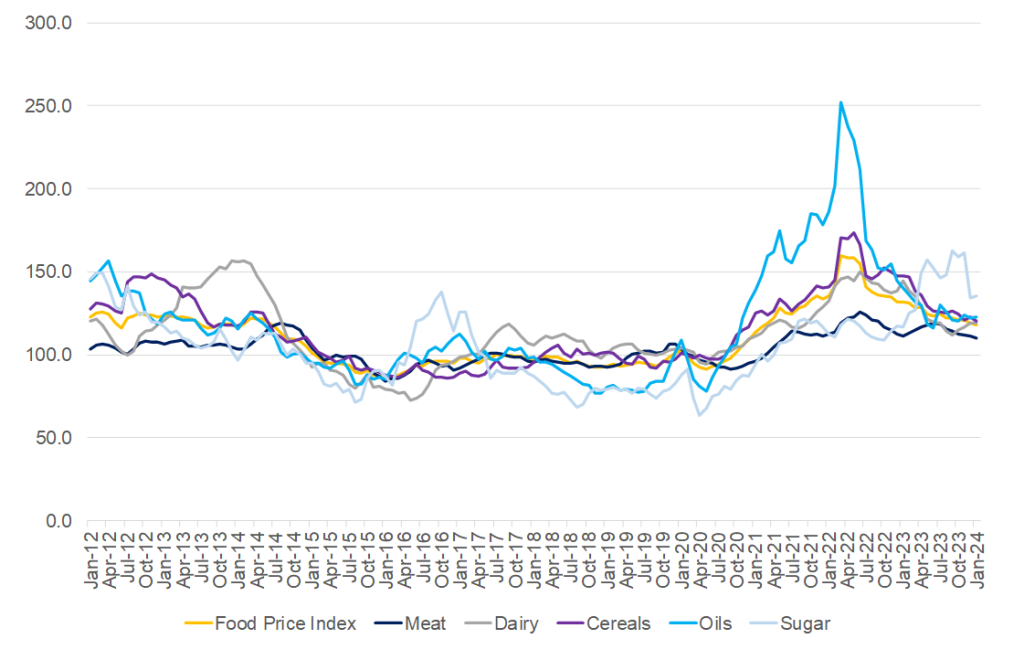

In January, the FAO Global Food Price Index (FFPI), which measures the monthly change in the international prices of a basket of food commodities, declined by 1% MoM and by 10.4% YoY. Decreases in the price indices for cereals and meat more than offset an increase in the sugar price index, while those for dairy and vegetable oils only registered slight adjustments. Global wheat export prices declined in January, driven by intense competition among exporters and the arrival of recently harvested supplies in the Southern Hemisphere countries. Meanwhile, the price of maize fell sharply – reflecting improved crop conditions and the start of the harvest in Argentina and larger supplies in the US. On the other hand, sugar prices increased due to concerns over the likely impact of below-average rains in Brazil on sugarcane crops harvested in April 2023, coupled with unfavourable production prospects in Thailand and India.

Figure 1: FAO Global Food Price Index, January 2012 to January 2024

Source: FAO, Anchor

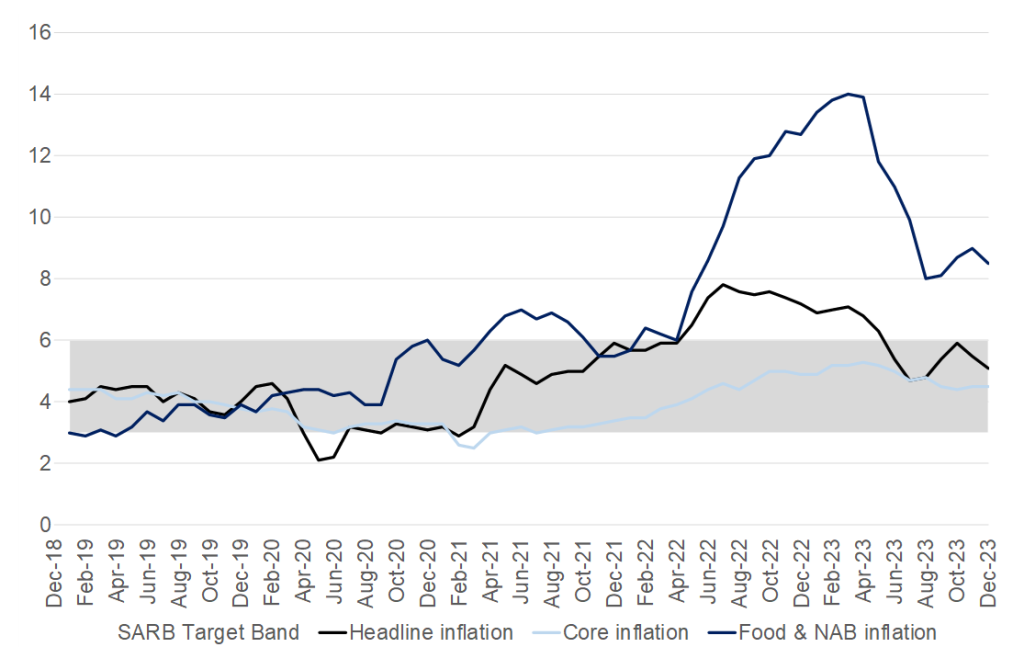

In South Africa (SA), annual consumer price inflation, as measured by the consumer price index (CPI), pulled back in December, easing to 5.1% from 5.5% in November. On a MoM basis, CPI was unchanged in December. Core inflation (excluding the more volatile categories of food, fuel, and electricity prices) remained steady at 4.5% YoY in December despite prices for housing and utilities, health and restaurants and hotels increasing. As such, core inflation remains relatively subdued, particularly on the demand side. The average core inflation for 2023 was 4.8%, compared with 4.3% in 2022. Notably, food and non-alcoholic beverages prices decelerated for the first time in four months, printing at 8.5% YoY from 9.0% YoY in November. The decline was supported by ongoing moderation in bread and cereals prices and favourable declines in vegetable prices. Nonetheless, other categories recorded price increases – such as meat prices, which continue to be hampered by high poultry prices. The downward trend in fuel prices continued in December, decreasing by 2.5% YoY compared with a 1.8% YoY decline in November. This was mainly due to lower oil prices, which more than offset the slight depreciation of the rand.

Figure 2: SA inflation, January 2019 to December 2023 (YoY, % change)

Source: Stats SA, Anchor

The 2023 inflation results are wrapped up with the December 2023 release. The yearly average inflation rate stood at 6.0%, a decrease from 2022’s 6.9%. In the initial five months of 2023 (January–May), inflation remained relatively high, consistently surpassing 6.0%. However, inflation eased below this threshold for the remaining seven months of the year. The peak 2023 inflation rate occurred in March at 7.1%, while the lowest was recorded in July at 4.7%. Product categories that concluded the year with annual rates higher than 6.0% in December included food & non-alcoholic beverages (8.5%), restaurants & hotels (7.0%), and health (6.5%).

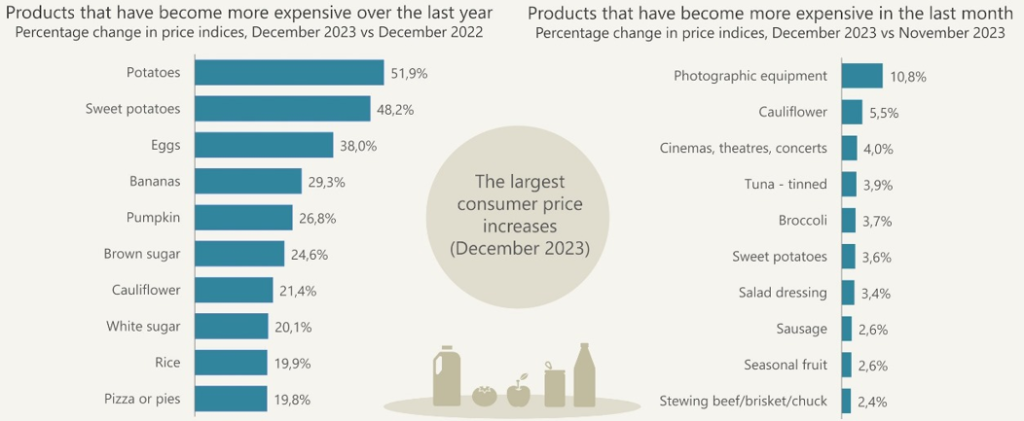

Figure 3: Products that recorded the most significant annual and monthly price increases in December

Source: Stats SA

Considering specific individual food price trends in more detail, with regards to vegetables and fruit, 2023 proved to be an interesting year on the domestic market. Sales on the domestic municipal markets totalled R24.55bn, marking a notable 21% YoY increase. However, there was a 9% YoY decrease in volume, resulting in the sale of just over 3mn tonnes of fresh produce. Vegetables accounted for 74%, while fruit comprised the remaining 26%. External factors beyond the farm level (such as challenges in irrigation due to persistent loadshedding and high input costs) contributed significantly to the decrease in supply. This led to a reduction in planted areas and sub-optimal irrigation practices, ultimately impacting yields. Despite the decline in volume, prices surged, generating more value from the lower supply. Fruit prices rose by 26% YoY, increasing from R7.53/kg to R9.50/kg on average, while vegetable prices witnessed an even more significant jump of 36% YoY, climbing from R5.61/kg to R7.64/kg. Potatoes, onions, and tomatoes accounted for half of all fresh produce market sales in 2023. Notably, these staple vegetables became pricier than the average for other vegetables for the first time since 2009, with an average YoY increase of 45%, compared to a 13% YoY rise for other vegetables.

In the local grains and oilseed market, sunflower seed prices rose 2.4% MoM, aligning with the global trend. Conversely, soybean prices experienced a decline of 2.6% MoM in December, reflecting softer prices for soybeans and soybean oil on the international market. When comparing the average prices in 2023 to those in 2022, sunflower seed prices were down by 13.2% and soybean prices by 3.3%. These declines were predominantly influenced by dynamics in the global market. In the soybean market, continuous bumper crops in SA contributed to higher stock levels, thereby maintaining prices at export parity levels.

Much in line with world markets, grain prices in December maintained a positive trajectory in the local market, with price increases for maize (yellow 5.7% YoY and white 5.2% YoY) and wheat (+0.1% YoY). Due to robust maize production surpluses in recent seasons, domestic prices are primarily influenced by global market trends and currency exchange rates. Initially, concerns were raised regarding the size of the 2024 crop due to predictions of a strong El Niño and delayed onset of rains in summer production regions. However, most areas were eventually planted, albeit with some delay, and improved weather conditions throughout January have bolstered market sentiment. Although there was a slight increase in December, prices for cereal commodities were generally lower on average in 2023 compared to 2022.

However, in the meat market, domestic meat market trends diverged from international patterns in December, with most local meat prices experiencing an uptick. This phenomenon is typical during the festive season when demand increases. Despite lower global prices, poultry prices saw only a marginal 0.2% YoY increase. Import levels rose sufficiently despite port delays, averting any shortages despite the significant impact of the avian influenza outbreak, which reduced the national flock. Given recent price hikes, December may have witnessed softer-than-usual demand. In the red meat sector, beef carcass prices surged by 4.4% YoY, buoyed by heightened festive season demand and the reopening of the Chinese export market in October after a closure in May 2022 due to foot-and-mouth disease concerns. In contrast, sheep meat demand remained subdued amid challenging economic conditions. The pork industry stood out with a trend contrary to that of other meat types, experiencing a 3.4% YoY price decrease in December.