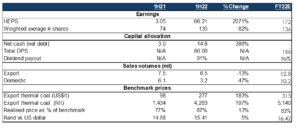

Coal miner, Thungela reported results for the six months ended 30 June 2022 on Monday (15 August 2022). The company, which spun out of Anglo American in June 2021, was buoyed by soaring coal prices which have reached record highs following Russia’s invasion of Ukraine. The resultant sanctions on Russia, a major European gas supplier, have seen increased gas to coal switching. Thungela posted a profit of R9.6bn vs an R351mn profit in the same period of 2021, and its cash soared 70% YoY to R14.8bn. It also declared an R60/share dividend – a payout of R8.2bn, or c. 92% of adjusted operating free cash flow (FCF). Thungela’s share price is up c. 237% YTD.

Figure 1: Thungela overview and forecasts, in Rmn except per share

Source: Company data, Anchor

We note that the two things which investors were probably most focused on in this set of results are:

1). The dividend; and

2). Full year (FY22) sales volume guidance, given Transnet’s disappointing performance YTD.

The R60/share dividend seems to be in line with consensus analyst forecasts. In 2H22, we expect Thungela to pay out 100% (or very close) of its earnings as dividends.

Looking ahead, Thungela lowered its sales volume guidance from 14.0-15.0mt to 13.0-13.6 mt (see table in Figure 2 below), meaning that the Group has cut its FY22 guidance for export production by between 7% and 9.3%. CEO July Ndlovu said that the downward revision in export saleable production guidance resulted from continued uncertainty around Transnet Freight Rail’s (TFR’s) performance. He added that this was disappointing, but Thungela continues to “… use the levers at our disposal to mitigate the impact on our operations and financial performance,”. The lower guidance was expected given TFR’s woes this year. Our FY22 earnings estimate is based on a 12.8 mt volume estimate.

Figure 2: Thungela – Group operational outlook

Rand amounts in the table above are in real money terms

Source: Thungela

Our FY22 EPS estimate is R171. Bloomberg consensus earnings have been in an upgrade cycle for some time and, as a result, the difference between consensus (R152/share) and our estimate (R171/share) is now relatively small (an 11% difference).

In summary, we would continue to be buyers of Thungela. We expect cash returns to be solid and second-half earnings to come in more robust than what Thungela has just reported for its first half. Thungela has reduced its volume guidance, which has led to higher unit cost guidance. For now, high coal prices mean unit cost inflation can be overcome. We believe Thungela will produce stronger earnings in the second half of this year, thanks to higher volumes and coal prices. We estimate earnings of R171/share for FY22. That implies Thungela is trading at 1.7x FY22 earnings and a 56% FY22 dividend yield. We do not expect coal prices to hold near their extraordinarily high spot levels over the long term. Still, there is the potential for energy prices to remain higher for longer than initially expected.