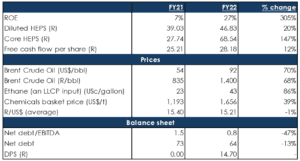

Sasol reported results for the year ended 30 June 2022 (FY22) on Tuesday (23 August), which showed that its adjusted core profit soared 48% YoY to R71.8bn. Earnings before interest and tax (EBIT) of R61.4bn increased significantly from FY21’s R16.62bn, while headline earnings grew 21% YoY to R29.73bn. The chemicals and energy Group benefitted from improved demand and a c. 70% jump in the US dollar oil price, offsetting various issues Sasol experienced, including coal quality and export sales (-12% YoY, due to operational challenges on SA’s port and rail network), shutdowns, and safety.

As Sasol guided at its 1H22 results, the dividend was reinstated following a c. two-year pause. Going forward, Sasol will pay 36%-40% of its core HEPS as a dividend (a dividend cover of 2.5x-2.8x). Sasol will be more exposed to spot energy and chemical prices from here.

The stronger balance sheet, the company said, “significantly reduces the need for hedging going forward”. The hedge ratio for oil has come down from 70% recently to a target of 25% in FY24 (i.e., Sasol does not want to hedge more than 25% of its FY24 oil exposure).

Higher feedstock prices (driven by rising natural gas prices) are pressuring margins for the chemical business (for example, see the ethane price in Figure 1 below). Selling prices for the chemical business have also come off, further pressuring margins. Sasol is expected to earn c. R70/share in FY23, putting the share under 5x FY23 earnings. The market is clearly worried about a potential recession and that earnings estimate being too high. As the macro picture further deteriorates, we would have to be sellers, but for now, we continue to hold the share.

Figure 1: Sasol overview and forecasts, in Rbn unless otherwise indicated

Source: Sasol, Bloomberg, Anchor

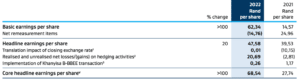

Why is core HEPS so much higher than basic HEPS?

The difference mainly comes from hedging losses (see Figure 2 below).

Figure 2: Sasol core headline EPS reconciliation

- Translation losses arise from translating monetary assets and liabilities into functional currency.

- Consists of R18.3bn realised and unrealised net losses/(gains) on all derivatives and hedging activities.

- Sasol Khanyisa equity-settled share-based payments charges are recorded in the employee-related expenditure line in the income statement.

Source: Sasol

We note that free cash flow (FCF) of R28/share was well below diluted HEPS (R47) and core HEPS (R69). Over the past few years, all of the disposals have made it somewhat challenging to get a clean FCF/share number, but it seems to be below reported earnings numbers.

The balance sheet

Sasol has been struggling with high debt levels due to its expensive foray into the US, but these results showed that it had cut its total net debt levels by R9bn (c. R14/share) this year. Now that the big FCF burn of FY16-FY20 has ended, the pressure on the balance sheet has been alleviated. The new CFO said the Group is open to the possibility of both dividends and share buybacks going forward.

Figure 3: Sasol FCFE per share, rand

Source: Sasol, Anchor

If you have any questions or would like to discuss the subjects raised in this article with someone at Anchor, please email us at info@anchorcapital.co.za.