BHP Group is unifying its dual-listed company (DLC) corporate structure, which will have an impact on shareholders in South Africa (SA). For shareholders who own BHP Group shares on 28 January 2022, they will be deemed to have sold their shares and bought the new BHP Group JSE-listed share. We do not expect this to change the value of the share in the short term and many individual shareholders might not even notice, but in the background a capital gains tax (CGT) event will have occurred.

This will have a different impact on different shareholders, but we advise material BHP Group shareholders to discuss this with their advisors and to ensure that they are appropriately positioned. Anchor has various alternative courses of action depending on an investor’s individual circumstances.

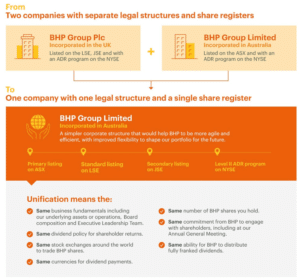

The background to this corporate action is as follows: BHP currently has a DLC corporate structure that consists of two companies (BHP Group PLC in the UK and BHP Group Limited in Australia), with separate legal structures and share registers. The intention is to transition to one company (BHP Group Limited in Australia) with one legal structure and share register (see Figure 1).

Figure 1: The impact of the proposed corporate action on BHP Group

Source: BHP Billiton

What are the tax implications for BHP shareholders on the JSE?

This unification will be deemed a CGT tax event. Therefore, some SA shareholders will have CGT crystallised on unification.

What are the listing implications for BHP shareholders on the JSE?

BHP will maintain its secondary listing on the JSE. Shareholders will have their shares exchanged on a 1:1 basis for BHP Group Limited shares.

When will unification happen?

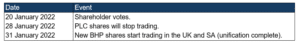

See the pertinent dates in Figure 2 below.

Figure 2: BHP Group unification – relevant dates

Source: BHP Group

Why is BHP Group unifying its corporate structure?

The motivation for this move is greater simplicity and reduced cost. Following the unification, BHP will have:

- one annual general meeting (AGM);

- one set of company laws;

- one primary tax residency; and

- one share price globally.

The unification will also allow for simpler Group transactions, such as M&A or capital raising, in the future.

What is the investment case for BHP Group?

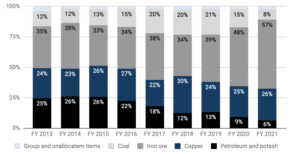

BHP is a low-cost, iron ore miner (iron ore unit cost is currently just above US$13/t). Alongside Rio Tinto and Fortescue, BHP is right at the low end of the iron ore cost curve. Given BHP’s low-cost iron ore operations and the strength we have seen in iron ore prices recently, iron ore has contributed more than 80% of the Group’s operating profit over the past two fiscal years. The remainder of earnings has come largely from copper and coal.

Volume growth is unlikely to be material, so commodity pricing is particularly important for growth. BHP has a net debt target range of US$12bn-US$17bn. As at 30 June 2021, net debt stood at US$4.1bn. Although iron ore prices have declined from their 2021 highs, BHP is likely to continue to generate meaningful free cash flow (FCF) in the current environment. It thus seems likely that BHP will return most of the cash it generates to shareholders via dividends and/or share buybacks. We estimate that BHP is trading at 7x FCF/share or a 14% FCF yield.

In summary, we view BHP as a low-cost, high-margin business that is highly dependent on iron ore prices. We expect it to return most of the FCF it generates back to shareholders in the near term.

Figure 3: BHP Group revenue by commodity

Source: Company data