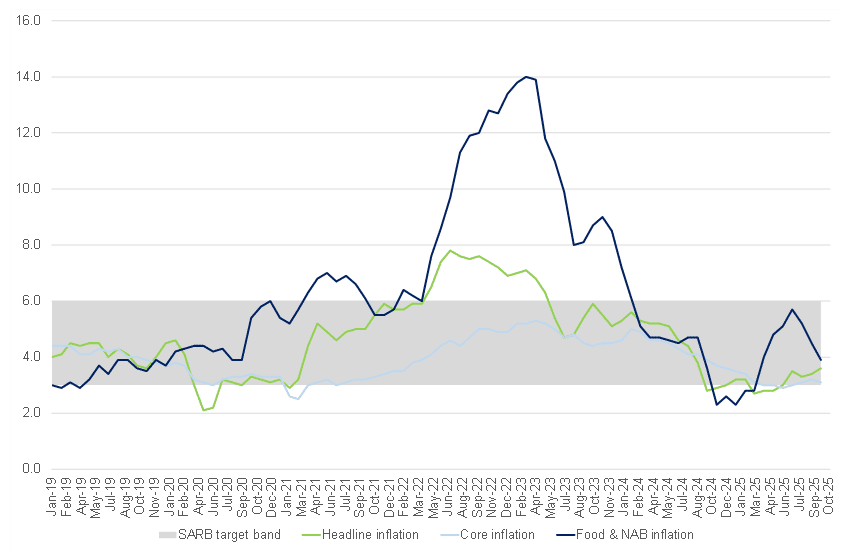

South Africa’s (SA) headline consumer inflation increased modestly to 3.6% YoY in October from 3.4% in September, undershooting market expectations and reflecting a broadly contained inflation environment. The key source of downside surprise relative to forecasts was food and non-alcoholic beverages (FNAB) inflation, which decelerated to 3.9% YoY, from 4.5% YoY in September. This moderation contributed to a softer core inflation outcome of 3.1% YoY, down from 3.2%.

The disinflation in FNAB was driven primarily by further notable declines in vegetable prices. Vegetable prices contracted by 3.0% MoM in October, marking a fourth consecutive monthly decline. Consequently, annual vegetable inflation moved sharply lower to -4.4% YoY from 1.2% in September. Meat prices were broadly stable on a monthly basis, resulting in a modest easing in YoY meat inflation to 11.4% from 11.7%. Cereal and bread prices remained subdued, rising only 2.0% YoY, supported by favourable global grain dynamics and a strong local maize harvest. While base effects may lift cereal inflation in the near term, the broader food inflation trajectory remains uncertain amid heightened volatility in vegetable pricing.

The upward pressure on headline inflation stemmed almost entirely from fuel prices. Fuel inflation rose to 3.3% YoY from -2.2% in September, ending more than a year of sustained annual fuel deflation. However, this outcome largely reflects base effects rather than renewed price pressure, as fuel rose a negligible 0.1% MoM in October. Fuel-related inflation is expected to retreat in the next CPI print, given prevailing price declines at the pump. Core pricing dynamics continue to reflect weak domestic demand conditions and a favourable import cost environment. Durable goods inflation contracted by 0.3% MoM and 0.9% YoY, driven by deeper price declines across electronics, household goods and appliances. Vehicle prices were flat MoM, moderating annual vehicle inflation to 1.2%.

Figure 1: SA inflation, YoY % change

Source: Stats SA, Anchor

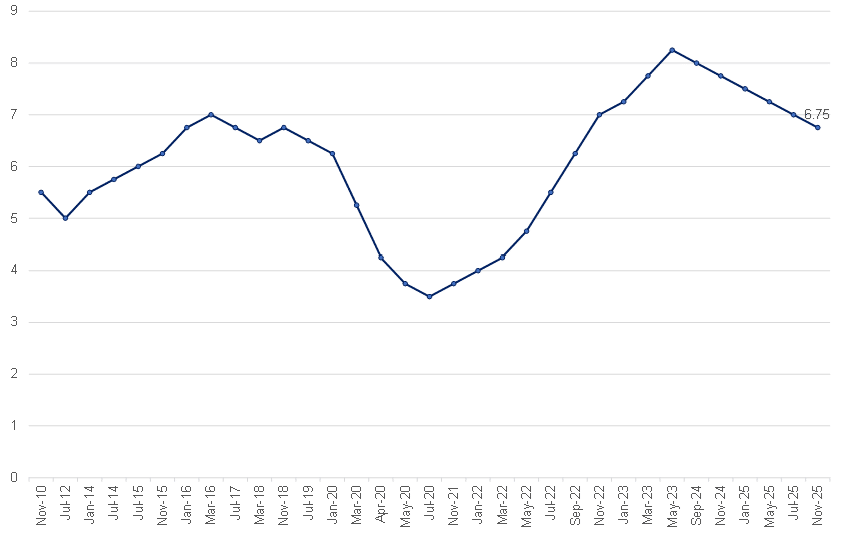

Against this backdrop, and in line with expectations, the South African Reserve Bank’s (SARB) Monetary Policy Committee (MPC) opted to reduce the policy rate by 25 bpts to 6.75%, effective 21 November. The prime lending rate now stands at 10.25%. The decision was unanimous, signalling confidence in the durability of the disinflation process and the scope for a less restrictive policy stance. The SARB’s Quarterly Projection Model (QPM) continues to indicate gradual rate reductions as inflation converges towards the target, although decisions will remain data-dependent and assessed meeting-by-meeting.

Two risk scenarios informed the MPC’s deliberations.

- The first reflected the potential for a rebound in the US dollar, which could test the recent rand appreciation that has partly stemmed from broad US dollar weakness rather than domestic strength alone.

- The second considered the inflationary impact of a rapid adjustment in administered electricity prices following the R54bn tariff miscalculation disclosed earlier this year.

Both scenarios imply a slower pace of easing relative to the baseline, highlighting the sensitivity of the rate trajectory to exchange-rate and administered-price shocks. Notably, the electricity-pricing scenario underscored that greater alignment of price-setting behaviour to the new 3% target would provide space for faster policy normalisation.

Significantly, the SARB also revised its GDP growth forecast up to 1.3% for 2025, with a gradual improvement toward 2% over the medium term. Employment gains have supported this trajectory, though investment remains a key lagging component. Fixed investment contracted in the first half of the year but is expected to recover modestly in 2H25, which, if realised, would signal progress toward a more sustainable growth path. Overall, output conditions are strengthening, but the pace of expansion still falls short of levels associated with historically healthy growth. As such, the risks to the outlook are assessed by the SARB as broadly balanced, suggesting neither excessive downside vulnerabilities nor significant upside momentum at this stage.

Last week’s announcement of a revised inflation target of 3% with a ±1-ppt tolerance band marks a significant evolution in SA’s monetary framework. This shift away from the longstanding 3%–6% range reinforces the objective of entrenching price stability more explicitly at lower inflation levels. The tolerance band does not imply equal acceptability of inflation outcomes between 2% and 4%; instead, 3% remains the focal point, with the band recognising that shocks and lags in monetary transmission make exact precision impractical in real time. Flexible inflation targeting remains central to the framework. Deviations from target will be explained transparently, with policy actions calibrated to return inflation to 3% over the typical 12- to 24-month horizon. The effectiveness of the revised regime will hinge on long-term expectations anchoring at 3%, even during periods of short-run volatility.

Figure 2: The history of the SARB MPC’s repo rate changes, %

Source: SARB, Anchor

Taken together, the October inflation data and Thursday’s (20 November) rate cut reinforce a coherent narrative: inflation remains well-behaved, expectations are trending toward a lower anchor, and monetary policy is transitioning—gradually—toward a less restrictive stance while safeguarding the credibility of the new target regime. This measured easing supports household consumption via lower debt-servicing costs, and together with moderating food inflation, should lift real disposable incomes without reigniting price pressures. For firms, a stable disinflation path and a clearer 3% anchor reduce planning uncertainty and lower the cost of capital over time, creating a more supportive environment for an eventual investment recovery.

A credible lower inflation regime also carries fiscal benefits, contributing to reduced risk premia in government borrowing costs and, ultimately, easing pressure on the sovereign balance sheet.

Nevertheless, the strength of these benefits depends critically on expectations remaining firmly anchored at 3%. The effectiveness of the revised regime will hinge on long-term expectations holding at the target (even during periods of short-run volatility), allowing rate cuts to proceed without undermining price stability.