Ferrari is a luxury car brand like no other. Although there are many other superb luxury car brands, none quite stir the emotions like Ferrari does. The heritage of the leading European luxury brands cannot be replicated, almost by definition. It is nearly impossible to launch a new, stand-alone luxury brand and expect it to compete with companies that have existed for generations.

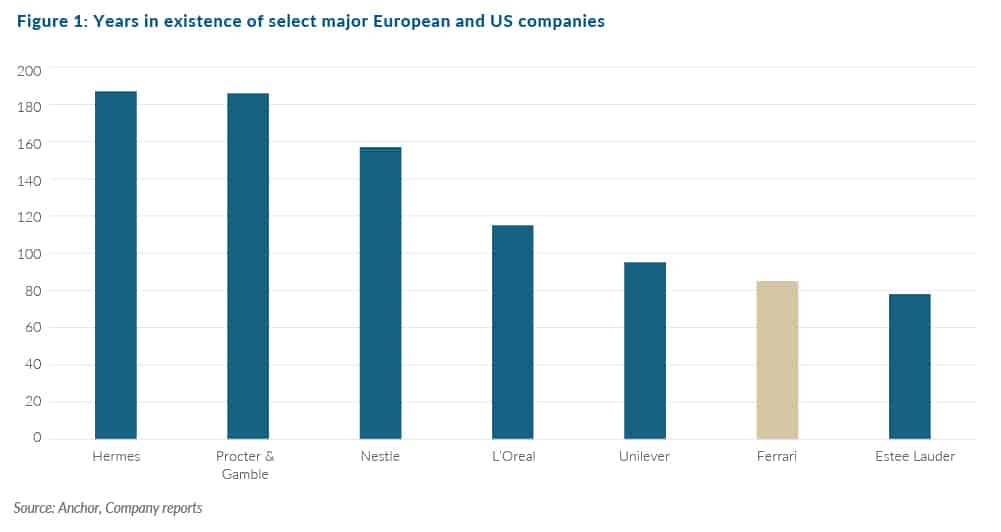

This intangible value is real but nevertheless difficult to quantify. Ferrari has existed for over 80 years. Presumably, it will not disappear within the next five years. No business has a guaranteed future, even those that have existed for decades. However, an extremely long corporate history should not be underestimated.

In this regard, there is something called the Lindy effect. This states that the longer something (non-perishable) has existed, the greater the likelihood it will remain in existence well into the future. This effect makes a business such as Ferrari (and other luxury brands) extremely durable. In turn, durable businesses typically attract higher valuation multiples.

*Note that this applies to non-perishable items.

One of the most crucial aspects to understanding the Ferrari business model is the tiny volume of c. 13,500 cars the company produces yearly. This is minute compared to total global vehicle sales of c.75mn p.a. Porsche produced more cars in 2023 than Ferrari has made in its entire history.

It seems that about two-thirds of Ferrari buyers each year already own at least one Ferrari. Furthermore, one-third of Ferrari buyers already own two or more Ferraris. These small production levels mean Ferrari is mostly insulated from downcycles in the broader auto industry. It also means that Ferrari’s environmental impact is extremely low on a global scale. The average Ferrari is driven very little. It is unusual for a Ferrari to be driven more than 8,000km p.a.

In this quote at the Berkshire Hathaway 2023 AGM, Warren Buffett specifically mentioned Ferrari as a different proposition to the rest of the auto industry.

“I would say Ferrari is in a special place, but they only sell 11,000 or 12,000 cars a year”.

Ferrari manages supply very carefully in relation to demand, constantly keeping the market tight. Hence the quote, “Ferrari are very good at saying no to the kind of people who are not used to taking no for an answer”. Ferrari’s production is almost sold out for the next two years. Sometimes, this leads to misperceptions that Ferrari is a no-volume growth model. However, Ferrari can grow its future production volumes (as it has done in the past), provided it does so in a careful, controlled manner while tapping into new target markets.

Below is a quote from the Ferrari 2022 annual report on this issue.

“On the other hand, our current growth strategy contemplates a measured but significant increase in car sales above current levels as we target a larger customer base and modes of use, we increase our focus on reaching a younger customer base and creating new Ferrari collectors, and our product portfolio evolves with a broader product range. We sold 13,221 cars in 2022 compared to 7,255 cars in 2014, the year before our initial public offering, and sales are expected to continue to increase gradually”.

About 7% of Ferrari’s production by volume (a significantly higher percentage by value) is in limited edition cars. Whereas a “regular” Ferrari sells for an average of US$250,000 before customisations, a new, limited-edition Ferrari can sell for more than US$2mn. For these limited-edition models, production is limited to a few hundred, and they usually sell out before the model even goes into production. Why would a Ferrari customer pay such a premium for a limited-edition car? The answer is these limited-edition cars are immediately worth a few hundred thousand US dollars more than the buyer paid. However, there are restrictions to immediately selling a limited-edition Ferrari.

A regular or “range” Ferrari, as the company calls them, is likely to slowly depreciate in hard currency terms, albeit at a slower rate than an everyday car. However, the anecdotes of people making meaningful returns from owning a physical Ferrari are usually on a limited-edition model. It also helps if the limited-edition model is based on the heritage of a track Ferrari from back in the day. The most expensive Ferrari ever auctioned was a 1962 Ferrari 250 GT for US$52mn in New York in 2023. Only 56 of these cars were ever made.

The reality is Ferrari must invite one to buy a limited-edition car. Although Ferrari has never published a formal list of what it takes to get an invite, car enthusiasts have pieced together a list of do’s and don’ts. Some don’ts include not selling a limited-edition Ferrari for at least the first 12 months and not doing after-market modifications or covering the badge. Turning down an invitation will likely remove you from any future invitations. Also, bad-mouthing Ferrari or being a social media influencer is unlikely to help your cause. Some of the do’s include visiting the Ferrari factory in Maranello periodically and attending Ferrari special track days worldwide. Owning at least four Ferraris is also considered to help one’s cause.

There is a famous account of a renowned Ferrari collector in the US who sued Ferrari in 2016 for not inviting him to buy the US$1.4mn (c. R19mn at the time) limited edition LaFerrari Aperta. All 200 vehicles were sold out prior to production. The collector owned at least 15 Ferraris at the time, which were considered worth a combined value of over US$100mn. He sent a deposit cheque of US$1mn to the then-CEO of Ferrari, who declined his offer. The collector subsequently withdrew his legal case against Ferrari.

Ferrari entered the Sport Utility Vehicle (SUV) market for the first time in 2023 with the Purosangue model (at a price of c. US$400,000). This model is sold out for the next 2-3 years. Ferrari has committed to limit the sales of this SUV to no more than 20% of its total production. This is to avoid flooding the market with SUVs, as some of its luxury car competitors have done.

Ferrari is very unique compared to the other luxury car brands on the market. It seems to be a case of “there is Ferrari, and then there is everyone else”. The other competing brands are either too niche or have not been in production for very long (thereby lacking Ferrari’s heritage). Also, others are part of larger car companies (sharing body frames or interior parts), which arguably reduces their exclusivity.

Owning a Ferrari gives one a membership to one of the most exclusive clubs in the world. The Ferrari Finali Mondiali track event, held in Imola 2022, attracted c. 40,000 global fans. Ferrari is the only team to have competed in every Formula One season since the competition’s inception in 1950. Although it has been less successful in recent years in Formula One, it has been the most successful team over time. Ferrari does not formally advertise but uses Formula One to create brand awareness. It also earns additional revenue from its Formula One sponsorships.

Ferrari has materially enhanced its margins from customisations in recent years. Some buyers spend several hundred thousand dollars on expensive customisations. At the lower end, customisations can be ordered at the dealership where the car was purchased. However, the higher-end customisations involve clients travelling to Maranello, New York, or Shanghai to “Tailor Made” Ferrari centres to make their cars more unique.

The potential impact of the rise of electric vehicles (EVs) on Ferrari is a hotly debated issue. The negative implications for Ferrari may be relatively limited, and there could be some positive effects. Here are some salient points to consider. Ferraris are sold in tiny quantities and are driven very little (< 8,000km p.a. equals low utility value). So, the negative environmental impact of Ferrari as a company is small. Furthermore, c. 50% of new Ferraris sold are already hybrids (mild hybrids and plug-in hybrids). Ferraris are more a collectable art form than an automobile.

The first Ferrari Battery Electric Vehicle (BEV) is targeted to come into production in 4Q25, although it will likely be delayed. Ferrari plans for 40% of its vehicles to be fully electric by 2030 (5% initially), although this could be a moving target. No images or details are publicly available yet for this BEV prototype. The Ferrari CEO has already test-driven a prototype version in private during 2023.

The EU is planning to ban the sale of all petrol and diesel cars by 2035. Many believe this will not happen according to that timeline and will get pushed out. However, an all-electric Ferrari brand may not have the same appeal vs if it was still allowed to produce some internal combustion engine (ICE) vehicles. Ferrari and other small supercar brands have been lobbying to be allowed to adopt electric power more slowly than the mass brands.

However, the global shift to EVs might even enhance the value of the Ferrari brand, similar to Apple and other sports watches, which enhance the value of ultra-high-end mechanical watches. In an ever-increasing EV world, Ferrari’s small number of ICE vehicles might be considered objects of increasingly rare beauty (with a minimal negative environmental impact).

The Ferrari share price has been an excellent performer since its 2015 IPO. With the benefit of hindsight, this has turned out to be a spectacular buy-and-hold stock.

We believe there are currently two key risks to investing in Ferrari shares: a global decline in asset values and the high P/E multiple of the stock. The typical Ferrari buyer is a high-net-worth individual whose fortunes are not necessarily tied to their salary/bonus in any given year. Instead, these are individuals with financial wealth accumulated over many years. For the most part, the past fifteen years have been good for individuals with financial assets (shares, art, Bitcoin, alternative assets, etc.). A protracted slump in global asset values could remove some of the confidence, which has resulted in the typical Ferrari buyer being so comfortable with the high Ferrari price tag and willing to spend a fortune on customisations.

Since its IPO in late 2015, Ferrari has traded on a high P/E multiple. Analysts have consistently agonised over this high valuation multiple. Over time, though, the market has come to appreciate Ferrari as one of the world’s top luxury brands rather than a conventional auto manufacturer. However, even by its own lofty standards, Ferrari is currently trading on a particularly high multiple. This makes the Ferrari share price vulnerable to even small disappointments in the company’s financial performance. However, for quality growth investors, one should always look for a temporary pullback in the Ferrari share price to create an entry point into a truly unique, high-quality luxury business.