September has historically been the weakest month of the year for equities, but last month bucked that trend as US and most major global equity markets logged solid gains (MSCI World +3.3% MoM/+17.9% YTD/+7.4% in 3Q25). A US Federal Reserve (Fed) rate cut, resilient economic indicators, artificial intelligence (AI) optimism, and easing inflation fears helped buoy markets. This was despite US President Donald Trump continuing his aggressive tariff policy (he unveiled fresh tariffs recently on furniture) and a looming US government shutdown, which could delay key jobs and possibly inflation data (the US government shutdown started at 12.01 AM on 1 October after the Republicans and Democrats failed to secure a temporary spending bill).

While September has in the past been jinxed for US equities (the S&P 500 declined during September in four out of the past five years), this year saw the major US indices ending higher. The S&P 500 closed at a record 6,693.75 on 22 September, before ending the month at 6,688.46 – a 3.5% MoM gain (+13.7% YTD/+7.8% in 3Q25). The Dow also reached new record levels before ending September at 46,397.89 (+1.9% MoM/+9.1% YTD/+5.2% in 3Q25). The Nasdaq outperformed, rising by 5.6% MoM (+17.3% YTD/+11.2% in 3Q25) – its sixth consecutive positive month.

In US economic data, August headline inflation, as measured by the Consumer Price Index (CPI), picked up, rising to 2.9% vs July’s 2.7% print and the fastest inflation print since January. Core CPI, excluding food and energy, also rose by 2.9% vs July’s 3.1%. August’s core personal consumption expenditure (PCE), excluding food and energy, the Fed’s preferred inflation gauge, remained at 2.9% YoY, while it rose by 0.2% MoM. US 2Q25 GDP was revised higher, growing at an annualised rate of 3.8% vs a prior reading of 3.3%. The print was the fastest pace since 3Q23. The US Fed cut rates in September – its first cut since December. US rates are now at a range of 4% to 4.25% – the lowest since November 2022. Fed Chair Jerome Powell said that US job gains have slowed and “… the downside risks to unemployment have risen.” At the same time, he warned, inflation has picked up. September consumer confidence edged lower, with the Conference Board headline confidence index registering a 94.2 reading, off 3.6 points from the August reading and the lowest since April.

European stocks wrapped up the month with their best September performance since 2019. Sentiment was buoyed by optimism around resilient US economic growth, the prospect of lower interest rates, and improved risk appetite. However, while France’s CAC closed 2.5% higher (+7.0% YTD/+3.0% in 3Q25), Germany’s DAX retreated by 0.1% MoM (+19.9% YTD/-0.1% in 3Q25), August eurozone headline inflation printed at 2.1% vs July’s 2.0% print, overshooting the European Central Bank’s (ECB) 2.0% target for the first time since April. Core inflation was unchanged at 2.3%. At its September meeting, the ECB held rates steady as it grapples with economic uncertainty despite inflation seemingly stabilising, by hovering around the ECB’s 2% target in recent months, and the EU reaching a trade agreement with the US.

UK equity markets delivered gains, with the FTSE 100 advancing to new highs (+1.8% MoM/+14.4% YTD/+6.7% in 3Q25. UK August inflation was unchanged from July at 3.8% YoY, near the highs reached in January 2024. MoM, inflation rose 0.3%, following a 0.1% gain in July. Core inflation rose by 3.6%. UK 2Q25 GDP advanced by 0.3% QoQ in 2Q25, in line with market expectations.

In China, equity markets shrugged off economic worries (China is still subject to at least 50% tariffs on its US exports, tepid domestic demand, etc.) as tech shares took centre stage, buoyed by investor excitement around AI and innovation. The Shanghai Composite ended the month 0.6% stronger (+15.8% YTD/+12.7% in 3Q25), while Hong Kong’s Hang Seng Index jumped by 7.1% MoM (+33.9% YTD/+11.6 in 3Q25), on pace for its biggest annual gain since 2017. Renewed interest in China’s equity markets, which market commentators are referring to as 9/24, harkens back to 24 September last year when China’s central bank, flanked by financial regulators, cut rates and bank reserve requirements. It also made it easier for firms to buy back their shares and for institutional investors to leverage their balance sheets. However, according to August economic data released last month, China’s economic slowdown worsened, with industrial output up 5.2% vs July’s 5.7% growth – its weakest pace since August 2024. August retail sales grew 3.4% YoY, below expectations and slower than July’s 3.7% growth. Nevertheless, the official manufacturing PMI showed signs of improvement, recording a smaller-than-expected contraction in September to 49.8 vs August’s 49.4. Still, it has remained below the 50-mark separating expansion from contraction since April. Non-manufacturing PMI, which includes services and construction, printed at 50.0 in September from 50.3 in the prior month.

Japan’s benchmark Nikkei closed September 5.2% higher (+12.6% YTD/+11.0% in 3Q25). August headline inflation fell to 2.7% YoY vs July’s 3.1% print, marking the 41st straight month that inflation has run above the Bank of Japan’s (BoJ) 2% target. So-called “core-core” inflation, excluding the prices of fresh food and energy, decreased to 3.3% from July’s 3.4% print. At its September meeting, the BoJ kept its policy rate steady at 0.5% – in line with expectations.

Among commodities, Brent crude (-1.6% MoM/-10.2% YTD/-0.9% in 3Q25) rallied to surpass US$70/bbl, but fell back towards month-end on news that OPEC+ will likely approve another production hike of at least 137,000 barrels per day at its meeting on 5 October. Gold (+11.9% MoM/+47.0% YTD/+16.8% in 3Q25) roared to new all-time highs, powered by the dip in the US dollar and investor concerns about the possible ramifications of a US government shutdown. The yellow metal is on track to record its best year since 1979, when US inflation was at 11%. Global central banks bought 415 tonnes of gold in 1H25 – the third-largest half-year on record. Among the platinum group metals (PGMs), platinum gained 14.9% MoM (+73.6% YTD/+15.9% in 3Q25), reaching its highest levels in over a decade due to intensifying supply and demand concerns. Palladium (+14.3% MoM/+38.2% YTD/+13.9% in 3Q25) and rhodium (+0.4% MoM/+55.7% YTD/+30.1% in 3Q25) also ended higher. Iron ore rose c. 0.4% MoM (+3.3% YTD/+11.1% in 3Q25) despite overall weakness in the steel industry as China’s steel production and domestic consumption have not recovered at the rate hoped. However, market commentators have noted that the recent surge could hint at a gap between actual raw material demand and steel output.

The FTSE JSE All Share Index (ALSI) recorded its seventh consecutive monthly advance in September, up 6.0% MoM (+28.4% YTD/+11.9% in 3Q25), while the Capped SWIX ended 6.5% higher (+31.0% YTD/+12.8% in 3Q25). Commodity-linked shares (Resi-10 +27.4% MoM/+116.6% YTD/+49.5% in 3Q25) once again accounted for most of the JSE’s gains as precious metals miners were once again the biggest contributors to the month’s performance, buoyed by soaring gold and platinum prices. At the same time, the broader market was constrained by an underperformance in domestically focused (SA Inc.) stocks, with financials (Fini-15 -2.7% MoM/+2.7% YTD/-0.4% in 3Q25) and the listed property (-1.2% MoM/+8.7% YTD/+6.0% in 3Q25) sectors ending in the red. Industrials (Indi-25 +1.3% MoM/+19.7% YTD/+3.7% in 3Q25) recorded good gains supported by investment conglomerates Naspers and Prosus (+7.7% and +10.8% MoM, respectively). The rand firmed by 2.2% MoM against a weaker US dollar (+9.1% YTD/+2.6% in 3Q25).

In domestic economic data, August headline inflation pulled back to 3.3% YoY, from 3.5% in July, as softer food and fuel costs took some of the pressure off the index. MoM, inflation decreased by 0.1%. August core inflation advanced slightly to 3.1% YoY vs July’s 3.0% print. Against this backdrop, at its September meeting, the SA Reserve Bank’s (SARB) Monetary Policy Committee (MPC) opted to keep the repo rate unchanged at 7%.

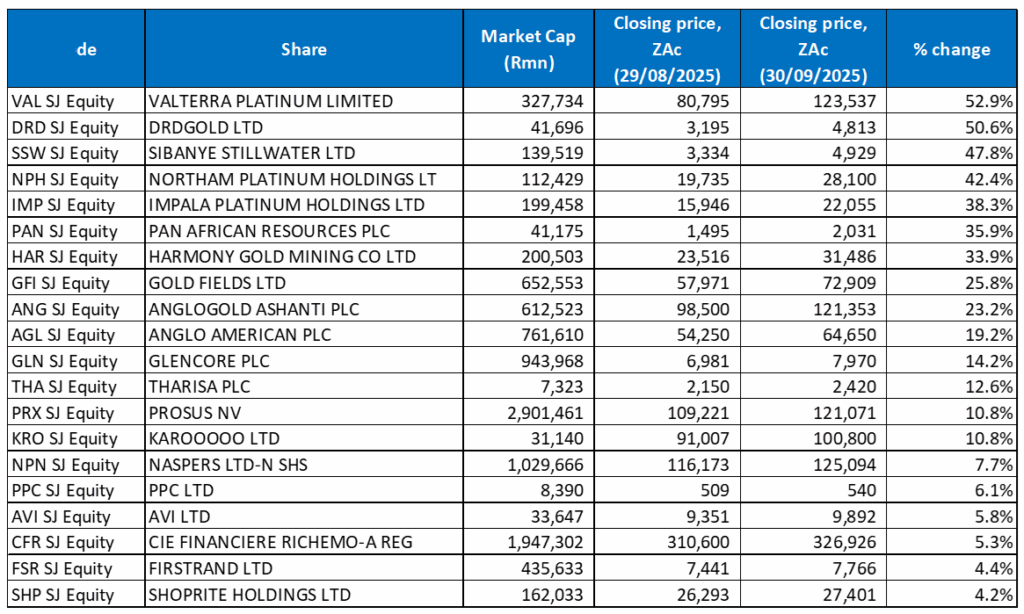

Figure 1: September 2025’s 20 best-performing shares, MoM % change

Source: Bloomberg, Anchor

In a familiar theme this year, it was the precious metals miners that drove returns on the local bourse in September, with 12 of the 20 best-performing shares coming from the sector, buoyed by rising commodity prices. Valterra Platinum was last month’s best-performing share overall, with the counter surging by 52.9% MoM, driven by soaring platinum prices and the completion of its demerger from Anglo American (Anglo sold its remaining 15.5% stake, exiting the company following a two-stage demerger). The stellar performance came despite weak 1H25 results, where Valterra reported an 81% YoY drop in its half-year headline earnings per share (HEPS) and a 91% YoY decline in overall profit. Valterra has been one of 2025’s standout performers, soaring 117.1% YTD as platinum prices hit multi-year highs.

DRDGold was September’s second-biggest gainer, jumping by 50.6% MoM. The share price reached levels not seen in c. 30 years as the gold price hit record highs above the US$3,800/oz level. In third place, Sibanye Stillwater rose 47.8% MoM, as a surging gold price buoyed the firm’s SA gold operations. At the end of August, the gold and platinum miner released its 1H25 results, which showed that revenue fell to R54.8bn from R55.2bn posted in 1H24, while it reported a diluted loss per share of ZAc127 compared with ZAc259 recorded in the prior year. However, the company said that greater operational stability and good cost control at most Group operations, combined with leveraged exposure of the local gold operations to the rand gold price, had notably improved Group profitability for the period. Sibanye opted not to declare an interim dividend despite narrowing its losses to US$211mn from US$372mn in the previous year.

Sibanye was followed by Northam Platinum (Northam), Impala Platinum (Implats), and gold miner Pan African Resources, which recorded MoM gains of 42.4%, 38.3%, and 35.9%, respectively, as PGM price appreciation offered relief to the sector. Northam released results at the end of August, which showed that its FY25 profit fell by 14.4% YoY, as mining costs surged, despite record sales volumes. HEPS came in at R3.81, compared with R4.45 in FY24. However, Northam’s total refined PGM sales exceeded 1 million ounces for the first time, although cash costs jumped 8.1% YoY, negatively impacting the higher revenue. In August, Implats reported a weaker FY25 operational performance as its headline earnings dropped 70% YoY to R732mn on lower sales volumes and muted rand PGM prices, which weighed on profitability. Revenue was down 1% YoY at R85.5bn after a 3% slip in PGM output to 3.55mn ounces. Implats delivered gross profit of R2.4bn, down 55.3%. Still, despite the plunge in earnings, Implats surprised investors with its first dividend payout in c. two years, signalling the board’s confidence in its prospects amid the resurgence in PGM prices. Pan African Resources reported record FY25 earnings, driven by rising gold prices and increased production from new projects. Revenue climbed 44.5% YoY to US$540mn while HEPS jumped by 41.9% YoY to USc5.89.

Gold producers, Harmony, Gold Fields and AngloGold Ashanti rose by 33.9%, 25.8%, and 23.2% MoM, respectively. Besides the surge in the gold price, Harmony’s share price has also been buoyed by its international expansion and the acquisition of Australia’s MAC Copper. Once approved, the proposed R19bn all-cash deal will give Harmony full ownership of MAC’s only asset, the CSA copper mine, which is expected to boost its cash flow and aid in Harmony’s decarbonisation efforts. Its diversification into copper has generated positive investor buzz. Meanwhile, AngloGold Ashanti’s share price reached an all-time high in September, building on the share price’s 2025 gains (+188.2% YTD). In addition to this year’s record gold price, AngloGold’s strong 2Q25 earnings, its acquisition of Augusta Gold in North America, its inclusion in the Russell 3000 Index, and the successful discovery of a large gold deposit in Nevada have improved its financial position and attracted investors.

Finally, Anglo American (+19.2% MoM) rounded out September’s top-performing JSE-listed shares. Last month, Anglo and Canada’s Teck Resources announced that they will merge to create a leading copper producer, in what would be the biggest mining sector M&A deal in over a decade. Under the proposed deal, which still requires regulatory approval, Anglo American shareholders would own 62.4% of the newly combined company, Anglo Teck, while shareholders in Teck will hold 37.6%. This deal is seen as a strategic move to simplify the combined company’s structure and focus on high-value copper assets. Anglo has been simplifying its portfolio by demerging its platinum business, selling its Valterra stake, and divesting other assets like its coal and diamond businesses.

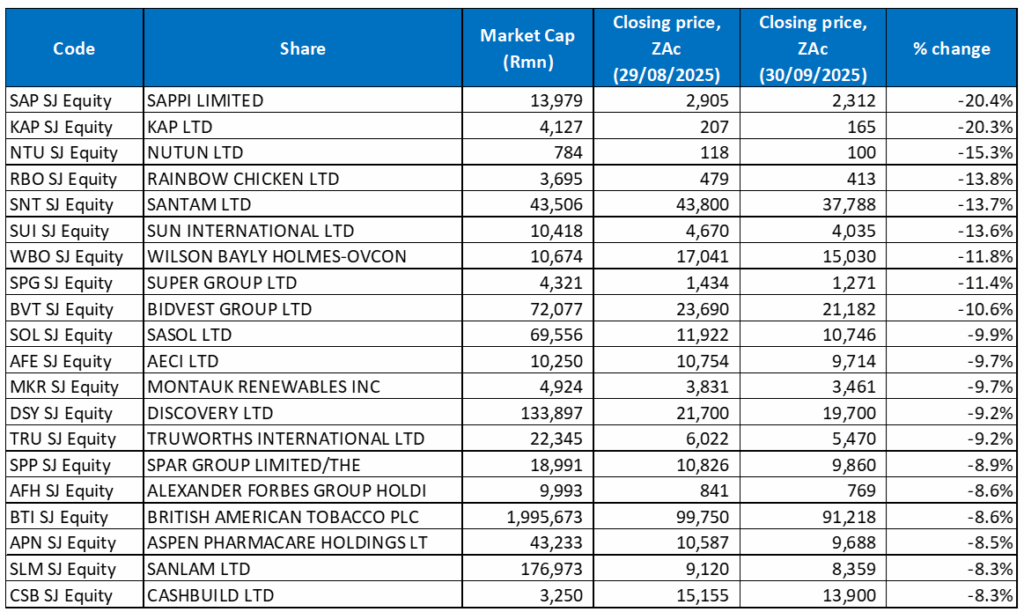

Figure 2: September 2025’s 20 worst-performing shares, MoM % change

Source: Bloomberg, Anchor

Sappi was September’s worst-performing share, declining by 20.4% MoM. The company released disappointing 3Q25 results in August, reporting a US$33mn loss vs a profit of US$51mn in 3Q24. Its net debt position of US$1.95bn at the end of June was up 45% YoY. Due to the weaker results and its growing debt burden, Sappi announced that no FY25 dividend would be paid. Its CEO attributed the jump in Sappi’s debt levels to weaker profitability, a softer US dollar and investment in its Somerset Mill in the US. Sappi Europe also initiated a consultation process in July regarding the proposed partial restructure of operations at its Alfeld Mill in Germany and the possible closure of certain paper machines due to financial pressures and declining demand.

Chemical and logistics Group KAP Ltd was September’s second-worst-performing share, falling by 20.3% MoM, followed by Nutun (formerly Transaction Capital) in third place with a 15.3% MoM decline. Kap reported disappointing FY25 results at the end of August, with revenue rising by 2% YoY to R29.6bn, while operating profit fell 14% YoY to R1.9bn and HEPS plummeted 47% YoY to ZAc24.1. The company blamed it on a subdued operating environment and flagged that some capital projects were still in the ramp-up phase, incurring costs before full returns are realised. In third place,

Nutun was followed by Rainbow Chicken Ltd, Santam and the entertainment and hospitality Group Sun International, with MoM declines of 13.8%, 13.7%, and 13.6%, respectively. Market conditions, particularly cost pressures in feed, energy, logistics, and input inflation, common to poultry businesses, have weighed on investor sentiment towards Rainbow Chicken. Meanwhile, Santam released 1H25 results last month, which showed that revenue advanced 11.6% YoY to R27.5bn, while HEPS stood at ZAc1,873 (+18.7% YoY). However, the company noted that it delivered a strong performance despite the challenging operating environment in SA, which has been marked by slow growth, high unemployment, and consumers’ disposable income coming under pressure because of high debt, elevated inflation and interest rates. These factors are suppressing real growth in the country’s consumer base and making it difficult for them to afford insurance premiums, thus putting a damper on vehicle sales – a key driver of growth in Santam’s largest business line. Sun International reported that its Group profit more than doubled in 1H25, helped by a strong performance from its online gambling segment, Sunbet and careful cost management across the Group. HEPS rose 60.5% YoY to ZAc305. However, investors seem nervous about the sector in the current challenging operating environment.

Wilson Bayly Holmes-Ovcon (WBHO), Super Group and Bidvest followed with MoM declines of 11.8%, 11.4%, and 10.6%, respectively. Logistics company Super Group’s share price has been under pressure due to several factors, including underperformance in its key divisions and declining EPS. It released disappointing FY25 results last month, which showed that revenue fell 1.4% YoY to R44.51bn (from R45.15bn in FY24), while HEPS decreased by 1.2% YoY to ZAc239.8. Bidvest fell after releasing its FY25 results, which missed expectations, showing a revenue increase of 4.9% YoY to R126.6bn from R120.7bn in FY24, while EPS declined by c. 4% YoY to R17.32 (vs R18.09 in FY24). Divisionally, weak performances in its freight and commercial product segments offset profit growth in other divisions. Bidvest’s performance was impacted by a sluggish local economy, which has affected demand in consumer-facing sectors.

Rounding out September’s ten worst-performing shares was Sasol, which declined by 9.9% after a strong run in August when it rose by 27.2%. However, a decline in the oil price, lower refining margins (crucial to Sasol’s profitability), reduced sales volumes, as well as impairments and write-downs, have weighed on sentiment.

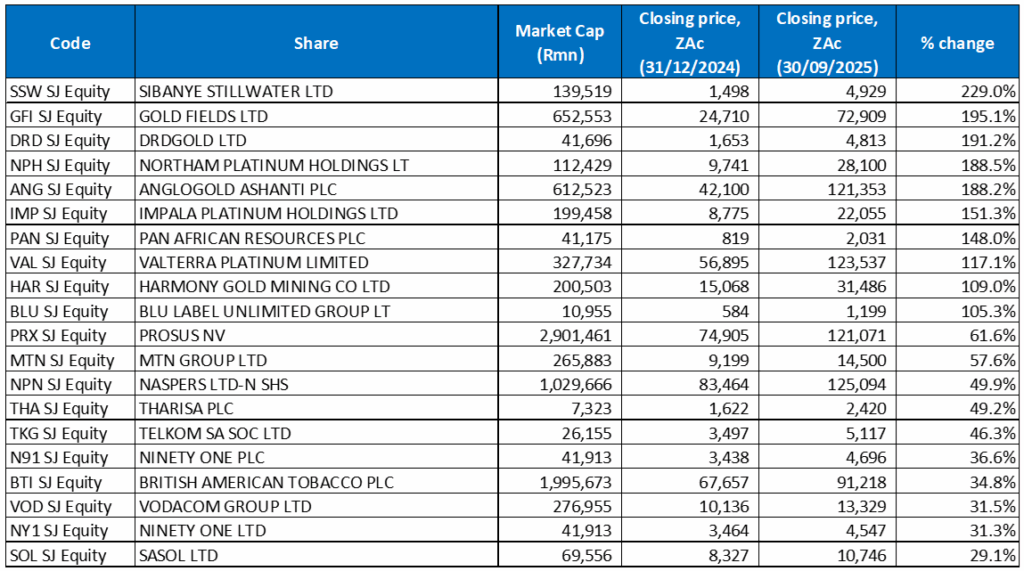

Figure 3: Top-20 best-performing shares, YTD

Source: Anchor, Bloomberg

Record gold and platinum prices, spurred by safe-haven demand amid a confluence of macroeconomic and geopolitical factors, including global policy uncertainty, US Fed rate cut expectations, persistent inflation concerns, a weakening US dollar, and central bank buying of gold, continued to power the JSE’s YTD rally. The result is that eleven of the top-performing shares for the year to end September have again come from the commodities sector. There is also a major overlap with those to the end of August as gold and platinum miners, whose share prices have soared in 2025, continued to feature prominently among the best performers. Eighteen of the year to end August’s best performing shares were also among the best performing shares for the year to end September, with only two new entrants – Ninety One Plc and Ninety One Ltd.

Sibanye Stillwater bumped Gold Fields from the top spot with an impressive 229.0% YTD gain, after its share price soared by 25.8% last month. It was followed closely by Gold Fields (+195.1% YTD) and DRDGold (+191.2% YTD). Sibanye’s 2025 surge, powered by improving financial metrics, has positioned it as a strong performer in the mining sector, with some market commentators attributing its share price rise to the miner being undervalued. The share price jumped 47.8% in September.

Northam was in fourth place with a YTD gain of 188.5% and was followed by AngloGold Ashanti and Implats with YTD gains of 188.2% and 151.3%, respectively.

Implats was followed by Pan African Resources, Valterra Platinum and Harmony (all discussed earlier) with YTD gains of 148.0%, 117.1%, and 109.0%.

Blu Label Unlimited (previously Blue Label Telecoms) rounded out the ten best-performing shares YTD with a gain of 105.3%. Blu Label’s share price declined by 2.9% in September, primarily due to investor concerns around its decision not to declare a dividend and complexities surrounding its planned listing of its subsidiary, Cell C.

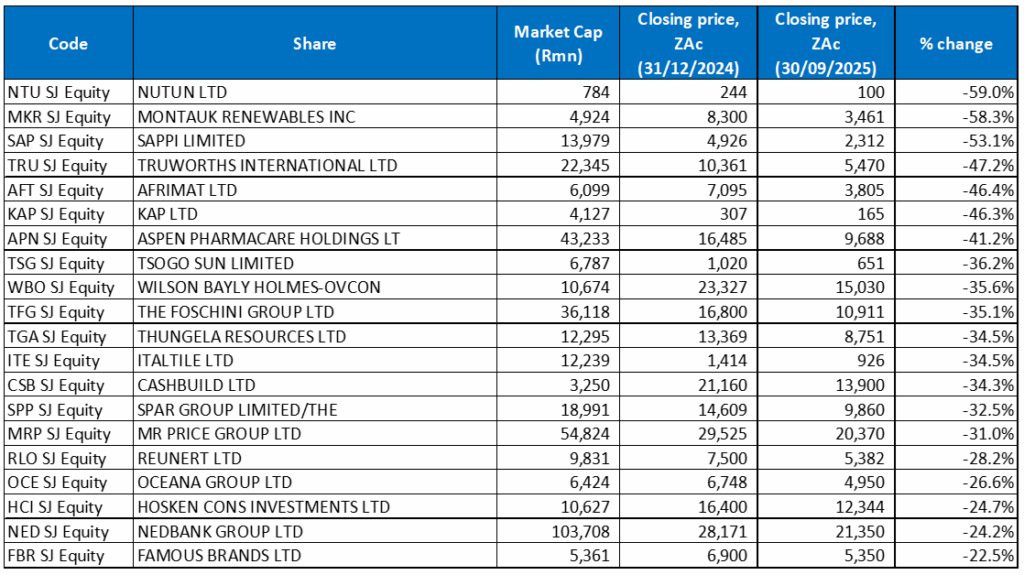

Figure 4: Bottom-20 worst-performing shares, YTD

Source: Anchor, Bloomberg

The worst-performing shares for the year ending September also showed a considerable overlap with those to the end of August, with nineteen stocks unchanged and only one new addition – Famous Brands. After a poor performance in September, when its share price declined by 15.3%, Nutun (-59.0% YTD) bumped renewable energy company Montauk Renewables (-58.3% YTD) from the top position to second place. Sappi (-53.1% YTD) took Afrimat’s third spot.

Truworths and Afrimat followed Sappi – down 47.2% and 46.4% YTD, respectively. Clothing retailer, Truworths, delivered disappointing results in August with HEPS for its financial year to 30 June falling 8% YoY to ZAc752.1, while Group trading profit decreased by 31.4% to R2.9bn. Revenue rose 2.7% YoY to R22bn. The Africa division, which is Truworths’ largest, experienced a 0.4% YoY sales decline, contrasting with a 9.7% sales increase in its UK-based subsidiary. Challenges in its cement division have significantly impacted Afrimat’s overall earnings and weighed on the share price this year (the share was down a further 3.2% in September).

Afrimat was followed by KAP, Aspen, and Tsogo Sun with YTD declines of 46.3%, 41.2%, and 36.2%, respectively. Pharmaceuticals Group, Aspen’s share price has seen a significant decrease in 2025 on the back of financial losses and impairments, contractual disputes (a contractual dispute concerning a manufacturing and technology agreement for mRNA products led to a reduction of c. R2bn in normalised EBITDA, impacting the profitability of Aspen’s French sterile manufacturing site), restructuring costs (particularly in China following integration of the Sandoz business) and a dividend reduction. Meanwhile, Tsogo Sun’s share price has declined on the back of operational challenges and cautious investor sentiment.

WBHO and The Foschini Group (TFG) rounded out the YTD worst-performing shares with declines of 35.6% and 35.1%, respectively. Like Truworths, TFG is navigating a challenging retail environment characterised by reduced consumer spending, operational disruptions, and competitive pressures, which have contributed to its YTD decline.