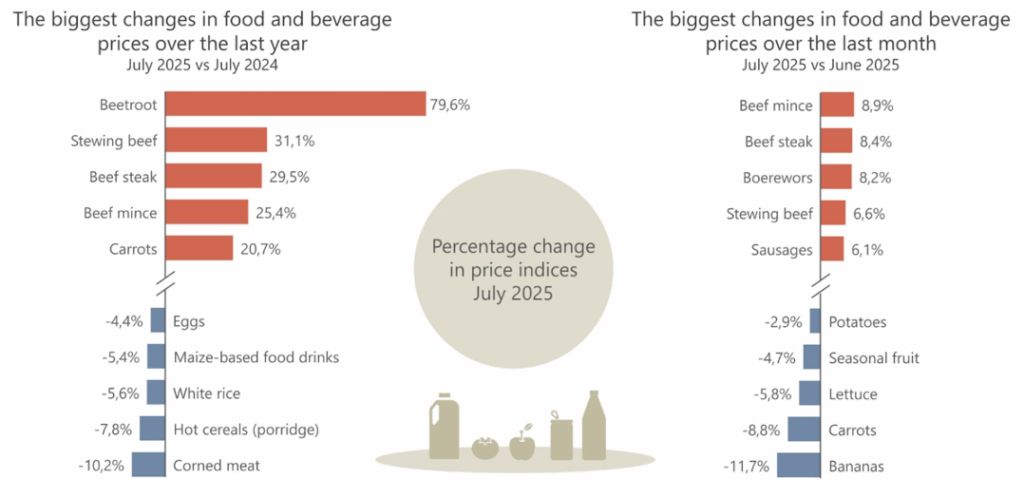

After four consecutive months of decline, fuel prices shifted direction in July, rising by 2.6% MoM. This uptick narrowed the annual rate from -11.2% in June to -5.5% in July. While fuel inflation remains negative compared with a year ago, the impact of favourable base effects is fading, signalling a possible return to upward pressure in the months ahead. The most significant and persistent pressure point, however, remains food inflation. Annual inflation for food and non-alcoholic beverages accelerated to 5.7% YoY in July, from 5.1% in June, with meat, vegetables, and “other food” categories fuelling the uptick. Meat prices, particularly beef, are under considerable strain, climbing 10.5% YoY in July- the steepest pace since early 2025. This reflects ongoing disruptions from foot-and-mouth disease (FMD), which has reduced supply and kept costs elevated. Looking ahead, further outbreaks of animal diseases, including avian flu, could prolong these price pressures well into 3Q25. While global supply interventions (particularly from Brazil) may help stabilise markets later in the year, the immediate risk is that persistently high food prices continue to erode the spending power of lower-income households, who spend a disproportionately larger share of their income on food.

Figure 1: SA inflation rates, YoY % change

Source: Stats SA, Anchor

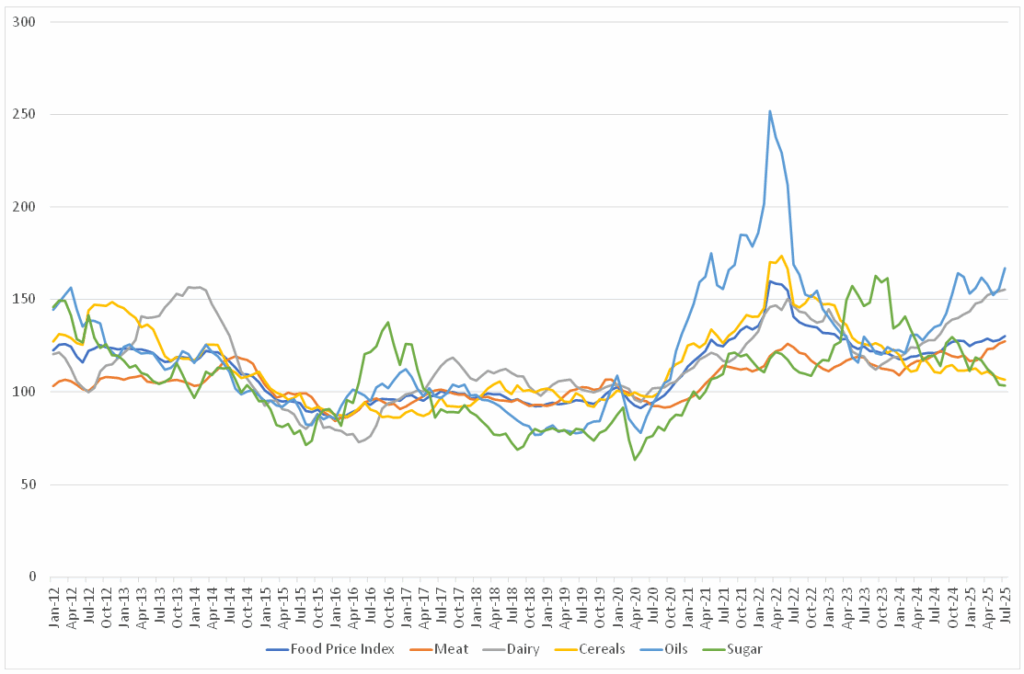

In its July 2025 report, the Food and Agriculture Organization (FAO) of the United Nations noted that the Global Food Price Index (FFPI), a key measure of international food commodity prices, averaged 130.1 points in July. This was 2.1 points higher than June, reflecting a 1.6% MoM increase. Declines in cereal, dairy, and sugar prices were more than offset by gains in meat and vegetable oils. On an annual basis, the index stood 9.2 points (7.6%) above its July 2024 level, though it remained 30.1 points (18.8%) below the peak recorded in March 2022.

Figure 2: FAO Global Food Price Index, January 2012 to July 2025

Source: FAO, Anchor

On a commodity-specific level, global food price trends have diverged across categories, with important spillovers into SA’s local market. In July, the global wheat market was weighed down by ample seasonal supply in the Northern Hemisphere. However, weather-related risks and farmer behaviour in North America, Europe, and the Black Sea tempered the decline. In contrast, maize prices moved higher, supported by tight Argentine export availability, strong Brazilian domestic demand, and dry conditions in Eastern Europe and Ukraine. These international dynamics filtered directly into the SA market, and after months of decline, local maize prices ticked up again in July. White maize rose 5.6% MoM, while yellow maize was up only marginally, reflecting the lingering impact of the 2024 drought in the western parts of SA and robust import demand from neighbouring countries. Although a recovery in local and regional production has helped normalise the white-yellow maize premium, late-season rains caused quality issues, keeping premiums on top grades elevated. Wheat prices, meanwhile, increased despite softer global benchmarks and a stronger rand, highlighting SA’s structural reliance on imports, which still account for nearly half of domestic consumption.

For domestic consumers, these grain dynamics matter profoundly. Maize is the staple base of the national diet, particularly white maize, which is central to lower-income households through products like maize meal. Even small price increases can quickly squeeze household budgets, leaving less room for protein or fresh produce purchases. Higher wheat costs also filter into bread and other baked goods, which are key calorie sources across income groups. The combination of elevated maize and wheat prices, therefore, risks amplifying food insecurity pressures, particularly for the most vulnerable segments of society.

The global meat market has also exerted pressure. The FAO Meat Price Index rose 1.2% MoM and 6% YoY, driven by lamb, beef, and poultry. Tight supply from Oceania pushed lamb prices to record levels, while limited cattle inventories in the US and strong Chinese import demand lifted beef. Local meat markets, however, were shaped more by domestic disease outbreaks and supply constraints. Poultry prices rose c. 20% YoY, underpinned by avian flu cases and higher global prices. Beef remained expensive, with carcass prices more than 30% higher than in July 2024, though some correction is underway as slaughter numbers recover. Pork offered a cheaper substitute, keeping pig carcass prices firm, while sheep prices finally eased under weaker demand. For local households, this translates into a narrowing of affordable protein options. Poultry, usually the cheapest source of protein, is no longer providing as much relief, while beef is increasingly out of reach for many families. The result is a “trading-down” effect, with consumers shifting toward pork or processed meats where possible, but even here, prices are under upward pressure. For poorer households, this often means protein consumption is reduced altogether, raising longer-term nutritional risks.

Globally, dairy prices edged lower in July for the first time in over a year, yet remain significantly higher than in 2024. Local dairy followed seasonal trends, with producer prices climbing as milk supply tightened. Fresh produce markets were more mixed, with potatoes and onions trading lower on substantial volumes, while tomatoes and apples recorded gains due to reduced supply. Carrots and lettuce remained elevated compared with last year, though prices are off their early-2025 peaks. While the moderation in some fresh produce and dairy prices offers pockets of relief, local consumers are still contending with volatility across categories. Lower vegetable prices may ease monthly grocery bills, but offsetting increases in dairy and fruit constrain these gains. The uneven nature of these price movements makes it difficult for households to plan and stabilise their food spending, adding to a sense of uncertainty and financial strain.

Figure 3: Food and beverage products that registered notable price changes

Source: Stats SA

Looking ahead, the rand’s strength continues to shield local prices from sharper global increases, while a positive crop outlook offers relief for grains and oilseeds. Still, structural risks remain acute: animal disease outbreaks threaten both supply and exports, while energy and transport costs risk reversing recent price relief. These linkages highlight how international dynamics (from global biodiesel demand to weather shocks in Ukraine or South America) filter through to SA households via staples like maize, meat, and vegetable oils. Ultimately, the picture is one of vulnerability – while global prices set the tone, it is the interplay with local structural constraints that determines how much pressure domestic consumers feel at the till.