Bidcorp released a very good 10-month (10M22) trading update on 25 May, showing that its operational performance continues to improve, and its sales trends continue to track higher than pre-COVID levels. This, even as some segments of the market in which Bidcorp operates continue to be negatively impacted by pandemic-induced effects. Trends within the foodservice market have been challenging given labour shortages and ongoing supply chain disruptions. Inflationary pressures are also evident and have been fuelled by higher labour costs, as well as increased energy, fuel, and higher food prices.

Bidcorp has thus far managed these cost pressures relatively well and, through a combination of strategic buying and passing these costs on to its customers, it has protected Group margins. We are encouraged by Bidcorp’s ability to expand margins in an operating environment that continues to witness increased cost pressures globally. While share price reaction post this capital markets trading update conference call has been muted, we remain bullish on the counter, and we believe that Bidcorp will continue to benefit from out-of-home eating habits as the world returns to normal.

Below we highlight the key takeaways around Bidcorp’s 10M22 trading performance (for the 10 months to end-April 2022).

- The 10-month period under review shows a stronger performance from most of Bidcorp’s geographies. However, the Netherlands, New Zealand, and Greater China are some of the countries that have been negatively impacted by more stringent COVID-19-related restrictions. This is especially so for China with its zero-COVID policy.

- The gross profit (GP) margin for the period under review has held up relatively well and is ahead of the GP margin for both FY19 and FY21’s 10-month periods.

- Margins have benefitted from Bidcorp’s customer mix and the company’s response to increasing prices due to rising input costs. In addition, margins held up as increased selling prices were supported by Bidcorp’s buying gains as its stock purchases were made before significant price increases were implemented.

- Although Bidcorp experienced GP margin pressure in its 2Q22, its GP margins have recovered in its 3Q22 period (January to March 2022) as the company managed to pass on cost increases to customers.

- The EBITDA margin increased to 5.3% when compared to the previous 10-month period (10M21), which recorded an EBITDA margin of 4.3%.

- The 5.3% EBITDA margin is slightly below Bidcorp’s EBITDA margin of 5.7% for the 10 months to April 2019 (a period unaffected by COVID-19 and inflationary pressures).

- Constant currency operating expenditure has risen by 27.1% YoY compared to a constant currency revenue increase of 31.6% for the ten-month period to April 2022.

- In terms of HEPS, the company said that YTD (to end-April 2022) it has delivered a good performance compared to the FY19 pre-COVID comparative period, reflecting a strong recovery in the current financial year (FY22).

Sales progression trends

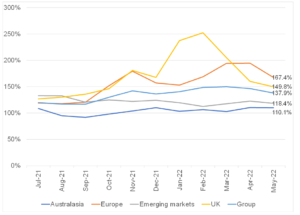

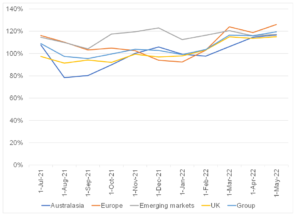

When looking at constant currency sales by geographic segment (see Figure 1) and Group on a monthly basis from July 2021 to mid-May 2022 vs FY21 and FY19, we note the following:

- Bidcorp’s trading update reflects strong performances from most of the geographies in which it operates and trading levels in most of these regions have surpassed pre-pandemic sales levels.

- Within Europe, most countries had normalised seasonality during the winter period, with the Netherlands being the only country that was negatively affected by stringent COVID-19 restrictions during the period under review.

- In emerging markets (EMs), all countries performed well except for Greater China as restrictions due to the country’s zero-COVID policy impacted activity levels.

- Post the easing of lockdown restrictions, Australia has recorded a strong performance, however, New Zealand continues to be negatively impacted by pandemic-induced restrictions.

Figure 1: Bidcorp sales trends by region, July 2021 to date as a percentage of FY19 sales

Source: Company data, Anchor

Figure 2: Bidcorp sales trends by region, July 2021 to date as a percentage of FY21 sales

Source: Company data, Anchor

Interesting market trends are emerging and here we note the following:

- Management said it is seeing a normalisation of most discretionary spending categories in most of its geographies but accommodation, workplace catering, entertainment, sporting events, business travel, and the cruise line industry continue to be negatively affected by ongoing COVID-19 effects, to varying degrees.

- Hybrid working arrangements have improved workplace catering activity in larger cities and catering demand has improved but is still tracking at c. 60%-70% of pre-pandemic levels.

- Product shortages have had a minor impact on Bidcorp as most products are sourced locally within each of the Group’s geographies.

Finally, we note that management sounded relatively upbeat about the Group’s near-term future despite the various headwinds still affecting the food services market. Still, overall, we have enough assurance that in the long term Bidcorp’s business operations are not permanently impaired and our fundamental thesis on Bidcorp remains intact. We recommend holding the share.

If you have any questions or would like to discuss the subjects raised in this article with someone at Anchor please email us at info@anchorcapital.co.za.