Several big South African (SA) retailers released their Festive Season trading updates recently. While the YoY growth reported was strong, it should be kept in mind that the stricter COVID-19 restrictions in late 2020 meant that the base was relatively weak. The latest results reflect consumer habits returning closer to normality. Below we highlight the main points from the trading updates of Mr Price (MRP), Woolworths (WHL), Truworths (TRU), and The Foschini Group (TFG).

Mr. Price (MRP)

MRP released a relatively good, and better-than-expected, 3Q22 trading update (for the period 3 October 2021 to 1 January 2022) on 21 January. Our key takeaways from the release were:

- The Group’s retail sales and other income increased by 19.2% YoY to R9.3bn, inclusive of its recent Power fashion and Yuppiechef acquisitions. Excluding these acquisitions, retail sales and other income rose 7.2% YoY to R8.3bn.

- Margins were preserved as MRP managed to maintain low markdown levels during the period under review.

- SA retail sales increased by 5.8% YoY to R7.4bn (excluding acquisitions) and comparable store sales grew by 4.0% YoY.

- During the period under review, consumers were more comfortable with going to physical stores, as is evidenced by the strong performances of MRP’s large-format stores in super-regional and regional shopping centres.

- Group online sales (including Yuppiechef) increased by 51.8% YoY compared to the 66.3% YoY jump in the same period of 2021. Online sales contributed c. 2.7% to total retail sales

MRP segmental commentary

Apparel segment (74.5% of total retail sales)

- Retail sales (excluding the Power Fashion acquisition) increased by 6.4% YoY. Positively, MRP also gained market share in several of its newly launched categories.

- COVID-19 effects negatively impacted Miladys and Mr Price Sport. However, these two segments recovered nicely during the period. Miladys continues to regain lost market share and Mr Price Sport achieved pre-COVID-19 sales levels, despite ongoing pandemic-related challenges.

- The Group said that it is pleased with Power Fashion and Yuppiechef’s performances. Power Fashion continues to improve and gained market share in October and November, while Yuppiechef continued to grow in line with management expectations.

Home segment (22.6% of total retail sales, Handsets contribute 2.9%)

- The Home segment increased its sales by 0.7% YoY, this is against a really strong base that was driven by home improvement trends.

Other income

- Other income increased by 96.2% YoY to R431mn. Much of this increase was driven by a one-off receipt of insurance proceeds from the July 2021 civil unrest, which amounted to R204mn.

Outlook

Although 3Q22 trading was relatively good, management remains cautious. Rising input costs and higher exchange rates are expected to result in higher merchandise inflation in 2022. Management also expects a reduced risk of inventory shortages and delays as shipping container availability has improved significantly.

Conclusion

Overall, MRP’s core apparel business performed well, and new acquisitions are improving and performing to management expectations. Looking ahead, increased unemployment and pressure on disposable incomes mean that consumers’ search for value has increased and some retailers could be negatively affected as a result. We reiterate that retailers operating within the value space have more of a defensive moat in the current economic landscape and, in our view, MRP’s retail offering lends itself to the value space. We recommend holding onto the share.

Woolworths (WHL)

WHL released a further trading statement update for the six months ended 26 December 2021. The Group’s previous trading statement for the six-month period in November 2021 disappointed the market, but it is important to note that its operations during that period were negatively impacted by stringent Australian lockdowns and the aftermath of the July SA civil unrest. In the previous trading statement, management was expecting adjusted HEPS to decline by more than 20% YoY. However, post-December, this guidance has improved, with adjusted HEPS now expected to have declined by between 10% and 20% YoY.

Key takeaways from the WHL trading statement

- Group turnover and concession sales for the 26 weeks ended 26 December 2021, decreased by 2.1% YoY and declined by 0.3% YoY in constant currency terms.

- Sales in the last six weeks of the period under review advanced 3.0%, and by 3.5% in constant currency terms.

- WHL also saw improved trading momentum in all its divisions except for its fashion, beauty, and home (FBH) business over the past six weeks. This improved trading momentum is said to have been driven by targeted Black Friday promotions, positive Festive Season trade, and the lifting of lockdown restrictions in Australia.

WHL segmental commentary

WHL Food

- Turnover and concession sales for the 26 weeks increased by 3.8% YoY, while sales for the past six weeks rose by 5.8%. These growth rates in WHL Food are comparable to a higher COVID-19 base in the prior period, where lockdowns drove increased home consumption.

WHL FBH

- Turnover and concession sales for the 26 weeks rose by 4.2% YoY and by 4.7% YoY, respectively, in comparable stores:

- Sales momentum in the last six weeks of the period under review slowed as the womenswear performance was below expectations.

- While sales momentum for the last six weeks of the period under review was disappointing, strategic initiatives to rationalise space and reduce costs in FBH are starting to bear fruit. WHL managed to reduce space by 6.1% compared to the prior period and this has resulted in improved trading densities.

WHL Financial Services

- The net book grew by 5.3% YoY to the end of December 2021, compared to a 7.8% YoY contraction as at 31 December 2020, reflecting a recovery in local consumer spending.

Australia and New Zealand

WHL’s performance in these countries was significantly impacted by COVID-19 restrictions. About 70% of WHL’s brick-and-mortar stores in Australia and New Zealand were unable to trade due to these restrictions. The easing of lockdown restrictions and pent-up demand delivered positive sales growth in the last six weeks of the period.

- David Jones

- Turnover and concession sales declined by 9.2% YoY and 9.0% YoY, respectively, in comparable stores for the 26 weeks but grew by 3.2% in the last six weeks of the period.

- Space reduction initiatives have continued as trading space declined by a further 5.8% relative to the prior period.

- Country Road

- Sales declined by 3.1% and by 3.2% YoY in comparable stores for the 26 weeks, but grew by 1.7% in the last six weeks of the period

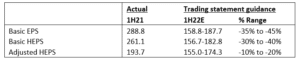

WHL trading statement earnings guidance

It is important to note that WHL did release a 26-month trading update on 17 November 2021, where it expected adjusted HEPS to decline by more than 20% YoY. This is no longer the case, adjusted HEPS is now expected to decline by between 10% and 20% YoY, which is an improvement from November’s guidance. We also note that Bloomberg consensus expectations for FY22 adjusted HEPS is R3.33.

Figure 1: WHL 1H21 results vs 1H22 expectations, ZAc/share

Source: Company data, Anchor

Conclusion

The key takeaway from WHL’s latest trading statement is that the strategic initiatives to reduce space in David Jones and in its FBH businesses are starting to bear fruit. FBH’s trading densities have improved, and we expect a better margin performance to follow. The strategic initiatives are also likely to result in an improved operational performance as trading conditions normalise. Overall, while unfortunate events such as the Australian lockdowns and the July civil unrest locally have hindered the continued recovery in WHL’s operations, they are mostly out of the way now and we expect an improved operational performance from WHL in 2H22 and beyond. We recommend holding on to the share.

Truworths (TRU)

TRU released its trading update for its 26-week period ending 26 December 2021 on 21 January. The key takeaways from this trading statement update are:

- Group retail sales growth for the 26-week period ended 26 December 2021 only increased by 2.0% YoY to R9.9bn. However, this was despite challenges, including the pandemic, as well as load shedding and civil unrest in SA.

- Truworths Africa: Retail sales for Truworths Africa advanced by 1.4% YoY to R7.4bn, with account sales increasing by 1.3% and cash sales rising by 1.5% YoY. Account sales contributed 68% towards total retail sales (2020: 68%).

- Office (UK): Retail sales for the Group’s UK-based Office segment rose 8.1% YoY (in British pound terms) to GBP123mn.

- In rand terms, retail sales for Office increased by 3.9% YoY to R2.5bn, due to a stronger rand vs British pound sterling.

- The Office segment continues to benefit from its strong online presence, with online sales contributing c. 47% (2020: 59%) of total retail sales.

- Trading space for the Office segment decreased by 14.7% YoY and is expected to decline by c. 11% for the 2022 financial year as management continues to exit unprofitable stores as their leases expire.

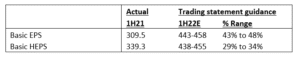

TRU earnings guidance

Figure 2: TRU 1H21 results vs 1H22 expectations, ZAc/share

Source: Company data, Anchor

Conclusion

TRU’s story is predominantly centred around its top-line growth and it is mostly a credit retailer that sells clothes at a higher premium. Given TRU’s business model, the current economic climate, low consumer confidence and increased pressure on disposable incomes, we expect low single-digit top-line growth to translate to soft earnings growth in the short-to-medium term and we would not be buyers at current price levels.

The Foschini Group (TFG)

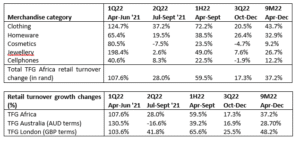

TFG released its 3Q22 trading update for the 3 months ended December 2021 on 21 January. The trading statement’s key takeaways were:

- TFG Group retail turnover growth increased by 17.3% YoY and was driven by a good Black Friday trading period.

- Retail sales jumped by 19.3% in November 2021 vs November 2020, while retail sales increased by 19.8% YoY in December 2021.

- For the nine months to December 2021, total Group retail turnover grew by 37.3% compared to the previous period. This performance was supported by the easing of lockdown restrictions and a subsequent increase in consumer activity.

Figure 3: TFG revenue by operating segment

Source: Company data, Anchor

- TFG Africa delivered strong retail turnover growth of 17.3% YoY for 3Q22 (this is inclusive of the Jet acquisition).

- It recorded YoY growth of 13.9% in November 2021, while December’s growth exceeded expectations at 23% YoY (we suspect that much of this growth has been driven by a good trading performance from Jet); and

- all merchandise categories grew retail turnover compared to the same quarter in the previous financial year, except for the cosmetics and cellphones segments.

- TFG Australia’s retail turnover growth increased by 16.9% in Australian dollar terms in the third quarter as multiple state governments across Australia relaxed COVID-19 restrictions. Growth was also driven by stronger trade in November.

- TFG London’s performance continued to improve in 3Q22 as retail turnover growth rose by 25.5% YoY in pound sterling. Recovery in December was dampened when the UK government announced a move to ‘Plan-B’ measures to help slow the spread of the Omicron variant.

TFG outlook

- Management sounds cautiously optimistic and is encouraged by the trading performance in the third quarter. Management also mentioned that the good trading performance seen in the third quarter has continued into the first few weeks of January.

- No earnings guidance was given for the full year in this trading statement.

- It is important to note that the growth in FY22E will be inflated due to the low base in FY21 (COVID-19 impact) and the non-comparable Jet inclusion. We expect a normalised growth level comparison from FY23E onwards.

- Bloomberg consensus forecasts expect diluted HEPS of R9.39 in FY22E.

Conclusion

Overall, TFG released a good trading update, and we expect the retail growth to have been predominantly driven by Jet’s performance. While we like the integration of Jet into TFG and Power fashion into MRP, our preferred retailer out of the two is MRP.

Summary

We expect a bumpy ride ahead for SA retailers. We believe that they will continue to recover from the devastating effects of the COVID-19 pandemic, but we also caution that growth will not be linear. In particular, we expect increased pressure on disposable incomes given the various headwinds that SA consumers are facing. The possible cessation of the unemployment grant in March 2022, the potential increase in electricity rates, elevated petrol prices, and increasing interest rates will weigh on consumers’ disposable incomes, which could impact retail sales into the year. Given the current local economic landscape and the financial health of the SA consumer, we feel that retailers operating within the value space have somewhat of a defensive moat. Among the retailers mentioned in this note, we prefer MRP and WHL.