Global equity markets posted modest gains in July despite a sluggish end to the month (MSCI World +1.3% MoM/+11.2% YTD). Equity markets were supported by strong US corporate earnings, improving risk sentiment, easing trade tensions and broader investor optimism across regions. Still, headwinds persisted, especially towards month-end, as US high-margin debt (now over US$1trn) and trade policy uncertainties remained, raising concerns about equity markets overheating. Nevertheless, global growth remains resilient, with the IMF raising its 2025 global GDP forecast to c. 2.7%–3.0%, with stronger projections for the US, Europe, and China.

US markets rallied to new all-time highs, although major indices closed softer into month-end. The S&P 500 reached record highs for six consecutive sessions before losing ground in the last few trading days of July. However, the index still ended the month 2.2% higher (+7.8% YTD) as strong earnings from semiconductor and AI-related companies buoyed sentiment. The Nasdaq surged 3.7% MoM (+9.4% YTD), extending winning streaks driven by optimism over easing trade tensions and robust AI-related earnings. The Dow lagged, advancing only 0.1% MoM (+3.7% YTD).

In economic data, US June headline inflation, as measured by the Consumer Price Index (CPI), accelerated, coming in at 2.7% YoY vs May’s 2.4%. Core CPI, excluding food and energy, picked up slightly at 2.9% vs May’s 2.8% YoY print. June’s core personal consumption expenditure (PCE), excluding food and energy, the US Federal Reserve’s (Fed) preferred inflation gauge, rose by 2.8% YoY – unchanged from May’s revised print. After contracting by 0.5% in 1Q25 (the first decline in three years), 2Q25 GDP rebounded, growing at an annualised pace of 3.0%. However, the data are somewhat distorted by big swings in international trade as businesses and consumers initially braced for, then reacted to, Trump’s tariffs – early-year import surges, driven by pre-tariff stockpiling, had dampened 1Q25 GDP. In contrast, 2Q25 imports dropped due to new tariffs, boosting GDP slightly, although exports also declined. Consumer spending was modest, and fixed investment growth weakened. This casts some doubt on the sustainability of the rebound, especially while key risks such as tariffs, policy uncertainty, and weak private-sector demand persist. At its 30 July meeting, the Fed held rates steady, with Chair Jerome Powell saying that rates are in the right place to manage continued uncertainty around tariffs and inflation, tempering expectations for a September rate cut.

European markets advanced, with gains in some indices tempered by trade-tension volatility, geopolitical risks, mixed economic data and sector-specific challenges. Germany’s DAX rose 0.7% MoM (+20.9% YTD), while France’s CAC closed 1.4% higher (+5.3% YTD). June eurozone headline inflation came in at 2.0% up from 1.9% YoY in May and in line with the European Central Bank’s (ECB) 2.0% target. Core inflation was unchanged at 2.3%. Trump struck a deal with the EU, setting a 15% tariff on most imported goods and including EU commitments to invest in the US and buy US energy products. The new across-the-board tariff halves the 30% levy he had threatened to impose. However, it remains well above the average of c. 1.2% from before Trump’s second term. In a statement, EU Commission President Ursula von der Leyen said the agreement offered “stability and predictability” to European and US companies.

In the UK, the FTSE 100 rose 4.2% MoM (+11.7% YTD). UK June inflation jumped to a higher-than-expected 3.6% YoY (the highest since January 2024) after reaching 3.4% in May. Core inflation rose 3.7% YoY vs 3.5% in May.

In China, the Shanghai Composite Index climbed 3.7% in July (+6.6% YTD), while Hong Kong’s Hang Seng rose 2.9% (+23.5% YTD), fuelled by the country’s stimulus efforts and infrastructure optimism, including a major hydropower dam launch in Tibet, while broader investor confidence was supported by easing US/China trade tensions. China 2Q25 GDP jumped 5.2% YoY, coming in slightly ahead of expectations. The beat was primarily due to a decline in imports, which boosts GDP but is a sign of weak domestic demand rather than economic strength, while the government-led fixed asset investment into manufacturing and infrastructure continued to support growth, albeit at a slower pace than in 1Q25. Housing and real estate remain a drag on the economy, with key activity indicators showing the property market is still declining, with new housing starts and property sales having dropped for the better part of three to five years. China’s official manufacturing PMI shrank more-than-expected in July to 49.3 vs June’s 49.7, remaining below the 50-mark separating expansion from contraction. The non-manufacturing PMI, which includes services and construction, also fell to 50.1 from 50.5 in the prior month.

Japan’s benchmark Nikkei ended July 1.4% higher (+2.9% YTD). June headline inflation declined to 3.3% YoY vs May’s 3.5% print and in line with expectations. Still, it marked the 39th straight month that inflation has run above the Bank of Japan’s (BoJ) 2% target.

Commodities saw a mixed performance in July. Brent crude (+7.3% MoM/-2.8% YTD) recorded gains in a rally fuelled by OPEC+ production cuts and tight supply, ending the month at c. US$73.50/bbl. However, gold edged 0.4% lower amid US dollar strength, although it is still up an impressive 25.4% YTD. Copper prices (-2.6% MoM/+9.6% YTD) initially surged at the start of July, driven by tight supply and tariff fears, but then plummeted 18% after a surprise US tariff announcement excluded key inputs like ores and cathodes, triggering a correction. Among the platinum group metals (PGMs), after a stellar performance in June, the platinum price declined by 5.0% MoM (+42.4% YTD), while palladium was up 8.3% MoM (+31.4% YTD), and rhodium rose 32.4% MoM (+58.5% YTD).

On 23 July, the FTSE JSE All Share Index (ALSI) crossed the historic milestone of 100,000 points for the first time, closing the day at 100,179.84 before retreating to end the month at 98,519.51. The index recorded its fifth consecutive monthly advance in July, up 2.2% MoM (+17.2% YTD). The Capped SWIX also ended July 2.2% higher (+18.7% YTD). Advances were led by a concentrated rally in commodity-linked shares (Resi-10 +5.1% MoM/+52.3% YTD), particularly miners. At the same time, the broader market performance was constrained by an underperformance in domestically focused shares (SA Inc. stocks). Listed Property (+4.4% MoM/+7.1% YTD) delivered strong contributions, likely bolstered by the interest rate cut. Industrials (Indi-25 +1.1% MoM/+16.8% YTD) and financials (Fini-15 +1.4% MoM/+4.6% YTD) recorded gains but lagged, reflecting ongoing domestic economic softness and subdued confidence. The rand dropped 2.8% MoM against a stronger US dollar (+3.4% YTD).

In a unanimous decision at its 31 July meeting, the SA Reserve Bank (SARB) lowered rates by 25 bpts, bringing the policy rate to 7.0%. In domestic economic data, June headline inflation rose slightly to 3.0% YoY, from 2.8% in May, remaining at the lower bound of the SARB’s 3%–6% target range. MoM, inflation ticked up to 0.3% from 0.2% in May, primarily driven by food inflation. June core inflation edged slightly lower to 2.9% YoY vs May’s 3.0% print.

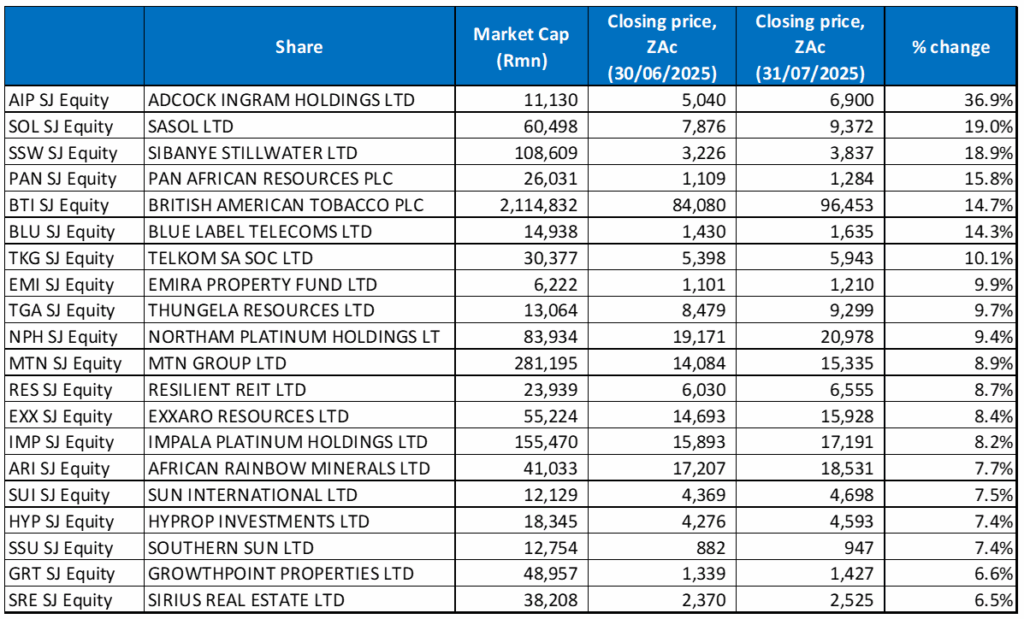

Figure 1: July 2025’s 20 best-performing shares, MoM % change

Source: Bloomberg, Anchor

Adcock Ingram (+36.9% MoM) was July’s best-performing share, on the back of a takeover bid announcement. India-listed diversified pharmaceutical manufacturer Natco Pharma tabled a R75/share offer to buy out Adcock Ingram minorities’ 35.75% stake. The announcement was made on 23 July, with the offer price c. 48% above Adcock’s Friday (18 July) close of R50.83/share, triggering a sharp jump, as investors priced in its potential delisting from the JSE, with Bidvest retaining its 64% share after the transaction.

Sasol’s share price rallied strongly (+19.0% MoM), primarily driven by a surge in the oil price and increased Middle East tensions, as the heightened geopolitical risk lifted crude prices sharply, positioning Sasol as a possible beneficiary amid energy volatility. In addition, a solid trading update saw Sasol flag a 20%-plus YoY rise in earnings per share (EPS), highlighting robust fuel and chemical margins, settling a R4.3bn Transnet dispute, and reaffirming its commitment to disciplined cost and balance sheet management, thus reinforcing confidence in its turnaround trajectory.

In third place, Sibanye Stillwater recorded an 18.9% MoM gain, benefitting from this year’s surging gold price and investor demand in the precious metals space. A turnaround in company fundamentals and strategic acquisitions also drove market confidence, pushing the share price higher.

Sibanye was followed by Pan African Resources, British American Tobacco Plc (BATS) and Blue Label Telecoms with MoM gains of 15.8%, 14.7%, and 14.3%, respectively. Favourable gold market dynamics and strong mining sentiment buoyed Pan African Resources. BATS’ rally was powered by stronger 1H25 results and an upward revision in its FY25 revenue forecast after a jump in the number of users of its smokeless products and a strong performance in the US market, where it reported a revenue and profit increase for the first time since 2022. BATS also announced that it will increase this year’s share buyback by GBP200mn to GBP1.1bn. Meanwhile, Blue Label Telecoms surged on renewed investor confidence tied to its strategic transformation. The company said on 11 July that it will rename itself ‘Blu Label Unlimited’ as part of its restructuring to separate its telecoms and non-telecoms businesses. Management also unveiled plans to separately list Cell C on the JSE, which further lifted the share price.

Telkom SA, June’s best-performing share, continued to perform well, recording a 10.1% gain in July. The company’s CEO, Serame Taukobong, has refocused Telkom’s efforts on leveraging its extensive fixed infrastructure while gradually growing its mobile business. In June, Telkom reported robust FY25 results and announced a resumption in dividend payments (after a four-year suspension). It has also improved its debt profile with a R750mn bond issuance.

Emira Property Fund, Thungela Resources and Northam Platinum rounded out July’s ten best-performing shares with MoM gains of 9.9%, 9.7%, and 9.4%, respectively. The rally in the platinum price, which has gained c. 50% YTD, buoyed Northam’s performance, sparking renewed enthusiasm around the company’s refined metal exposure. After a challenging 1H25, Northam released its FY25 production update last month, which showed that the miner is well-placed to ride the wave of rising commodity prices. Northam operates three PGM mines in SA and reported a solid operational performance, with production well within its full-year guidance (total refined metal production advanced 5.2% YoY, while sales rose 3.8% YoY). Northam has also outlined cost-saving initiatives—including large-scale solar and wind energy projects that are expected to lead to R700mn p.a. in savings.

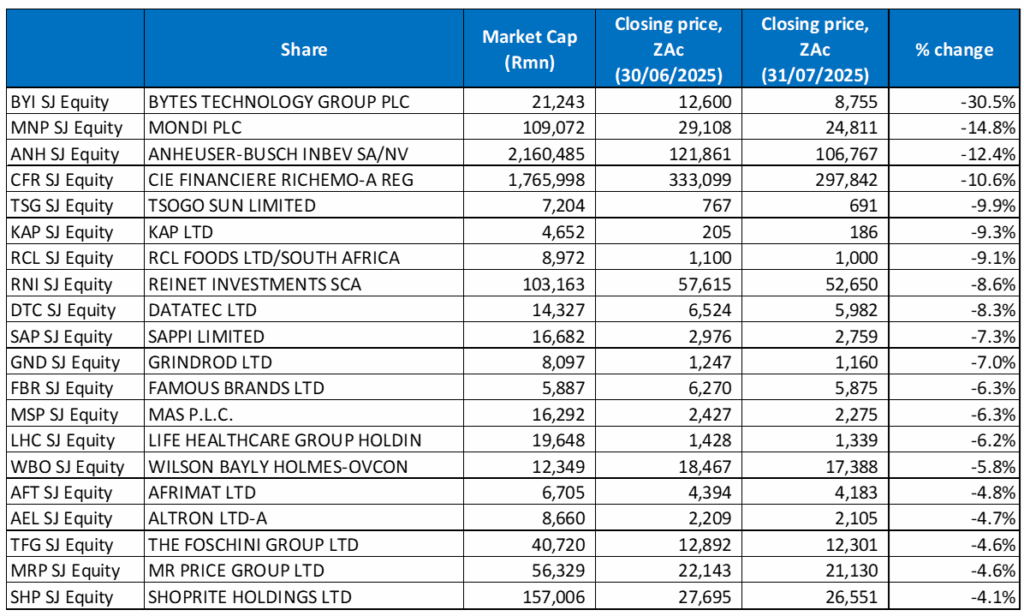

Figure 2: July 2025’s 20 worst-performing shares, MoM % change

Source: Bloomberg, Anchor

JSE and UK-listed Bytes Technology Group (-30.5% MoM) was July’s worst-performing share. The share price plummeted after the company released a profit warning, saying that it expected flat YoY first-half gross profit while operating profit was expected to come in marginally lower. In a statement, CEO Sam Mudd noted that in recent weeks, the Group had navigated a more challenging macro environment, with trading in the first months of the year impacted by the environment, leading to some deferral of customer buying decisions, particularly in the corporate sector. Execution setbacks in its restructuring compounded the dip in spend.

Mondi Plc came second (-14.8% MoM) after reporting a drop in earnings for the six months to end-June, despite a strong performance from its core packaging businesses. HEPS fell 11% YoY to EUc37.2, on the back of a weaker performance by its uncoated fine paper unit and a lower forestry fair value gain. Group revenue rose slightly, supported by higher average selling prices across its packaging operations. Its corrugated packaging division delivered double-digit growth in earnings, while flexible packaging posted a solid increase. Despite pressure from currency movements and inflation, Mondi maintained stable underlying earnings before interest, taxes, depreciation, and amortisation (EBITDA), helped by cost control and improved volumes. Excluding forestry gains, core profitability improved. The company completed its acquisition of Schumacher’s Western Europe packaging assets at the end of March, with Mondi saying that the integration process was “progressing well” and significant capacity expansion projects across the Group were operational and ramping up production.

Anheuser-Busch InBev (AB InBev) was July’s third-worst-performing share, declining by 12.4% MoM. The share price dropped to a five-month low on 31 July, on investor concerns around industry growth. The world’s biggest brewer by sales posted a 1.9% YoY fall in 2Q25 organic volume, missing analyst estimates for a slight increase. The two regions with the most disappointing volumes were Brazil (-9% YoY), accounting for c. 15% of its profit, and China (7.4% YoY), which accounts for c. 7% of Group profit and where it has been struggling to keep pace with growth at its rivals. SA (c. 5% of Group profit) delivered mid-single digit volume and revenue growth. Nevertheless, ABI InBev did report revenue and profit growth, with the latter coming in ahead of forecasts at 6.5% YoY, while revenue lagged forecasts at US$15bn.

AB InBev was followed by Richemont, Tsogo Sun Ltd, and the industrial, chemical and logistics Group KAP with MoM declines of 10.6%, 9.9%, and 9.3%, respectively. Richemont released 1Q26 results in July, with sales of EUR5,412mn (up 3% YoY), driven by the jewellery maison (+7%) segment, while specialist watchmakers recorded a 10% decline. Sales were relatively solid in the Americas, with Asia recovering, making up for a sharp slowdown in demand from Japan. Greater China sales declined while broader tariff uncertainty impacted US luxury imports, adding pressure on investor sentiment. KAP has been under pressure for a while now after recording a 19% MoM loss in June, with its July share price drop driven by a combination of lowered earnings expectations, higher costs from the company’s ambitious capital projects, and unfavourable operating conditions, exacerbated by macroeconomic and sentiment headwinds.

KAP was followed by RCL Foods Ltd, Reinet, and Datatec, which were down 9.1%, 8.6%, and 8.3% MoM, respectively. RCL Foods’ July share price decline is reflective of a combination of structural cost pressures and sluggish consumer demand undermining investor confidence in the business. Investment vehicle Reinet released its 1Q26 management statement on 22 July, which showed that its net asset value (NAV) declined by 4.6% QoQ, although it rose 5% YoY. The NAV decline was primarily driven by adverse foreign exchange effects as the US dollar weakened 9% against the euro during the period. Reinet said geopolitical tension and economic risks remained heightened, and market uncertainty continued to be impacted by Russia’s war on Ukraine, turmoil in the Middle East and ongoing global trade tariff negotiations. Ordinary and special dividends received from Pension Insurance Corporation Group (PICG) during the quarter amounted to GBP178mn. Reinet has agreed to sell 100% of its holding in PICG to Athora Holding in a transaction which is expected to close in early 2026. The share price dip was likely driven by uncertainty over such a significant asset sale, related corporate announcements, and soft financial results, all creating headwinds for sentiment around the company. Although Datatec has improved its profitability and dividends, concerns over declining revenue, business transformation execution, and a cautious market outlook have weighed on its performance.

Sappi Ltd (-7.3% MoM) rounded out July’s worst-performing shares. Its share price downturn reflects a combination of operational disruptions, disappointing earnings, and pressure from weak global demand, especially in the Group’s key pulp and paper markets.

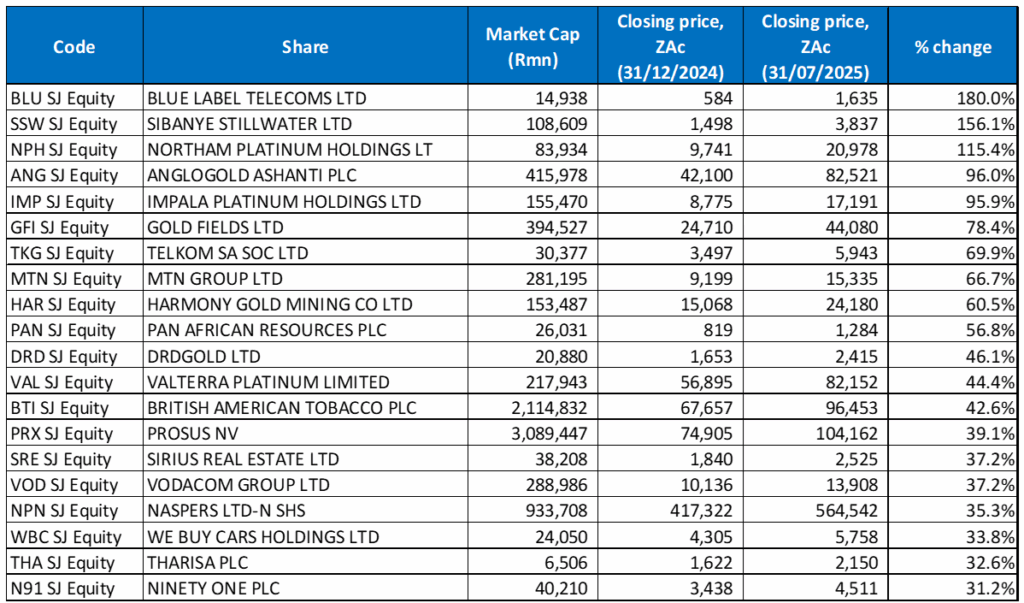

Figure 3: Top-20 best-performing shares, YTD

Source: Anchor, Bloomberg

This year’s JSE rally has been fuelled mainly by mining stocks as record gold prices—spurred by safe-haven demand amid global policy uncertainty—along with the recent rise in platinum prices, have provided further encouragement for the SA mining industry. SA’s dominant role in platinum supply has further enhanced this momentum (it contributes c. 70%–75% of global platinum production, underscoring its outsized influence on global platinum supply). The result of this is that half of the top-performing shares for the year to end July have come from the resources sector. There is also a significant overlap with those to the end of June as gold (and platinum) miners, whose share prices have soared this year despite gold and platinum’s lacklustre performances in July, continued to feature prominently among the YTD best performers. Seventeen of the year to end June’s best performers were also among the best performing shares for the year to end July, with only three new shares in the rankings – BATS, Sirius Real Estate, and Tharisa Plc.

Blue Label Telecoms (discussed earlier) continued its strong run in July and remained in the top spot YTD with a gain of 180.0%. It was again followed by Sibanye Stillwater (+156.1% YTD). Sibanye’s 2025 surge has been powered by improving financial metrics, which have positioned it as a strong performer in the mining sector, with some market commentators attributing its share price rise to the miner being undervalued as well as its operational recovery and strategic growth initiatives, which have aroused investors’ interest. Northam (+115.4% YTD, discussed earlier) remained in third spot.

AngloGold Ashanti (+96.0% YTD) was again in fourth place and was followed by Impala Platinum (Implats), Gold Fields, and Telkom SA, with YTD advances of 95.9%, 78.4%, and 69.9%, respectively. Implats was up 8.2% in July while Gold Fields gained 6.0%. Last month, Zimplats (87%-owned by Implats) unveiled plans to potentially reopen its mothballed Hartley mine amid renewed platinum demand, emphasising future production growth.

Mobile operator MTN Group (+66.7% YTD), Harmony Gold (+60.5% YTD), and Pan African Resources (+56.8% YTD) rounded out the ten best-performing shares for the year to end July.

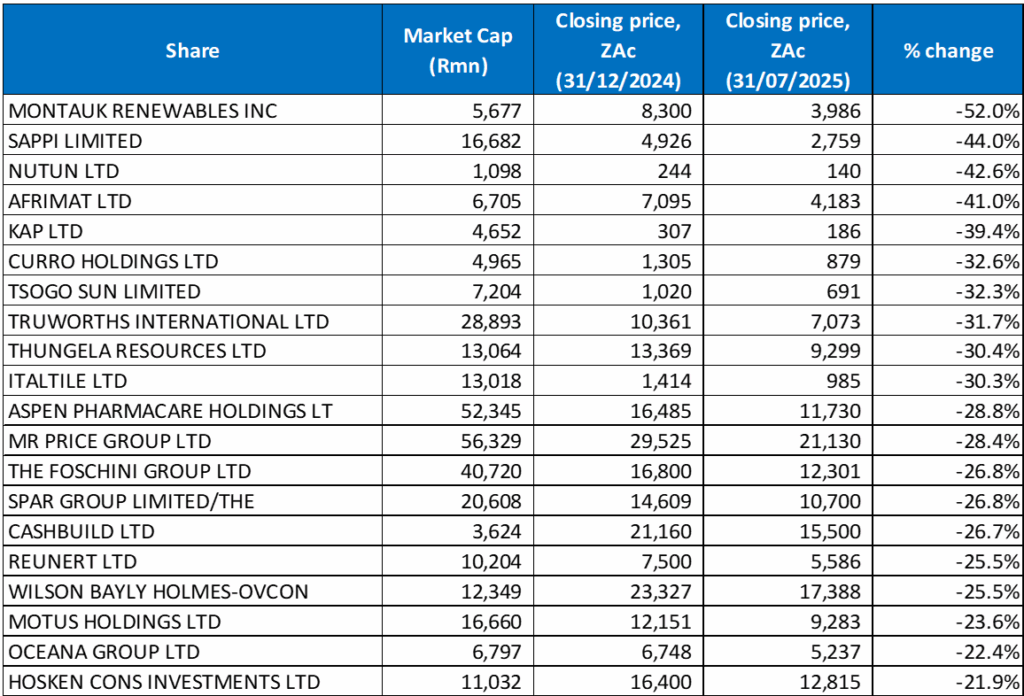

Figure 4: Bottom-20 worst-performing shares, YTD

Source: Anchor, Bloomberg

There was also a notable overlap between the worst-performing shares for the year ending June and those through to the end of July (YTD), with nineteen stocks unchanged and only one new addition, Wilson Bayly Holmes-Ovcon (WBHO).

Montauk Renewables (-52.0%) remained the worst performer YTD for a fifth consecutive month, followed by Sappi (-44.0% YTD) and Nutun (formerly Transaction Capital; -42.6% YTD) in third place. While Nutun’s share price rose 2.9% in July, the share’s 2025 decline reflects ongoing sentiment issues tied to its legacy operations, which are contributing to sustained investor pessimism. Nutun is undergoing a two-year restructuring after a comprehensive reorganisation in 2024. It now trades as a global specialist business process outsourcing (BPO) operator and provider of collection and debt acquisition services in SA. In May, Nutun reported interim results to the end of March 2025, which showed a revenue decline of 4% YoY to R1.48bn due to a reduced non-performing loans portfolio (NPL) acquisitions in 2024 and 1H25 and the impact on consumer payment behaviour of the adverse SA economic environment. However, Nutun’s headline loss per share improved to ZAc17.2 from a loss of ZAc231.2 in the same period of 2024. The company has suspended its dividend payments until the restructuring is complete.

Nutun was followed by Afrimat (-41.0% YTD), KAP Ltd (discussed earlier; -39.4% YTD), Curro Holdings (-32.6% YTD) and Tsogo Sun Ltd (-32.3% YTD). In May, Afrimat reported a sharp drop in its HEPS to ZAc72.3 for the year to end-February from ZAc567.3c in the previous year, while its operating profit fell by c. 60% YoY. The decline in earnings was due to falling iron ore prices and the underperformance of SA’s export rail lines. Iron ore prices have been under pressure (-7.1% in 2Q25) due to a combination of slowing steel demand in China, particularly in the property sector, and increased global iron ore supply. Curro’s share price weakness in 2025 reflects slowing enrolment growth, elevated impairments, rising credit risk, and a broad re-rating of expectations in a challenging macroeconomic environment.

Retailer Truworths, thermal coal producer and exporter Thungela Resources, and Italtile rounded out the year to end July’s worst-performing shares with losses of 31.7%, 30.4%, and 30.3%, respectively. Despite solid operational execution and share buybacks, Thungela’s share price has continued to decline in 2025 as falling coal prices (due to lower-than-expected energy demand in Europe and Asia), lower earnings, and production challenges (Transnet Freight Rail’s performance), have been key constraint in its ability to export coal and have weighed on investor sentiment. Finally, Italtile’s decline in 2025 stems from sluggish consumer demand, mounting margin pressure, weaker earnings, and a challenging operating environment, all weighing on the share price.