“I don’t know,” may be the three most liberating words in financial markets.

I learned this in 1991 as a university student studying for a commerce degree. There was an imminent threat of war between the US and Iraq, which the world was following closely. The then secretary general of the United Nations (UN) was Javier Pérez de Cuéllar. Following a last-ditch meeting in January 1991 with Iraqi leadership (in an attempt to avert war with the US), he was asked by reporters whether he thought there was going to be war or not. His answer was striking: “It is a question, if you believe in God, only God knows. If you don’t believe in God, who knows?”

His admission that, despite his position, he did not know what was going to happen made a more powerful statement to me than if he had tried to force a “Yes” or “No” answer. It made me realise the seriousness and gravity of the situation. Sometimes, there can be a signal in someone in an apparently knowledgeable position, admitting they do not know the answer to a question. A caveat is that this article relates more to investment matters that involve gazing into a crystal ball. It is less relevant for more fact-based areas such as legal and tax advice.

It seems like we do a complete circle in this regard. As a junior sell-side analyst in the mid-1990s, I felt like I knew almost nothing. You lived in fear of being asked a question by a client that you could not answer. For years, you worked on your knowledge base to find the answers to the questions ahead of time that clients might ask. A junior analyst saying “I don’t know” to a fund manager client asking a question felt like a disaster. The reality is that being unable to answer many client questions was likely to bring one’s career to a premature end. However, eventually, as an experienced analyst, you complete the circle and become quite comfortable with periodically telling a client you did not have the answer to their question. Sometimes it is more helpful to acknowledge you don’t know, rather than trying to force an answer.

American philosopher, diplomat, and president of Columbia University, Nicholas Murray Butler (1862–1947) captured this perfectly:

“An expert is one who knows more and more about less and less until he knows absolutely everything about nothing.“

The point here is that the more of an expert one becomes in a field, the more one appreciates the intricacies of that field and how little one actually knows. In my view, this ties directly into the phenomenon of so-called imposter syndrome (a term coined in the late 1970s). Imposter syndrome is where experts in their field secretly feel like they are fraudsters tricking their audiences into believing that they know more than they really do. One school of thought is that, ironically, the more you know about a topic, especially a complex one, the more likely you are to experience imposter syndrome. Research shows that as many as 70% of people will experience it at some point in their lives. It is also more prevalent in high-performance fields like technology and medicine.

Arguably, the most burning issue in global investment markets at the moment is whether AI-exposed companies are in a bubble or not. Is AI a bubble? I don’t know! I hear the compelling arguments from both sides, and I am really not sure. I am also not sure anyone genuinely knows. However, here are some observations I have made.

It seems to me that the AI bears are a lot more confident that they are right than the AI bulls, often stating their opinions as fact. It is simply “the AI bubble” or “when the AI bubble bursts”. So much so that the term “AI bubble, bubble” comes to mind. It feels like there is currently a bubble in people calling AI a bubble! Negative narratives about AI (from an investment perspective) are completely overwhelming financial podcasts, social media and mainstream global business news networks. There is a lot of FUD (fear, uncertainty and doubt) on social media about the AI trade. I will say that this is not how bubbles usually form, in my opinion.

Although many of the bearish arguments are compelling at face value, they are mostly the same arguments being rehashed, perhaps from different angles. A key one being OpenAI committing to future capex well in excess of its current or 2026 projected revenue of c. US$30bn. I am not sure the world has ever seen this before, especially at such a large scale from a single company. Another one is the circular nature of funding transactions between Nvidia and companies such as OpenAI and CoreWeave, which has the market understandably very concerned. I am not going to go through all the details for the purposes of this article. There are countless articles out there discussing these issues.

It is hardly worth following most of these articles at this point due to their repetitive nature. I would say that calling AI a bubble is not a niche, contrarian view anymore. It is now consensus amongst social media and mainstream business media. If AI does end up being a bubble, it would be one of the most widely telegraphed bubbles ever. It seems unusual that a bubble would be so widely warned about ahead of time. I have never viewed social media as a prime source of investment advice.

I believe the overwhelming view of AI being a bubble is not a negative thing, but actually a good thing. It reduces the chances of excess developing in the AI ecosystem. It might reduce the risk of failures or disappointments to individual companies periodically, rather than a dramatic, overall stock market collapse. I would be more worried if almost no one were talking about a potential AI bubble.

The AI bulls seem more guarded about their views for the most part. A lot of the bulls appear to be people heavily involved in the inner workings of AI, with a deep technical knowledge of what is going on. They portray the view that the general investing public has a limited understanding of how profound and enduring the oncoming AI onslaught is going to be. They seem to be a smaller and less vocal but more knowledgeable group than the AI bears. That in itself, does not make the AI bears wrong!

I was working in the market in 1999 as the tech bubble was playing out. This was before the days of podcasts, social media and trading apps on pocket devices. However, it felt to me that the market was all-in on tech stocks back then. One did not hear many dissenting voices about investing in tech shares. The tech bears felt like a contrarian minority. It was mostly conservative, deep value investors who were sounding the alarm bells, and they were typically ostracised for their views. They did end up being correct and saved themselves and their clients from a tremendous amount of pain for a couple of years.

However, there was a sting in the tail. From the wreckage of the tech collapse starting from about 2002, arose generational opportunities to invest in tech stocks that have lasted over two decades. It is easy to identify these tech winners with the benefit of hindsight, but even owning just a couple of them over the long term has yielded outstanding returns. My point here is that avoiding the tech bubble of 1999 was only part of the story. The other arguably more important part of the story was to be ready to buy some winning tech companies and hold them for the very long term. Anecdotally, I feel that many investors who correctly avoided the tech bubble around 1999/2000 then missed the subsequent opportunity to invest in the generational tech companies that arose from the ashes of the tech collapse.

If nobody really knows how AI will unfold over the next three to five years, how does one invest in the AI theme? In my view, risk management is key. Do not be all in on AI, but also, do not be all out. The AI thesis is likely to be in a constant state of flux. Be flexible and keep an open mind, listening to both sides of the argument. Do not hold onto your views too rigidly. Narratives are shifting all the time.

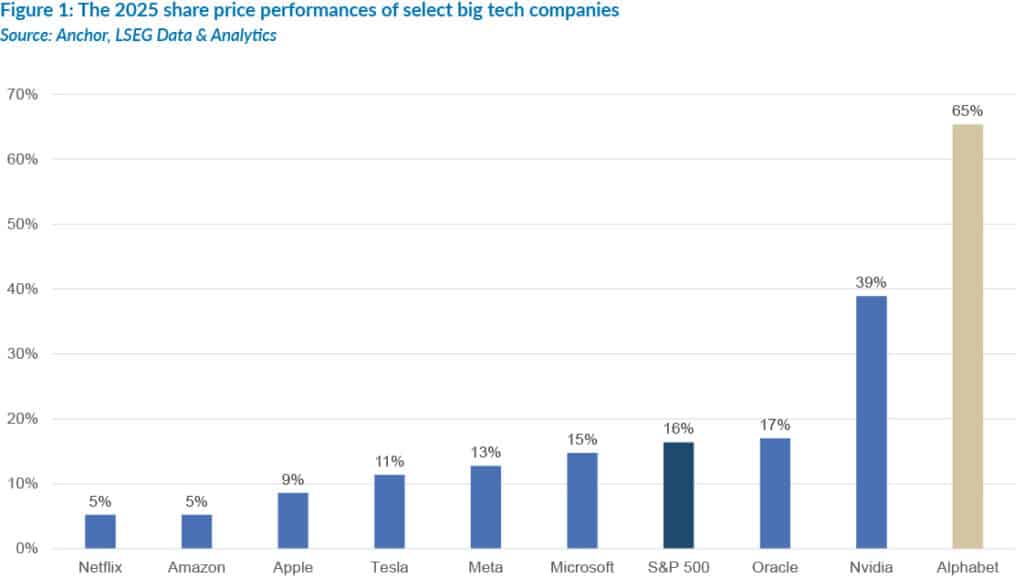

Arguably, the most significant narrative shift this year has been Alphabet (Google’s parent). Several prominent global tech investors, 12-18 months ago, felt that Alphabet was facing an almost existential threat from OpenAI. Recently, the narrative has shifted to the threats that OpenAI faces from Alphabet! Suddenly, companies perceived to be over-indexed to the success of OpenAI are selling off after having previously been winners for the very same reasons. The world of AI will probably look completely different in 5 years than how we perceive it today. I also think focusing on big companies with decent balance sheets reduces risks a lot. Big companies with financial might and scale are going to be very difficult to compete against in the world of AI.

Another possibility is that the big, audacious AI bubble bursting that many AI bears expect may never happen. It could be contained to failures amongst individual AI-exposed stocks over time. So rather than making a top-down decision to “get out of AI exposure”, investors should focus on stock selection while managing overall portfolio risk.

In conclusion, we start off our careers in financial markets by saying “I don’t know” to just about everything because we lack experience. As we become more experienced, we feel compelled to have an answer for every question. Finally, you go back to admitting you don’t know something when you don’t know. So next time your favourite Anchor advisor or analyst answers your question with “I don’t know”, it may be the most insightful answer you hear. Sometimes it is okay or even better not to know.