Global equity markets were a volatile and mixed bag in January (MSCI World +1.2% MoM), with Japan, the US and Europe continuing their upward trajectory, while China and other emerging markets (EMs), including South Africa (SA), lagged. The collapse and court-ordered liquidation of Chinese property behemoth Evergrande, concerns about China’s slowing economy, geopolitical tensions in the Middle East, instability in the Red Sea shipping route, and markets tempering the speed of rate cuts weighed on sentiment. At its first meeting of 2024, the US Federal Reserve (Fed) opted to hold rates steady. Still, equities came under significant pressure on the last day of January after Fed Chair Jerome Powell said the central bank would likely not be ready to cut rates in March.

In US economic data, December headline inflation, as measured by the Consumer Price Index (CPI), came in above expectations, rising 3.4% YoY vs November’s 3.1% print. December core CPI, excluding the erratic food and energy components, rose 3.9% YoY vs November’s 4.0% YoY. MoM, headline and core inflation increased by 0.3%. The higher-than-expected inflation print dimmed market expectations that the Fed would cut interest rates as soon as March from their 23-year-high. US 4Q23 gross domestic product (GDP) growth exceeded forecasts as cooling inflation fuelled consumer spending. GDP increased at a 3.3% annualised rate, according to preliminary estimates, while for 2023, the US economy expanded by 2.5% YoY, with personal consumer spending rising by 2.8%. Business investment and housing helped fuel the larger-than-expected advance last quarter. December US retail sales advanced 0.6% MoM vs November’s 0.3% MoM gain. This was the biggest MoM gain in three months and exceeded consensus expectations of a 0.4% increase. YoY, retail sales rose 5.6% in December vs November’s 4.1% rise. December core personal consumption expenditure (PCE), excluding food and energy, the Fed’s preferred inflation gauge, slowed to 2.9% YoY compared to 3.2% YoY in November, edging closer to the Fed’s goal (the US central bank targets a 2% annual inflation rate). MoM, December core PCE rose 0.2% vs 0.1% in November.

All three major US benchmark indices ended January with positive gains despite a dismal last day of trading after Powell discouraged hopes for a rate cut as early as March in his post-Fed briefing. Nevertheless, the Dow rose 1.2% MoM, while the tech-heavy Nasdaq Composite, aided by further advances from some of the Magnificent Seven stocks (Apple, Microsoft, Google parent Alphabet, Amazon, Nvidia [+25% MoM], Meta Platforms and Tesla), gained 1.0% MoM. The blue-chip S&P 500 index jumped 1.6% MoM.

Major European markets also increased in January, with Germany’s DAX gaining 0.9% MoM, while France’s CAC Index closed 1.5% higher. In economic data, December’s euro area inflation rose to 2.9% vs 2.4% YoY in November, while European Union (EU) annual inflation was 3.4% in December, up from 3.1% in November, according to Eurostat data. Germany’s December inflation accelerated to 3.7% YoY vs November’s 3.2% print, with the main upward pressure coming from a surge in energy prices (+4.1% YoY). The core inflation rate declined to 3.5% YoY vs 3.8% in November – its lowest reading since July 2022. France’s December inflation came in higher at 3.7% YoY vs November’s 3.5% print on the back of a rise in energy prices (+5.6% YoY). Eurozone 4Q23 GDP data saw the bloc narrowly avoid a recession as growth came in 0.1% higher YoY (vs 3Q23’s 0.1% YoY GDP decline) and printed flat MoM.

The UK’s blue-chip FTSE-100 declined by 1.3% in January, as UK equities recorded their worst month since October. December UK inflation rose unexpectedly to 4.0% YoY vs November’s 3.9% YoY print – the first increase in 10 months.

In Asia, China’s equity markets recorded a punishing sell-off in January as concerns over its beleaguered property sector (the liquidation of debt-ridden property giant China Evergrande Group) and lack of stimulus from the government to boost the economy weighed on sentiment. Hong Kong’s Hang Seng Index plummeted 9.2% MoM, while the Shanghai Composite Index was down 6.3% MoM. China’s official January Manufacturing Purchasing Managers Index (PMI) rose slightly, coming in at 49.2 vs December’s 49.0 print. The official non-manufacturing PMI, measuring business sentiment in the services and construction sectors, advanced to 50.7 in January vs 50.4 in December. The 50-point mark separates expansion from contraction. China also posted GDP growth for 2023 and 4Q23 in January, which came in at 5.2% for both periods.

Japanese markets were star performers in January, with the benchmark Nikkei ending 8.4% higher, its best January performance since 1998. Japan’s December core CPI (excluding the volatile fresh food category but including energy costs) came in at 2.3% YoY vs November’s 2.5% print. This marked the slowest increase since June 2022.

Among commodities, following three consecutive months of declines, Brent crude was up 6.1% in January as heightened tension in the Middle East kept the oil price above the US$80/bbl level. After three consecutive months of gains, the spot gold price ended January 1.1% in the red. The platinum price fell 7.0% MoM, while palladium plummeted 10.8%. Natural gas prices recorded a 16.5% MoM decline.

The JSE continued to lag major global markets, with the FTSE JSE All Share Index down 3.0% in January, while the FTSE JSE Capped SWIX retreated by 2.8% MoM. Property counters were the best performers on the JSE for a second month running, with the SA Listed Property Index up 4.1% in January, while the Resi-10 was once again the laggard, declining by 5.9% last month. The Fini-15 lost 2.9% MoM, while the Indi-25 retreated by 1.5%. Highlighting the monthly performances of the biggest shares on the JSE by market cap, the largest company on the exchange, BHP Group, was down 8.4% MoM, while the second-biggest share, Anheuser-Busch InBev, lost 2.6% MoM. Prosus and Naspers increased slightly – by 0.1% and 0.3% MoM, respectively. Other large-cap counters, such as Glencore, dropped 9.7%, while Richemont and British American Tobacco (BAT) rose by 9.7% and 3.0%, respectively. The rand came under pressure against a strong US dollar, weakening by 1.8%.

In local economic data, December headline CPI pulled back to 5.1% vs 5.5% YoY in November, while MoM CPI was unchanged in December. Core inflation (excluding the more volatile price categories of food, fuel, and electricity) remained steady at 4.5% YoY in December despite rising prices for housing and utilities, health and restaurants and hotels. Seasonally adjusted November SA retail sales (released in January) retreated by 0.9% YoY vs October SA retail sales, which declined by 2.5% YoY. The lacklustre performance was despite the Black Friday sales during November. MoM seasonally adjusted retail trade sales increased by 0.4% in November. At its first meeting of 2024, the SA Reserve Bank’s (SARB) Monetary Policy Committee (MPC), as widely expected, cautiously kept the repo rate on hold at 8.25%, with the prime rate remaining at 11.75%.

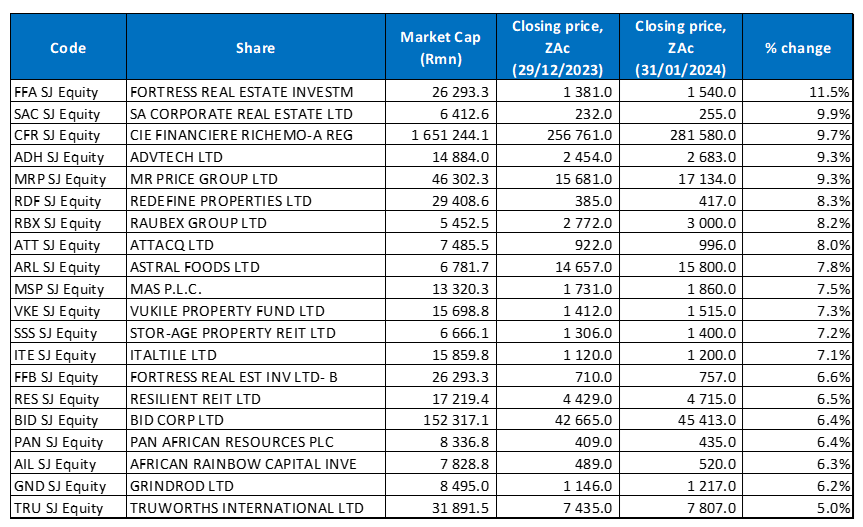

Figure 1: January 2024/YTD 20 best-performing shares, MoM % change

Source: Bloomberg, Anchor

In a lacklustre month on the JSE, property counters proved to be the exception, with a stellar start to the year buoyed by the view that local interest rates have peaked. Fortress Real Estate Investments (Fortress) was January’s best-performing share, rising by 11.5%. Fortress Management confirmed last month that income payouts will likely resume in March when the Group’s results for the six months to December are announced. Management also said it had kept its policy of paying out 100% of distributable earnings to shareholders. This comes after over 90% of Fortress shareholders approved the company’s latest proposal to collapse the A and B share structure.

Fortress was followed by SA Corporate Real Estate in second place with a 9.9% MoM gain. In third position, Swiss-based global luxury goods company Richemont recorded a 9.7% MoM share price gain. Richemont soared after its better-than-expected 3Q23 sales numbers impressed the market. The company reported 3Q23 sales of EUR5,593mn – 4% YoY growth (+8% YoY in constant currency terms [with foreign exchange fluctuations removed]). Its Jewellery Maisons division (which accounts for c. 90% of its profit) reported sales of EUR3,952mn (+12% YoY in constant currency and 2% above consensus estimates). Spending by Chinese nationals grew 42% YoY in 3Q23, driven by local demand and increased spending abroad.

Richemont was followed by private sector education provider ADvTECH, Mr Price Group, and Redefine Properties with MoM advances of 9.3%, 9.3% and 8.3%, respectively. Mr Price’s share price surged after it reported 3Q23 retail sales growth (to end December 2023), which was more than double that of 3Q22 and significantly higher than its competitors. The company’s retail sales rose 9.9% YoY to R13.2bn in the quarter. As measured by the Retailers’ Liaison Committee data, comparable market sales grew 3.4% YoY. Mr Price said its retail sales rose an impressive 15.5% in December, supported by its core apparel division, which it said continued to gain market share. Same-store sales, stripping out new stores, rose by 8% YoY.

Last month, construction and engineering Group Raubex (+8.2% MoM) said that to improve the quality of its R20bn-plus order book, it was looking to lower its exposure to provincial and municipal government customers this year while increasing its private and international customer base and its contracts with toll concessionaries. Besides SA, Raubex has operations in Australia and the rest of Africa. Its latest annual report shows that the company recorded an uptick in private sector work from 27% in 2023 to 31% in its 1H24, while municipal work declined from 6% to 4% of its total order book.

Attacq (+8.0% MoM) released a positive retail trading update in January. The company refers to its malls as “retail-experience hubs” and said that they traded well over the festive period, with most “hubs” reflecting a YoY improvement in turnover and footcount for November and December 2023. At a total portfolio level, November was up 6.4% YoY, while December recorded a 10% YoY jump. The collective December turnover in the Attacq retail-experience hub portfolio vs November reflected a 40.3% MoM increase. This MoM growth exceeded the respective periods’ growth in 2022 of 35.6%. Total footcount in the portfolio rose by 5.3% YoY in November and by 5.6% YoY in December.

The Astral Foods share price rose by 7.8% MoM. After a disastrous 2023, when Astral recorded a R621mn operating loss (the first in its 23 years), the chicken producer said in a voluntary trading update that it expected to return to profitability in 1Q24 (its financial year ends on 30 September) after making headway in addressing some of its recent issues. For 1H24, Astral expects headline EPS to rebound to ZAc654, up at least 300% YoY vs the ZAc162 reported in the same period last year.

Finally, MAS PLC rose by 7.5% MoM. Last year, the share price plummeted when the company announced it was suspending dividends for two years to fund developments. However, in a presentation to investors in January, MAS explained that the suspension was not due to any immediate problem but rather because it is strengthening its balance sheet and planning ahead to 2026.

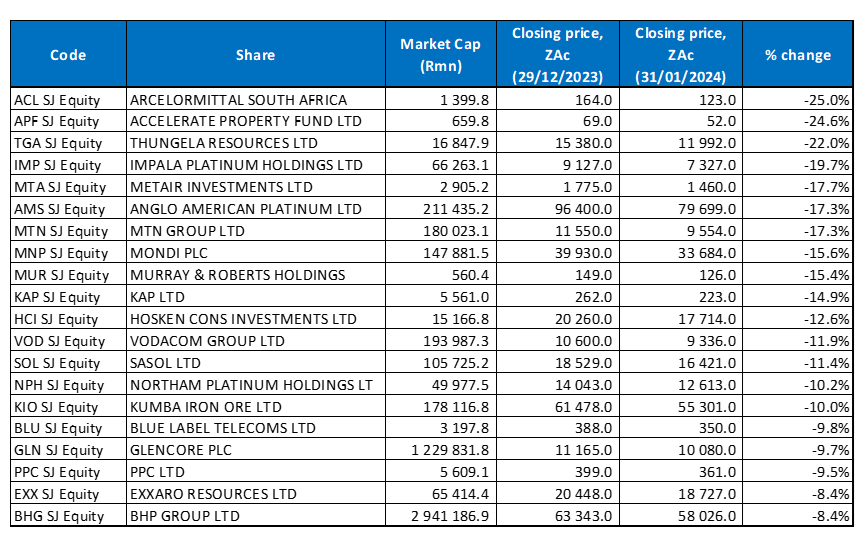

Figure 2: January 2024/YTD 20 worst-performing shares, MoM % change

Source: Bloomberg, Anchor

ArcelorMittal SA (AMSA) was January’s worst-performing share, falling by 25.0% MoM (the share price had declined by 65.4% in 2023). In its trading and business update for the year ended 31 December 2023, the steel producer revealed that it expects to report a headline loss per share of between R1.55 and R1.85, compared with HEPS of R2.34 recorded in the previous year. Moreover, it stated that earnings levels were severely pressurised because of the challenging operating environment, aggravated further by a substantial impairment charge of R2.10bn recognised against the property plant and equipment and other intangible assets of its long steel business only.

AMSA was followed by Accelerate Property Fund (Accelerate) in second place and coal producer Thungela Resources (Thungela) in third, with MoM declines of 24.6% and 22.0%, respectively. Accelerate has been under pressure for a while now, with its share price dropping by 31.7% in 2023. In December, Accelerate, the co-owner of Fourways Mall, approved R1.1bn of asset disposals and a potential R300mn rights issue to reduce its high debt levels.

Thungela, which houses the assets demerged by Anglo American in 2022, recorded a share price drop of 65.4% last year as it continues to struggle with issues at state-owned Transnet Freight Rail (TFR), including corruption and a shortage of locomotives, lower commodity prices and poor demand from China. In 2022, Thungela recorded a stellar performance, which saw the company’s shares soar by 239.1% YoY.

In its 1H24 trading and production update, Impala Platinum (-19.7% MoM) said it expects at least a 20% YoY decline in profit for the six months to 31 December, mainly due to weaker metal prices. Implats’ headline earnings and HEPS came in at R14bn and R16.54, respectively, in the previous half-year period. Platinum group metals (PGMs) prices have fallen sharply over the past year due to weak automotive demand and rising battery-powered electric vehicles (EVs) sales. In 2023, the prices of palladium and platinum dropped 38.6% and 7.7% in US dollar terms, respectively.

Implats was followed by automotive components manufacturer and distributor Metair (-17.7% MoM), Anglo American Platinum (Amplats; -17.3% MoM) and MTN Group (-17.3% MoM). In January, Metair announced the appointment of Paul O’Flaherty as its new CEO, effective 1 February 2024. Meanwhile, like its peers, Amplats (which rallied by 20.9% in December) has been caught up in the depressed PGM market.

Mondi PLC (-15.6% MoM), engineering and construction firm Murray & Roberts (MUR; -15.4% MoM) and KAP Ltd (-14.9% MoM) rounded out January’s ten worst-performing shares. After its strong share price run in December (+129.2% MoM), MUR returned some of those gains in January. In early December, MUR said that “meaningful progress” was being made to reduce its high debt level, that it had significantly lowered overhead costs, and that it would continue to focus on operational efficiencies and liquidity management.