Coal miner, Thungela Resources released a pre-close and trading statement for the six months ended 30 June 2022 (1H22) on Monday (13 June 2022). Below we discuss the main points coming from the trading statement.

In summary:

- Export volumes disappointed due to a poor and inconsistent performance by Transnet Freight Rail (TFR). Thungela CFO Dean Smith said that the steps taken to soften the impact of this included the decision to curtail production where Thungela was able to minimise stranded costs.

- Thungela has built up its cash position to R15.3bn or R115/share as of 31 May 2022.

- In our view, there is the potential for an interim dividend of c. R55-R60/share being declared. However, we note that the CFO did not want to quantify anything on the call although he reiterated Thungela’s intention of returning cash to shareholders.

- We estimate that the share is currently trading on 1.7x FY22 earnings

Export volumes disappointed due to poor performance from TFR

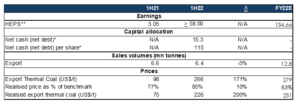

In February, Thungela guided for export sales volumes of 14mn–15mn tonnes for FY22. It has done 6.4mn tonnes in 1H22 – a disappointing number resulting from the ongoing issues at TFR. Nevertheless, Thungela is maintaining its FY22 export sales volumes guidance of 14mn–15mn tonnes although it did state that it is “… closely monitoring the previously issued export saleable production guidance in light of the inconsistent TFR rail performance”. We have lowered our expectations for FY22 export volumes to 12.8mn tonnes (i.e., assuming a second half in line with 1H22), which brings our FY22 HEPS estimate down to R135/share (the Bloomberg consensus analyst forecast is at R141/share).

Figure 1: Thungela Resources 2022 forecasts, Rbn except per share

Source: Bloomberg, Anchor

*Tax and royalty payments relating to 1H22 will be made in June 2022.

**FY22 HEPS estimate of R135 assumes actual YTD prices to 13 June 2022, then assumes spot to 31 December 2022.

*** Spot API4 thermal coal: US$312/tonne.

Net cash has built up to R15.3bn or R115/share

Thungela reiterated its liquidity target range of R5bn-R6bn (R38-R45/share) in the present environment. Thermal coal demand was firm at the start of this year as the world continued to recover from the pandemic, but Russia’s war on Ukraine significantly impacted global energy markets, sending volatile coal prices soaring as many European countries attempted to find alternative energy sources after sanctions were imposed against Russia. The benchmark price of coal has risen by c. 167% YTD to US$312/tonne. Thungela is currently targeting the upper-end of its liquidity target range – R6bn or R45/share. That would suggest R9.3bn or R70/share being available first for tax and royalty payments relating to 1H22 (to be paid in June) and second for dividend payments. The company’s official dividend policy is 30% of free cash flow but we expect Thungela to distribute most of whatever cash exceeds its R6bn liquidity buffer after making the necessary tax and royalty payments. The statement suggests that this move by Thungela remains a good possibility. It also reiterates the board’s commitment to “return additional cash to shareholders above the targeted minimum payout ratio of 30% of adjusted operating free cash flow”. Such a dividend could turn out to be around R55-R60/share.

The R15.3bn of net cash was as at end-May 2022 and thus we can add another month of earnings (R1.5bn or R11-R12/share) to that number. We could therefore see an interim dividend of around R55-R60/share if Thungela decides to distribute all cash above its R6bn liquidity buffer to its shareholders.

On export volume guidance, the CFO indicated that he accepts that there is a risk to the 14mn–15mn tonnes guidance. Thungela aims to hit the bottom range of that guidance. We are assuming FY22 volumes will come in below the 14mn tonnes number.

We remain holders of the share due to tightness in thermal coal prices and the potential for above-normal cash returns. However, we also highlight that these positive factors need to be weighed against ongoing volume issues at TFS.