Glencore announced on 24 May that it has reached an agreement with authorities in the US, the UK, and Brazil to settle past corruption and bribery charges. Glencore has been facing bribery and corruption investigations in these jurisdictions for some time. It previously raised a US$1.5bn provision (the Group’s best estimate of the cost to resolve the investigations) in its FY21 results and said that it expected the investigations to be concluded in 2022.

On Tuesday (24 May), Glencore announced that:

- The company will pay at least US$1.2bn and two business units will plead guilty.

- Glencore will pay US$1.02bn to US authorities to resolve bribery and market manipulation investigations in that country. The plea agreements, entered into by Glencore International AG and Glencore Ltd. with the US Department of Justice (DoJ), provide for the appointment of an independent compliance monitor for a period of three years to assess and monitor Glencore’s compliance with the agreements and to evaluate the effectiveness of its compliance programme and internal controls.

- It will also pay c. US$40mn to Brazilian authorities in connection with the country’s bribery investigation against it.

- Glencore UK has pleaded guilty to charges brought by the UK’s Serious Fraud Office (SFO) regarding its bribery investigation. The penalty to be paid will be determined after a sentencing hearing, which is scheduled for 21 June 2022. Glencore currently expects that the penalty payable to the SFO will mean that the total payable for all the above investigations will not exceed the US$1.5bn provision it raised last year (i.e., Glencore does not expect the SFO payment to exceed c. US$400mn-US$500mn).

Figure 1: Aggregate penalties and amounts payable to the US and Brazilian authorities

Source: Glencore

We note that there are other investigations against Glencore currently underway in Switzerland and the Netherlands and the resolution of those investigations are not included in this agreement. Nevertheless, in our view, this is a big step towards the closure of this matter. We believe this announcement will be viewed positively by the market as there have been fears that the amounts payable could be meaningfully higher. For context, Glencore’s market cap is currently c. US$88bn. The Group had net debt of US$31bn as at 31 December 2021 (or US$6.7bn if you subtract readily marketable inventories to calculate net debt, as Glencore does), and we estimate that it is earning US$19bn on an annualised basis at current commodity prices.

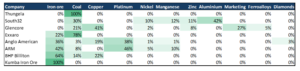

Glencore’s new management team insists that the culture in the company has changed, and it is a new organisation (that will obviously take time to prove). As a reminder, Glencore has quite a different commodity mix to its JSE-listed peers (see Figure 2), with no iron ore, the price of which is down c. 18% YoY, and more thermal coal, base metals (mostly copper), and a marketing (trading) business.

Figure 2: Commodities mix – Glencore vs JSE-listed peers

Source: Bloomberg, Anchor

*Note that totals may not add up to 100% due to rounding and/or corporate costs.

We estimate that the share is currently trading on a 5x P/E multiple with earnings upgrades likely to continue to come through given the strength of the commodity prices in its portfolio. We currently hold Glencore in the SA Equity Fund, and we continue to be buyers of the share.

If you have any questions or would like to discuss the subjects raised in this article with someone at Anchor please email us at info@anchorcapital.co.za.