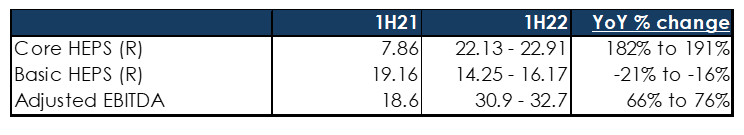

Sasol released a trading statement on Tuesday (8 February) for the six months ended 31 December 2021 (1H22). Headline EPS are now expected to be 16%-20% lower for the period, despite the higher oil and chemical prices lifting its profit margins. The reason for this, according to the company, is its hedges and coal challenges locally.

Figure 1: Sasol 1H22 trading statement overview, Rbn except per share

Source: Anchor, company data

How does the trading statement compare to consensus analyst expectations?

For the full year (FY22), Bloomberg consensus analyst forecasts are expecting core HEPS of R45.05 and EBITDA of R60.7bn. The trading statement suggests that Sasol should at least be able to meet these FY22 consensus expectations. Oil and chemical prices appear likely to be stronger in 2H22 compared to 1H22, so the second half could also be stronger for the company. We note that, while Sasol has had operational issues over the period, the macro environment has been a strong enough tailwind for the company.

Why the Sasol story is very different vs a couple of years ago

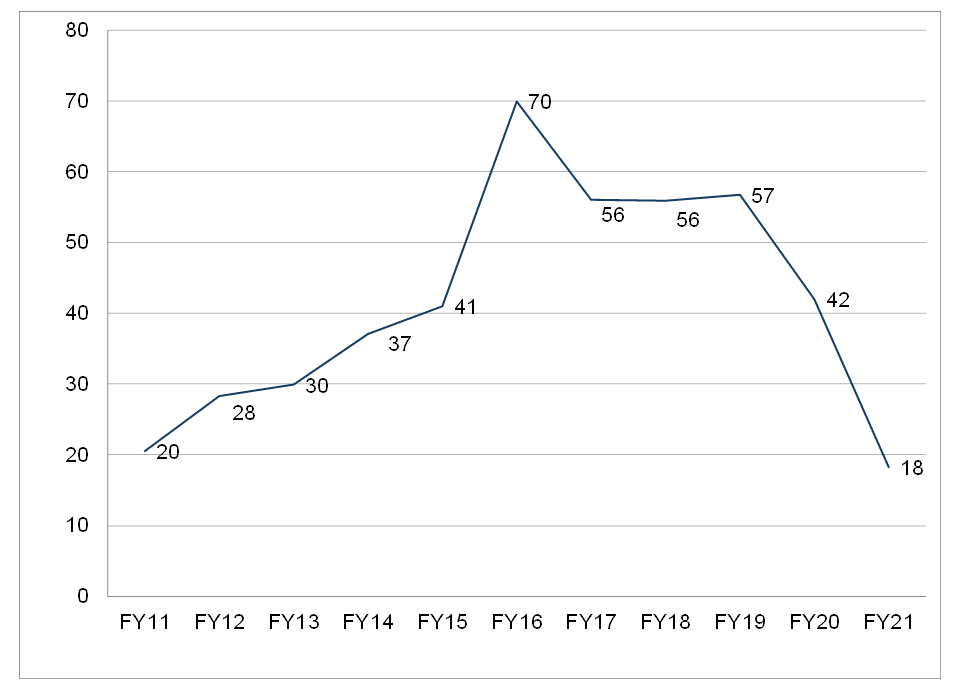

The Lake Charles Chemicals Project’s (LCCP’s) capex is done, and Sasol’s Group capex should now sustainably be less than half of what it was while that project was being completed. Sasol has also guided to FY22 capex of R20bn-R25bn (see Figure 2 below for Sasol’s capex history).

Figure 2: Sasol capex, FY11-FY21 (Rbn)

Source: Anchor Bloomberg

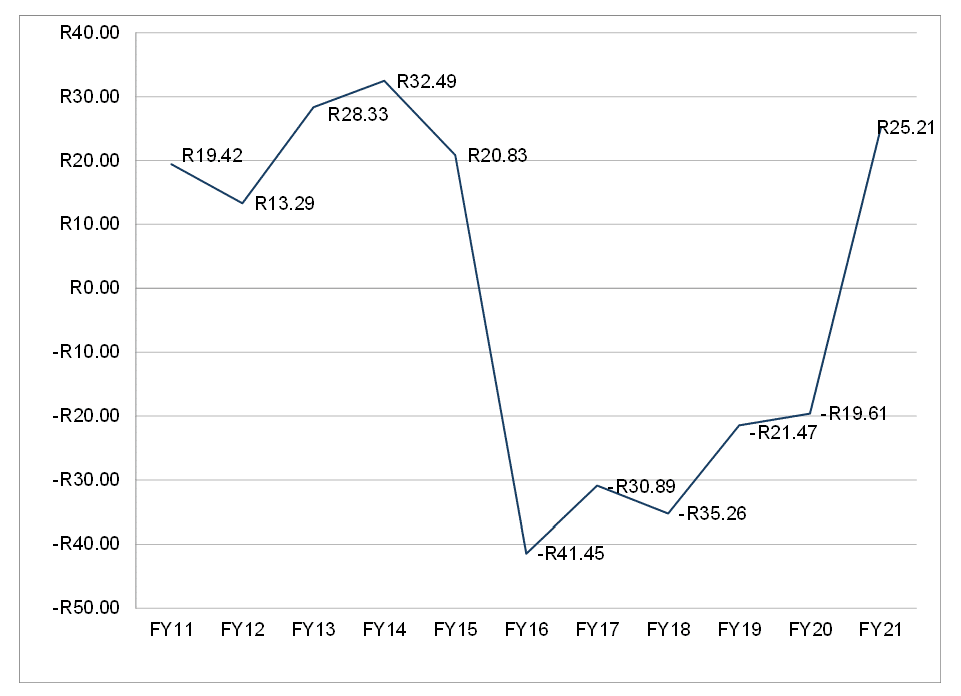

The lower capex requirement should result in much better free cash flow (FCF) generation. In FY21, Sasol was FCF positive for the first time since FY15 (see Figure 3).

Figure 3: Sasol FCFE/share, FY11-FY21

Source: Anchor Bloomberg

We would expect FCF to remain strong, especially given where oil and chemical prices are trading at currently. Finally, following its asset disposal programme, Sasol’s net debt halved in FY21 from R157bn to R74bn. The balance sheet is now in a much better position.

Conclusion

Sasol is a cyclical with a recent history of challenging operational performance and capital allocation. There are also question marks over the long-term around how Sasol will operate in a world aiming to reduce carbon emissions (and what that means for capex, etc.). Nevertheless, Sasol is in a dramatically better fundamental position to where it was a couple of years ago. Net debt has halved, while capex has more than halved. FCF should be stronger, and the business has the tailwind of strong oil and chemical prices at present. FY23 HEPS at spot is estimated to be c. R70/share, putting the share at below 5x those earnings. Given this backdrop, we continue to view Sasol as a strong buy.