Introduction

The outlook for South African (SA) food producers is increasingly positive heading into 2026, supported by tailwinds including easing input costs, cost efficiencies driven by investment-led economies of scale, and an emerging inflection in industry volume growth. In this note, we focus on the bread market—an industry with a complex history in SA following deregulation, pricing scandals, and, more recently, intensifying competition. We argue that the sector is entering a new phase in which structural efficiency, rather than pricing power, will determine long-term winners.

The dominant milling and baking (Millbake) players are Premier (Blue Ribbon), RCL Foods (Sunbake), Pioneer Foods (Sasko), and Tiger Brands (Albany). We focus on Tiger Brands and Premier, as both businesses are undergoing material structural change within their Millbake operations. These initiatives (such as automation and regional consolidation) are expected to support improved volume growth and meaningful operating margin expansion, underpinning medium-term earnings growth for both companies and positioning them as long-term winners.

The SA bread industry – a brief history

Since the early 1990s, the local bread industry has undergone profound structural change. Once heavily regulated, it was progressively deregulated in the early 1990s, fundamentally altering market structure and pricing dynamics.

Prior to deregulation, the Wheat Board controlled wheat pricing, while the government fixed bread prices and subsidised bread as a staple food. The final direct price control occurred in 1990, when the retail price of a standard loaf was set at R1.05.

In 1991, the government withdrew subsidies and lifted bread price controls, allowing market forces to determine pricing. Deregulation continued throughout the 1990s, culminating in 1997 with the abolition of the single-channel, fixed-price wheat marketing system and the disbandment of the Wheat Board. This marked the beginning of a fully liberalised wheat and bread value chain.

However, deregulation and industry consolidation ultimately created conditions for abuse. In the mid-2000s, the Competition Commission uncovered widespread collusion among major bread producers, including Tiger Brands, Premier Group, and Foodcorp (later part of RCL Foods). The investigation revealed coordinated price increases and market allocation practices, including the strategic closure of bakeries to limit competition in certain regions.

The fallout was significant, resulting in reputational damage and financial penalties. While the industry came under heightened scrutiny, no lasting price regulation was imposed. Instead, competition was expected to reassert itself—and it has. Today, the bread industry is intensely competitive, with pricing remaining the primary battleground.

Market structure

Bread market structure varies by region; however, at a national level, Nielsen data suggest Tiger Brands’ Albany is the leading brand with a c. 27% value share, followed by Pioneer Foods’ Sasko at 24% and Premier’s Blue Ribbon at around 15%.

Figure 1: Bread market share by brand

Source: Company websites

Value share estimates vary due to the presence of secondary brands. Premier, for example, also owns Star, B&B, and Mister Bread, which hold meaningful shares in specific regions despite being smaller nationally. On a consolidated basis, we estimate that Premier’s total bread value share now exceeds that of Pioneer Foods (now under PepsiCo). RCL Foods remains the smallest of the major players, with Sunbake holding an estimated 6%–8% market share.

Regionally, Tiger Brands dominates inland markets, while Premier holds leading positions across many coastal regions, including the Western Cape, KwaZulu-Natal, and the Eastern Cape. RCL Foods has a narrower footprint, with Sunbake primarily present in inland provinces such as Gauteng, Limpopo, Mpumalanga, North West, and the Free State.

Long-term winners

Bread is a mature, highly competitive category; the important question is where sustainable value creation comes from. In our view, long-term winners will be determined by two factors: scale-driven cost leadership and superior asset utilisation. These characteristics increasingly favour Tiger Brands and Premier.

Food manufacturing is inherently high in terms of operating leverage. Production is concentrated in capital-intensive facilities with high fixed costs, meaning profitability improves as volumes rise. In commoditised categories such as bread, where differentiation is limited and competition is primarily on price, scale is the most effective defence against margin erosion.

Both Tiger Brands and Premier are actively reshaping their cost curves through regional consolidation, automation, and logistics optimisation. Smaller players lack the balance sheet strength, scale, and distribution density to replicate these investments, raising barriers to entry and supporting sustained returns above the cost of capital.

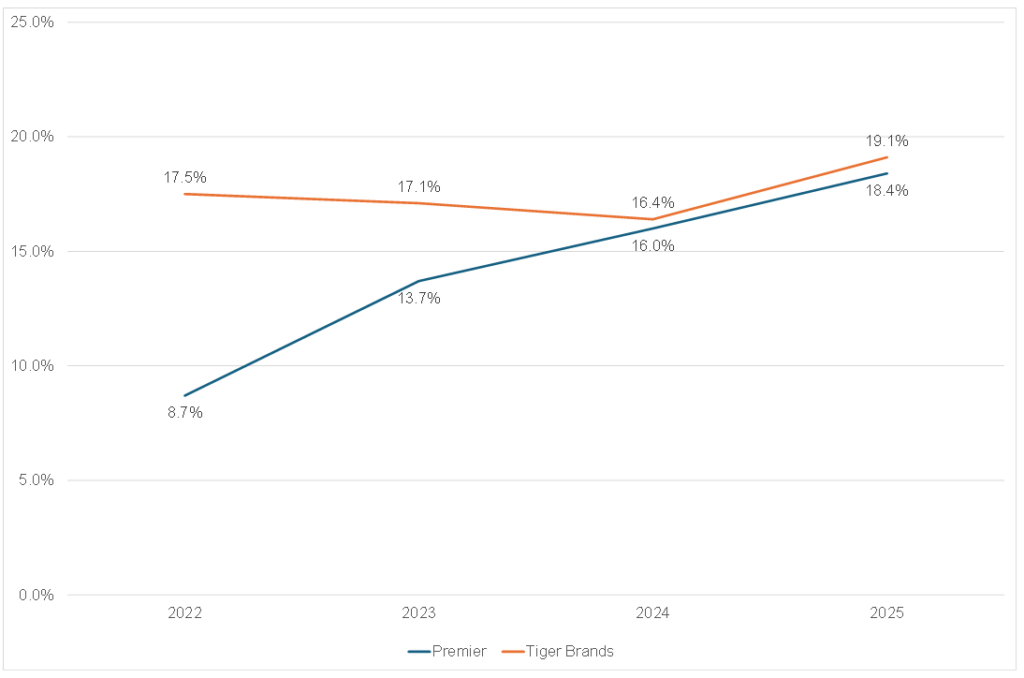

Figure 2: Premier and Tiger Brands return on invested capital

Source: Company data, Anchor Capital

Tiger Brands

Tiger Brands’ Milling and Baking division is undergoing a multi-year structural reset following a prolonged period of operational underperformance. The centrepiece of this turnaround is the commissioning of its Super Bakery, expected by the end of CY26. This facility will replace six sub-scale inland bakeries without increasing overall capacity, lowering conversion costs through automation, reducing labour intensity, and improving yields.

Management has guided to a c. 50% reduction in regional conversion costs, which should underpin a step-change in margins into FY27. Importantly, this improvement will be a structural reset rather than a cyclical one.

In parallel, Tiger Brands has launched a logistics network optimisation programme targeting more than R200mn in cost savings. This initiative is focused on fleet utilisation, route optimisation, back-haul efficiencies, and warehouse rationalisation.

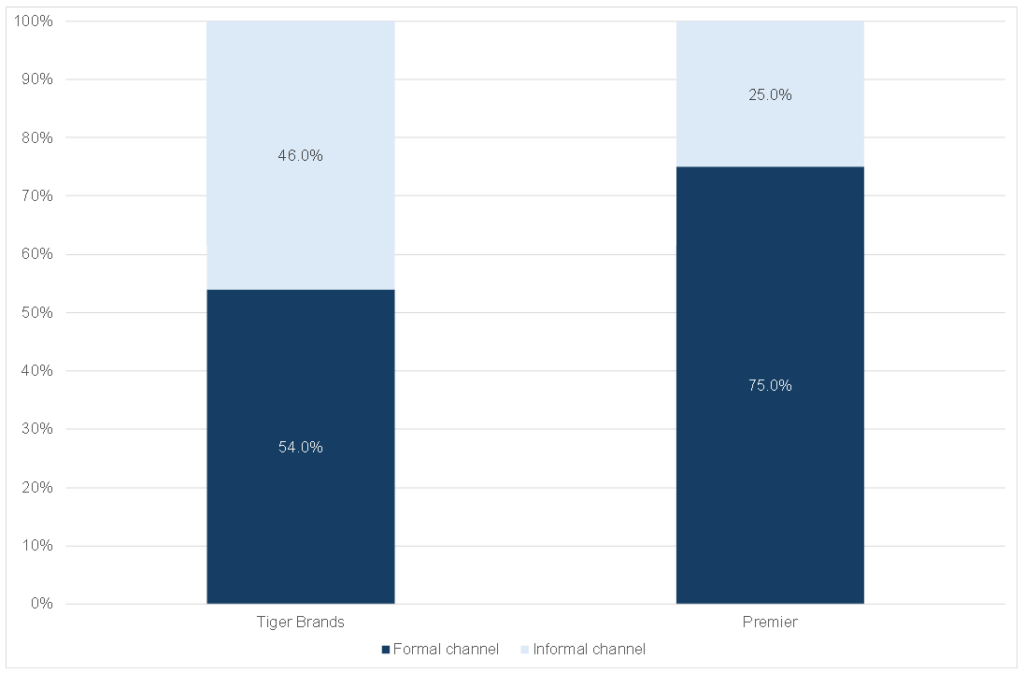

Figure 3: Millbake revenue by sales channel

Source: JP Morgan Research

The last cornerstone of Tiger’s Millbake renaissance is renewed focus on the informal trade channel. The company is targeting 130,000 general trade outlets by FY29 (up from 91,000 in FY24), leveraging improved driver sales incentives. A higher informal trade sales mix is margin accretive and should support volume recovery following years of market share loss.

With improved product consistency and better on-shelf availability, we expect Tiger Brands to return to modest but sustainable volume growth over the medium term, alongside meaningful margin expansion as fixed costs are absorbed over a more efficient asset base.

Premier

Premier enters this phase of the cycle from a position of strength. A defining competitive advantage is its vertical integration, with c. 60% of its wheat flour supplied internally from co-located mills. This positions Premier as the lowest-cost producer in the market and provides a natural hedge against volatility in wheat pricing and supply.

The Group operates 13 bakeries and has invested heavily in large-format, highly automated “mega-bakeries” over the past 5 years. These include the Pretoria facility commissioned in 2023 and the Aeroton bakery commissioned late last year. These plants are capable of producing up to 8,000 loaves per hour vs 5,000-6,000 at traditional bakeries, significantly improving asset turns and conversion efficiency.

Historically, Premier’s inland bakeries generated materially lower margins than coastal operations due to outdated technology. The commissioning of Pretoria and Aeroton marks a structural shift. Management expects several older inland bakeries to be mothballed, resulting in a sustained uplift in operating margins.

Geographically, inland expansion is particularly attractive for Premier. Gauteng accounts for roughly one-third of SA bread consumption, and Premier has already overtaken Sasko to become the number two player in the province. If Premier were to lift Gauteng market share to its national average, inland volumes could increase by c. 20% over the medium term.

Premier’s exposure to the informal channel is another advantage, with c. 75% of its bread volumes sold through this channel, supporting both mix and operating margins.

Conclusion

While the bread industry remains highly competitive, we believe scale and efficiency – not price – will determine long-term winners.

Premier and Tiger Brands appear best positioned to benefit from this structural shift, and we expect both businesses to continue gaining market share from independent and private-label players (including Pioneer/PepsiCo). Even assuming stable market shares between the two incumbents, we believe both companies can deliver industry-leading profit growth from margin expansion alone.

With easing input costs, improving volumes, and substantial operating leverage embedded in both businesses, Millbake remains a key cornerstone of each investment case, which we view as increasingly attractive.