On 25 February, South Africa’s (SA) Minister of Finance Enoch Godongwana will deliver the 2026 Budget Speech to the National Assembly. This year’s budget is being tabled against a complex and volatile global backdrop.

Global markets have experienced notable volatility YTD, which has coincided with a rapid succession of policy announcements and geopolitical developments emanating from US President Donald Trump’s administration. Trump has adopted an increasingly confrontational stance on trade and foreign policy, contributing to sharp, headline-driven market moves. Geopolitical risks have intensified, including the US setting the dangerous precedent of snatching a sovereign country’s president, criminal indictment threats against the sitting chair of the US Federal Reserve (Fed), the weaponisation of rare earth minerals, Russia continuing its onslaught on Ukraine, and growing international condemnation regarding the humanitarian crisis unfolding in Gaza.

SA has not been completely insulated from these dynamics. The country continues to find itself in the US’s crosshairs due to its foreign policy allegiances. At the same time, domestically, it must contend with underperforming municipalities, infrastructure constraints, water shortages, ANC succession battles, and the upcoming 2026 Local Government Elections. Exposure to global commodity and rate cycles adds further complexity. If not managed prudently, these factors could undermine investor and business confidence.

That said, in a world characterised by elevated geopolitical tension, weakening global institutions and rising fiscal dominance, SA appears relatively well positioned. A rotation of global capital flows, a weaker US dollar, supportive commodity prices and improving domestic policy credibility have combined to create one of the most constructive backdrops for the local economy in over a decade. In several respects, SA enters 2026 surprisingly better-positioned than a year ago, contributing to a degree of economic resilience.

Encouragingly, the Government of National Unity (GNU) also appears to be holding up (despite occasional tensions), adding some political stability to the mix that has supported ongoing economic reform efforts and strengthened perceptions of policy continuity.

The rand strengthened meaningfully in early 2026, breaking through the psychological R15.70/US$1 level on 29 January and appreciating c. 4.2% against the greenback YTD (to 12 February). This strengthening has been driven primarily by broad-based US dollar weakness, supported by stronger commodity prices and, to a lesser extent, gradually improving investor sentiment towards SA assets. A stronger currency provides a dual benefit: higher US dollar receipts from elevated gold and metals prices and improved tax revenues from the mining sector. While the recent currency moves have been pronounced, we believe that the broader trend could persist through 2026, albeit at a more measured pace.

After the embarrassment of February 2025’s postponed National Budget (which was ultimately tabled in May due to disagreements within the ruling coalition over a proposed VAT hike), November’s Medium-Term Budget Policy Statement (MTBPS) was presented against a far more constructive environment. Broader consultation within the GNU and improved in-year fiscal performance helped restore a more measured, market-friendly tone.

The market’s response to the MTBPS was swift and positive. The rand strengthened, bond yields eased, with bullish sentiment around SA Inc. Two announcements were particularly noteworthy for us at the time. First, the National Treasury (NT) reduced weekly fixed-rate government bond issuance from R3.75bn to R3bn. This larger-than-expected adjustment signalled confidence in funding conditions and a lower borrowing requirement. Second, the formal endorsement of a 3% inflation target, with a 1% tolerance band, aligned fiscal and monetary policy. Although the South African Reserve Bank (SARB) had effectively been informally targeting this level, the NT’s formal adoption cemented a clear and cooperative policy framework that enhances credibility and strengthens institutional independence.

Despite ongoing geopolitical risks, the domestic economy has entered the year with renewed momentum. Inflation has moderated, monetary policy has become more accommodative, electricity supply has stabilised, and business and consumer confidence have improved. Structural reforms are progressing, and while logistical bottlenecks persist, operational gains are becoming increasingly evident—albeit somewhat overshadowed by external volatility.

Further positive developments include SA’s removal from the Financial Action Task Force (FATF) grey list on 24 October after nearly three years and a sovereign credit rating upgrade from S&P Global in November (to BB from BB-, while maintaining a positive outlook). Improvements in port and rail performance have also been recorded.

On the fiscal front, the South African Revenue Service (SARS) collected a record R1.9trn in net tax revenue in FY24/FY25, up 6.6% YoY. Despite challenges, for FY25/FY26, collections to 30 September 2025, exceeded R925bn, suggesting that full year revenue may outperform the NT’s c. R1.9trn target.

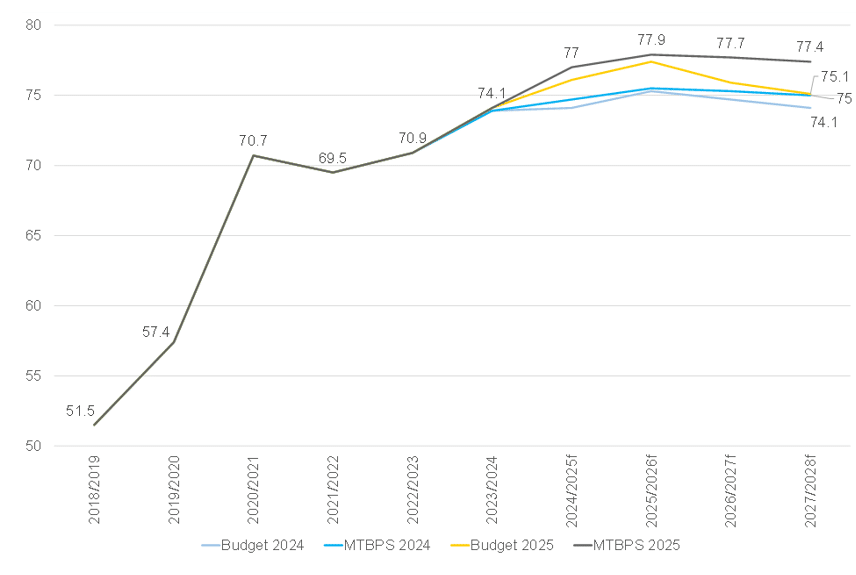

At the time of the MTBPS, the NT projected debt to stabilise at 77.9% of GDP in FY25/FY26, marginally better than prior consensus expectations. Debt-service costs have begun to moderate, supported by lower inflation, a firmer rand, and improving funding conditions. The consolidated budget deficit is projected to narrow gradually from 4.7% of GDP in FY25/FY26 to 2.9% by FY27/FY28. Total expenditure was revised R36bn lower over the medium term relative to the May 2025 Budget, primarily reflecting savings from a softer inflation trajectory and underspending in certain departments.

Figure 1: SA government debt forecasts as a percentage of GDP, %

Source: NT, Anchor Capital

Nevertheless, risks remain:

- Continued weak growth: GDP growth remains subdued, SA’s economy grew 0.5% in 3Q25, slower than the previous quarter’s revised 0.9% QoQ growth. While multiple sectors have shown improvement, overall economic expansion remains insufficient to reduce unemployment, inequality or household income pressures meaningfully. Without accelerated reform to unlock investment and rebuild confidence, the economy risks remaining trapped in a low-growth equilibrium, where even small gains feel elusive against the weight of structural constraints and everyday cost pressures.

- Public sector wage pressures: The higher-than-budgeted wage agreement (of 5.5%) to public sector employees exceeds earlier budget assumptions, adding material fiscal pressure over the medium term. Absorbing these costs without compromising consolidation efforts will require difficult trade-offs. According to the NT, the agreement will cost the fiscus an additional R7.3bn in 2025/2026, R7.8bn in 2026/2027 and R8.2bn in 2027/2028.

- State-owned enterprises (SOEs): The precarious financial fragility of several SOEs continues to pose contingent risks to the balance sheet. Ongoing bailouts and operational inefficiencies, particularly in logistics, constrain growth and reduce export-related revenue.

Additional vulnerabilities include weaker global growth, commodity price volatility, substantial debt redemptions and persistent structural constraints in energy, logistics, and local government. SA’s greatest structural risk is not a single shock but the combination of low growth, high debt and limited fiscal space. Policy credibility remains critical, and SA does not have much room for mistakes.

Regardless, amidst all these factors, in anticipation of the 2026 Budget, the points highlighted below form part of our wish list, or set of ideals, for the Budget:

- A clear and credible demonstration of the government’s commitment to fiscal consolidation with difficult actions rather than simply words. SA’s gross loan debt is over 70% of GDP, with interest payments one of the largest line items in the budget. The core focus should be on stabilising and the eventual reduction of public debt.

- Ongoing and transparent SOE reform to limit their reliance on government.

- No additional tax increases, but rather improved revenue efficiency and enforcement of tax compliance. We expect that the minister will have significant wiggle room as elevated commodity prices have supported profits in the mining sector and boosted tax receipts. This is likely to continue for some while; however, the commodity cycle is not forever.

- A credible and firm trajectory for debt reduction, where debt levels begin to come down rather than escalating at a slower pace. It is the application of the windfall gains from the mining sector toward debt reduction that is important.

- Additional reforms to improve the ease of doing business in SA.

- A focus on working towards further rating upgrades through better fiscal management and a durable rebuilding of infrastructure.

- Concrete plans to address the financial distress of municipalities nationwide.

- Clarity on the future structure and funding of the Social Relief of Distress (SRD) grant. The NT has confirmed the grant is funded until March 2027, but it remains uncertain if it will finally be formalised into a basic income grant beyond that point.

- Greater transparency regarding the funding model of the National Health Insurance (NHI) Bill.

Ultimately, whether any of the abovementioned wish list items will come to fruition remains to be seen. Many other fiscal-related issues also need to be addressed, and this list is by no means exhaustive. Overall, reining in new expenditure pressures, eliminating waste and inefficiencies, and prioritising growth-enhancing initiatives will be essential. In an increasingly uncertain global environment, consistent delivery and credible reform can lower SA’s risk premium, attract investment, and support a more durable growth trajectory over time.