This is one of the most fascinating plays on the SA market at present and the way it plays out will be an investment lesson that will be long remembered.

Sibanye-Stillwater is a story of governments around the world collectively increasing vehicle emission standards, which has resulted in a surge in demand for the PGM metals, with supply constrained because of a lack of investment. This is due to an industry in financial distress after the Global Financial crisis of 2008 and an uncertain and unsupportive investment environment in South Africa, which accounts for the bulk of global PGM production. PGM prices have risen to levels nobody would have dreamed of a few years back.

There is no doubt a short term bubble, but prices might remain elevated enough, for long enough, to make Sibanye very attractively priced. Management wants to use a portion of the current massive cash generation to diversify the business into other areas (more gold and green energy metals) to sustain future dividends. Sibanye wants to be a dividend leader, but it appears that short term holders (which characterise the marginal investor in resource companies) just want cash back as dividends (more than the promised 25-35% of normalised earnings) or buybacks and the default view seems to be that any cash spent on new ventures or acquisitions is toxic. This despite the fact that Sibanye’s current cash flows would pay for ALL historic acquisitions in 6 months – a truly remarkable outcome and an indication that the company is among the best in the market in capital allocation, if measured by historic success.

The share price is suggesting that either PGM prices are set to have a sustained, sharp decline from this point, or that management will burn all the current cash being generated. We think that neither implied assumptions are correct. In fact if the current share price was R120 (now R65) I would imagine that broker reports would be viewing the share as fairly valued. The collective investment community seems scared to push the share price higher and we believe are all looking over their shoulders at what others are doing and thinking. It currently seems popular to be concerned about “what Sibanye will do with its cash”. This might well present an opportunity. Sibanye’s disclosure, transparency and future prospects are all world-class. So we don’t have any secrets, but this looks like a good story.

- This company has a market cap of R190bn with net cash – bear this in mind when you read the below. Historic HEPS is 1068c and 2021 HEPS could well be 2000c to 2500c – a 3.2x to 2.6x PE. The dividend should be 650c-1000c – a 10% to 15% DY. The ranges are so big because prices are so high, but it certainly looks like Bloomberg consensus HEPS of 1644c (for 2021) and 1497c (for 2022) could be exceeded materially!

- Current business performance is ridiculous at R20bn EBITDA for the quarter. This number was just under R50bn for the whole of last year and they paid R40bn for ALL their acquisitions to date! The R4.3bn Lonmin purchase price now looks like a joke.

- The first quartile is usually the worst from a production perspective, after return from holidays etc. At the same commodity price basket, this level of earnings is at least sustainable for the year.

- However …. The average PGM basket price for the quarter was R53,000 per ounce and the current spot is R70,000. With an all-in sustaining cost of R18,000 per ounce, some simple maths suggests current run-rate/spot profit is 40-50% HIGHER than the R20bn per quarter. So that’s about R9 billion per month in cash currently – it would take 21 months to make the market cap back in EBITDA, or viewed another way it is generating 5% of its market cap in EBITDA every month. When you hold the share it is currently getting 5% cheaper every month.

- It obviously cannot last – PGM prices are at levels nobody ever dreamed of, but it is important to contextualise the impact of current cash flows. If this was sustained, at an 8x PE the price would be circa R240.

- But the upside lies in the fact that it can last for a while and if sustained, the value in the share quite quickly becomes substantial.

- The company view is that basket prices could remain high for 3-4 years – not the market view as the share price would be MUCH higher.

- The current PGM price bubble is due to a combination of limited supply (little new capex and production due to uncertain long-term future) and increasing demand (due largely to INCREASING emission standards from governments – these continue to increase and cars need higher PGM loadings). The PGM cost per medium sized car is now around US$600 (5-6 grams), which is uncomfortably high – the incentive to reduce this must be big. However, it is difficult to see how this squeeze changes in the next few years as these factors are likely to be sustained. But car companies are very conscious of not cutting corners and not getting fines or bad press like VW a few years ago.

- The individual metal outlooks are as follows:

- Platinum (of SA PGM: 51% of production, 21% of revenue) – 3 to 4 year positive. In the interests of long-term sustainable prices, Sibanye has sponsored R&D into palladium/platinum substitution technology. The industry has been hesitant to invest because of long term uncertainty. There should be 1.5m ounces of substitution from palladium to platinum by 2025 which should result in a platinum deficit. This suits Sibanye as it is 51% of production.

- Palladium (of SA PGM: 25% of production, 25% of revenue) – strong for 3 years, thereafter negative. High prices have resulted in investment and more production coming on stream and for the same factors as indicated above for platinum, demand will decrease.

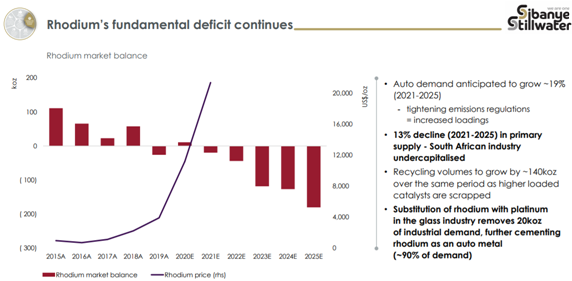

- Rhodium (of SA PGM: 8% of production, 46% of revenue) – strong for three years, thereafter sustained deficit for a time period, but after five years could decline sharply. This is where the real squeeze has happened and as they say “is the most precious metal of all”. Rhodium is a by-product and a small part of the physical PGM basket (only 8% for Sibanye), but contributes a massive 46% of revenue. You cannot set out to mine more Rhodium due to its small part of the basket. As you can see in the chart below Rhodium has gone from under US$3,000 an ounce to over US$20,000 (currently US$29,000). Rhodium is unique in that it is the only PGM that convert nitrous oxide to nitrogen and is crucial in the green energy world. A substitute is a long way off and almost counter-intuitively, Sibanye is sponsoring R&D to substitute Rhodium with Palladium. Currently it takes about 6-8 oz of Palladium to achieve the same result as 1 oz of Rhodium, which explains some of the exaggerated price move. The recent spike in Rhodium was probably caused by the ACP outage at Angloplats, which required the company to buy Rhodium in the market to meet contractual supply agreements. This has added to the tightness and could see a drop down to lower levels (but still dramatically higher than a few years back). If the deficit picture painted by Sibanye below comes to pass, rhodium could be the major profit driver for some years to come.

Sibanye used to be a gold company and there is no doubt Neal Froneman loves gold. Due to PGM party times, the gold contribution is down to 19% of group EBITDA (and 10% of earnings). This has been relatively unexciting and gold has not shared to the same extent in the resources run as it has little industrial use. There is optionality here as gold has not been a hype-metal. However, gold has a more certain future than PGM metals and Sibanye makes no secret of its ambition to grow its gold portfolio – probably outside of the SA issues of electricity, deep level mining and other structural challenges. Froneman has a history of looking ahead, while investors seem more fanatically focussed on pocketing short term dividends, the company is balancing that with long term positioning. The current cash flow bounties might leave enough room for both. With the current collective and consensus allergic paranoia of the market to Sibanye investing for the future, we suspect that the announcement of an acquisition would remove uncertainty and be positive for the price as the market then has certainty of what the future profile of the business is.

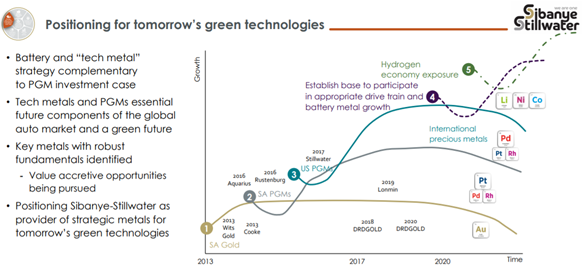

But maybe, just maybe, investors are more astute than they seem at pricing Sibanye at seemingly eye-watering levels. The chart below from a Sibanye presentation, gives a hint of the future. The next 3-5 years seems predictable in terms of supply and demand, but further out there is a lot more uncertainty. PGM’s play little or no role in electric vehicles and the pace at which these replace internal combustion engines is a key metric for the company. This is the key reason why there has been very little investment in the sector – big capital investments require a decade of certainty. PGM’s are required for the “hydrogen economy”, and this can play a role in the vehicle segment, but this is far from certain and industrial uses of hydrogen power seem more certain. So in a sense, PGM’s are currently being driven by the green economy, the extent of their role in the green economy in five years time is uncertain – the bigger EV’s are as part of the mix, the less relevant PGM’s are.

But as the company points out, EV is not all about batteries. They will play a major role, but bigger vehicles like trucks busses, ships etc can’t use batteries (will be too big), and that’s where PGMs come in. They will be used in electrolysers (converting water to Hydrogen) and then that hydrogen will be used in fuel cells (again using platinum) to create energy like a battery does. The fuel cells use much more platinum than auto catalysts, so along with continued (but declining) sales of internal combustion engine vehicles, demand will still remain. The possible need for hydrogen in other industries like steel and aluminium making etc, is another area of possible demand although difficult to quantify right now.

Because of the trends shown above, Sibanye seems to be focussing investment on increasing gold exposure and “establishing a base to participate in drive train and battery metal growth”. This is conceptual, but we will hear more of this in the future. For now it’s an immaterial investment in a Finnish lithium producer (Kiliber), but this could be a place at the table for the new opportunities that might arise in this sector and geography. This could well be a material future use of capital.

We like analysing businesses and doing spreadsheets, but ultimately the real art of investment is trying to predict how others will value businesses. For now the investment community is ignoring current high prices and huge cash flows, and focussing on the downside and potential acquisitive activity. But this is a consensus trade and as each month goes by, the company becomes more valuable. The market is notoriously fickle and if prices stay relatively high, or there is an acquisition announced that actually makes sense, there is big upside in this share. It is also not alone. Most resources companies trade at 3-6x spot cash flows, so while Sibanye is a value outsider, they all look cheap. This is a normal part of the cycle, where low multiples are placed on record earnings – these companies are cyclical and earnings decline. But our instinct is that Sibanye might have fallen too far behind and discounting much more downside than others. So with the caveat of what happens to the resource sector, we think this looks good and the risk/return equation looks favourable.

Covid is a qualifier for all investments, although the company points out that they increased production 6% (industry leading) in Covid and know how to deal with a third wave (unless we get an Indian type equation, which is a force majeure for anybody and would impact all SA businesses dramatically). Covid is unlikely to be a big issue with moderate infection expectations.

So what do you do with the share? We think value is strongly underpinned. If resources tank (not our view), Sibanye is going down with the rest, but if the global economic environment continues on its recovery path this is an impressive story. The current share price leads one to try and think of reasons for its outlier valuation status, but we don’t think the reasons are there. This is a great trading share and has been for the last six months and for longer term investors we would be prepared to back the track record of management into the evolving future. In the next two years we will learn again about commodity cycles and how prices react, but Sibanye would be part of our portfolio. It is the kind of share you continually keep an eye on.

So that’s a fund managers bigger picture view of a business and company. Our resource analyst Seleho Tsatsi had the following to add: “We’d expect multiples to be low given how strong commodity prices are. But ~ 3x earnings for a company with no debt operating in a tight market seems punitive. The other point that may differentiate PGMs from the rest of the RESI sector is the long lead times for new production. It takes at least about seven years from the time of announcement to the time of first production for a greenfield platinum operation to produce new supply (sometimes more). One can argue that it’s near the opposite end of the spectrum from something like oil in the 2010’s where new prices quickly incentivized new supply from sources like the shale players. They were able to bring production to the market quickly. This is a bit different. So although we can never predict what will end the cycle, an upset in demand in the short-term at least seems more likely than a swathe of new supply. There’s a lot of nervousness around what SSW will do with the cash it’s generating, in their defence, they wouldn’t be generating any of this cash if they didn’t make the brave decision to enter the PGM space a few years ago. On that basis alone, they deserve the benefit of the doubt in terms of what they decide to do with the current windfall they are getting, until they prove otherwise.”