Anglo American (Anglo [AGL]) confirmed on 25 April that it had received a US$39bn takeover offer from BHP Group (BHG). The details of the offer are:

- It is an all-share offer – Anglo shareholders will receive 0.7097 BHP shares for every 1 Anglo share owned.

- The South African (SA) platinum and iron ore companies, Anglo American Platinum (Amplats [AMS]) and Kumba Iron Ore (Kumba [KIO]), will be spun off to Anglo shareholders before BHP acquires Anglo. Anglo has a 78.6% stake in Amplats and a 69.7% stake in Kumba.

- The two parts of the proposal are inter-conditional.

- BHP has until 22 May 2024 to either announce its firm intention to make an offer or its decision not to make an offer.

Following Anglo’s share price moves on Thursday (25 April), we estimate that Anglo will trade at 10x run-rate earnings. While that multiple would usually represent a reasonable approximation of fair value for the share, we would continue to hold the counter given the current M&A interest and the potential for higher bids from either BHP or others.

BHP is bidding for the rump of Anglo

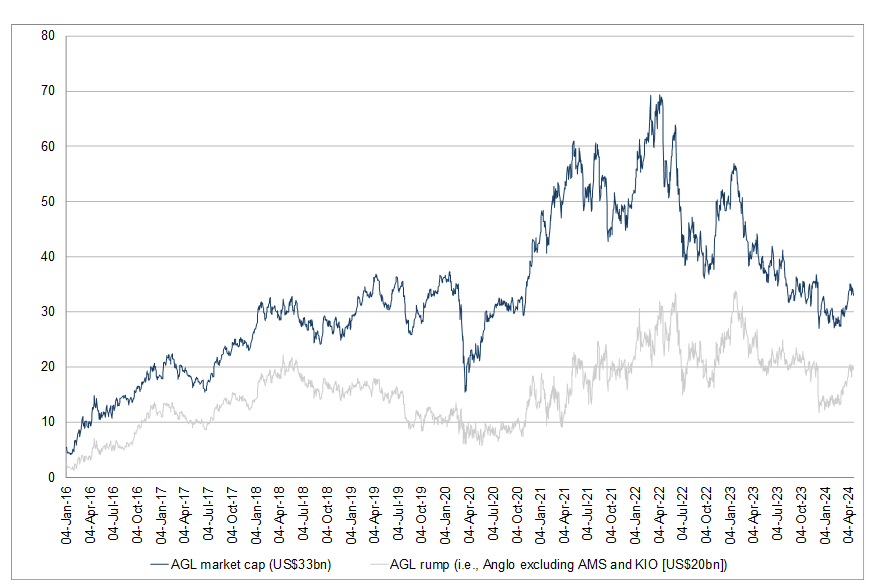

BHP is bidding for Anglo’s rump – everything in Anglo, excluding Amplats and Kumba. The market (before BHP’s initial proposal was announced) was implying a value for that rump of US$20bn. We estimate that Anglo’s rump (before BHP’s initial proposal was announced) was trading at 7x 2023 operating profit.

Figure 1: BHP Group, Anglo and Anglo rump market capitalisations, US$bn

Source: Anchor, Bloomberg.

What is in the Anglo rump that BHP is interested in?

Copper!

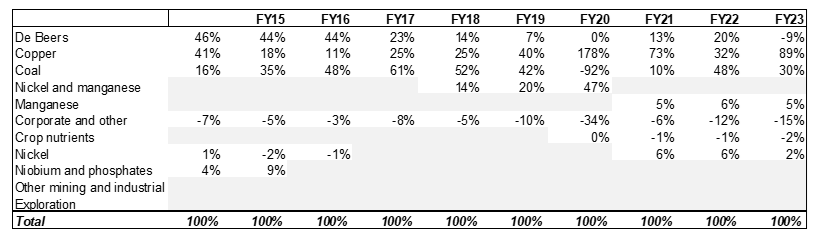

As the table in Figure 2 below shows, copper is the major contributor to the Anglo rump’s operating profit. Metallurgical coal (SA thermal coal was spun out into Thungela in 2021) is the second major contributor to the Anglo rump’s profit.

Figure 2: Anglo rump underlying EBIT

Source: Anchor, Bloomberg.

How has the rump performed operationally over time?

Figure 3 below shows that the Anglo rump’s underlying operating profit has stagnated over the past few years. Iron ore (Kumba and Minas-Rio in Brazil) and Amplats have increased Anglo’s profits from their 2015 lows.

Figure 3: Anglo’s underlying EBIT performance over time, US$bn

Source: Anchor, Bloomberg.

How has the rump’s valuation performed over time?

Just as operating profit from the rump has stagnated, so has its valuation. The US$20bn current rump valuation is at a similar level to where it was at the start of 2018.

Figure 4: Anglo total market cap (US$33bn) vs rump (US$20bn)

Source: Anchor, Bloomberg.

Given the historic lack of growth in the rump’s earnings, why is BHP interested?

We believe there are two reasons for BHP’s interest. These are:

1. Anglo’s copper volume growth.

2. The copper price outlook.

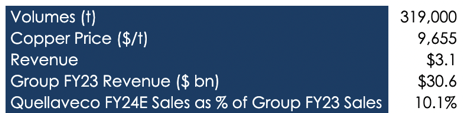

Figure 5: Anglo copper volume growth

Source: Anchor, Bloomberg.

Anglo’s Quellaveco Copper Mine project in Peru reached full production capacity in 2023. At current copper prices, its revenue would equate to 10% of last year’s total Group revenue. Quellaveco is one of the biggest new copper projects to be completed globally in the last few years.

Figure 6: The copper price outlook – demand by sector (total consumption)

Source: Wood Mackenzie.

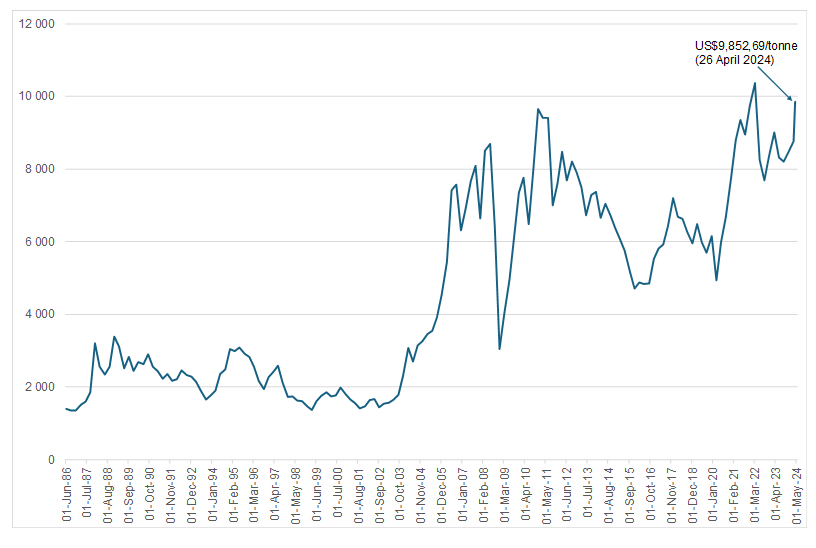

The world currently produces around 28mn tonnes of copper annually, but the demand for copper is forecast to grow very strongly as the world’s economy decarbonises. For example, electric vehicles (EVs) need three to four times as much copper as the standard internal combustion engine (ICE).

On its 1H22 earnings call, Anglo estimated that another 17mn tonnes of copper will be needed by 2040 for the world’s energy transition. That equals copper demand growth of c. 3% p.a., while copper supply is not growing anywhere near that rate.

Figure 7: The copper price performance, US$/tonne

Source: Anchor, Bloomberg

BHP acquired OZ Minerals for c. US$5.9bn in 2023, so it is clearly interested in growing its copper business. Copper accounts for c. 21% of BHP’s total operating profit.

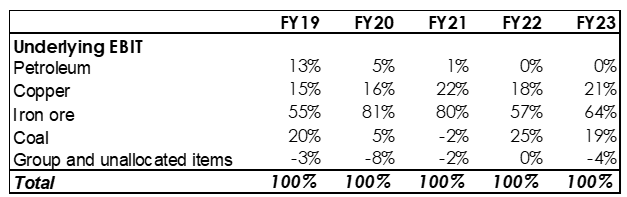

Figure 8: BHP Group underlying EBIT by commodity

Source: Anchor, Bloomberg

What would BHP Group look like if the deal were to go through?

BHP Group would essentially be an iron ore, copper, and coal producer.

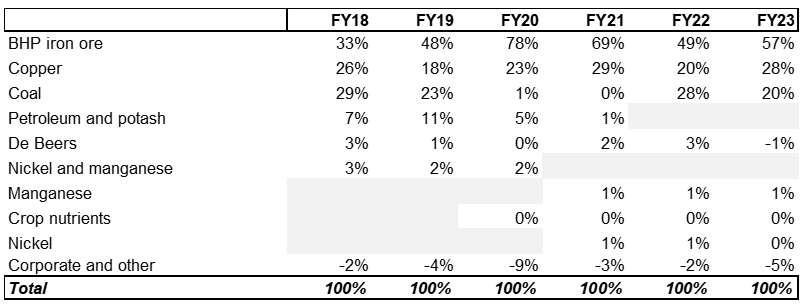

Figure 9: BHP Group* underlying EBIT post-merger

Source: Anchor, Bloomberg

*Note that BHP has a June year-end and Anglo has a December year-end, so the table above uses data from different year-ends for BHP (June) and the Anglo rump (December). Despite that, it is still illustrative of historical EBIT contribution by commodity for a post-merger BHP.

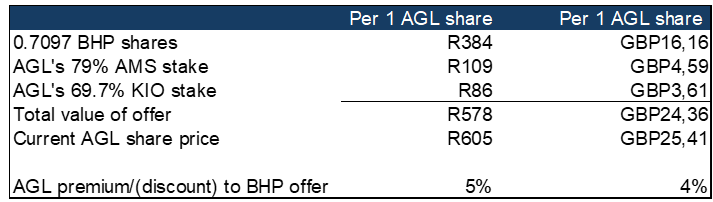

The table in Figure 10 shows a breakdown of the offer at current prices (as at 25 April 2024). Anglo is trading at a slight (4%) premium to the value of BHP’s proposal, perhaps suggesting that Anglo investors will expect higher offers (either from BHP or other bidders) following the announcement.

Figure 10: A breakdown of the BHP Group offer for Anglo, in bn except per share*

Source: Anchor, Bloomberg

*as at 25 April 2024

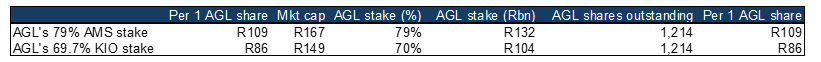

Below, we detail the value of Anglo’s stakes in Amplats and Kumba, per one Anglo share.

Figure 11: A breakdown of Anglo’s stakes in Amplats and Kumba, bn except per share*

Source: Anchor, Bloomberg

*as at 25 April 2024

On Friday (26 April), Anglo announced that it rejected BHP’s proposal. The Anglo share price ended Friday at R620.90/share, still at a premium to BHP’s rejected proposal. Clearly, the market is expecting further bids from BHP (or other suitors).

Figure 12: Anglo share price vs BHP’s rejected proposal

Source: Anchor, Bloomberg

We would continue to hold Anglo American.