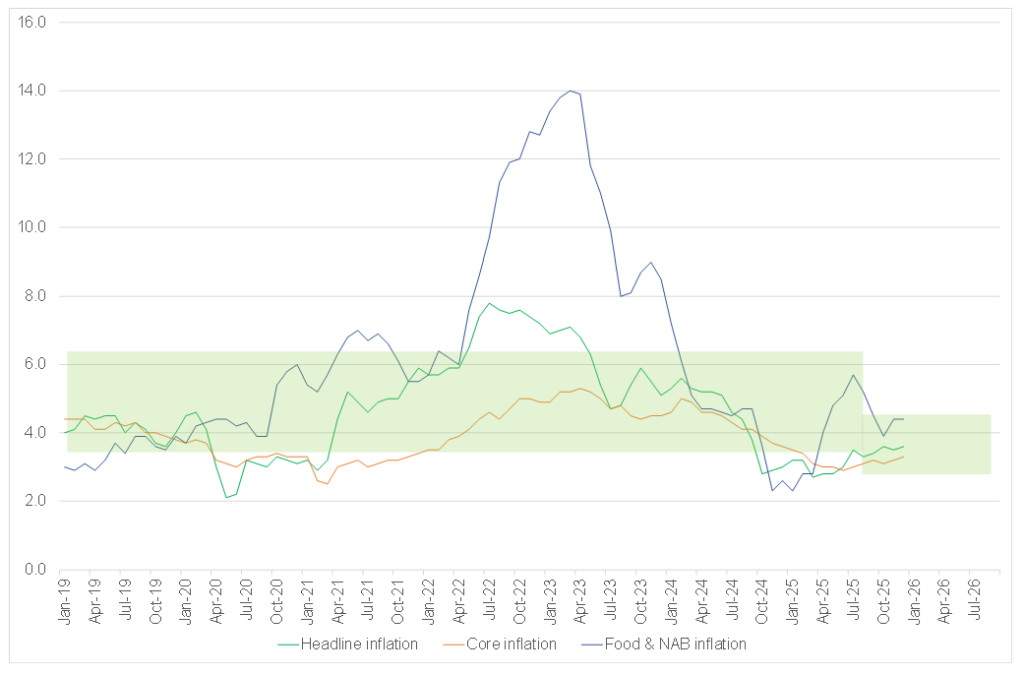

South Africa’s (SA) headline consumer inflation increased modestly to 3.6% YoY in December from 3.5% in November, undershooting market expectations and reflecting a broadly contained inflation environment. The key takeaway from this slightly below expectations inflation print is that most analysts expect this to be peak inflation and that we anticipate marginally lower prints for the time being. With the peak lower than expectations, it does open the door to further rate cuts.

Currently, inflation is largely being driven by housing and utilities (of which administered prices are a significant component), food and non-alcoholic beverages (NAB) inflation, which continues to track higher than average at 4.4% (in large part because of rising meat prices and the impact of the recent outbreak of foot-and-mouth disease) and insurance costs, which are above average. While lower oil prices combined with a stronger rand have helped bring the cost of fuel down, we note that oil prices have ticked up again in recent weeks and that the rand may find it difficult to continue to strengthen at the current pace. So, although we expect headline inflation to decline over 2026, a key driver of the inflation decline over the last while is set to lose its impetus.

Figure 1: SA inflation, YoY % change

Source: Stats SA, Anchor

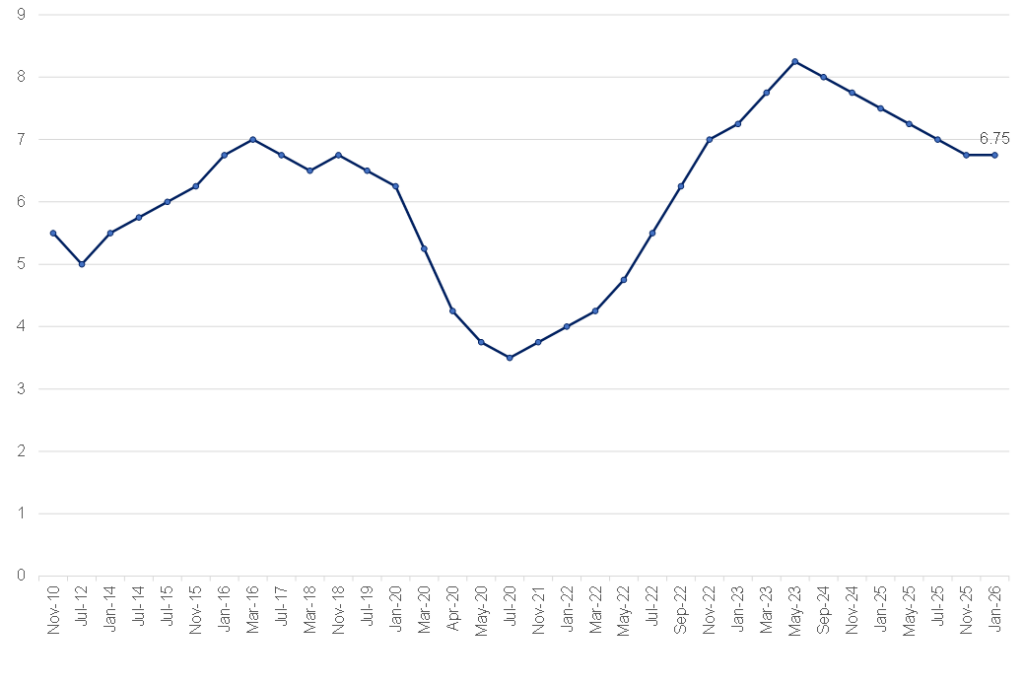

Against this backdrop, and in line with expectations, the South African Reserve Bank’s (SARB) Monetary Policy Committee (MPC) opted to maintain interest rates at 6.75%. The prime lending rate remains at 10.25%. The decision was split with 4 members voting for a hold and 2 members preferring a cut. This, along with the contents of the statement, indicates that while this is a pause, we are likely see further rate cuts this year. The SARB’s Quarterly Projection Model (QPM) continues to indicate gradual rate reductions as inflation converges towards the target, although decisions will remain data-dependent and assessed meeting-by-meeting. The model suggests that SA will move from a slightly restrictive monetary policy stance toward a neutral stance in 2027. This implies three more interest rate cuts of 0.25% each between now and mid-2027, assuming that the economy progresses in line with the model.

Two risk scenarios informed the MPC’s deliberations, both centred around the risk of shocks to the oil and the value of the rand (one scenario positive, one scenario negative). The conclusion was that shocks might accelerate or slow down the likelihood of interest rate cuts as the inflationary impacts play out. Shocks that raise inflation will make it more difficult for inflation expectations to slide lower toward the SARB’s inflation target. Conversely, shocks that might bring inflation even lower would likely accelerate the acceptance and adoption of the lower inflation regime, allowing for interest rates to move toward neutral faster. The path toward the target might accelerate or decelerate depending on how this plays out and feeds into inflation expectations. In either scenario, SA will achieve the SARB’s inflation targets.

Significantly, the SARB also revised its GDP growth forecast upward with a gradual improvement toward 2% over the medium term. Employment gains have supported this trajectory, though investment remains a key lagging component, although it is improving. Fixed investment contracted in 1H25 but recovered modestly in the second half of the year. Overall, output conditions continue to improve, but the pace of expansion remains gradual. As such, the risks to the outlook are assessed by the SARB as broadly balanced, suggesting neither excessive downside vulnerabilities nor significant upside momentum at this stage.

Figure 2: The history of the SARB MPC’s repo rate changes, %

Source: SARB, Anchor

The broadly expected decision to maintain interest rates at current levels reinforced a coherent narrative: inflation remains well-behaved, expectations are trending toward a lower anchor, and monetary policy is transitioning—gradually—toward a less restrictive stance while safeguarding the credibility of the new target regime. This measured easing supports household consumption via lower debt-servicing costs, and together with moderating food inflation, should lift real disposable incomes without risking price pressures. We note that services inflation, which is above 4%, and administered price inflation, which might rise with the latest National Energy Regulator of South Africa (NERSA) rulings, are risks that need to be considered.

Overall, Anchor interprets this to mean that, absent any major shocks, the SARB wants to see inflation reduce as is expected by both the SARB and consensus economists’ forecasts before a likely interest rate cut at the MPC’s next meeting in March.