Kumba Iron Ore (Kumba), and Anglo American Platinum (Amplats) released disappointing trading statements for their six-month periods ended 30 June 2022 (1H22) on 21 July, flagging subdued results for Anglo American (Anglo). Anglo owns 70% and 80% of Kumba and Amplats, respectively.

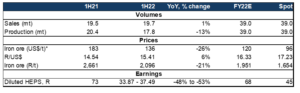

Kumba said that its 1H22 HEPS is expected to fall by 48%-53% YoY. The biggest driver of this is the iron ore price, which declined 26% in the first six months of this year. The 2021 average iron ore price of US$161/tonne was the second-highest price going back to 2011. We do not expect iron ore prices to rally back to those levels and so we believe that Kumba’s earnings will continue to decline in the second half of this year (2H22).

Figure 1: Kumba trading statement overview and forecasts, Rbn except per share

Source: Bloomberg, Anchor

*Kumba’s realised pricing is higher due to its higher-quality product.

Our FY22 diluted HEPS estimate for Kumba is R68, putting the share on a 6.5x multiple to the end of this year. As at 21 July 2022, the share price is trading c. 35% off its 2022 high and is starting to look more reasonably valued than it has over recent times. It is important to note, however, that downside risk remains to Bloomberg consensus’ FY22 HEPS estimate of R80. Kumba’s earnings remain elevated vs its history and are near cyclical highs.

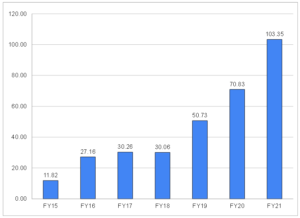

Figure 2: Kumba diluted HEPS, R

Source: Bloomberg, Anchor

Given the above, we would not currently be buyers of Kumba.

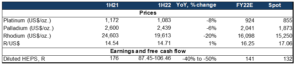

Meanwhile, Amplats’ 1H22 HEPS will also be down around 50%. However, for Amplats, it is a combination of the 20% YoY drop in production volumes and the 14% YoY fall in the platinum group metals (PGMs) basket price.

Figure 3: Amplats trading statement overview and forecasts, Rbn except per share

Source: Bloomberg, Anchor

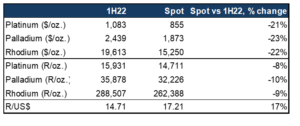

Despite a significant pullback in the share prices of the local platinum miners, we remain cautious and would not be buyers of shares in this sector at the moment. The spot prices for the three main metals (platinum, palladium, and rhodium) are c. 20% lower in US dollar terms and c. 10% lower in rand terms than their averages for the first half of this year (January to June 2022 – see table in Figure 4 below).

Figure 4: PGM prices 1H22 vs current spot

Source: Bloomberg, Anchor

Volume growth is negligible to negative for most platinum miners (Northam being the notable exception). So, at current prices, Amplats’ revenue is likely to be down c.10% YoY, whilst cost inflation remains high, meaning earnings can once again come under meaningful pressure. While we are not buyers of the sector, our preferred pick would be Northam for its volume growth.

Being underweight the platinum sector does come with risk, as there is the possibility that Russia’s PGM supply gets sanctioned in some way due to its war on Ukraine, which would be positive for metal prices and local PGM counter’s share prices.

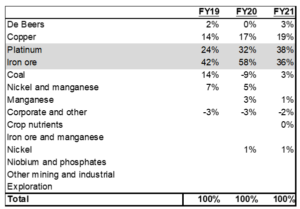

These updates from Kumba and Amplats do not bode well for Anglo’s 1H22 results. Platinum and iron ore together have contributed 66%, 90%, and 74% of Anglo’s underlying operating profit in FY19, FY20, and FY21, respectively (see table in Figure 5 below).

Figure 5: Underlying EBIT contribution to Anglo American

Source: Bloomberg, Anchor

Amplats and Kumba account for most of the two segments (Minas-Rio also contributes to iron ore for Anglo Group). De Beers (YTD cycle sales up 24%), copper (average price up 7%) and met coal (average price up 132%) had good pricing YoY, and we believe that should mitigate some of Anglo’s earnings shortfall from platinum and iron ore, but it will likely not be enough. Anglo earned US$6.92 in diluted HEPS in 2021. Although downgrades have started to come through, Bloomberg consensus earnings forecasts still look quite high at US$6.13/share for FY22 (implying an 11% YoY decline).

YTD, Anglo’s share price has underperformed both Glencore and South32 (although we note that South32’s absolute return is disappointing at -8.5%). Given the above, we continue to believe that Anglo is likely to be a relative underperformer and would thus favour Glencore and South32 over Anglo.