Compagnie Financière Richemont SA (Richemont) posted better-than-expected first-half (1H22) earnings on Friday (12 November) and said that it is in talks to divest control of its struggling e-commerce platform, Yoox-Net-A-Porter (YNAP). 1H22 sales jumped, reaching EUR8.91bn (US$10.2bn) – up 20% vs 1H19 (the comparable period prior to the COVID-19 pandemic), while Group operating profit surged to EUR1.95bn.

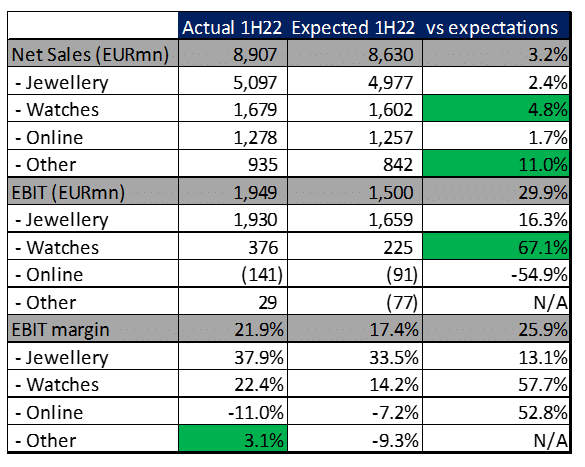

Figure 1: Richemont 1H22 results – actual vs expected

Source: UBS, Anchor

Richemont recorded noteworthy beats from the following of its operations:

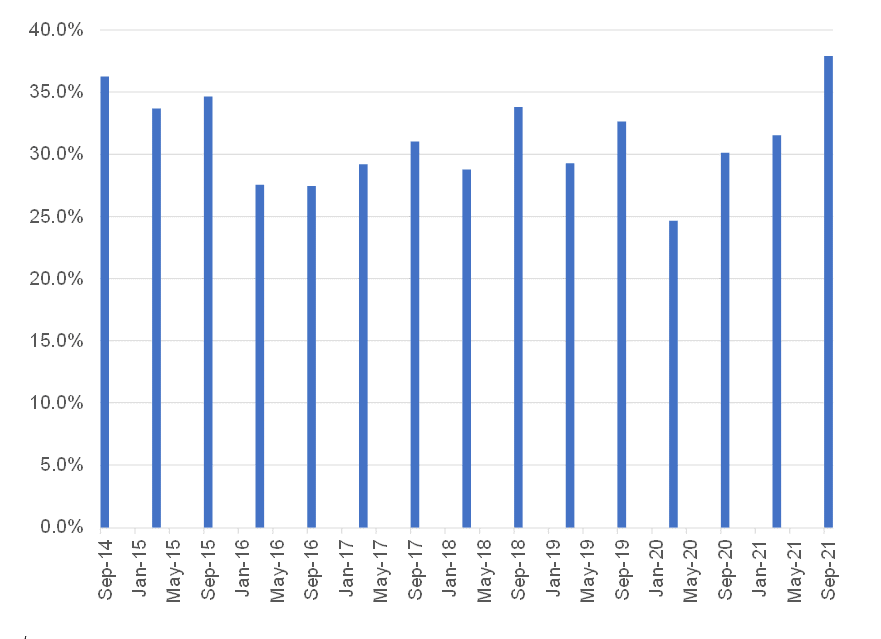

- Jewellery: Margins were better than they have been in years, with two structural forces contributing to this:

- A much larger percentage of direct-to-consumer sales. Group-wide only 26% of total sales came through its wholesale channel (this was at c. 50% just five years ago).

- A shift towards higher-value (higher-margin) items as in-person events (where those purchases typically happen) resumed with the pandemic receding.

Figure 2: Richemont Jewellery Maison EBIT margin, September 2014 to September 2021

Source: UBS, Anchor

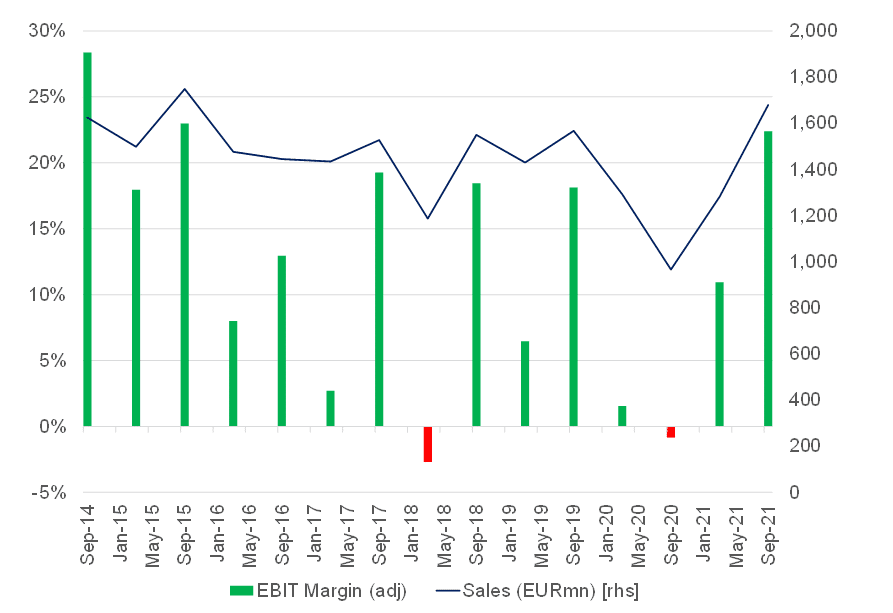

- The Group’s Specialist Watchmakers division achieved its best margin since 2016 when the corruption crackdown in China decimated profits in the sector, as sales matched its best ever half-year in that division (1H16)

Figure 3: Richemont Specialist Watchmakers’ division sales and EBIT margin, September 2014 to September 2021

Source: UBS, Anchor

- The “Other” division (which includes a few of the smaller soft luxury brands such as Montblanc, Purdey and Peter Millar) unexpectedly turned profitable. The comments from management on the company’s earnings call suggested that smaller luxury brands are a huge beneficiary of the structural shifts to online purchases, where they can reach their target market more cost effectively without giving up too much in terms of margins.

Relative to the same period pre-COVID-19 (1H19)

- Sales are up 20.4%; and

- Profits are 43.7% higher.

Perhaps slightly disappointing to us is the fact that the online division (YNAP and Watchfinder & Co.) saw operating losses widen, which they attributed to:

- The absorption of Brexit-related customs duties and VAT.

- Increased communications investments (i.e., a big marketing push).

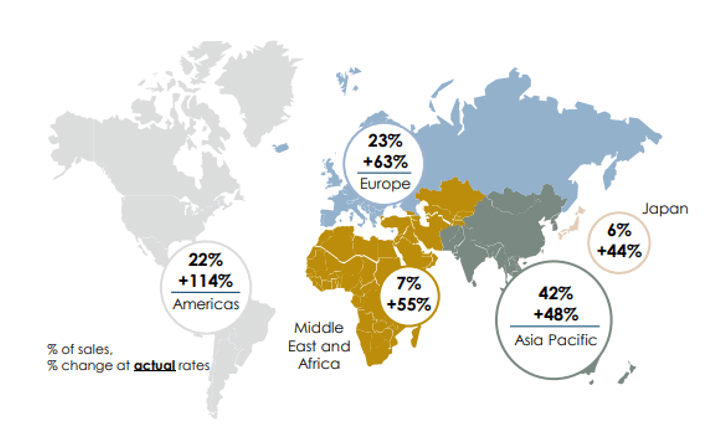

From a regional perspective, Japan, and Europe (which are big beneficiaries of travel spending) were still somewhat weaker and the US and China are driving most of the sales momentum:

Figure 4: Richemont regional sales split and YoY sales growth

Source: Company presentation

We note that this business seems to be experiencing strong operating momentum with:

- The Specialist Watchmakers’ segment “fixed” and more sustainable in the post-China corruption crackdown era.

- Online and direct-to-consumer strategies progressing strongly.

- Live events returning, which bodes well for the shift to a more profitable sales mix.

The focus for Richemont will now be on:

- Improving the profitability of its “Other” division, which contains the company’s soft luxury offering and has just turned marginally profitable.

- Completing the strategic reorganisation of its online distribution business

It seems like the path for Richemont’s online distribution now involves:

- Folding YNAP into Farfetch (in which Richemont has a 25% stake) and which it recognises has the superior technology offering.

- Moving the business out of Richemont and creating a “neutral” platform, owned and used jointly by the major luxury goods players (much like how Mastercard was originally jointly owned by all the major banks). This seems to be a vision that Chairman Johann Rupert has had since acquiring the platform in 2015 and the discussions have been accelerated by the pandemic and seem to be close to execution.

The second half of the year is expected to see some margin pressure as marketing spend accelerates around Christmas, Chinese New Year, and Richemont’s Watches and Wonders event, but revenue momentum remains positive.

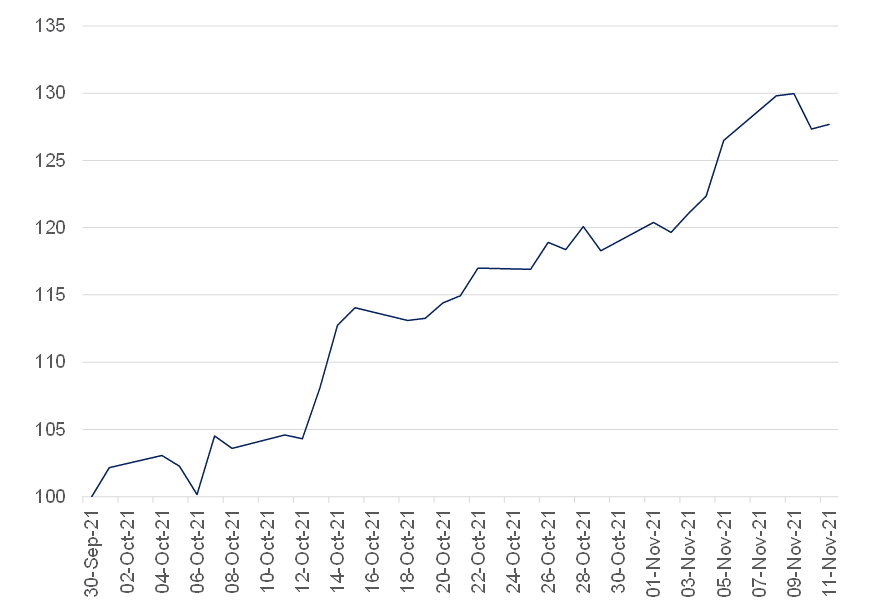

The share has recently run hard (up by 28% in US dollar terms since the start of October – before Friday’s share price move). This has been largely on the back of expectations that the loss-making online division would be spun out (which was effectively confirmed by Richemont, although the terms, timing, etc. are still uncertain).

Figure 5: Richemont share price performance (in US dollar terms) was up 28% in the lead up to the results presentation

Source: Bloomberg, Anchor

The Richemont share price rallied by a further c. 11% (in US dollar terms) on Friday (12 November) after the stronger-than-expected operating results were announced.

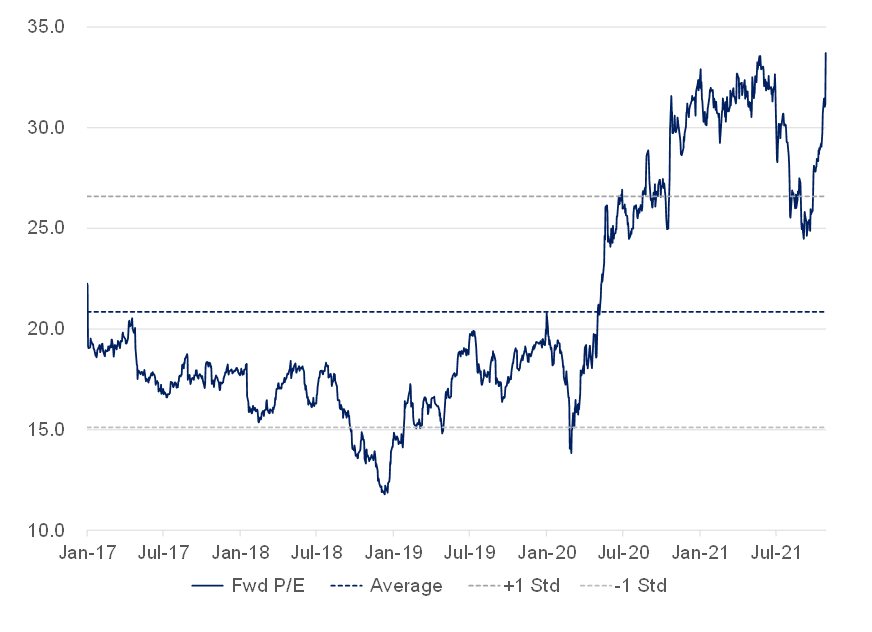

Looking at the valuation, we note that Bloomberg FY22 consensus earnings (to 31 March 2022) are EUR3.70 and Richemont delivered EUR2.14 of that in 1H22, so we expect analysts will need to upgrade their full-year (FY22) earnings by 5%–10% following these results. This puts the share on c. 32x earnings multiple to March 2022, which is towards the high-end of where the share price has traded historically.

Figure 6: Richemont forward P/E based on next 12 months earnings estimates

Source: Bloomberg, Anchor

However, attention will now shift to modelling Richemont’s earnings in a post-YNAP world, where it could have operating margins in excess of 30%, assuming that its Specialist Watchmakers’ business is indeed “fixed”. Then Richemont should start commanding multiples similar to LVMH, which could see it re-rate another 10%-plus from here.

It certainly feels uncomfortable to be investing in a share that has run 40% in two months, and it is indeed very conceivable that there could be a period of consolidation for the share price from here, especially as we await execution of the YNAP spin-off and structurally lower second-half margins weigh on near-term earnings. Nevertheless, this certainly seems to be a company that has strong operating momentum in a sector with good structural tailwinds and we believe that it should be a core holding in local equity market portfolios.