It has been a dreadful few months for global investors and, while Chinese markets (emerging from lockdowns) were a bright spot in an otherwise gloomy month, June was no exception. On the contrary, June was a significantly tougher month for markets (MSCI World -8.6% MoM/-20.3% YTD – its biggest first-half drop on record) as global inflation data deteriorated further, raising recession fears and expectations of steep interest rate hikes by the US Federal Reserve (Fed) to combat inflation. Runaway US inflation is to blame for much of the broader market slump this year as businesses increase their prices and consumers are being squeezed (US consumer spending – accounting for over two-thirds of US economic activity – also fell for the first time this year). The aggressive rate hikes to fight inflation have resulted in renewed concerns that a US recession is on the cards as these rate hikes might put the brakes on economic growth too much and bring on a recession. Added supply chain issues, due to COVID-19 lockdowns in China because of that country’s zero-COVID policy and Russia’s war on Ukraine, have prompted an oil price surge (+47.6% YTD), although the oil price was down in June – OPEC and its allied oil-producing countries decided on 30 June to increase crude production. Nevertheless, this is unlikely to relieve high prices at the pump and the energy-fueled inflation weighing on the global economy.

The US stock market recorded its worst first half since 1970 with inflation being the main culprit. The blue-chip S&P 500 posted its worst first-half to a year in more than 50 years – down 20.6% YTD (-8.4% MoM/-16.4% in 2Q22). MoM, the Dow ended June 6.7% lower, while the index has dropped by 15.3% YTD and is 11.3% lower for 2Q22. The tech-heavy Nasdaq lost a further 8.7% MoM in June, bringing its YTD loss to 29.5% (-22.4% in 2Q22).

On the US economic data front, the aforementioned May inflation (released in June) accelerated by a worse-than-expected 8.6% YoY (vs a deceleration to 8.3% YoY in April) – the biggest inflation increase since December 1981. Excluding the volatile food and energy prices categories, core CPI rose 6.0% YoY vs April’s 6.2% print. MoM, headline inflation was up 1.0% – significantly above April’s 0.5% increase. The much-higher inflation print saw the US Fed’s Federal Open Market Committee (FOMC), at its meeting on 14-15 June, hike rates by 0.75%. There was no change in the Fed’s guidance to winding down the balance sheet, which started at the beginning of June at a rate of c. US$50bn/month and will ramp up to US$95bn/month by September. May employment data, released in June, were largely in line with expectations. Consumer spending fell by 0.4% YoY in May (vs a downwardly revised 0.3% YoY gain in April), and the core personal consumption expenditures (PCE) price index, the Fed’s preferred inflation gauge, rose 4.7% YoY – its smallest gain since November 2021. According to a third and final GDP estimate, the US economy shrank 1.6% YoY in 1Q22 (vs an initial reading of -1.5% YoY) – slightly above earlier estimates and a sharp reversal from 4Q21’s GDP growth number of 6.9% YoY. US consumer confidence fell to 98.7 in June vs May’s 103.2 print – its lowest level since February 2021.

In Germany, Europe’s largest economy, the DAX closed the month 11.2% lower (-19.5% YTD/-11.3% in 2Q22), while the eurozone’s second-biggest economy, France’s CAC Index ended June 8.4% in the red (-17.2% YTD/-11.1% in 2Q22). In economic data, May eurozone headline inflation reached a much higher-than-expected 8.1% YoY vs April’s 7.4% print. This was the eleventh consecutive rise in inflation for the region and the highest since records began in 1997 as the fallout from Russia’s invasion of Ukraine saw energy and commodity prices soaring and added to global supply chain issues. France’s June inflation rate also continued to rise – hitting a new record of 5.8% YoY vs May’s 5.2% print, while Germany’s June inflation declined slightly (+7.6% YoY) vs May’s record high of 7.9% YoY.

After surprising gains for April and May, the UK’s blue-chip FTSE-100, ended June 5.8% in the red (-2.9% YTD/-4.6% in 2Q22). In economic data, May UK inflation, released last month, came in at another high of 9.1% YoY (vs April’s 9.0% YoY print) while GDP fell for a second month running – down 0.3% in April after a 0.1% drop in March

China’s markets made a strong comeback in June with its equity markets one of the few to end June higher although concerns remain after President Xi Jinping said recently that China cannot afford to relax its zero-COVID policy at the cost of short-term economic growth. Still, the initial signs of a recovery in China emerged with May economic data (released in June), showing several key indicators improving (including industrial production, fixed-asset investments, manufacturing, and services PMIs). The official manufacturing PMI expanded to 50.2 in June – up from May’s 49.6 print, while non-manufacturing PMI, which measures business sentiment in the services and construction sectors, also advanced, coming in at 54.7 in June vs 47.8 in May (the 50-point mark separates expansion from contraction). Hong Kong’s Hang Seng Index posted an MoM gain of 2.1% (-6.6% YTD/-0.6% in 2Q22), while the Shanghai Composite Index rose by an impressive 6.7% MoM (-6.6% YTD/+4.5% in 2Q22).

Elsewhere, Japan’s benchmark Nikkei fell 3.3% MoM in June and is down 8.3% YTD and 5.1% in 2Q22. On the economic front, May data recorded the biggest MoM decline in factory activity (-7.2% YoY) since May 2020 as manufacturers were impacted by shortages of semiconductors and other parts due to China’s COVID-19 lockdowns in May.

Oil prices slipped in June (the first monthly decline since November 2021) with the price of Brent crude down 6.5% MoM (+47.6% YTD), dipping to US$114.81/bbl as global supply concerns were outweighed by higher US fuel inventories and worries that the slower global economic growth could offset concerns about tight crude supplies. In addition, OPEC+ completed the return of output that it halted during the pandemic. Iron ore continued to slump (-12.5% MoM/+2.3% YTD) while disappointing US economic data provided some support for gold as the price of the yellow metal traded higher towards month-end although it was still down 1.6% MoM (-1.2% YTD). The yellow metal has been struggling over recent months due to the Fed’s aggressive and hawkish campaign. Platinum plummeted 7.4% MoM and YTD, while palladium fell 3.1% MoM (+1.9% YTD), as demand concerns due to China’s zero-COVID policy precipitated sharp declines in these autocatalysts.

The local market continued to take its cue from global markets with the JSE ending June in the red, as South Africa’s (SA’s) FTSE JSE All Share Index ended the month 8.1% lower (-10.2% YTD/-12.3% in 2Q22) and the FTSE JSE Capped SWIX was down 7.5% MoM (-4.6% YTD). The Indi-25 outperformed in June, gaining 1.4% MoM (-16.8% YTD/-2.9% in 2Q22), buoyed by good share price gains in market heavyweights, Naspers and Prosus. However, the Resi-10 ended the month significantly lower (-17.2% MoM/-10.2% YTD/-21.9% in 2Q22), while the Fini-15 (-13.6% MoM/-0.8% YTD/-17.0% in 2Q22) and the SA Listed Property Index (-11.4% MoM/-15.6% YTD/-13.9% in 2Q22) also recorded MoM declines. Highlighting June’s best-performing shares by market cap, Prosus soared 30.1% MoM, Naspers jumped 38.1%, while British American Tobacco gained 1.5% MoM. BHP Group, the largest company on the JSE by market cap, lost 9.4% MoM. After clawing back c. 1.0% in May, the rand retreated by 3.9% in June (-2.0% YTD/-11.3% in 2Q22).

On the local economic data front, SA’s economic recovery from the depths of the pandemic-induced lockdowns has generally been faster than anticipated, and some of that momentum has carried over into 1Q22, with the latest GDP print coming in ahead of most forecasts at 1.9% QoQ – the second consecutive quarter of GDP growth. YoY, GDP was up 3%. Another positive print, also released in June, was the 1Q22 current account, which showed the current account surplus widening to 2.2% of GDP – an increase from the upwardly revised 2.1% for 4Q21. We expect the current account to stay in surplus until 4Q22. Meanwhile, printing at 6.5% YoY in May (vs 5.9% YoY in April) annual headline inflation, as measured by the consumer price index (CPI), officially breached the upper limit of the SA Reserve Bank’s (SARB’s) 3%-6% target band. Stats SA said the upside surprise stemmed largely from food and fuel prices, with core inflation coming in at 4.1% YoY vs April’s 3.9% print. April SA retail sales rose 3.4% YoY vs March’s 1.30% YoY rise. For 1Q22 retail sales were up 2.5% YoY. Meanwhile, the FNB/BER Consumer Confidence Index (CCI) plunged to -25 in 2Q22, from -13 in 1Q22 – the lowest reading in 30 years which signals a marked slowdown in consumer spending in the coming months. Striking workers at SA’s power utility, Eskom exacerbated the already challenged state of the grid, plunging SA into darkness with Stage 6 loadshedding being implemented for the first time since December 2019.

On the pandemic front, as at 30 June, Department of Health data show that 36.8mn vaccine doses have been administered (vs 36.1mn as at 31 May), while the total number of confirmed COVID-19 cases in SA since the start of the pandemic stood at c. 4mn vs 3.96mn on 31 May.

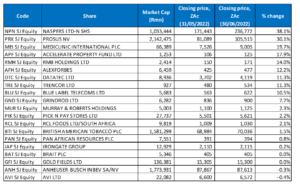

Figure 1: June 2022’s 20 best-performing shares, % change

Source: Bloomberg, Anchor

Naspers (+38.1% MoM) and Prosus’ (+30.1% MoM) share prices rebounded sharply following the release of their FY22 results on 27 June and the announcement that they will be commencing an open-ended, share buyback programme. With Chinese tech giant Tencent’s agreement, the lock-up that had been in place after the last Tencent selldown has ended, allowing the sale of Tencent shares to fund the buyback. The share buyback news overshadowed a decline in profitability from the stable, so it comes as no surprise that these two counters were the top-performing and second best-performing shares for June.

In its FY22 results, Naspers reported that its revenue advanced by 24% YoY to US$36.7bn, while its core EPS stood at USc718 (down 12% YoY), compared with USc814 recorded in FY21. Prosus posted FY22 revenue growth of 24% YoY to US$35.6bn (its Ecommerce revenue grew 51% YoY to US$9.8bn), while core headline earnings were USc247/share (-17% YoY) – exactly at the mid-point of Prosus’ recent trading update range. The main contributory factors to the decline were the fact that Prosus sold down 2% of its Tencent stake last year (its main profit-generating investment), while losses in its Ecommerce division (all the other tech investments Prosus has been making) increased because of new, earlier-stage investments made, and new growth initiatives being pursued by its investee companies.

Mediclinic (+19.7% MoM) was June’s third best-performing share. The private hospitals Group’s board last month recommended rejecting a GBP3.4bn cash offer from a consortium of its biggest shareholder, Remgro (which holds a c. 46% stake) and a shipping group (MSC), saying that the proposal undervalued the company. Mediclinic shares continued to trade higher following the rebuff likely in the hope that a higher offer is on the cards.

Accelerate Property Fund (Accelerate), RMB Holdings, and Alexforbes followed, with MoM share price gains of 17.9%, 14.0%, and 12.2%, respectively. Accelerate reported an FY22 revenue increase to R912.5mn from R625.3mn posted in the previous year, while its diluted EPS stood at ZAc6.44 compared with a loss per share of ZAc72.85 reported in FY21. Meanwhile, investment management company, Alexforbes reported FY22 results that showed its headline EPS from continuing operations increased by 19% YoY to ZAc37.2. It also declared an annual dividend of ZAc32 (+45% YoY) as its investment and individual consulting businesses grew.

Datatec and Trencor were both up 11.3% MoM. Last week, Datatec’s share price shot up after it said that it had sold its consulting unit (Analysys Mason) for R4.1bn as it looks for ways to unlock value. The company said that the proceeds from the deal will be returned to shareholders and the sale is in line with its strategic review process. The announcement saw Datatec’s share price soar by more than 22% on Thursday (30 June).

Rounding out June’s 10 best-performing shares were Blue Label Telecoms (+10.5% MoM) and Grindrod (+7.7% MoM). It was reported on Thursday that a highly complex recapitalisation of SA’s smallest mobile player, Cell C, will be voted on this week with its majority owner, Blue Label standing by the mobile operator (in which it bought a 45% stake in 2017). As part of the R7.3bn recapitalisation, Blue Label will loan c. R1bn to Cell C, which will be used to pay 20% of claims by secured lenders. Lenders looking to remain invested will lend a further amount to Cell C in exchange for new shares. Following this arrangement, Blue Label’s shareholding will increase to 49.3%. To provide Cell C with more liquidity, Blue Label says it will then buy prepaid airtime worth R2.4bn from the mobile provider while deferring an R1.1bn loan repayment owed to it. Part of the funding for the airtime purchase will come from lenders that have already approved lines of credit to Blue Label.

Freight and financial services Group, Grindrod’s share price jumped after it flagged a strong performance in the first 5 months of this year. In a pre-close update last week, Grindrod said that it expects its headline EPS to soar by c. 100% in the year to end June (FY22) compared with ZAc0.7 in the previous year’s corresponding period as disruptive weather, including floods in KwaZulu-Natal, failed to derail healthy volume and profit growth for the company.

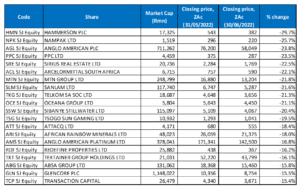

Figure 2: June 2022’s worst-performing shares, % change

Source: Bloomberg, Anchor

Real estate investment firm, Hammerson Plc was last month’s worst-performing share, recording a 29.7% MoM decline as UK inflationary concerns and its impact on discretionary spending weighed on the counter. It was followed by Nampak (-25.7% MoM) in the second spot, with Anglo American Plc (-23.8% MoM) coming third as commodity prices fell with the increasing possibility of slower global economic growth.

Anglo American was followed by PPC (-23.5% MoM) and Sirius Real Estate (-22.5% MoM). PPC reported underwhelming FY22 results in June, posting a HEPS loss of ZAc3 compared to a profit of ZAc3/share last year. PPC CEO Roland van Wijnen said that PPC Zimbabwe had incurred a loss before tax of R67mn and that impairments totalled R38mn. Group revenue rose by 11% YoY to R9.9bn due to double-digit volume growth in Rwanda and Zimbabwe and normalised volume growth in SA and Botswana. Excluding PPC Zimbabwe (with its hyperinflation), revenue growth was 5% YoY. Importantly, the company said that it had yet to experience any meaningful uplift in cement sales volumes from the SA government’s infrastructure programme, other than limited road construction and rehabilitation activity. Sirius Real Estate reported FY22 results last month which showed that headline EPS fell 5.8% YoY to ZAc5.32 vs FY21’s ZAc5.65. Sirius declared a total dividend of ZAc4.41/share – up 16.1% YoY.

ArcelorMittal SA, MTN Group, and Sanlam were down 22.1%, 21.8%, and 21.6% MoM, respectively. In its operational update for the four months ended 30 April 2022 and released in June, Sanlam said that its earnings decreased by 7.0% as it battled the headwind of a decline in world financial markets as Russia’s war on Ukraine rages, the significant hike in global inflation and the “catastrophic” KwaZulu-Natal floods.

On 14 June, Telkom’s (-21.3% MoM) share price closed c. 10% down on the day after the Group released lacklustre FY22 results and forecast tepid future revenue and profit growth due to a slowdown in the growth of its mobile business (which now has c. 17mn active subscribers) and a drop in its legacy fixed-line segment. Mobile service revenue rose 3.3% YoY to R17.5bn – a significant slowdown from FY21’s 34.5% YoY growth when data demand surged because of people working and schooling from home. Meanwhile, mobile data revenue grew by 2.9%, also a slowdown. Telkom reported a 1.1% YoY decline in revenue, to R42.8bn, while headline EPS rose by 2.5% YoY.

Rounding out the 10 worst-performing shares for June was Oceana Group (-21.1% MoM), which reported lacklustre results for 1H22. Oceana’s revenue dipped 11% YoY to R3.2bn from R3.6bn for the same period of 2021, while its gross margin was 3.7% lower at 30.2%, down from 33.9% in 1H21. The company blamed the revenue dip on COVID-19 supply chain disruptions, the civil unrest in Kwa-Zulu Natal that impacted its SA canned fish sales volumes, and Hurricane Ida in the US, which impacted fishmeal and fish oil production at its US-based Daybrook operations. Headline EPS was down 51% YoY to ZAc126.4 vs ZAc260.5 in the same period of 2021.

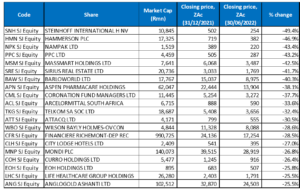

Figure 3: Top-20 June 2022, YTD

Source: Anchor, Bloomberg

Fourteen out of June’s top-20 YTD best-performing shares also featured among the top-20 performers for the year to end May, with Mediclinic (+32.3% YTD), Blue Label Telecoms (+22.2% YTD), Trencor (+16.3% YTD), RMB Holdings (+14.0% YTD), Irongate Group (+10.0% YTD), and Accelerate (+9.6% YTD), replacing Glencore, Absa, FirstRand, Anglo American, Remgro, and Foschini.

Thungela Resources (+173.9% YTD) took the top spot for the fifth month in a row, although MoM its share price retreated by 7.7%. This was after the company released a disappointing 1H22 pre-close and trading statement in June with export volumes below expectation due to the underperformance from Transnet Freight Rail (TFR), which failed to meet its obligation of delivering coal. Thungela guided export FY22 sales volumes of 14mn-15mn tonnes but was only able to export 6.4mn tonnes in 1H22. Nevertheless, Thungela is maintaining its FY22 export sales volumes guidance, although the company stated that it is “… closely monitoring the previously issued export saleable production guidance in light of the inconsistent TFR rail performance”. The thermal coal price has been trading at record highs since the beginning of 2022 due to several factors including the Russian invasion of Ukraine, as well as limited supply in Australia and Indonesia reducing its supply of coal. With a net cash balance of R15.3bn at the end of May 2022, we could expect an interim dividend of c. R55-R60.00/share if Thungela decides to distribute all the cash above its R6bn liquidity buffer.

Thungela was followed by Hosken Consolidated Investments Ltd (HCI; +108.6% YTD), which remained in second place although the HCI share price did lose some ground in June – down 8.4% MoM. It was followed by Grindrod (+81.8% YTD, discussed earlier) still in third spot. Sasol (+43.5% YTD) also remained in the fourth position for the second month running. Sasol’s energy business has been doing extremely well due to high demand and the company’s operational risk has lowered as its capital expenditure has reduced significantly. As a result, Sasol’s cash flow has improved substantially compared to the pressure the balance sheet faced two-three years ago.

Sasol was followed by Mediclinic (+32.3% YTD, discussed earlier), Exxaro Resources (+29.6% YTD), and Blue Label Telecoms (+22.2% YTD, discussed earlier). In June, Exxaro (+44.7% YTD) said in an update that it is expecting the export price of coal to increase by c. 80% in 1H22 but that the poor rail performance has meant that exports declined, despite high international demand. The company said that domestic and export flows remain severely impacted by logistical constraints and “it continues to impact our ability to move coal to customers and ports …”. Exxaro now expects to export a total of 6.2mn tonnes of coal in 2022 vs the initial export guidance for this year of 7.6mn tonnes. The miner added that while total coal production was expected to rise by c. 1% in 1H22, sales would be 3% lower YoY due to logistical constraints and the sale of its Exxaro Coal Central operations in 2021.

Rounding out the YTD 10 best-performing shares were British American Tobacco, Nedbank, and Sappi Ltd with YTD gains of 19.5%, 18.4% and 18.0%, respectively.

Figure 4: Bottom-20 June 2022, YTD

Source: Anchor, Bloomberg

Among the YTD worst-performing shares, 13 of the 20 shares for the year to end-June were also among the 20 worst performers for the year to end-May. ArcelorMittal (-33.6% YTD), Telkom (-32.4% YTD), Attacq (-30.5% YTD), City Lodge Hotels (-27.0% YTD), Curro (-26.4% YTD), EOH Holdings (-25.8% YTD) and AngloGold Ashanti (-25.5% YTD) were the newcomers, replacing Prosus, Naspers, Quilter, Murray & Roberts, Reunert, RCL Foods, and Famous Brands.

Steinhoff (-49.4% YTD) was the worst-performing share YTD for the third month running after posting an MoM decline of 5.6% in June. In its 1H22 results, released last month, Steinhoff reported a revenue increase to R42.0bn from R40.7bn posted in 1H21, while basic EPS surged to R265.44 from R49.42 recorded in the same period of the prior year. Hammerson Plc (-46.9% YTD, discussed earlier) came in second place and Nampak (-43.4% YTD) was in the third position.

Nampak was followed by PPC (-43.2% YTD, discussed earlier), Massmart (-42.5% YTD), Sirius Real Estate (-41.7% YTD, discussed earlier), and Barloworld (-40.3% YTD).

Aspen Pharmacare, Coronation Fund Managers and ArcelorMittal rounded out the ten worst-performing shares with YTD losses of 38.1%, 37.7%, and 33.6%.