Global markets (MSCI World -2.6% MoM/+19.2% for 2024) recorded mixed performances in December, with most ending a stellar year on a disappointing note as year-end profit-taking emerged. A much hoped-for Santa Claus rally (the phenomenon where markets rise over the last five trading days of December to 2 January) also did not materialise. At its final meeting for 2024, the US Federal Reserve (Fed) cut rates, but Fed Chair Jerome Powell projected only two further cuts of 25 bpts each in 2025, adding that inflation might remain sticky this year. These comments could have been interpreted as being more hawkish than market participants had hoped, thus also contributing to the declines in US equity markets.

US markets limped into year-end but have posted significant gains for 2024, reaching a series of all-time highs along the way as solid consumer spending and a strong jobs market buoyed the US economy. The Dow was down 5.3% MoM (+0.5% in 4Q24/+12.9% in 2024), while the blue-chip S&P 500 retreated by 2.5% (+2.1% in 4Q24/+23.3% in 2024). It was the Dow’s worst December since 2018 and its biggest MoM percentage drop since September 2022. However, the tech-heavy Nasdaq managed to eke out a 0.5% MoM gain (+6.2% in 4Q24/+28.6% in 2024).

In US economic data, November headline inflation, as measured by the Consumer Price Index (CPI), rose to 2.7% YoY, while core CPI, excluding the erratic food and energy components, was at 3.3% YoY. MoM, both headline and core inflation rose 0.3%. November core personal consumption expenditure (PCE), excluding food and energy, the Fed’s preferred inflation gauge, printed at 2.8% YoY – unchanged from October. MoM, core PCE rose by 0.1% vs 0.2% in October.

European equity markets also recorded a late-year sell-off, as concerns about high valuations and policies, especially regarding tariffs under incoming US President Donald Trump, weighed on sentiment. MoM, Germany’s DAX gained 1.4% (+3.0% in 4Q24/+18.8% in 2024), while France’s CAC closed December 2.0% higher (-3.3% in 4Q24/-2.2% in 2024). November eurozone headline inflation printed at 2.2% vs October’s 2.0% YoY. The European Central Bank (ECB) cut rates a fourth time in December (by 25 bpts), taking its benchmark rate to 3.0%.

The UK equity market reversed November’s gains, with the blue-chip FTSE-100 ending December 1.4% lower (-0.8% in 4Q24/+5.7% in 2024). November UK inflation rose to 2.6% (its highest level in eight months) vs 2.3% in October. Core inflation printed at 3.5% YoY, up from October’s 3.3% print.

China’s equity markets closed December in the green as various stimulus measures introduced since September to bolster its economy (including interest rate cuts, incentives for home buying and funding schemes to buy equities) overshadowed ongoing economic concerns. MoM, Hong Kong’s Hang Seng rose 3.3% (-5.1% in 4Q24/+17.7% in 2024), while the Shanghai Composite advanced by 0.8% in December (+0.5% in 4Q24/+12.7% in 2024). November inflation declined to a five-month low of 0.2% YoY vs 0.3% in October. Core inflation rose 0.3%, accelerating from October’s 0.2% gain. December’s manufacturing PMI maintained a positive momentum printing at 50.1 vs November’s 50.3. The official non-manufacturing PMI, tracking business sentiment in services and construction, rose to 52.2 vs 50.0 in the prior month (50 separates expansion from contraction).

Japan’s benchmark Nikkei ended December higher (+4.4%) and is up 5.2% in 4Q24 and 14.2% in 2024. At its last meeting of 2024, the Bank of Japan (BOJ) kept rates unchanged as policymakers remained cautious over the country’s economic outlook. Inflation rose slightly more than expected in November, indicating a sustained uptick that could push the BoJ into raising rates early in 2025. November’s national core CPI, excluding the volatile fresh food items, grew 2.7% YoY from 2.3% in October.

In commodities, Brent crude oil rose 2.3% MoM (-3.1% in 2024) due to declining US stockpiles and renewed optimism around China after President Xi Jinping pledged to promote growth. Gold declined 0.7% MoM (+27.2% in 2024) even though geopolitical tensions are expected to remain high moving into 2025, with central banks continuing to buy gold, while the US debt situation will likely worsen under the Trump administration, fuelling ongoing safe-haven demand for the yellow metal. Among platinum group metals (PGMs), platinum lost 4.5% MoM (-8.5% YoY), palladium plummeted 7.2% MoM (-17.1% YoY), and rhodium was unchanged MoM (+3.4% YoY). Iron ore retreated 1.2% MoM (-25.3% YTD) as the world’s largest iron ore consumer, China, grapples with a sluggish economy, particularly in its crucial property sector, weighing on the steelmaking ingredient.

In South Africa (SA), the JSE was down for a third consecutive month. The FTSE JSE All Share Index retreated by 0.5% MoM but was up 9.4% in 2024 (-2.8% in 4Q24), while the Capped SWIX was also down 0.3% MoM (+13.5% in 2024). Mining counters were the worst performers (with coal miners hardest hit) for a second month as commodity prices continued to decline, pushing the Resi-10 down 5.9% MoM (-9.8% in 2024/-10.3% 4Q24). Industrials, as measured by the Indi-25, outperformed, gaining 2.2% MoM (+14.4% in 2024/-0.9% 4Q24), while the SA Listed Property Index (-0.1% MoM/+21.4% 2024/-3.4% 4Q24) and the Fini-15 (-1.6% MoM/+15.3% 2024/-2.9% 4Q24) also lagged. The rand weakened by 4.2% against the US dollar (-2.6% 2024/-9.1% 4Q24) in December.

SA November headline inflation rose slightly to 2.9% vs 2.8% in October but remained below the South African Reserve Bank’s (SARB) target range of 3%-6%. A slower pace of deceleration in fuel inflation drove the modest uptick in headline inflation. Still, a notable decline in food inflation (a key driver of household expenses over recent months) partially offset this upward pressure. Core inflation eased to 3.7% YoY vs 3.9% in October.

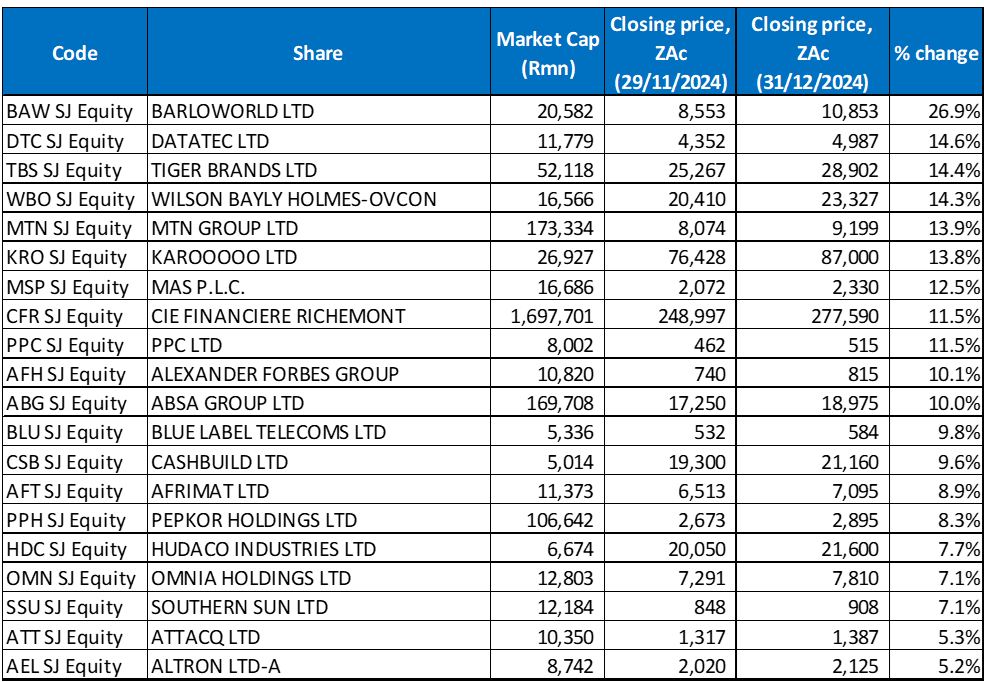

Figure 1: December 2024 20 best-performing shares, MoM % change

Source: Bloomberg, Anchor

Industrial Group, Barloworld, was December’s best-performing stock, soaring 26.9% MoM. The share price rocketed after Barloworld CEO Dominic Sewela and Saudi Arabia’s Zahid Group announced an offer for all its shares at an 87% premium to the share price at the time. The offer, if successful, will result in the delisting of Barloworld and values the Group at R23bn. It represents a total value unlock at R123.10/share, comprising a cash offer to shareholders of R120/share, which will not be reduced by the R3.10/share dividend which Barloworld declared on 22 November. However, UK-based Silchester International Investors, a major investor in Barloworld, has said that it does not believe the offer from the consortium is “compelling”.

Datatec (+14.6% MoM) and Tiger Brands (+14.4% MoM) were the second and third best-performing shares, respectively. Tiger Brands reported strong FY24 results last month, which showed revenue had advanced by 1% YoY to R37.7bn, while headline earnings per share (HEPS) rose c. 4% YoY to ZAc1,810 from ZAc1,735 in FY23. Price hikes drove the increase in earnings to offset rising input costs and gains from the sale of the Group’s non-core assets.

Tiger Brands was followed by construction and materials firm Wilson Bayly Holmes Ovcon (WBHO), MTN Group, and provider of fleet management, stolen vehicle recovery and insurance telematics services, Karooooo, with MoM gains of 14.3%, 13.9%, and 13.8%, respectively. Karooooo (previously Cartrack) has grown from vehicle tracking to fleet management and various mobility software-as-a-service (SaaS) platforms for connected vehicles with its extensive global expansion. Headquartered in Singapore, it is also listed on the Nasdaq and has expanded into the rest of Africa, Europe, Asia and the Americas. Karooooo has over 2.2mn subscribers, servicing more than 121,000 businesses.

In December, MAS Plc (+12.5% MoM) renewed its cautionary regarding negotiations with Prime Kapital to acquire a 60% interest in PKM Development Limited. The company believes that contracts should be concluded by the time the results for the six months to December 2024 are released.

Richemont (+11.5% MoM), PPC Ltd (+11.5% MoM), and Alexander Forbes (+10.1% MoM) rounded out December’s best-performing shares. PPC’s share price has been trending higher on a positive outlook for the cement manufacturer’s earnings. At the end of October, PPC flagged that it expected profit to rise by almost one-fifth in its half-year to September. Its 1H24 results (reported in November) showed a 4.2% YoY revenue decline to R5bn as cement sales dropped. However, PPC’s HEPS leapt 10% YoY to ZAc22, free cash flow surged 36.2% YoY to R500mn, and profit after tax rose 18.2% YoY to R318mn. In its 1H24 results released last month, Alexander Forbes indicated that its fee and commission revenues from continuing operations rose to R2.8bn from R2.5bn in 1H23, while HEPS improved by 3% YoY to ZAc28.4. The company said the results reflected a resilient performance across its consulting, investment, and retirement offerings.

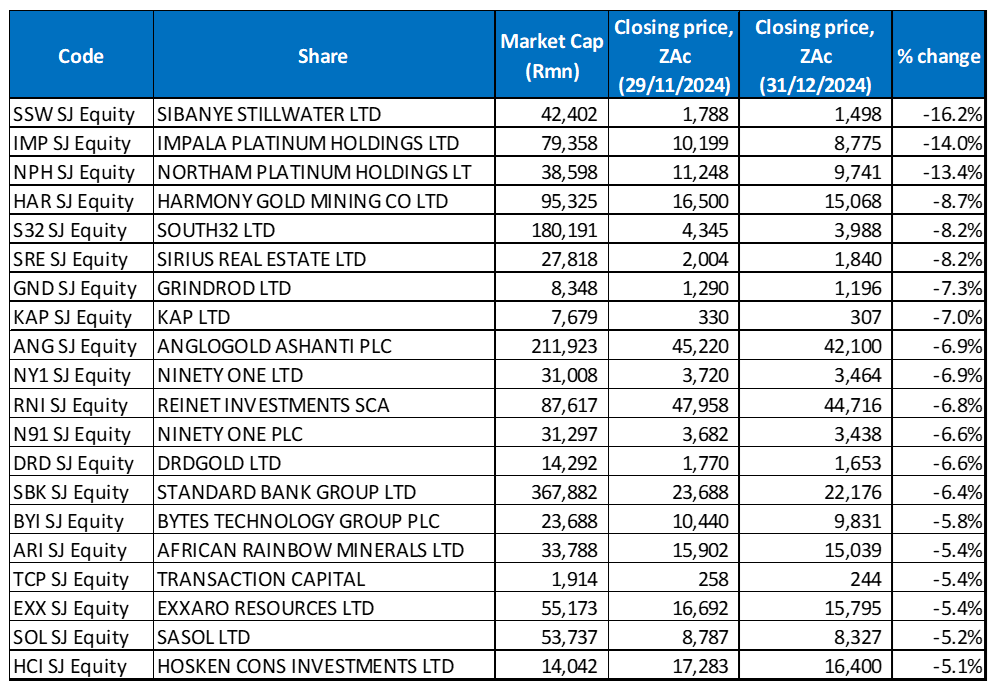

Figure 2: December 2024 20 worst-performing shares, MoM % change

Source: Bloomberg, Anchor

December’s worst-performing shares were, for the most part, commodity counters as metal prices continued to slump due to (among other factors) softening demand from China. Sibanye Stillwater (-16.2% MoM) was the worst performer as it continues to face a challenging PGM market, even with the gold price performing well in 2024. Last month, Sibanye said it had entered into a US$500mn streaming agreement with Canada-based Franco-Nevada Corporation in exchange for selling gold (mainly) and platinum streams from its Marikana, Kroondal and Rustenburg operations. According to Sibanye, the transaction is value accretive, with the company receiving a US$500mn (c. R8.9bn) upfront payment and a production payment of between 5% and 10% of the spot price per ounce, depending on whether it is the gold or platinum that is sold.

Sibanye was followed by two major platinum producers, Impala Platinum (Implats) and Northam Platinum, with MoM declines of 14.0% and 13.4%, respectively. The lower average price of PGMs has continued to weigh on the share prices of these counters and has negatively impacted both companies’ financial performance.

South32’s (-8.2% MoM) share price came under pressure after it withdrew its production guidance for the Mozal Aluminium business due to the operational impact of the recent civil unrest (over the disputed elections held in October) in Mozambique. South32 had previously forecast 360,000 tonnes of aluminium output in FY25 from the smelter. However, it said that the country’s escalating civil unrest and road blockages have impacted the transport of raw materials to Mozal. The company also warned that any escalation in the unrest could hurt its operations at Mozal Aluminium.

South32 was followed by Sirius Real Estate and logistics Group Grindrod, which recorded MoM declines of 8.2% and 7.3%, respectively. Protest disruptions in Mozambique also impacted Grindrod, which said it had resulted in the delay of 24 vessels at the Port of Maputo, while six vessels had been cancelled due to stock shortages. With these protests and a subdued coal market, volumes fell 13% at the Group’s Maputo terminal, and margins came under pressure. Grindrod provided a pre-close trading update in December, noting that its focus is now on bulk and container handling, logistics capability, rail, and transport. The lack of Chinese economic growth has put the commodity market under pressure, creating a negative environment for Grindrod’s dry bulk commodities export business. Group gross debt rose from R2.9bn in June to R3.1bn by the end of November, while the net debt remains low, dipping from R0.5bn to R0.4bn.

Diversified industrial group KAP (-7.0% MoM), in an operational update for the five months ended 30 November, said its Group revenue advanced, driven mainly by expanded production capacity and increased market share. In terms of its divisions, PG Bison’s new R2.0bn medium-density fibreboard (MDF) production line has reached full capacity, boosting domestic and export MDF sales by 50%. Its Safripol segment saw higher revenue and profit from increased production and sales, while Unitrans improved profit despite lower revenue and a smaller fleet. Restonic also grew revenue and profit, mainly from increased bedding unit sales in a weak market. KAP noted that while it continued to experience a subdued operating environment, positive sentiment after the formation of the GNU and the anticipated benefits pertaining to the two-pot retirement system, reduced loadshedding, lower inflation and easing of interest rates were encouraging. However, it noted that these factors have yet to filter through to trading.

Rounding out December’s ten worst-performing shares were AngloGold Ashanti and Ninety One Ltd, both of which recorded MoM share price losses of 6.9%.

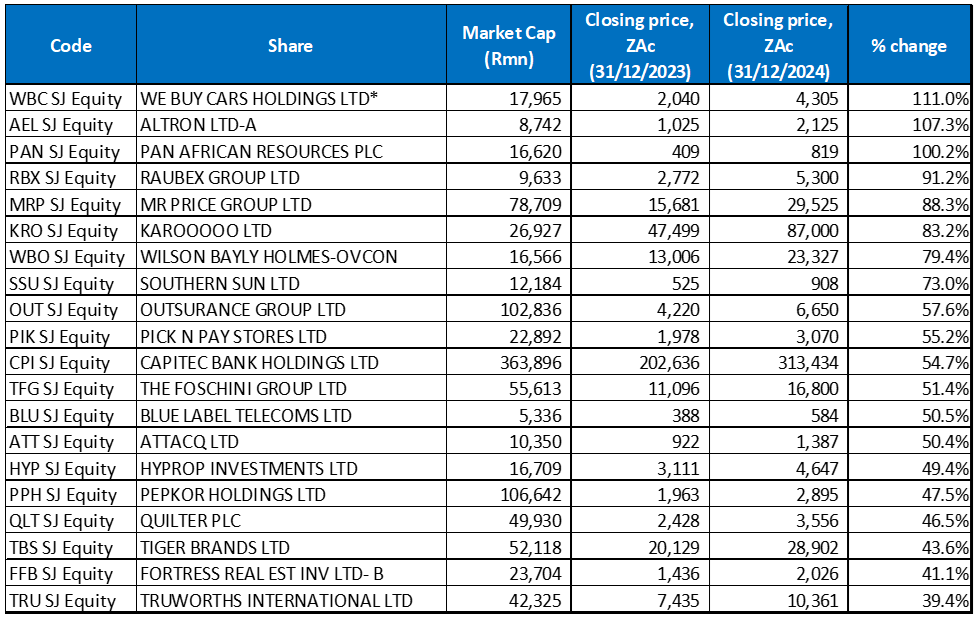

Figure 3: The 20 best-performing shares of 2024

Source: Anchor, Bloomberg. *listed on 11 April 2024.

The 2024 best-performing shares on the JSE featured seventeen of the year-to-end November’s best performers, with three new shares entering the top-20 in December. Most of 2024’s outperformers were SA Inc. or domestically focused shares, buoyed by the outcome of the 2024 elections, which ushered in a new era in local politics with the formation of the Government of National Unity (GNU).

WeBuyCars, spun out of Transaction Capital and listed in April, was 2024’s best-performing share, with a 111.0% gain since listing. The used-vehicle business reported good FY24 results in November despite a challenging domestic operating environment. It sold over 40,000 cars in the three months ending September (the last three months of its financial year-end) and recorded increased average selling prices. The surge in vehicle sales resulted in WeBuyCars recording a 16.5% YoY rise in FY24 revenue to R23.3bn. It also reported a 23.4% increase in core headline earnings to R815.4mn.

Altron Ltd (+107.3% YoY) had a bumper 2024 as investor optimism around the technology firm’s prospects reached new highs following uncertainty after it unbundled its former cash cow, Bytes Technology (which ironically ranked high among 2024’s worst performers). In November, Altron released impressive 1H25 results, with operating profit more than doubling, while headline EPS jumped over 100% YoY.

UK and JSE-listed gold miner Pan African Resources came in third, soaring 100.2% in 2024, helped by a surge in the gold price and an upgrade in its production forecast, assisted by its Mintails project, which it completed in October. The Mintails project will see gold from dumps re-mined, adding a further c. 50,000 oz p.a. to its 186,000 oz p.a. FY24 output. In November, Pan African announced the US$54.2mn all-share acquisition of Australian privately owned Tennant Consolidated Mining, which controls the Nobles mine, once that country’s biggest open-pit gold mine. Nobles is expected to increase Pan African’s production to c. 300,000 oz p.a. by 2026.

Construction Group Raubex, Mr Price, and Karooooo Ltd (discussed earlier) followed with YoY gains of 91.2%, 88.3%, and 83.2%, respectively. In the last few months of 2024, local retailers experienced improved market sentiment buoyed by two interest rate cuts, two-pot retirement system withdrawals, and optimism around SA’s economic future following the establishment of the GNU. In November, at the release of its 1H24 results, Mr Price said there were signs that SA was finally entering an upward economic cycle.

WBHO recorded a 79.4% YoY gain. In September, it reported a 16% YoY rise in FY24 revenue to R27.5bn, with HEPS from its continuing operations jumping 18.7% YoY. SA now accounts for 69% of WBHO’s revenue, the UK 20%, and the rest of Africa 11%. WBHO and Raubex have benefitted from positive sentiment as the government commits to ramping up infrastructure spending.

The SA hospitality sector has been steadily recovering from the impact of the COVID-19 pandemic, as the local tourism industry shows a resurgence. Southern Sun’s (+73.0% YoY) restructuring post-pandemic helped it deliver 10% growth in EBITDAR, with its results boosted by softening inflation, lower rates, and SA simplifying requirements for visitors from China and India.

SA’s third-largest insurer, OUTsurance Group, surged 57.6% YoY, while Pick n Pay jumped 55.2% YoY following several tumultuous years during which the beleaguered retailer recorded a decline in its market share, a failed turnaround strategy and disastrous FY24 results (net profit plummeted from a R1.17bn profit to a R3.2bn net loss). However, its former CEO, Sean Summers, returned in October 2023 and implemented a multi-pronged approach with his ‘Back-to-Basics’ strategy to turn the retailer around. The Group’s two-step recapitalisation plan was completed in November (raising cash to lower debt and fix its loss-making core Pick n Pay supermarket business). The first part of its plan was a rights offer, which was oversubscribed and raised R4.0bn in August. The second was Boxer’s JSE listing in November, with the IPO multiple times oversubscribed at the top end of the price range (Pick n Pay retains a 65.6% stake). The retailer’s reinforced balance sheet is expected to help it recover after incurring losses and shedding market share in its supermarket business.

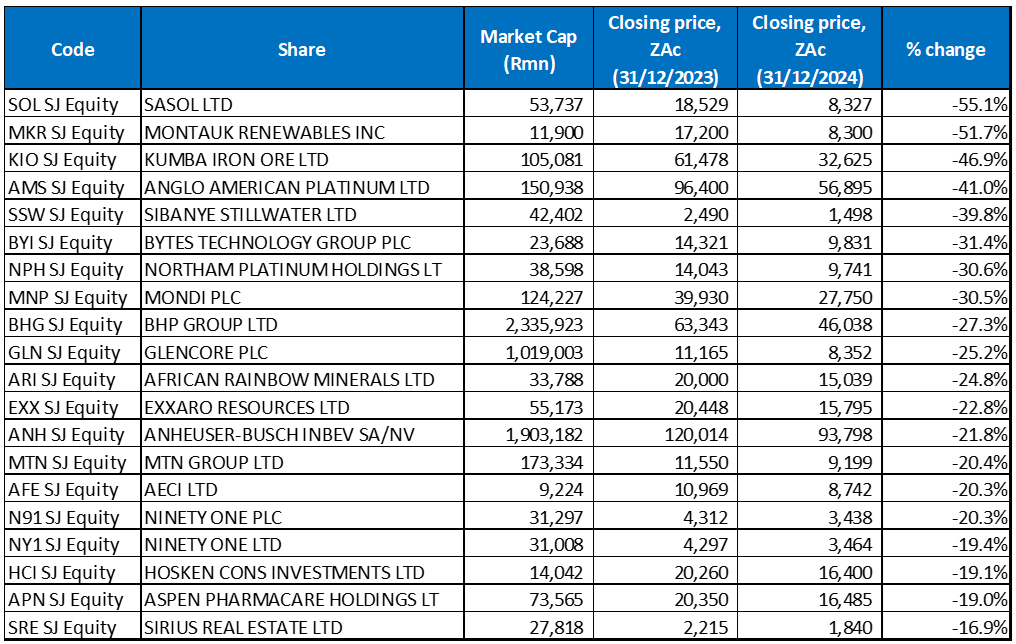

Figure 4: The 20 worst-performing shares of 2024

Source: Anchor, Bloomberg

There was also a large overlap between the year to November’s worst-performing shares and 2024’s worst performers, with eighteen shares unchanged and two new entrants to the grouping – Exxaro and Sirius Real Estate. Most of last year’s worst-performing shares were resource counters as global commodity prices slumped due (among other factors) to softening demand from China. In addition, Trump’s victory in the US Presidential Election saw the US dollar surge, exerting further downward pressure on precious and industrial metal prices.

Sasol (-55.1% YoY) had a tough 2024, emerging as the year’s worst-performing share. Its business was impacted by oil price volatility, lower refining margins and global chemical markets remaining oversupplied, with higher input costs, chemical prices and demand impacting Group margins. Sasol also had to contend with investor concerns about its plans to reduce environmental and operational risks to lower emissions by 30% by 2030.

JSE and US-listed renewable energy company Montauk Renewables was in second place with a 51.7% YoY decline. It was followed by Kumba Iron Ore (-46.9% YoY) in third spot. Kumba has remained under pressure as iron ore prices continued to decline in 2024 due to the ongoing slump in steel demand from property and construction sectors, especially its biggest consumer, China and its troubled property sector. Kumba has also faced operational constraints locally due to inefficiencies at Transnet.

Anglo American Platinum’s (Amplats; -41.0% YoY), Sibanye Stillwater (-39.8% YoY) and Bytes Technology Group’s (-31.4% YoY) followed. Among other factors, lower PGM prices weighed on Amplats and Sibanye in a challenging market environment (platinum, which once topped US$2,000/oz, fell 9% in 2024 to US$907.55, while palladium is down 17% over the same period). Meanwhile, Bytes Technology’s share price declined following a trading update, which signalled slower profit growth for the first four months of FY24. The UK-based software, security, cloud and AI services specialist was spun out of Altron in 2020. However, its trading statement seemed to signal that the FY24 results would show lower overall growth, with investors unimpressed by the apparent downward trend.

Northam Platinum’s (-30.6% YoY) share price plummeted in September after it reported FY24 results, with headline EPS dropping 81.6% YoY, mainly due to lower prices and despite higher sales volumes and revenue from chrome sales.

In its 1H24 results, released in August, Mondi Plc (-30.5% YoY) experienced ongoing pressures on its bottom line. BHP Group (-27.3% YoY) had a forgettable 2024, starting with its failed takeover attempt of Anglo American. Additionally, lower commodity prices, concerns over China’s economic growth, and mining sector cost inflation have weighed on the share price.

Finally, Glencore Plc’s (-25.2% YoY) share price decline can, for the most part, also be attributed to China – a massive consumer of metals and minerals (c. 60% of global production). However, over recent years, this has changed despite repeated announcements of stimulus packages (which seem, for the most part, to have underwhelmed investors).