The challenges of shifting rate cut expectations, a slowing US economy, and accelerating eurozone inflation saw a mixed month for global markets (MSCI World +1.8% MoM/+14.0% YTD) in July. The sudden withdrawal of US President Joe Biden from the presidential race and the evolving US political landscape added uncertainty in markets as to whether Vice President Kamala Harris could defeat Donald Trump in the November US Presidential Election. US rate-cut hopes increased with the US personal consumption expenditure (PCE) price index data seeing a further moderation in inflation and US Federal Reserve (Fed) Chair Jerome Powell indicating at the Fed’s 31 July press conference that a rate cut is “on the table”. However, he cautioned that a September rate cut is not set in stone.

Two of the three major US indices posted gains in July, with the tech stocks that powered US equity markets in 1H24 stumbling. MoM and YTD, the Dow Jones Industrial Average (Dow) was the outperformer, rising by 4.4% in July and recording an 8.4% jump YTD. The S&P 500 ended July 1.1% higher (+15.8% YTD), while the tech-heavy Nasdaq declined by 0.8% MoM (+17.2% YTD) as the Magnificent Seven counters (Apple, Amazon, Microsoft, Nvidia, Tesla, Alphabet, and Meta), which had experienced a surge in value this year, driven in part by AI enthusiasm, stalled in July as investors seemingly started to question their high valuations.

In US economic data, June inflation fell slightly faster than expected for a second consecutive month, with headline inflation, as measured by the Consumer Price Index (CPI), advancing by a less-than-expected 3.0% YoY vs May’s 3.3% print. June core CPI, excluding the erratic food and energy components, rose 3.3% YoY vs May’s 3.4% reading. MoM, June headline and core inflation stood at -0.1% and 0.1%, respectively. June US retail sales rose 0.3% MoM – unchanged from May’s revised print. YoY, retail sales increased by 2.3% in June vs May’s 2.6% rise. Core PCE, excluding food and energy, a key Fed inflation barometer, increased by 2.6% YoY in June – unchanged from May’s print. MoM, it rose 0.2% vs May’s 0.1%. According to an initial US Commerce Department estimate, US economic activity was considerably more robust than expected in 2Q24, with gross domestic product (GDP) increasing at a 2.8% annualised pace (adjusted for seasonality and inflation) vs consensus economists’ expectations of 2.1% QoQ growth. This print is up from a QoQ gain of 1.4% in 1Q24.

In Europe, major equity markets closed higher in July. MoM, Germany’s DAX was up 1.5% (+10.5% YTD), while France’s CAC ended the month 0.7% in the green (-0.2% YTD). In early July, France’s far-right National Rally (RN), widely expected to win the election, was beaten into third place as a left-wing alliance (New Popular Front) won the most seats. French President Emmanuel Macron called the election in June. France now faces a hung parliament with no party having a majority. Macron said that the current centrist caretaker government would be maintained until the end of the Olympic Games on 11 August, dismissing efforts by the leftwing alliance to name a prime minister.

On the economic data front, June euro area annual inflation came in at 2.5%, slightly below May’s 2.6% print, while June core inflation, excluding prices for energy, food, alcohol and tobacco, was unchanged from May’s 2.9% print. However, July eurozone inflation rose unexpectedly to 2.6% YoY from 2.5% in June and higher than the expected 2.4% print. It was also above the European Central Bank’s (ECB) target of 2%, undermining the possibility of further rate cuts from the ECB. In Germany, the June inflation rate fell to 2.2% YoY vs May’s 2.4% print, while France’s June inflation rose 2.2% YoY vs May’s 2.3% print. Germany’s GDP unexpectedly shrank 0.1% YoY in 2Q24, below the expected 0.1% rise as manufacturing and construction investment declined. However, France’s economy expanded at a faster-than-expected pace of 0.3% in 2Q24. After cutting rates by 25 bps in June, the ECB left rates unchanged at its meeting on 18 July, which was in line with market expectations.

The UK stock market also ended higher, with the blue-chip FTSE-100 Index up 2.5% MoM (+8.2% YTD). July’s UK general election saw the Labour Party sweep to power in a landslide victory, with Keir Starmer becoming the UK’s new prime minister (PM). Outgoing PM Rishi Sunak’s Conservative Party suffered a collapse in support after 14 tumultuous years in power, during which five different PMs ran the country. June UK inflation was unchanged from May, remaining at the Bank of England’s (BoE) 2.0% target rate, while core inflation (excluding energy, food, alcohol, and tobacco) was also unchanged from May at 3.5% YoY. Britain’s economy grew faster than expected in May, with economic output increasing by 0.4% after zero growth in April, a positive sign for the UK economy.

In Asia, China’s central bank, the People’s Bank of China (PBOC), cut major short- and long-term interest rates just days after a meeting of the Communist Party’s Central Committee, surprising markets. This was the first time since August 2023 that the PBOC has cut rates, signalling the government’s intent to stimulate growth in the world’s second-largest economy. Despite this, China’s equity markets remained volatile in July, lagging regional peers and reflecting investors’ broader concerns for the country’s economy as the real estate sector also continued to weigh on China’s growth. On Wednesday (31 July), Chinese equities rallied as anticipation grew that the government would further bolster the country’s struggling economy. Unfortunately, that was not enough to push equity markets higher, and the Shanghai Composite closed July 1.0% lower (-1.2% YTD), while Hong Kong’s Hang Seng lost 2.1% MoM (+1.7% YTD).

In economic data, China reported weaker-than-expected 2Q24 GDP data, with growth at 4.7% YoY – slower than 1Q24’s 5.3% YoY growth and below China’s targeted c. 5% growth. June retail sales missed expectations, although industrial production data beat forecasts. China’s official July Manufacturing PMI slowed slightly, printing at 49.4, down from 49.5 in June – a five-month low and its third consecutive month below 50. However, the official non-manufacturing PMI, measuring business sentiment in the services and construction sectors, came in above 50, although it declined to 50.2 in July, vs June’s 50.5 print. The 50-point mark separates expansion from contraction.

Japan’s benchmark Nikkei ended July 1.2% down (+16.8% YTD). In economic data, June headline CPI stood at 2.8% YoY – unchanged from May’s print. However, Japan’s core-core inflation (considered by the Bank of Japan’s [BoJ] when formulating monetary policy and excluding fresh food and energy prices) printed higher – at 2.2% in June, up from May’s 2.1% print. At month-end, the BoJ raised the benchmark interest rate to 0.25% from its previous range of 0% to 0.1% and outlined a plan to taper its bond-buying programme.

Commodity prices were under pressure in July, with some erasing nearly all of their 2024 gains as the challenging outlook in China weighed on commodities. The gold price was a standout, breaching fresh highs and ending the month 5.2% higher (+18.6% YTD), buoyed by its safe-haven status on the back of high interest rates, currency volatility and ongoing conflict in the Middle East igniting fears of a wider war. Still, gold consumption in China, a top consumer, reportedly fell 5.6% YoY in 1H24, according to the latest data from the Gold Association, as 2024’s higher gold price curbed purchases of gold jewellery. Among the platinum group metals (PGMs), platinum fell by 1.8% MoM (-1.3% YTD), palladium declined by 4.9% MoM (-15.6% YTD), and rhodium was unchanged MoM (+5.1% YTD). After its June increase, Brent crude declined 6.6% in July (+4.8% YTD) despite oil prices rising more than US$2 on 31 July, rebounding from seven-week lows, as the killing of a Hamas leader in Iran and Israel launching airstrikes in Beirut ratcheted up Middle East tensions, spurring concerns around supply disruptions. Iron ore was down 7.9% MoM (-28.8% YTD) as demand in China, its biggest consumer, continued to decline and the global seaborne market remained in surplus.

In South Africa (SA), with the market-friendly election outcome of a government of national unity (GNU) and an improved growth outlook, the JSE’s positive momentum continued. The FTSE JSE All Share Index broke above the key 82,000 level in mid-July, closing at a record high of 82,765.12 on 31 July. MoM, the index posted an impressive 3.8% gain (+7.6% YTD), while the Capped SWIX rose by 4.1% MoM (+10.1% YTD). Resources counters were the best performers (Resi-10 +5.7% MoM/+8.5% YTD), while financial stocks also performed well with the Fini-15 soaring 5.1% MoM (+11.0% YTD). The SA Listed Property Index jumped 4.3% MoM (+10.8% YTD), and industrial counters, as measured by the Indi-25, rose 1.6% (+6.0% YTD). Highlighting the July share price performances of the largest JSE-listed shares by market cap, BHP Group fell 3.8% MoM while the second and third-biggest shares on the bourse – Anheuser-Busch InBev (AB InBev) and Richemont were up 2.0% and down 2.9% MoM, respectively. After recording substantial gains in June, the rand declined 0.1% against the US dollar in July and is now c. 1% stronger YTD against the greenback.

On the economic data front, SA’s June headline CPI eased to 5.1% YoY vs 5.2% in May and rose by 0.1% MoM. June core inflation (excluding food, fuel, and electricity) came in at 4.5% YoY vs May’s 4.6% YoY print, while MoM core inflation rose 0.4% in June. The food and non-alcoholic beverages (NAB) category contributed to the improved data as it rose 4.6% YoY – the slowest gain since September 2020, while the transport category cooled to 5.5% YoY (vs 6.3% in May). Stats SA said the inflation rate has remained within the 5%-6% range for ten consecutive months. Meanwhile, SA retail trade sales rose 0.8% YoY in May after increasing by 0.6% YoY in April. MoM retail sales declined by 0.7% in May. At last month’s SA Reserve Bank’s (SARB) meeting, the Monetary Policy Committee (MPC) opted to keep the repo rate steady at 8.25% and the prime rate at 11.75%, as the market had expected. Interestingly, two of the six MPC members voted for a rate cut of 25 bps, while the remaining four preferred to maintain the current rates, suggesting a growing inclination towards future rate reductions.

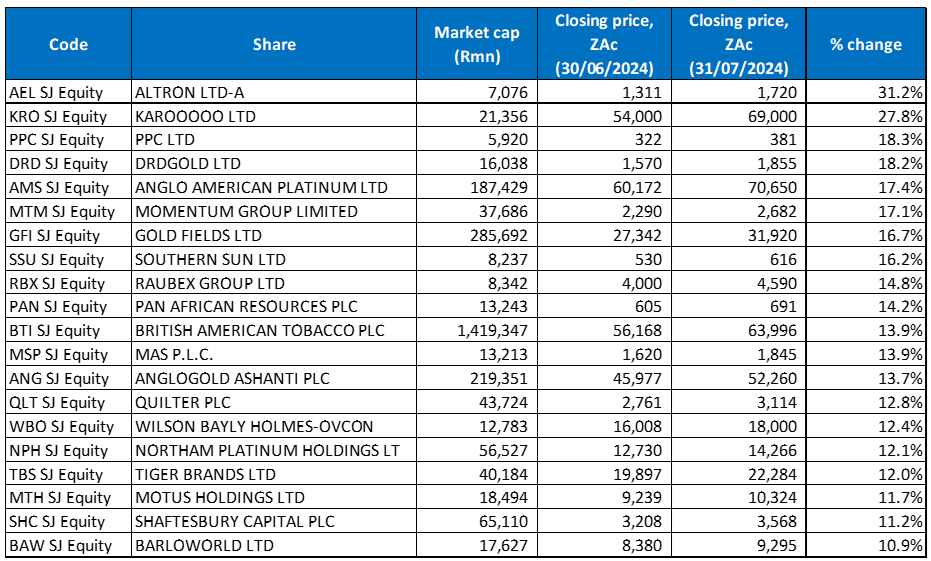

Figure 1: July 2024 20 best-performing shares, MoM % change

Source: Bloomberg, Anchor

Tech firm Altron was July’s best-performing share, gaining a whopping 31.2% MoM. In its 1H24 trading and operational update, Altron said it expects Group EPS and HEPS to be at least 20% higher YoY (a c. one-fifth increase) for its half-year to end August. The company noted that its Own Platforms segment delivered a strong YTD performance, with Altron FinTech, Altron HealthTech, and Netstar growing revenue and notable growth in EBITDA and operating profit. Within its IT Services segment, the Altron Digital Business segment delivered YTD revenue growth that was in line with the market. Altron also announced it has decided to keep its Altron Document Solutions business (a Xerox distributor), noting it believed this was the best way to maximise shareholder value. Earlier last month, Altron announced the formation of a new BEE trust focusing on funding ICT skills-related education. In a note to investors, the Group said it believed the transaction provided a “unique opportunity” to be a catalyst for SA’s societal advancement and industry innovation.

Software Group and Cartrack owner Karooooo was July’s second best-performing share with an impressive 27.8% MoM increase. In its 1Q25 results released in July, Karooooo reported a rise in revenue to R1.1bn from R1.0bn posted in 1Q24. Diluted EPS soared by 40.9% YoY to R7.17. Cartrack subscribers rose by 17% YoY, with 75,910 net subscriber additions in 1Q24. The company maintained its FY25 guidance, with EPS expected to come in between R27.50 and R31.00. Despite moving its headquarters to Singapore, SA remains Karooooo’s largest market. It is listed on the JSE and the Nasdaq.

Coming in third, PPC Ltd rose 18.3% MoM. The cement maker’s share price surged after it said it had received final approval to dispose of its 51% stake in Rwandan integrated cement manufacturer Cimerwa for US$42.5mn (c. R780mn). The regulatory approval by the Common Market for Eastern and Southern Africa (Comesa) means that all conditions precedent to the disposal have now been fulfilled. PPC wants to exit its Central and East African assets, allowing it to focus its resources on its core Southern African market.

According to the London Bullion Market Association, the gold price averaged new highs of US$2,338 (c. R42,870) per ounce in 2Q24, representing an 18% YoY jump and a 13% QoQ gain. The higher gold price in July (+5.2% MoM) buoyed local gold producers, including DRDGold (+18.2% MoM), Gold Fields (+16.7% MoM – in seventh place) and Pan African Resources (+14.2% MoM – in tenth spot). Pan African Resources raised its gold production by 6% to 186,039 oz in FY24, selling its bullion for the period at an average price of US$2,021/oz or R1.2mn/kg.

In its 1H24 results, Anglo American Platinum Ltd (Amplats +17.4% MoM) indicated that its gross revenue fell to R52.23bn from R64.69bn posted in 1H23, while diluted EPS declined by 18.3% YoY to ZAc2,399. This was on the back of lower PGM prices and restructuring costs. However, Amplats’ announcement that it was on track to demerge from Anglo American by 2025 and planned to expand its investor base through a secondary listing in London buoyed the share price. During a call, Amplats’ CEO told investors that the company was optimistic about the demand outlook for PGMs. He noted, “These metals all play an important role in creating a greener world – whether in internal combustion, hybrid or hydrogen electric vehicle drivetrains.” Global demand for catalytic converters, found in internal combustion engines (ICE) and hybrid engines, is rising as global sales of electric vehicles (EVs) slow down.

Last month, Momentum (+17.1% MoM) said it is seeing strong demand for health insurance. The company said SA is seeing robust growth in the demand for cheap primary health insurance products, starkly contrasting the stagnant medical schemes market. Primary healthcare insurance products cost a fraction of the price of medical scheme options, are not subject to the same regulatory oversight as medical schemes and offer a limited range of health services, such as GP and dentist visits.

Southern Sun, Raubex, and the aforementioned Pan African Resources rounded out July’s best-performing shares with MoM share price gains of 16.2%, 14.8% and 14.2%. Construction group Raubex has likely benefitted from the positive post-election momentum following the announcement of a GNU and the hopes of increased government infrastructure spending.

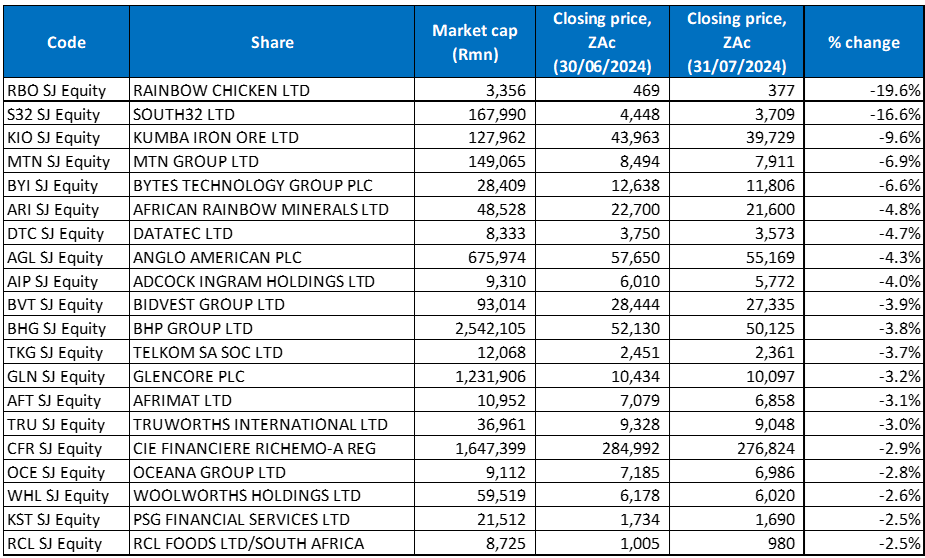

Figure 2: July 2024 20 worst-performing shares, MoM % change

Source: Bloomberg, Anchor

Rainbow Chicken Ltd, which was unbundled from RCL Foods and listed on the JSE in June, was July’s worst-performing share—down 19.6%. The share price opened at ZAc365, valuing the separated poultry business at c. R3.24bn. It closed at a high of ZAc469 on 28 June before falling back to a low of ZAc351/share on 24 July.

Rainbow was followed by diversified miner South 32 in second place – down 16.6% MoM. South32’s share price came under pressure after it said in July that it had received approval to complete the sale of its Illawarra Metallurgical Coal mine. For South32, the disposal of Illawarra “will significantly reduce the company’s capital intensity, with Illawarra Metallurgical Coal currently comprising 35%” of its capital expenditure. The sale has unlocked capital, which South32 can invest in copper and zinc projects in line with its plans to focus on low-carbon future opportunities.

Kumba Iron Ore (Kumba) came in third, declining by 9.6% MoM. In its 1H24 results, Kumba reported lower earnings mainly due to a lower average realised free-on-board (FOB) export iron ore price and decreased sales volumes. Revenue for the six months to end June was down 6% YoY at R35.8bn, while headline EPS declined by 26% YoY to R22.27. The company’s earnings before interest, taxes, depreciation and amortisation (EBITDA) of R15.6bn, down from R19.8bn a year ago, reflected the impact of lower realised FOB export prices and lower sales, which were in part offset by lower on-mine costs and a weaker rand. Kumba declared an interim dividend of R18.77/share.

Kumba was followed by MTN (-6.9% MoM), which took a hit of c. R6bn in its biggest market, Nigeria, as the weak naira ate into its bottom line in the six months to end-June. MTN reported an NGN519.1bn (c. R5.7bn) loss after tax for 1H24, compared with a restated NGN85.6bn loss a year ago. Nigeria’s poor macroeconomic conditions have seen inflation reach 34.2% in June, while the naira has plunged against the US dollar, the rand, and other currencies, especially in 1H24. The country’s economic reforms have driven up inflation and put consumers and businesses under pressure.

Rand hedge, Bytes Technology Group’s (-6.6% MoM) share price plunged after it gave a trading update at its AGM, signalling slower profit growth for the first four months of the current financial year (FY24). The UK-based software, security, cloud and AI services specialist, which was spun out of Altron in 2020, said it had continued to trade well against the backdrop of a competitive market environment, with good growth across its key financial performance metrics for the period. However, the trading statement seemed to signal that the current full year’s (FY24) results will show lower overall growth, with investors seemingly unimpressed by the apparent downward trend, backed by lower margin sales.

Last month, African Rainbow Minerals (ARM; -4.8% MoM) took full ownership of the Nkomati Mine in Mpumalanga. ARM acquired the remaining 50% stake in the mine from its current partner, Norilsk Nickel Africa (NNA), the local subsidiary of Russia’s Norilsk Nickel. The move solidifies ARM’s control over the mine, which has rich nickel, copper, cobalt, and PGM deposits. In terms of the agreement, ARM also assumes NNA’s obligations and liabilities related to the mine’s assets and environmental responsibilities, with a contribution of R325mn from NNA. ARM has reportedly allocated R836mn for the rehabilitation of the mine.

ARM was followed by Datatec (-4.7% MoM), Anglo American Plc (Anglo; -4.3% MoM), and Adcock Ingram Holdings (-4.0% MoM). Last week, Anglo released its 1H24 results, its first set since fending off a takeover bid from BHP Group in May. The company recorded a revenue drop of 8% YoY to US$14.5bn from US$15.7bn posted in 1H23, with underlying EBITDA profit down 3% YoY to US$5bn, reflecting a 10% YoY decline in the price of its basket of products. Anglo’s diluted loss per share stood at US$0.55, compared with an EPS of $1.03 recorded in the corresponding period of 2023. Anglo is expected to conclude its restructuring by the end of 2025. The restructuring includes divestments from steelmaking coal and diamonds and an increased focus on copper and premium iron ore.

Rounding out the ten worst-performing shares in July was industrial conglomerate Bidvest, which fell by 3.9% MoM. Bidvest said last month that it had agreed to acquire 100% of washroom hygiene products firm Citron Hygiene from Birch Hill Equity Partners and other investors for an undisclosed amount.

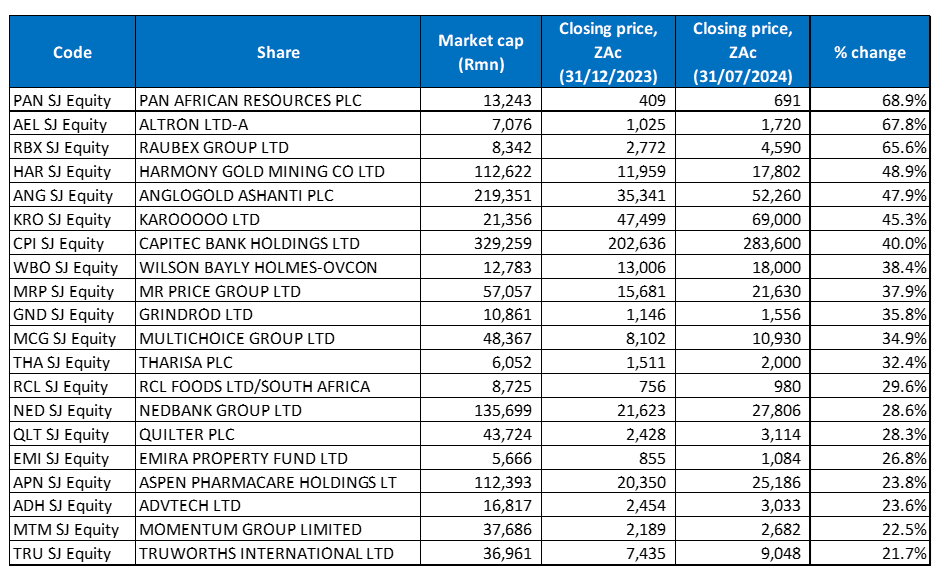

Figure 3: Top-20 best-performing shares, YTD

Source: Anchor, Bloomberg

YTD, the best-performing shares featured fifteen of the year-to-end June’s best performers, with five shares entering the best performers club in July – Karooooo Ltd, Quilter, Aspen Pharmacare, ADvTECH, and Momentum.

Mid-tier gold producer Pan African Resources (discussed earlier) reigned supreme for a third consecutive month with a 68.9% YTD gain after its share price rose a further 14.2% in July, buoyed by the strong gold price. Tech company Altron’s impressive share price performance in July (+31.2% MoM) propelled it to second position with a YTD gain of 67.8%, bumping Raubex (+65.6% YTD) from second to third spot.

Gold miners Harmony (+48.9% YTD) and AngloGold Ashanti (+47.9% YTD) have also benefitted from the strong gold price this year and a weak rand ahead of the May election. AngloGold was followed by Karooooo Ltd (discussed earlier), Capitec Bank, and Wilson Bayly Holmes Ovcon (WBHO), with YTD gains of 45.3%, 40.0%, and 38.4%. In its 1H24 trading update released last month, Capitec said that it expects HEPS to be between 25.0% to 35.0% higher YoY as compared with ZAc4,072 recorded in 1H23. The bank also said there was an improvement in the credit impairment charge and credit loss ratios during the period.

Mr Price Group and ports, terminals, and cross-border logistics group Grindrod rounded out the ten best-performing shares YTD, with gains of 37.9% and 35.8%, respectively. Last month, it was reported that Grindrod was selected as the preferred bidder for constructing and managing a new container handling facility at Richards Bay port. The company has been operating three terminals at the Maputo port, where, according to the company’s latest market update, the port of Maputo achieved record volumes of 5.8mn tonnes in the five months to 30 May – up 17% on the previous period. This was despite a challenging operating climate and events that affected the functioning of its terminals in Mozambique.

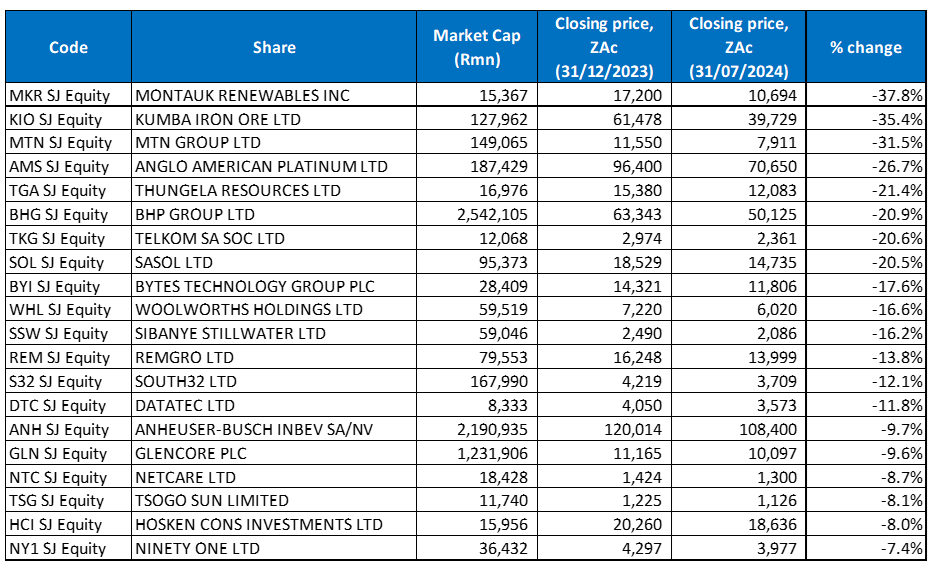

Figure 4: Bottom-20 worst-performing shares, YTD

Source: Anchor, Bloomberg

There was significant overlap between the year to end-June’s worst-performing shares and the worst-performers to the end of July (YTD), with seventeen shares remaining and only three new entrants to the worst-performers grouping – South32, Datatec, and Glencore Plc. Montauk remained the worst performer YTD, declining by 37.8%, although its share price retreated by only 0.1% in July. Montauk was followed by Kumba (discussed earlier) – down 35.4% YTD. MTN (discussed earlier) was the third worst-performing share, with a 31.5% YTD drop in its share price.

A 17.4% share price gain in July saw Amplats (-26.7% YTD) move from second to fourth spot among the worst performers. It was followed by Thungela, BHP Group, Telkom, and Sasol, which posted YTD declines of 21.4%, 20.9%, 20.6%, and 20.5%, respectively. Sasol’s share price rose 6.7% in July following its FY24 production and sales update, which revealed that the chemicals Group had maintained a consistent operational performance across all its business segments, meeting market expectations. The update showed that mining, fuel, and chemical production was within guidance, while gas production in Mozambique was higher than expected.

Bytes (discussed earlier) and retailer Woolworths rounded out the ten worst-performing shares with YTD declines of 17.6% and 16.6%, respectively. Woolworths, which recorded a 2.6% decline in July, revealed in its FY24 trading update released this week that it expects headline EPS for total operations to fall by between 27% and 32% YoY in the 53 weeks ended 30 June 2024, from ZAc514.7 in the prior year. Excluding Australian department store David Jones’ contribution in FY23 (before being sold) and on a comparable prior 52-week period, HEPS are seen falling by 14% to 19% YoY.