In investing, the age-old debate between quality and quantity continues to shape strategies and outcomes. Imagine an art collector who carefully selects each piece for its uniqueness and value rather than filling their gallery with numerous average works. Similarly, a well-curated stock portfolio, built on the principles of quality investing, can flourish and outperform market benchmarks over the long run.

This article aims to answer several key questions: What defines a quality company in equity investing? How can investors identify and avoid companies that appear to be high-quality but ultimately fail? By exploring these questions, we hope to understand better the risks associated with backwards-looking quality measures and offer insights into building a more resilient investment portfolio.

When discussing ‘quantity’ in equity investing, we refer to the strategy of buying broad market indices or exchange-traded funds (ETFs) that focus on quality factor stocks. This approach contrasts with selecting individual stocks based on specific quality criteria. Quality in equity investing is often defined by strong financial health, consistent earnings growth, and robust competitive advantages. However, not all companies that meet these criteria succeed long-term. For example, while companies like Nike have historically been considered high-quality, they have faced significant challenges impacting their performance.

What is Quality Investing?

Quality in stocks can be measured in different ways. Yet, the characteristics of resilient companies have something in common—they tend to underpin consistent, long-term equity return potential. The MSCI World defines quality investing as an investment strategy that aims to capture the performance of quality growth stocks by identifying stocks with high-quality scores based on three main fundamental variables: high return on equity (ROE), stable YoY earnings growth and low financial leverage. This approach emphasises the importance of investing in businesses that demonstrate consistent performance and resilience across market cycles.

Reliable Outperformance with the Quality Factor

Among investment professionals, the practice of selecting stocks based on quality attributes has a well-established track record. Warren Buffett is not alone in his emphasis on high-quality stocks; his mentor, Benjamin Graham, one of the pioneers of value investing, acknowledged the importance of high-quality companies as early as 1934 (Graham and Dodd, 1934). In recent years, academics have also highlighted the long-term outperformance of quality stocks. In 2014, Fama and French expanded their three-factor model (market, size, and value) to a five-factor model that incorporates two additional quality factors.

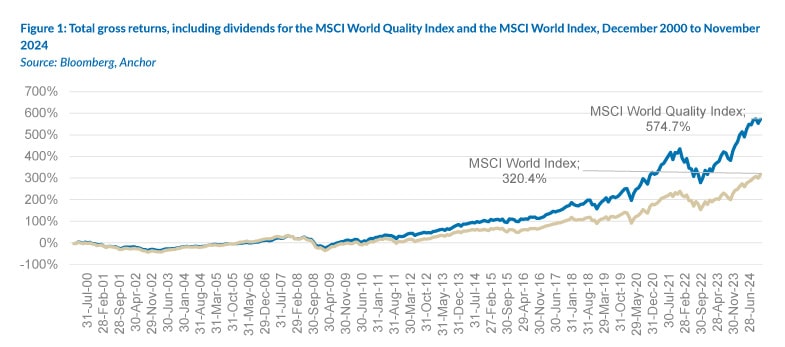

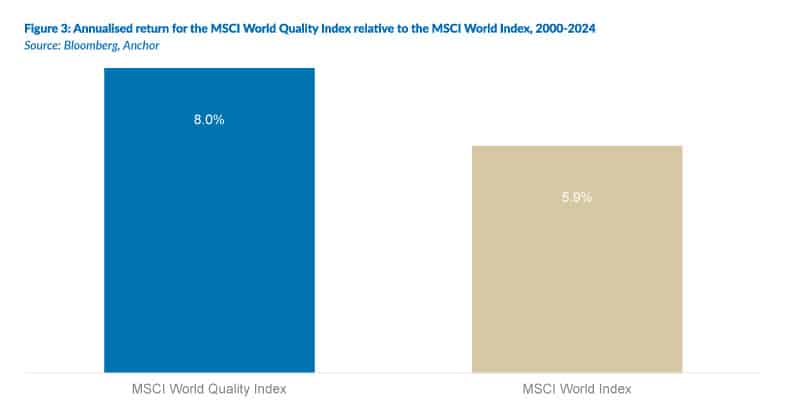

The MSCI World Quality Index, a widely recognised benchmark for quality investing, has consistently outperformed the broader MSCI World Index from January 2000 to November 2024.

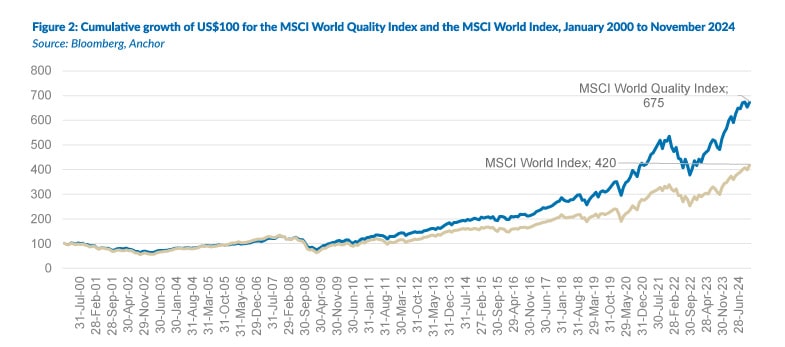

A US$100 investment in the MSCI World Quality Index would have grown to c. six times its original value, compared to c. three times for the MSCI World Index over the same period.

Historically, quality stocks have exhibited higher long-term returns, creating a very attractive risk-return profile for core holdings in investors’ portfolios.

Quality Stocks Provide Benefits in Good and Bad Times

For one to position appropriately in a crisis, quality control is crucial. When we consider three major historical incidents over the past two decades or so (the tech sector crash [dot-com bubble], the global financial crisis [GFC], and the COVID-19 pandemic), we find that the MSCI World Quality Index outperformed the MSCI World by significant margins. This highlights that investors who focus on quality in their daily stock picking tend to be better equipped to identify durable companies with what it takes to get them through uncertain times.

Dissecting Quality

When assessing whether a quality investment portfolio is better equipped to handle short-term market volatility, capitalise on opportunities arising from crises, and secure a leading position during recovery phases, it is important to ask the hard questions. The questions highlighted below are some examples of how to assess whether a company is a quality business or not:

i. Can the Company Control Its Own Destiny?

In today’s volatile global market environment, it often seems like companies are at the mercy of external forces. Historical events like the tech bubble in 2000, the 2008 GFC and COVID-19 have shown how external shocks can impact businesses. However, not all companies are equally vulnerable. At Anchor, we believe that companies with fundamentally sound businesses, strong leadership, superior products, excellent operational execution, and responsible financial practices can exert greater control over their destinies.

ii. Will a Dominant Position Persist?

Dominant market positions are crucial for sustainable growth. Companies with wide competitive moats and high barriers to entry often maintain their leadership. However, it is essential to ensure these positions are not eroded by new technologies or changing consumer behaviour. As economies recover from recessions, strong companies typically emerge even stronger, while the weaker ones may falter. This Darwinian dynamic, observed during the COVID-19 pandemic, suggests that financially flexible companies can capitalise on consolidation opportunities. Investors should focus on identifying resilient companies poised to thrive in a post-crisis world.

iii. Where’s the Innovative Edge?

Innovation drives growth in various ways beyond just the internet or social networks. Companies leveraging new technologies and data systems to understand customer behaviour can gain a competitive edge. Automation and machinery upgrades can boost productivity, while the shift towards electronic payments and increased internet traffic highlight ongoing digital transformation. Thematic growth trends, such as combatting climate change and improving healthcare, will likely accelerate. Innovations in robotics and new disease treatments are reshaping the healthcare industry. Across sectors, companies with pricing power driven by innovation are better positioned for long-term profitable growth, especially in an inflationary environment.

iv. Is Management Up to the Job?

Quality leadership is a hallmark of successful companies. Experienced management teams, aligned with long-term value creation, can navigate challenging environments more effectively. Balancing capital expenditures with workforce needs, reconstructing supply chains for continuity, and maintaining transparent communication with investors are key factors. Strong leadership can distinguish companies that lead from those that lag during a recovery.

Is Owning a Quality Index Enough? Lessons from the MSCI World Quality Index

While the MSCI World Quality Index aims to capture high-quality growth stocks, history shows that not all included companies have lived up to these lofty ideals. Here are four companies that were part of the index but ultimately failed the quality test, highlighting the importance of an active management approach:

i. Nokia

Nokia was once a dominant player in the mobile phone industry. The company had strong financials and market share, which initially screamed quality. However, its failure to innovate and adapt to the smartphone revolution led to its decline. Nokia’s inability to compete with Apple and Android devices resulted in significant market share loss and financial struggles.

ii. General Electric (GE)

GE was a staple in the MSCI World Quality Index for many years, boasting impressive revenues and a diversified business portfolio, marking it a quality company. However, a series of poor management decisions, overexpansion, and financial missteps led to its downfall. GE’s excessive debt and declining profitability forced it to sell off key assets and restructure its business.

iii. Intel

Intel has long been a leader in the semiconductor industry, known for its innovation and strong market position. Despite this, Intel has struggled in recent years to keep up with competitors like Advanced Micro Devices (AMD) and Taiwan Semiconductor Manufacturing Company (TSMC). Delays in product launches, manufacturing issues, and strategic missteps have led to a loss of market share and investor confidence.

iv. Nike

Despite its strong brand and market position, Nike has faced significant challenges that have impacted its performance, including quality control issues, particularly with its popular sneaker lines. Changing consumer preferences, supply chain disruptions, and intense competition have led to periods of underperformance.

These examples underscore the importance of active management in identifying and responding to changing market dynamics.

Success Stories: Quality Companies in the MSCI World Quality Index

Conversely, the index has also included companies that have thrived and delivered exceptional returns:

i. Apple

Apple’s consistent innovation, strong brand loyalty, and robust financial performance have stood out in the MSCI World Quality Index. Its ability to launch groundbreaking products and maintain high margins has driven sustained growth.

ii. Microsoft

Microsoft’s successful transition to cloud computing and its focus on recurring revenue streams solidified its quality company position. Its strategic acquisitions and strong leadership have contributed to its long-term success.

iii. Visa

Visa’s dominance in the electronic payments industry and its ability to capitalise on the shift towards digital transactions have made it a valuable addition to the index. Its strong financial metrics and growth prospects highlight its quality.

iv. Fortinet

Fortinet is a quality company due to its strong financial fundamentals, including high ROE, consistent earnings growth, and low financial leverage. Additionally, Fortinet’s innovative cybersecurity solutions, extensive patent portfolio, and commitment to integrating advanced technologies like AI and machine learning further enhance its reputation as a high-quality growth stock.

These success stories demonstrate the potential of high-quality companies to deliver superior returns. However, identifying and investing in such companies requires active management and a keen understanding of market trends.

Conclusion

Our analysis reveals that backwards-looking quality measures often fail to capture emerging risks that can undermine a company’s long-term success. Factors such as shifting market dynamics, technological disruptions, and management decisions are crucial in determining a company’s future performance. By identifying these risks early, investors can better curate their portfolios to avoid potential pitfalls and enhance their chances of achieving sustainable returns.

At Anchor, we are committed to a hands-on approach, leveraging our expertise to identify and invest in high-quality companies that can thrive in any market environment. By focusing on quality over quantity, we aim to build portfolios that outperform benchmarks and provide our clients with sustainable, long-term growth.