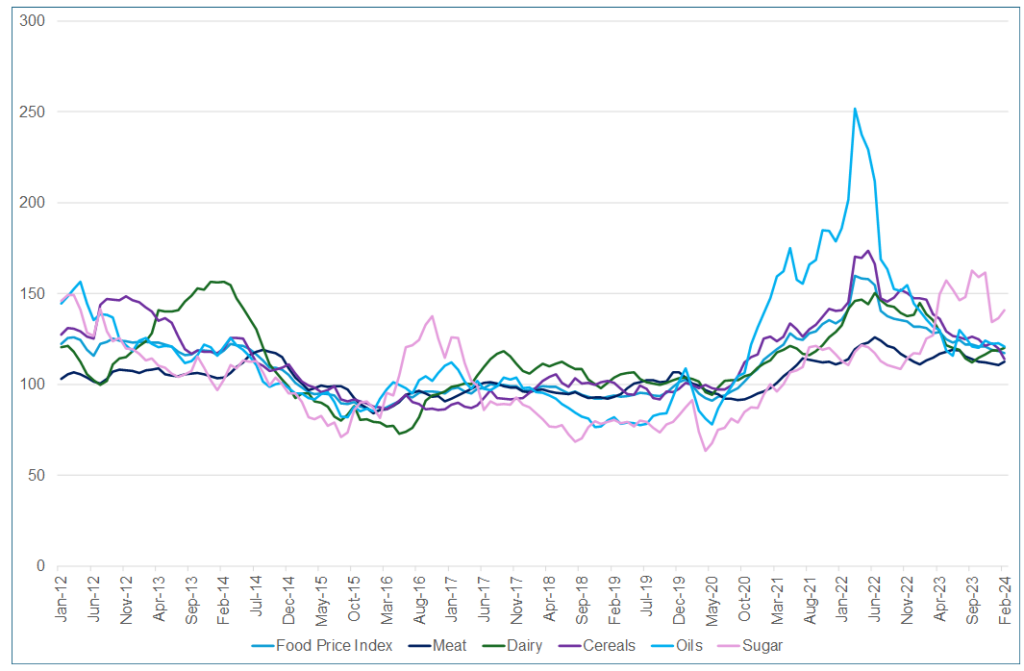

In February, the UN Food and Agricultural Organization (FAO) Global Food Price Index (FFPI), which measures the monthly change in the international prices of a basket of food commodities, fell for a seventh month in a row – declining by 0.7% from its revised January level. This is as decreases in the price indices for cereals and vegetable oils slightly more than offset increases in sugar, meat, and dairy products. The index was also down 10.5% YoY. The February 2024 reading marks the lowest level since February 2021. According to the FAO, maize export prices dropped the most amid expectations of large harvests in South America and competitive prices offered by Ukraine. In contrast, international wheat prices declined primarily due to a strong export pace from the Russian Federation. International rice prices also fell by 1.6% MoM in February. Conversely, the FAO Sugar Price Index rose by 3.2% MoM in February, while the FAO Meat Price Index advanced 1.8% MoM, with poultry meat quotations rising the most, followed by those for bovine meat, impacted by heavy rains disrupting cattle transportation in Australia.

Figure 1: FAO Global Food Price Index, January 2012 to February 2024

Source: FAO, Anchor

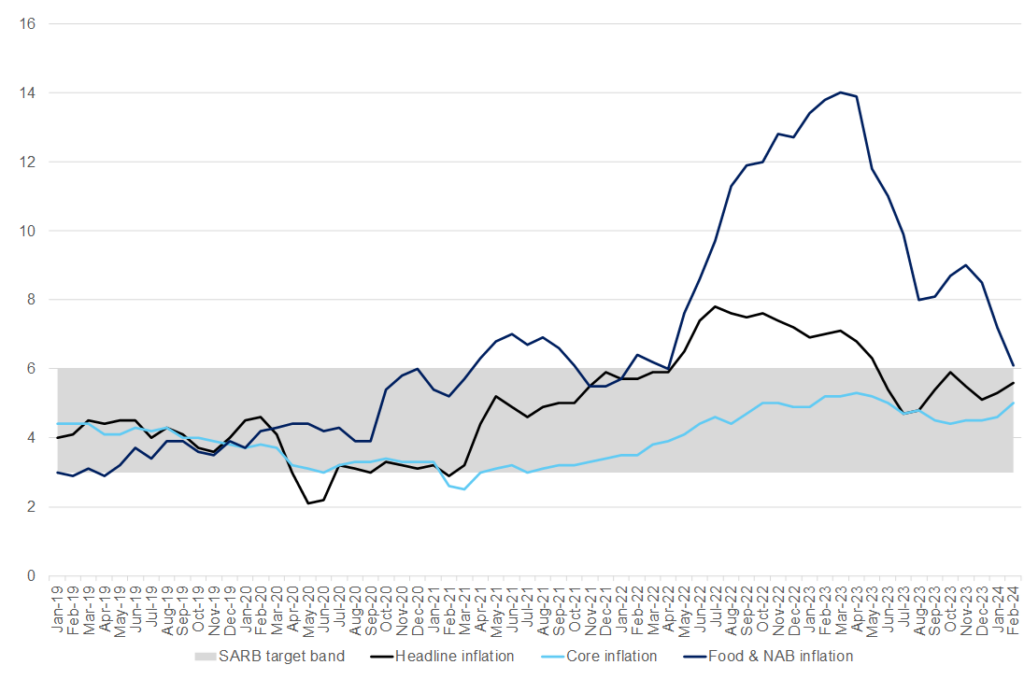

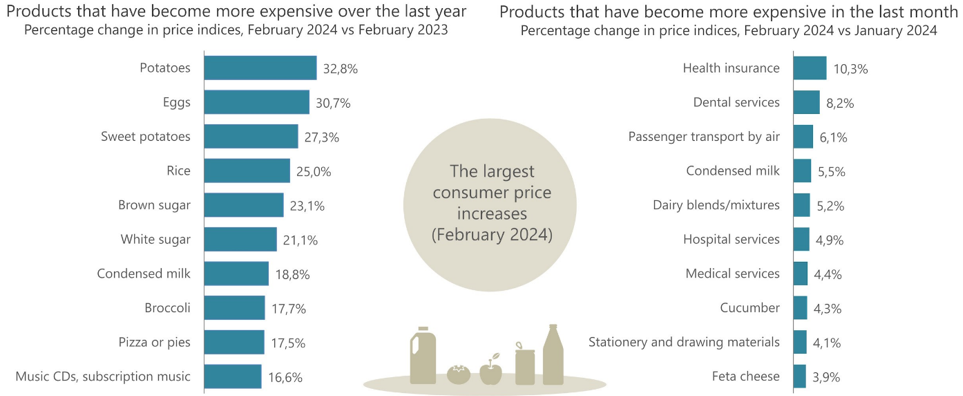

Unfortunately, for South African (SA) consumers, February headline inflation, as measured by the Consumer Price Index (CPI), climbed to a four-month high – printing at 5.6% YoY from 5.3% YoY in January. Product categories that drove much of the upward momentum include housing & utilities, miscellaneous goods & services (most notably, insurance), food and non-alcoholic beverages (NAB) and transport. More positively, however, food & NAB inflation slowed to 6.1% in February, with most food price categories recording lower annual rates. Notably, meat and egg prices are recovering from the impact of avian influenza (AI, bird flu), while the fruit and vegetable segment is rebounding from past challenges with harvests and quality, exacerbated by irrigation difficulties linked to power outages. Nonetheless, food prices continue to cause anxiety for the SA Reserve Bank (SARB). While they are continuing to moderate since the highs of last year, risks to the upside are increasing given the various ongoing supply shocks, particularly ahead of the forecast El Niño weather pattern (as already witnessed with large dry spells across the country) and amid relatively large swings in crucial commodity prices (including oil) and the rand exchange rate. White maize futures have risen 9.8% since the start of March, with increasing signs that the dry weather conditions may cause more damage to the summer crop than initially expected. Brent crude oil prices have also edged higher since the January Monetary Policy Meeting (MPC) meeting. Whilst SA had a more gradual acceleration in inflation than many peer countries (with a lower peak) since COVID-19, the return to the 4.5% midpoint of the SARB’s target band has been slow and remains at a distance.

Figure 2: SA inflation, January 2019 to February 2024 (YoY, % change)

Source: Stats SA, Anchor

Figure 3: Products that recorded the most significant annual and monthly price increases in February

Source: Stats SA

Considering specific individual food price trends in more detail, in contrast to global trends, maize prices within the domestic market surged in February, with white maize prices rising by 9.5% MoM and yellow maize by 3.2% MoM. This increase was propelled by a weakened rand vs US dollar exchange rate and apprehension surrounding the current maize harvest. By the end of February, the initial production forecast from the Crop Estimates Committee (CEC) indicated a projected decrease of 12.6% in the total domestic maize yield – down to 14.5mn tonnes from the previous season’s 16.4mn tonnes. The persistent hot and dry weather conditions, attributed to the ongoing El Niño climatic pattern, also continued into March. On 26 March, the second crop estimate was released, estimating the combined white and yellow maize harvest at 13.2mn tonnes. Considering that the total domestic demand for maize in feed and human consumption markets is around 12mn tonnes p.a., SA appears to have an adequate maize supply to meet local needs. Moreover, beginning the season with a carry-over stock of 2.3mn tonnes suggests the potential for SA to export white maize to its neighbouring markets as usual. However, the El Niño phenomenon has led to significant concerns in Southern Africa, particularly with anticipated major crop failures in Zimbabwe and parts of Zambia. Consequently, shortages, particularly in white maize, are rapidly increasing in these regional markets. This situation will likely sustain a notable price difference between white and yellow maize.

In February, global meat prices rebounded by 1.8% MoM, marking a reversal after seven consecutive months of decline. Poultry prices experienced a notable upswing of 4.0% MoM, driven by renewed demand from key importing nations. Bovine prices rose by 3.0% MoM, attributed to a decrease in supply from Australia caused by severe rains disrupting cattle transportation. Tight supply and slight improvements in demand for pig meat from China and Western Europe bolstered pig meat prices by 1.3% MoM. Conversely, ovine meat prices declined by 3.9% MoM, influenced by Australia’s heightened production levels following flock rebuilding efforts and reduced imports from China. Local meat prices generally moved counter to international trends (except for sheep meat), primarily due to a weakened local exchange rate. In February, the livestock sector faced pressure as prices for all meat types saw marginal decreases amidst softened demand. Notably, pig meat prices experienced the sharpest decline, down by 2.9% MoM, attributed to increased affordability following the sharp rise in poultry prices towards the end of 2023 due to the AI outbreak. Furthermore, the sector faced challenges with reports of an African swine fever (ASF) outbreak in early February, further dampening demand post-festive season. Poultry prices have also contracted since December 2023, indicating improved local chicken supply following the AI outbreak. Imports of fertile eggs were crucial in maintaining a consistent day-old chick supply, contributing to production stability. Compared to January, poultry prices dipped by 2.1% MoM in February 2024, using individually quick freezing (IQF) pieces as a reference. Despite these developments, the egg industry continues to face pressure and is likely experiencing a slower recovery from the AI outbreak.

Global dairy prices increased in February, up 1.1% MoM, with the most significant rise in butter prices. This surge was driven by heightened demand in Asian markets and decreased milk production across Oceania. In the domestic sphere, the latest (January 2024) producer price data (as released by the Milk Producers Organisation) indicates a 3.5% MoM increase and a 14.0% YoY jump in raw milk prices. This suggests that while demand for raw milk to produce dairy products may be low, producers are nevertheless grappling with the challenge of maintaining supply at a level commensurate with demand, albeit at higher costs. This is due primarily to disruptions in the supply chain, particularly concerning electricity supply.

Overall, we continue to view food prices as a critical upside risk given the various ongoing supply shocks, particularly ahead of the forecast El Niño weather pattern and amid relatively large swings in crucial commodity prices (including oil) and the rand exchange rate. Risks to the SA food inflation outlook, in particular, have deteriorated as geopolitical tensions have worsened, and the deteriorating performance at our key ports adds uncertainty to the future inflation path.