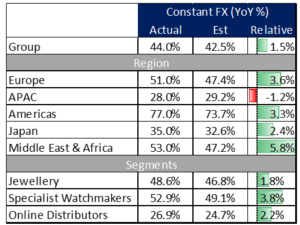

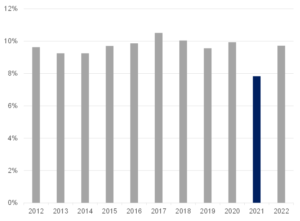

Richemont announced FY22 results (to 31 March 2022) on 20 May. The results were a mixed bag, with revenue coming in above expectations (see Figure 1) while operating profit disappointed.

Figure 1: Richemont FY22 revenue, YoY % change

Source: Bloomberg, Anchor

The company said that lockdowns in China were weighing on its results, with c. 40% of its retail network closed.

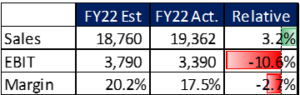

Operating profit lagged expectations as margins contracted despite stronger-than-expected top-line growth (see Figure 2 below).

Figure 2: Richemont FY22 performance, actual vs consensus analyst estimates

Source: Bloomberg, Anchor

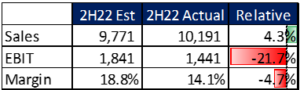

Given that we already knew the 1H22 numbers, the Group’s 2H22 miss at the earnings level was even more substantial (see Figure 3).

Figure 3: Richemont 2H22 performance, actual vs consensus analyst estimates

Source: Bloomberg, Anchor

The company announced a charge of EUR168mn related to the write-off of its Russian business, which explains c. one-third of the disappointment in operating margin (excluding Russia, the 2H22 operating margin would have been 15.7% vs 14.1%), but that still left two-thirds of the underperformance unexplained. A large part of the remaining disappointment around operating margin seems to be a return of marketing expenses to the pre-COVID run-rate of 10% of sales, with marketing expenses having run c. 20% below that run rate during the pandemic.

Figure 4: Richemont marketing expenses as % of total sales

Source: Bloomberg, Anchor

Richemont declared an annual dividend of CFR2.25 (c. R36.72) and a special dividend of CFR1 (c. R16.32).

Most of the questions on the results call were around:

- The disappointing margin: Management pointed out the one-off impact of Russia and then were at pains to highlight that they wanted to make sure they were using their pricing power responsibly, treating customers fairly, and not obsessing about margins from quarter to quarter. Management also suggested that perhaps expectations had become a little unrealistic.

- No progress on the spin-off of the online luxury business: Management suggested something should happen in the next 3 to 6 months. Stripping out the online business improves the operating margin on the remaining business from 17.5% to 21.7%, much closer to Richemont’s luxury peers like LVMH.

The share fell c. 13% in US dollar terms on the day of the results release, and future earnings are likely to be revised down c. 10% to reflect a return of more normalised marketing expenses. We expect earnings downgrades around that quantum to filter into estimates over the course of the next few weeks, suggesting a de-rating of around 3%-5%.

The share traded at c. 22.5x earnings for the 3 years leading up to the start of the pandemic in 2020 and it is now well below that level at 16.2x (although that is likely to unwind to c. 17.5x as earnings downgrades filter through).

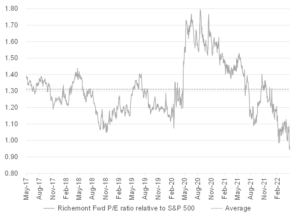

Figure 5: Richemont fwd P/E ratio

Source: Bloomberg, Anchor

Richemont’s share price has traded at a 20%–60% premium to the S&P 500 over the past 5 years and is now at a slight discount (which again is likely to unwind to a slight premium once the earnings downgrades filter through).

Figure 6: Richemont fwd P/E ratio relative to S&P 500

Source: Bloomberg, Anchor

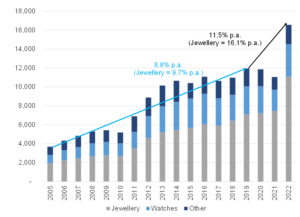

On an absolute and relative basis, the share is looking fairly cheap. This perhaps reflects the market’s current anxiety around shares which have been significant spending beneficiaries over the course of the pandemic, of which Richemont is definitely one. If we strip out the online business sales, the core underlying luxury goods business has seen a rapid acceleration in sales over the past three years (particularly in the Jewellery Maisons).

Figure 7: Richemont Jewellery Maisons segment has seen rapid sales acceleration since 2019

Source: Company data, Anchor

This company remains an outstanding business, with great long-term prospects and it is also exceptionally well run. In the short term though there are a few headwinds, which we highlight below:

- Question marks around the potential to spin off its loss-making online luxury division (YNAP) remain.

- There is potentially limited near-term upside to the operating margin.

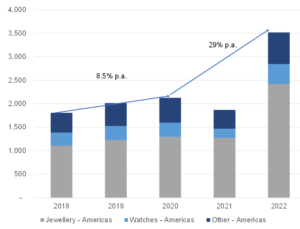

- Cyclical headwinds to discretionary consumer spending (particularly in the Americas segment, where sales have grown at 29% p.a. for the past 2 years).

Figure 8: Richemont’s Americas sales, FY18-FY22

Source: Company data, Anchor

There is the potential that the reopening of China, post-COVID lockdowns, will bring back some pent-up demand (although management cautioned against making this assumption).

While we are long-term holders of the share, we would like to have more clarity on some of the potential cyclical headwinds before getting too optimistic about the current share price.

If you have any questions or would like to discuss the subjects raised in this article with someone at Anchor please email us at info@anchorcapital.co.za.