Following its unbundling from Naspers, MultiChoice made its JSE-debut on 26 February. Ahead of the listing, what was notable was how divergent expectations for MultiChoice’s prospects were among investors. In the first few days of trading, the bears certainly appear to have been in the ascendency.

To summarise, this is the bearish view:

- Pay-TV/ linear television is a sunset industry which, if it is not already, will soon be in structural decline thanks to disruption from a growing range of content streaming services such as Netflix, Amazon Prime, Hulu, YouTube and so on.

- Pressure on consumers is leading to subscribers downtrading to cheaper packages or cancelling their subscriptions entirely.

- The cash-generative South African business is funding a loss-making pay-TV business in the rest of Africa (MultiChoice Africa). The timeline to return the rest of Africa segment to profitability is uncertain, as is the ability to reliably access cash from markets such as Nigeria and Angola (together accounting for almost 40% of MultiChoice Africa’s subscriber base).

Aside from selling by those that ascribe to the above bear-case scenario, we think the initial weeks of trade in MultiChoice shares will be heavily influenced by institutional investors who do not wish to hold MultiChoice for a variety of reasons. Those that invested in Naspers as part of a technology investment mandate may not be allowed to hold MultiChoice in terms of this mandate. Others may simply not wish to invest their resources in MultiChoice, which was not the reason they bought Naspers and is an immaterial part of Naspers’ portfolio. The fact that MultiChoice will not pay a dividend for the year to March 2019, despite having been spun out of Naspers in a positive net cash position (if one excludes the finance lease obligations for satellites), is perhaps a further reason for these shareholders to cut and run.

While it may be a bumpy ride in the short term, we think the sensible course of action is to hold fast and allow the fundamentals to assert themselves. The bearish case outlined above raises issues that investors will need to keep a careful eye on, but it also underappreciates the position MultiChoice has in Africa and the unique demands and challenges that this market presents.

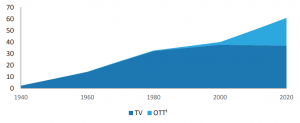

- MultiChoice’s competitive moat appears underappreciated at present – it is easy to become alarmed by those swapping anecdotes over craft beers in trendy Sandton pubs, as to how they are cancelling their DSTV subscription and moving to Netflix. This may well mirror the so-called “cord-cutting” trend in certain developed markets but in our view, it is not reflective of the broader realities in Africa. Arguments to suggest it is a little premature to be writing MultiChoice’s obituary include: (1) limited reliable internet access – fibre broadband penetration is only expected to reach 12% of households in SA in the next 5 years, while in the rest of Africa it is considerably less; (2) the challenge of collecting payment for streaming providers, which rely on credit card-based payments; (3) the preference for local content production which is a strength of MultiChoice but not a focus for international over-the-top (OTT) content providers. To reinforce this MultiChoice points out that, while local content accounts for just 12% of what it broadcasts, it constitutes 26% of what people actually chose to watch; and (4) MultiChoice estimates that c. 70% of those subscribing to OTT services do so as an additional service on top of their existing pay-TV subscription. Indeed, we found the following chart (see Figure 1) from the MultiChoice’s pre-listing statement interesting, with research suggesting that new viewing platforms are increasing overall video consumption globally, rather than simply substituting linear television.

Figure 1: Viewing habits (hours spent per week by media type)

Source: Carat insight media survey, European Technographics Benchmark Survey: eMarketer

- Note OTT includes online and mobile video

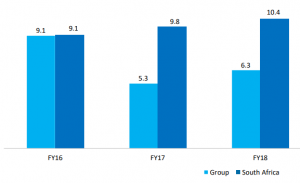

- Losses in Africa may be eliminated faster than expected – The bearish camp is currently placing a negative value on the loss-making MultiChoice Africa division. With reference to MultiChoice’s recent trading profit trend below, losses in MultiChoice Africa are responsible for the difference between ‘Group’ and ‘South Africa’. We note that MultiChoice Africa was not always loss-making. The currency and macroeconomic fallout in Africa, from the decline in commodity prices (oil in particular) in 2015 pushed the division into a loss. Admittedly slow to respond at first, MultiChoice has been rationalising costs (stripping out unprofitable content, for example) and reconfiguring its bouquets to better align with affordability. The lumpy cost of the FIFA World Cup rights in the first half of the current financial year distorted the progress that MultiChoice Africa is making towards getting back to a break-even point. Full-year results may show MultiChoice Africa is making more headway than currently assumed by most forecasters, who are not expecting it to reach breakeven before at least 2022.

Figure 2: Reported Group trading profit (Rbn)

Source: MultiChoice

- Attractive dividend potential in time – MultiChoice has been spun out of Naspers with net cash on its balance sheet of R4.2bn (R9.60/share), excluding its capitalised finance leases for satellite equipment. Over the past few years, it has paid out dividends in excess of R5bn p.a. (>R11.00/share). As noted above, it will not pay a dividend this year and has committed to a R5.70/share dividend for the coming financial year (FY20). With major investment projects such as the rollout of its digital terrestrial television (DTT) network largely done, beyond this rather underwhelming short-term guidance, MultiChoice has the potential to be a very strong dividend payer.

Placing just the South African operations on a similar rating to international pay-TV peers, implies a valuation of c. R150/share. With MultiChoice trading below R100/share at the time of writing, it seems that the bears are firmly in control currently. Indeed, the “sunset industry” argument, combined with frequent stumbling from SA corporates in the rest of Africa (think MTN and, more recently, Shoprite), are hard to ignore. They are what is causing MultiChoice to trade well-below its fundamental fair value. While nerves of steel may be required in the short term, we think those that avoid getting caught up in the crush of sellers heading for the exit will be well rewarded over the next few years.