As Black Friday 2025 approaches, it is increasingly becoming a fixture in South Africa’s (SA) retail calendar and a surprisingly valuable gauge of the country’s economic momentum. Investors are positioning themselves to interpret the spending data, recognising its value as an early indicator of the local economy’s underlying momentum. While Black Friday is often viewed as a consumer spectacle of discounts and retail theatrics, it has evolved into a meaningful barometer of consumer sentiment, household resilience, and underlying demand conditions. Trends in spending volumes, the appetite for durable goods, the intensity of online activity, and transactional intensity collectively provide a remarkably clear snapshot of consumer sentiment, household financial resilience, and broader demand-side conditions.

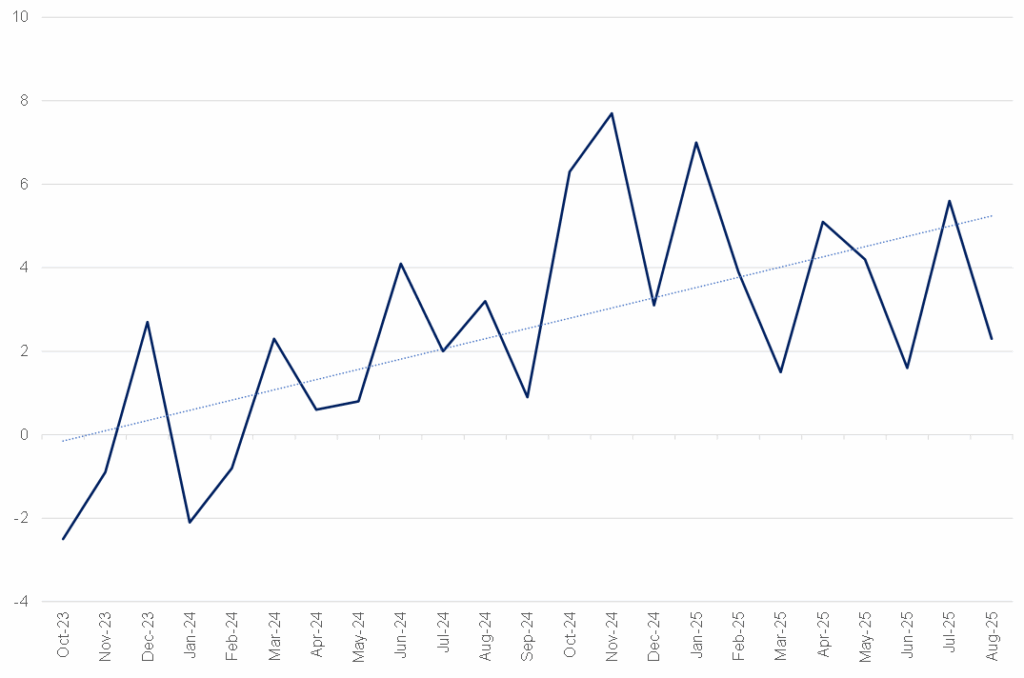

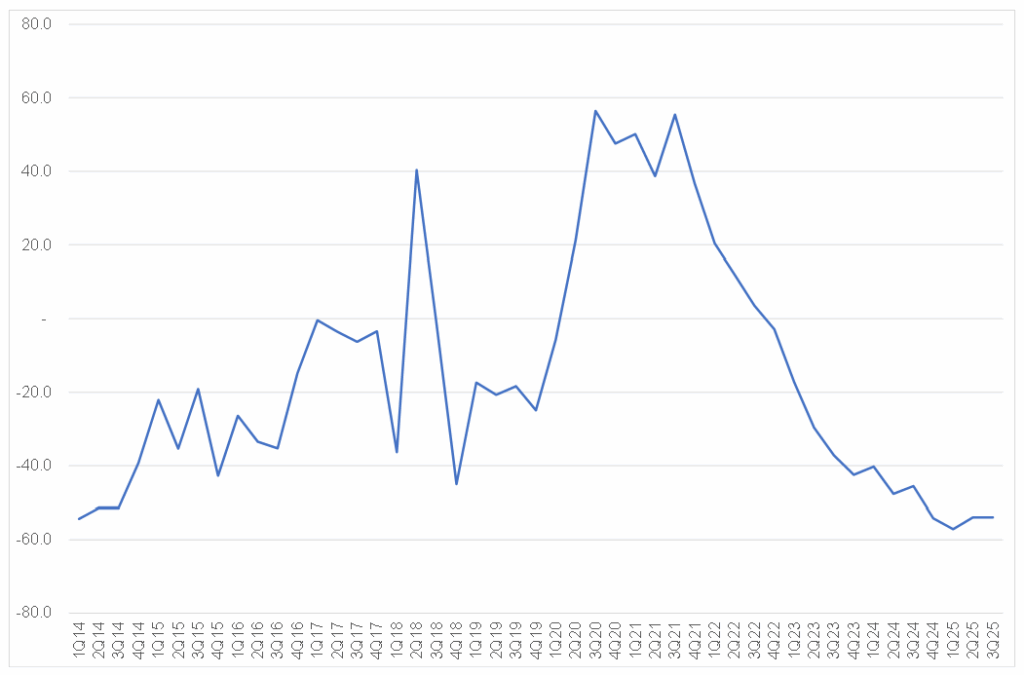

This year’s event arrives at an interesting point in the business cycle. Monthly consumer indicators have been surprisingly robust. Real retail sales have rebounded from earlier softness, and importantly, resilient nominal sales suggest that the improvement is demand-driven rather than simply a reflection of lower inflation.

Figure 1: SA retail sales, YoY % change

Source: Reuters, Anchor

The latest motor vehicle sales data add another layer of optimism. New passenger car sales have been trending higher throughout the year, supported by lower interest rates, competitive import pricing, and pent-up demand after the persistent ageing of SA’s vehicle fleet. In parallel, personal income tax payments have remained firm -an indicator of stable formal-sector earnings. Together, these trends point to a relatively healthy consumer base heading into the spending-heavy November period.

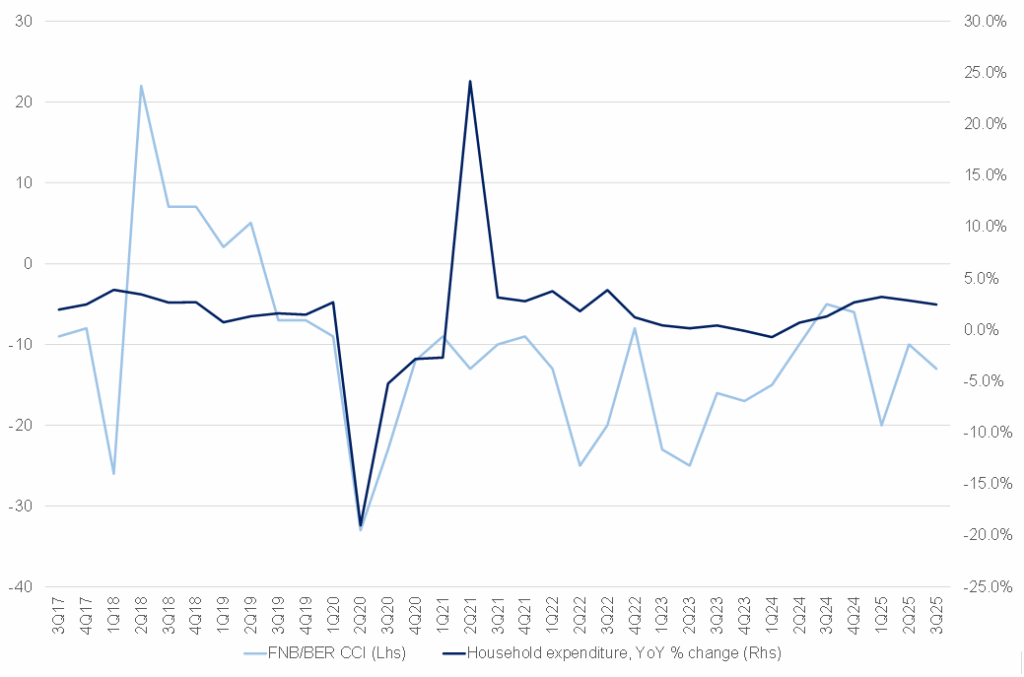

However, it is important to note that beneath these positive indicators, there are deeper structural pressures that will shape how households participate in Black Friday this year. The latest FNB/BER Consumer Confidence Index (CCI) reading (slipping from –10 to –13 in 3Q25) is a clear signal that households remain cautious. Although sentiment is well off its earlier lows, the index continues to sit significantly below its long-term average of –1, reflecting ongoing anxiety about job security, rising costs, and the general economic outlook.

Figure 2: Consumer Confidence Index vs household spending

Source: BER, Reuters, Anchor

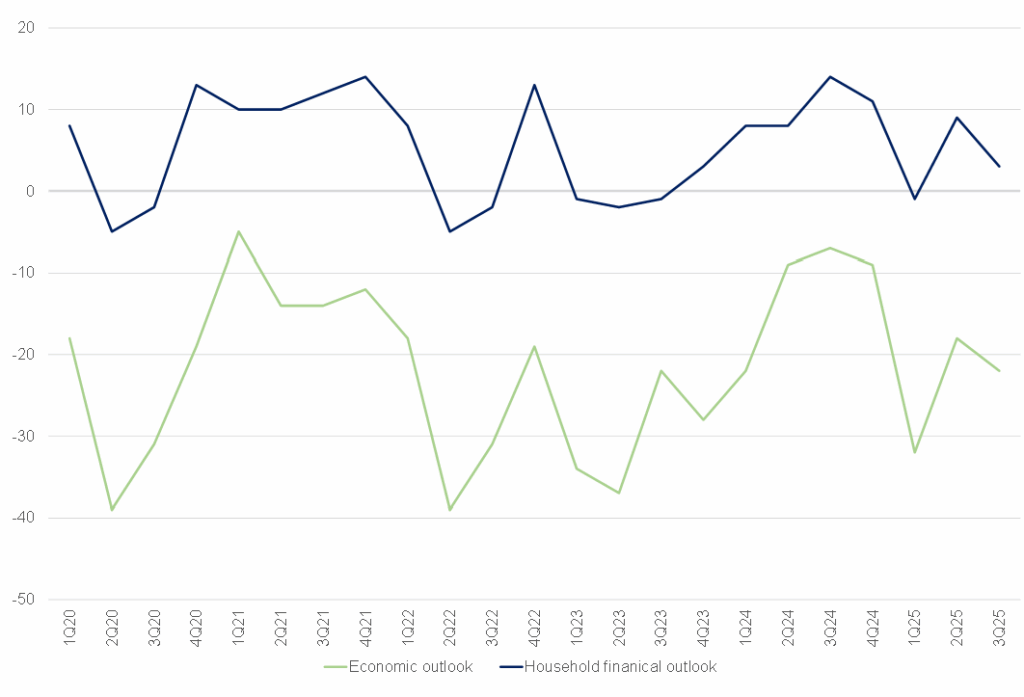

Figure 3: Consumer expectations (the CCI sub-indices)

Source: BER, Anchor

Middle-income households saw a sharp deterioration in sentiment (from –7 to –16), a noteworthy development given that this segment anchors SA’s mass-market retail spending. The pressure on this income segment suggests that, while Black Friday activity may be strong at the top end, participation across the broader consumer base could be increasingly selective. High-income households, by contrast, have maintained stable sentiment, with this notably being the segment that is most likely to drive sales in categories such as electronics, appliances, premium fashion, and home upgrades.

Income dynamics add further nuance. While salaries remain the dominant source of household earnings, investment income has played a surprisingly influential role in shaping consumption trends over the past few years. After plunging in 2020, investment income rebounded sharply in 2021–2022, even outpacing salary growth. This support tapered during 2023–2024, but with equity markets now rallying strongly, investment income may show a resurgence. This could provide additional fuel for higher-income spending over Black Friday, even as middle- and lower-income households remain under strain.

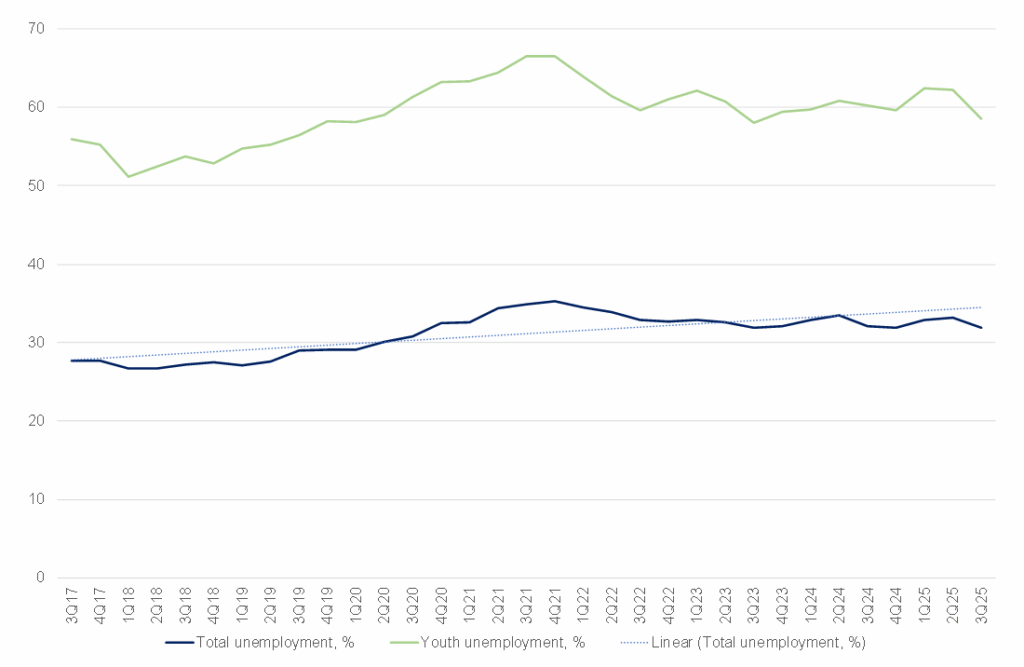

The labour market offers limited support in the near term. Although Stats SA’s latest Quarterly Labour Force Survey (QLFS) data appear stronger than expected, methodological changes have made it challenging to interpret formal vs informal employment trends with confidence. For now, we assume very modest uplift from job creation, reinforced only by targeted government employment programmes rather than broad-based, market-driven gains. This narrow employment impulse limits the potential for widespread retail buoyancy and reinforces the caution reflected in the confidence index.

Figure 4: SA unemployment as per the QLFS, %

Source: Stats SA, Anchor

Despite these headwinds, real household consumption growth is expected to be relatively strong in 2025, supported by earlier wage increases, improved retail performance, stronger vehicle sales, and a still-favourable interest-rate environment. However, the outlook for 2026 is more muted. Growth is expected to moderate as this year’s public-sector wage boost fades, inflation edges higher, and household financial buffers continue to weaken. The weakening buffers are already visible in the data. After briefly improving, household savings rates are drifting lower again, a sign that consumers are increasingly drawing on reserves or credit to manage cost pressures. This trend is relevant for Black Friday: consumers with shrinking financial cushions tend to concentrate spending into a narrower set of necessity-driven or opportunistic purchases, rather than broad-based discretionary splurges.

Figure 5: SA household savings, Rbn

Source: Reuters, Anchor

All these elements – improving retail activity, softening confidence, uneven income trends, fragile savings, and limited employment support – suggest that this year’s Black Friday will likely reflect a bifurcated consumer landscape. High-income households, buoyed by stable confidence and potentially rising investment income, may drive robust spending in premium segments. Middle-income consumers may participate more selectively, focusing on essential upgrades or once-off bargains. Lower-income households, still squeezed by inflation and weak job prospects, may be far more cautious.

For retailers, this suggests that the 2025 Black Friday outcome is likely to be strong in volume terms, particularly in categories tied to higher-income purchasing. Profitability, however, may again come under pressure as discount intensity remains high, and retailers continue to use aggressive pricing strategies to defend market share. For equity investors, this means carefully distinguishing between retailers capable of converting volumes into margin (or using Black Friday to clear high-cost inventory) and those where sales spikes mask deeper operational strain. For fixed-income investors and banks, the focus will be on the extent to which households are using credit to participate in Black Friday- a trend that has already been rising. Any increase in unsecured borrowing heading into the event may flag elevated delinquency risk into 2026 as growth slows and buffers weaken.

Ultimately, Black Friday 2025 is set to offer far more than a burst of seasonal retail activity. It will serve as a litmus test of household resilience, income stability, and economic sentiment heading into 2026. The event’s outcome will provide valuable clues about the durability of SA’s consumption cycle, the robustness of high-income spending, and the extent to which middle-income strain may weigh on broader domestic demand.

In many ways, this year’s event will function as a mirror of the broader economy – a mix of resilience and restraint, optimism and caution, momentum and underlying fragility. For investors, understanding both sides of that mirror (the spending enthusiasm and the structural headwinds beneath it) will be essential for navigating SA’s evolving consumer and macroeconomic landscape.