Global markets stumbled into year-end, with most major equity indices having a lacklustre December as a hoped-for Santa Claus rally failed to materialise (MSCI World +0.8% MoM/+21.6% YoY/+3.2% in 4Q25). Nonetheless, 2025 was a year of healthy returns, driven by AI momentum and a resilient US economy, which seemingly shrugged off fiscal and political headwinds, including President Donald Trump’s ill-advised roll-out of so-called “Liberation Day” tariffs (Trump later walked back his more severe tariff threats, earning him the nickname TACO [Trump always chickens out]). Strong US corporate earnings and Federal Reserve (Fed) rate cuts boosted equity markets and investor sentiment. As was widely expected, the Fed cut rates again in December (by 25 bps), citing a softening US labour market and lingering inflation pressures that remain above the central bank’s 2% target. In the press conference following the meeting, Fed Chair Jerome Powell signalled a possible pause in further easing, suggesting this latest cut might be the last for now unless incoming economic data justifies more accommodation.

Among the three major US indices, the S&P 500 was basically unchanged MoM (+16.4% YoY/+2.3% in 4Q25), and the Nasdaq was down 0.5% in December (+20.4% YoY/+2.6% in 4Q25). The Dow, however, advanced by 0.7% MoM (+13.0% YoY/+3.6% in 4Q25) – its eighth straight monthly gain. While the major US indices’ performances might have been mixed in December, they have now recorded three consecutive years of double-digit gains, with the Nasdaq being the best performer in each of the past three years.

In economic data, US November headline inflation came in at 2.7%, while core inflation, which strips out the volatile food and energy prices, was also cooler than anticipated, increasing by 2.6% YoY. This was the first report that encompassed the period of the US government shutdown, which disrupted data collection and led to the cancellation of the October release. Released in December, the September core personal consumption expenditure (PCE), excluding food and energy, the Fed’s preferred inflation gauge, printed lower-than-expected at 2.8% YoY, down from August’s 2.9%. Retail sales were flat in October vs a downwardly revised 0.1% gain in September.

European equity markets ended December mixed but recorded their strongest YoY performance since 2021, on the back of falling interest rates, the German government’s support measures (from fiscal stimulus to targeted infrastructure spending), and a rotation out of lofty US tech counters. France’s CAC closed December 0.3% higher (+10.4% YoY/+3.2% in 4Q25) while Germany’s DAX jumped 2.7% MoM (+23.0% YoY/+2.6% in 4Q25). The eurozone annual inflation rate was 2.1% in November 2025, unchanged from October’s print. At its meeting in December, the European Central Bank (ECB) kept rates unchanged.

UK equity markets rose in December, with the FTSE 100 ending the month 2.2% higher (+21.5% YoY/+6.2% in 4Q25). UK November inflation eased to 3.2% YoY vs October’s 3.6% print. Core inflation also rose by 3.2%, down from 3.4% in October.

China’s equity markets remained under pressure, ending December mixed as weak domestic demand and economic fundamentals continued to be a drag on its economy. The Shanghai Composite ended the month 2.1% higher (+18.4% YoY/+2.2% in 4Q25), while Hong Kong’s Hang Seng dipped by 0.9% MoM (+27.8% YoY/-4.6% in 4Q25). December’s official manufacturing PMI returned to growth, expanding for the first time since March and printing at 50.1 vs November’s 49.2. Non-manufacturing PMI, which includes services and construction, increased to 50.2 from 49.5 in November. The 50-point mark separates expansion from contraction.

Japan’s benchmark Nikkei closed 0.2% higher in December (+26.2% YoY/+12.0% in 4Q25). The country’s November headline inflation decreased to 2.9% vs October’s 3.0% YoY. So-called “core-core” inflation, which excluded prices of fresh food and energy, fell to 3.0% from October’s 3.1% print.

Among commodities, Brent crude (-3.7% MoM/-18.5% YoY/-9.2% in 4Q25) ended the month lower at US$60.85/bbl on expectations of oversupply. Gold gained 1.9% MoM (+64.6% YoY/+11.9% in 4Q25), as expectations of another US rate cut in December boosted demand for the yellow metal and geopolitical risk remained elevated. Platinum group metals (PGMs) had an impressive month: platinum jumped 23.3% MoM (+127.0% YoY/+30.8% in 4Q25), palladium soared by 11.4% MoM (+77.5% YoY/+28.4% in 4Q25), and rhodium bounced by 15.0% MoM (+100.5% YoY/+28.8% in 4Q25). Iron ore rose by 2.6% MoM (+8.7% YoY/+5.6% in 4Q25) amid resilient demand in its top consumer China, robust steel exports, and prospects of improved steel fundamentals.

As precious metals’ annus mirabilis continued in December, so did the JSE’s winning streak, with the local bourse recording a tenth consecutive monthly advance. The FTSE JSE All Share Index (ALSI) rose by 4.4% in December and has soared 37.7% in 2025 – its best annual performance in nearly two decades. A surge in gold and platinum prices provided the biggest boost, while more positive sentiment towards South Africa (SA) Inc. and the rand firming by 13.8% in 2025 (+3.3% MoM/+4.3% in 4Q25) to trade at c. R16.56/US$1 further buoyed the local equity market. Commodity-linked shares continued to propel the JSE to new highs in December (Resi-10 +5.6% MoM/+138.2% YoY), followed closely by financial shares (Fini-15 +7.2% MoM/ +20.7% YoY). Industrials were up 1.5% MoM (Indi-25 +16.7% YoY) while SA-listed property had a lacklustre month, declining by 0.4%. Still, for 2025, the SA Listed Property Index has outperformed, increasing by 23.2% YoY.

In domestic economic data, November headline inflation slowed to 3.5% YoY, from 3.6% in October, while core inflation printed at 3.2% YoY, up from October’s 3.1%. SA also recorded a preliminary trade surplus of R37.7bn in November, more than double October’s R15bn surplus. The November data mark the country’s largest monthly trade surplus in 2025, with December data still outstanding.

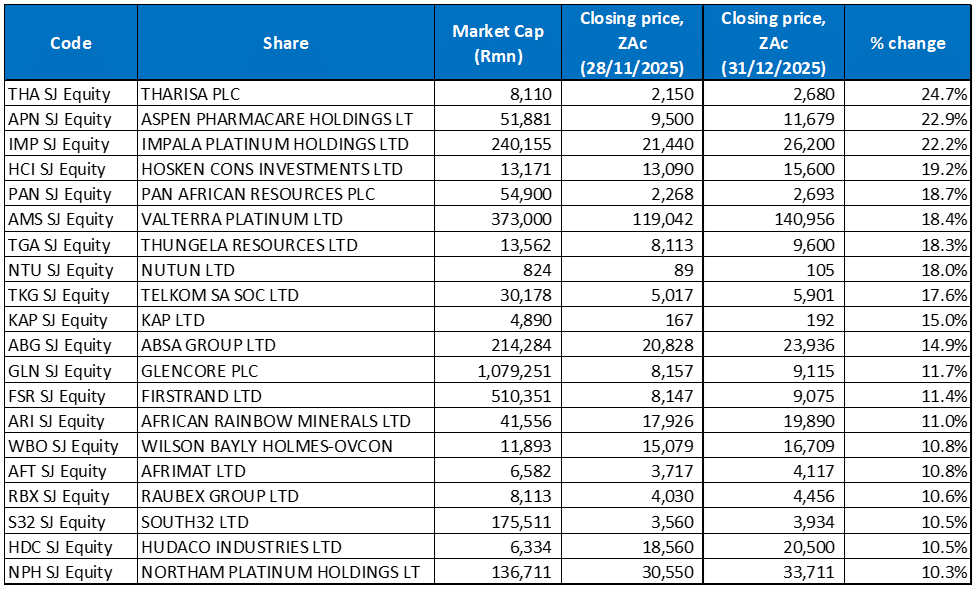

Figure 1: December 2025’s 20 best-performing shares, MoM % change

Source: Bloomberg, Anchor

Precious metals miners remained the key drivers of JSE gains in December, with ten out of the twenty best-performing shares coming from the materials sector. On 26 December, platinum, which is used in the automotive and jewellery industries, hit an all-time high of US$2,413.62/oz on the back of tight supply before retreating to end the year at US$2,060.51/oz – up 23.3% MoM. The metal has advanced by 127% in 2025 – its biggest annual gain since Bloomberg started compiling data in 1987.

Diversified mining company, Tharisa Plc (+24.7% MoM) was December’s best performer. In its FY25 results, released last month, the miner reported a 16.4% YoY revenue drop to U$602.9mn, while headline EPS fell 2.1% YoY to USc27.5. However, Tharisa said it remained bullish on the outlook for chrome, noting that “With the stainless-steel market in the Far East needing close to 2mn tonnes of chrome concentrate a month and the industry projected to grow at some 3%, the fundamentals for chrome remain strong.” The company added that SA’s chrome and PGM industries “are well positioned to benefit from structural global demand for stainless steel, renewable technologies and green-economy metals.” SA has 70%-80% of global chrome ore reserves, a critical mineral used to produce the steelmaking ingredient ferrochrome.

Local pharma Group, Aspen Pharmacare Holdings, with a 24.7% MoM gain, was the second-best performing share. Aspen’s share price jumped by over 20% on 29 December after it said it is selling its entire Asia-Pacific operations outside of China to Australia’s BGH Capital for c. R26.5bn in a deal that hands Aspen a premium valuation for assets it was not planning to sell. The sale is subject to regulatory and shareholder approval and includes operations in Australia, New Zealand, Hong Kong, Malaysia, Taiwan and the Philippines.

In third spot, Impala Platinum’s (Implats) share price rose by 22.2% MoM as the miner continued to benefit from 2025’s platinum price tailwind.

Implats was followed by investment holding company Hosken Consolidated Investments (HCI), Pan African Resources and Anglo American spin-off, Valterra Platinum (previously Amplats), with MoM gains of 19.2%, 18.7%, and 18.4%, respectively. In December, Pan African was included in the FTSE 250 Index following its recent shift to London’s main board. Days after the company was initially included in the London Stock Exchange’s list of likely index additions and deletions in late November, it announced plans to fast-track a R2.8bn expansion of its Johannesburg gold-from-tailings project at MintailsTailings Retreatment (MTR), which aims to increase output from the region by 30,000–35,000 oz p.a. to 100,000 oz p.a. Valterra has been rebuilding strong upward momentum on the back of rising platinum prices, an improved operational performance with production projections reaching the upper end of guidance after recovering from earlier disruptions. In addition, the completion of Valterra’s demerger from Anglo American has enhanced its strategic independence and investor confidence. S&P Global Ratings said last month that it expects the recent recovery in PGM prices to carry through to 2027, with the potential of providing support for Valterra to grow its earnings, noting that “We expect adjusted earnings before interest, tax, depreciation and amortisation (EBITDA) to increase by about 43% to R30.8bn from R21.5bn in 2024, and we see adjusted margins expanding to 27.9% from 19.7%,”.

SA’s largest coal exporter, Thungela Resources, which has been under pressure for most of last year, saw a share price turnaround in December (+18.3%) after reporting strong production (13.7mn tonnes vs a guided range of 12.8-13.6mn tonnes), an improved rail performance (by Transnet Freight Rail [TFR]) with volumes up 9% YoY, and disciplined cost control in its pre-close statement for the year ended 31 December 2025.

Nutun Ltd (+18.0% MoM), formerly Transaction Capital, released its FY25 results, which showed that revenue dropped to R1.44bn from R1.48bn posted in FY24, while its diluted loss per share improved, standing at ZAc30.3 vs ZAc126.2 recorded in the prior year. Nutun said that its 2025 year-end marked the completion of a two-year restructure and simplification of the Group, which now comprises two focused and distinct customer-centric divisions, Nutun International and Nutun South Africa.

Telkom SA and diversified industrials Group, KAP Ltd, rounded out December’s best-performing shares with MoM gains of 17.6% and 15.0%, respectively. In its operational update for the five months ended 30 November 2025, KAP reported improved EBITDA, operating profit and earnings, supported by full utilisation of PG Bison’s new MDF line, more substantial vehicle assembly volumes at Feltex and lower net finance costs. KAP said its 1H26 HEPS is expected to increase by over 20% YoY.

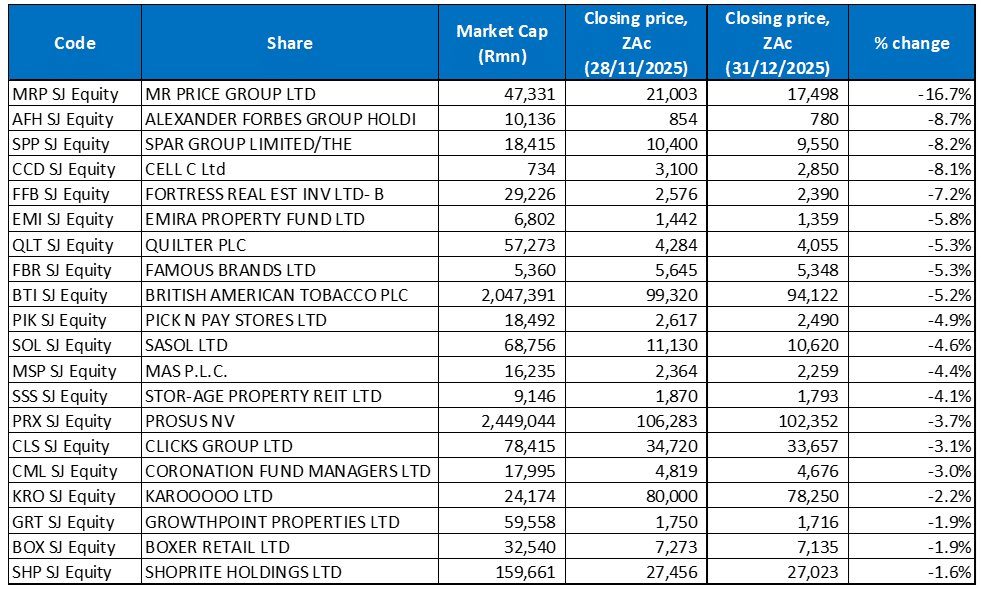

Figure 2: December 2025’s 20 worst-performing shares, MoM % change

Source: Bloomberg, Anchor

Mr Price was December’s worst performing share, declining by 16.7% MoM on investor concerns around its announcement that it planned to acquire German-based NKD, a value-focused apparel and homeware retailer servicing Central and Eastern Europe. The deal is valued at c. R10bn, which is around 18% of Mr Price’s market cap and is its largest venture yet. It will be funded by cash and debt and is expected to close in 2Q26 pending regulatory approvals. NKD’s management team will remain in place to run the business.

Diversified financial services Group, Alexander Forbes, was December’s second-worst performer (-8.7%), followed by Spar Group (-8.2% MoM) in third place. Spar’s FY25 results, released in early December, came in below expectations with revenue from continuing operations increasing 1.6% YoY to R132.4bn after 2H25’s revenue grew by 3.5%, a significant improvement on 1H25. HEPS from continuing operations declined to ZAc768.9 vs ZAc896 a year ago. Spar recorded a profit of R1.1bn from continuing operations, but its discontinued operations, including its Swiss and English businesses, posted a R6.1bn loss. During the period, Spar concluded its European strategic exits and said that it continued to make progress on the disposal of AWG in South-West England. It also sold Spar Switzerland for a total equity value of CHF46.5mn (c. R1,025mn) in September. No dividend was declared as the Group continues to de-gear its balance sheet to a more sustainable level.

Cell C, Fortress Real Estate -B-, and Emira Property Fund recorded MoM losses of 8.1%, 7.2% and 5.8%, respectively. On 27 November, Blu Label Unlimited listed Cell C as a separate entity on the JSE, with the counter debuting at a share price of R27. Cell C CFO El Kope noted that a separate listing will allow Cell C “… to streamline its balance sheet, reinforce its growth strategy and unlock long-term value,” adding that “The business today is fundamentally stronger and more competitive than it was two years ago.”

Quilter Plc and Famous Brands were both down 5.3% in December. Famous Brands said last month that it had entered the Asian market with the opening of a combined Steers and Debonairs Pizza restaurant in Kuala Lumpur (Malaysia) as part of a significant international expansion push, as it continues to look for growth outside of SA. The launch follows the signing of master licence agreements with Mesra Retail & Café (Mesra), a subsidiary of Petronas Dagangan Berhad. The deal gives Mesra exclusive rights to roll out Steers and Debonairs Pizza restaurants across Malaysia, marking the start of what both companies describe as a long-term partnership.

British American Tobacco (BAT; -5.2% MoM) and Pick n Pay Stores (-4.9% MoM) rounded out December’s ten worst-performing shares. BAT released a FY25 pre-close trading update on 9 December, showing that it expects c. 2% revenue and adjusted operating profit growth for the year, with New Category revenues accelerating to double-digit growth in 2H25 to deliver mid-single-digit growth for the full year. BAT said FY26 growth is expected at the lower end of its 3% to 5% revenue-expansion range, as it outlined slower momentum in parts of its heated-tobacco portfolio and uneven regional performance. The company also announced that it is increasing its share buyback programme to GBP1.3bn for 2026.

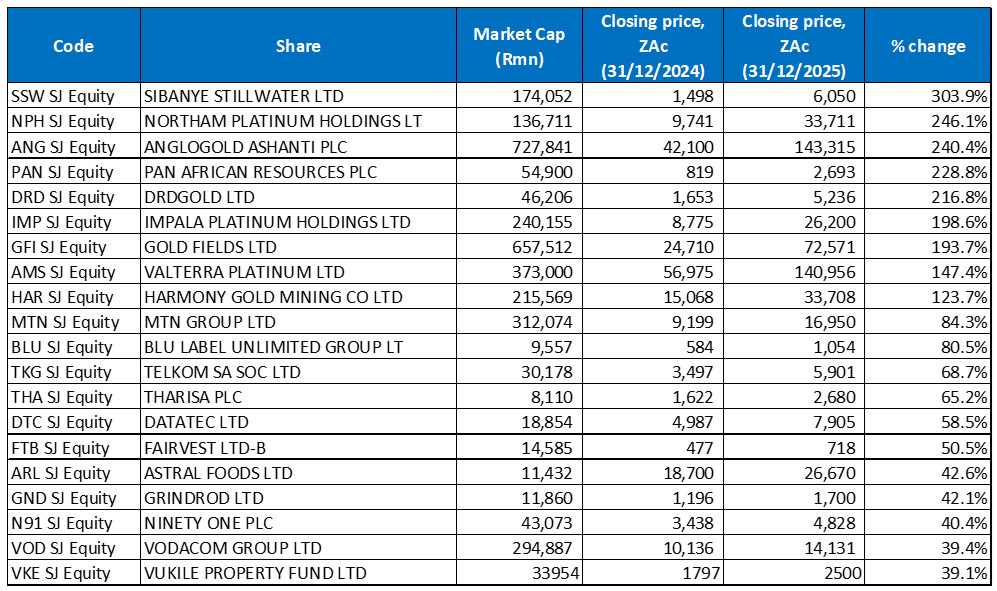

Figure 3: 2025’s twenty best-performing shares on the FTSE JSE All Share Index

Source: Anchor, Bloomberg

Record gold and platinum prices, spurred by safe-haven demand amid a confluence of macroeconomic and geopolitical factors, including global policy uncertainty, US Fed rate cut expectations, persistent inflation concerns, a weaker US dollar, and central bank buying of gold, powered the JSE’s rally in 2025. Among the 20 top-performing shares for 2025, ten came from the commodities or materials sector, with Sibanye Stillwater emerging as last year’s best performer with a 303.9% YoY gain. Sibanye’s 2025 surge, which was also powered by its improving financial metrics, has positioned the company as a strong performer in the mining sector, with some market commentators also attributing the share price rise to Sibanye being undervalued (the share price was down 39.8% in 2024).

Northam Platinum (+246.1% YoY) was in second place with AngloGold Ashanti (+240.4% YoY) a close third. Northam’s most important driver has been the powerful PGM rally, especially platinum, which has hit multi-year highs. The surge in PGM prices has been boosted by policy changes in the EU, which will boost the demand for PGMs in autocatalysts for emissions control. With the gold price a key player in AngloGold Ashanti’s share price, the yellow metal’s 64.6% gain in 2025 has acted as a significant tailwind for gold shares. AngloGold’s ability to produce more gold and maintain a strong balance sheet has helped it outperform other gold miners.

AngloGold was followed by Pan African Resources, DRDGold, Implats and Gold Fields, which recorded YoY gains of 228.8%, 216.8%, 198.6%, and 193.7%. Gold and platinum price strength has been a significant tailwind for all of these shares, but individual factors have contributed to their gains. Pan African has forecast strong earnings and production growth, DRDGold’s business model enables it to offer robust cash flows when the gold price is high, Implats is seeing an improving future earnings outlook because of a recovery in PGM prices, thus enabling it to restore dividends and strengthen its finances and Gold Fields has delivered higher production and earnings as well as strong dividends and strategic growth progress.

Rounding out 2025’s 10 best performers were Valterra Platinum (covered earlier), Harmony Gold and MTN Group with YoY gains of 147.4%, 123.7%, and 84.3%. The soaring gold price and an improved financial performance buoyed Harmony Gold’s share price. Meanwhile, MTN’s share price rally was driven by a recovery in its operational performance, improved earnings, strategic growth (as it expanded its digital and fintech services) and positive investor sentiment across its telecoms markets.

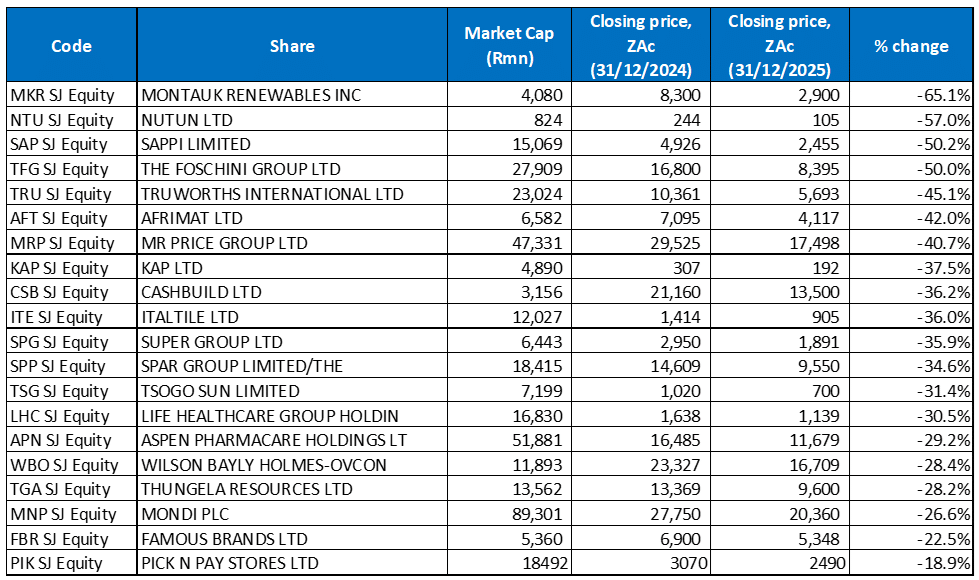

Figure 4: 2025’s twenty worst-performing shares on the FTSE JSE All Share Index

Source: Anchor, Bloomberg

Montauk Renewables (-65.1% YoY), which specialises in management, recovery and conversion of biogas into renewable natural gas (RNG), was 2025’s worst performer among the shares in the ALSI. The company had a tough year, navigating a challenging market environment as Renewable Identification Number (RIN) pricing pressures significantly impacted its financial performance. Montauk’s 3Q25 results, which showed revenue decreasing by 31% YoY to US$45.3mn, while net income stood at US$5.2mn (US$0.04/share), a decrease of 69.5% YoY, further weighed on the share price performance. The drop in profitability was primarily attributed to lower RIN pricing, which decreased by 31.4% YoY.

Nutun and Sappi Limited took the second and third spot with YoY losses of 57.0% and 50.2%, respectively. Nutun’s share price fell primarily because its earnings and revenue declined, the company was also in the early stages of restructuring with uncertain near-term outcomes, and dividends were suspended — all factors which weighed on investor sentiment. Sappi’s share price was under pressure as its financial performance deteriorated, with losses and margin pressure reflecting weaker global demand for its products. Rising debt and leverage, the suspension of dividend payments, and credit rating downgrades further weighed on sentiment.

The Foschini Group, Truworths, Afrimat, and Mr Price Group followed, recording 2025 declines of 50.0%, 45.1%, 42.0%, and 40.7%. Weak consumer demand, rising costs, weaker margins and falling profits have led to investors reducing their exposure to Foschini. At the same time, clothing retailer Truworths saw weak demand and poor sales in its biggest market, with disappointing earnings driving the share price lower in 2025. A perfect storm that included challenges in its cement division, logistics constraints, early acquisition pain and sharply lower profits significantly impacted Afrimat’s share price. Although Mr Price showed some resilience last year, concerns around sluggish domestic consumer demand and its controversial offshore acquisition, which saw the share drop substantially on the day of the announcement, have weighed on its share price performance.

Rounding out 2025’s ten worst-performing shares were KAP Ltd, Cashbuild, and Italtile with YoY declines of 37.5%, 36.2% and 36.0%, respectively. Investors penalised KAP after it reported a significant drop in FY25 HEPS (down 47% YoY), slowing profits, rising new project costs and weak trading conditions in an already challenging local industrial environment. Cashbuild’s share price underperformed because its growth has been modest relative to broader market gains as demand in its core retail segment remained weak on the back of a surge in cheap, low-quality building products, which hurt demand for Cashbuild’s higher-quality materials. Finally, Italtile’s share price was dragged lower by tepid revenue growth, margins being squeezed by competition and cheaper imports as well as broader manufacturing challenges in SA, including policy and infrastructure issues, that weaken producer competitiveness.