OPTION 1

DIY (Do it yourself)

For those who prefer to take the reins, our platform offers self-directed investment options, allowing you full control over your portfolio choices.

OPTION 2

Guided

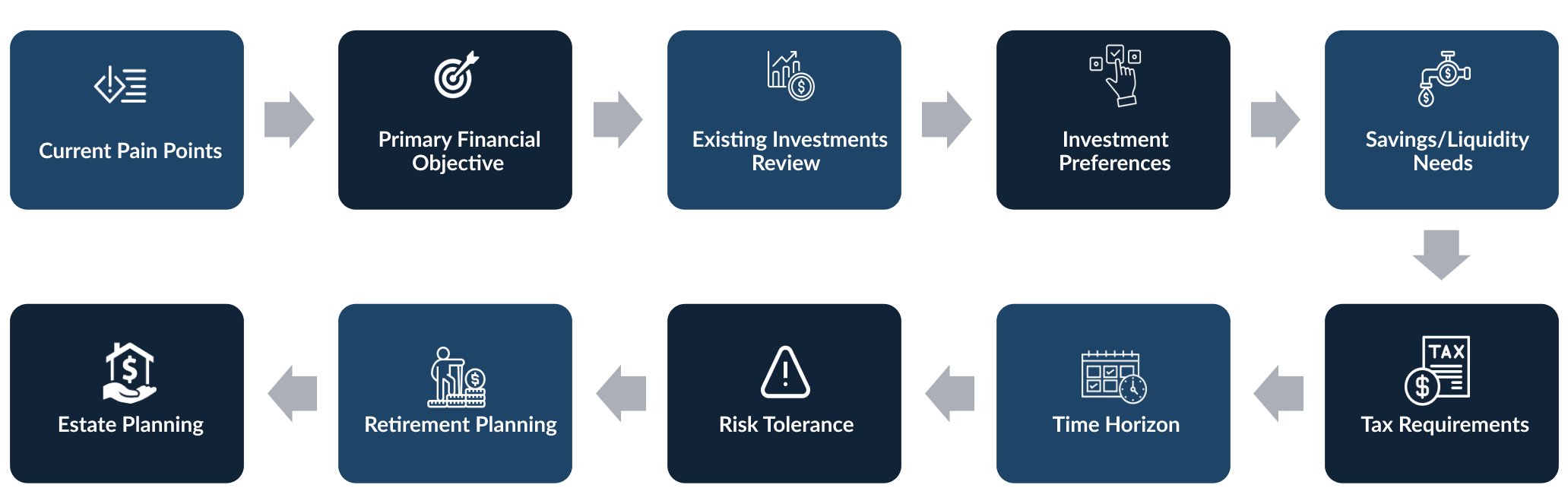

Ideal for executives seeking expert advice without relinquishing control. This option provides access to our wealth managers for guidance, ensuring your decisions are informed and strategic.

OPTION 3

Managed

Our full-service solution where our team handles all aspects of your investment portfolio. Tailored for busy C-suite professionals, this option guarantees that your investments are actively managed to align with your financial goals.