SUMMARY

Below we examine the investment case for the major US online travel agencies (OTAs), and we find that, unsurprisingly, the COVID-19 pandemic has had a devastating impact on industry fundamentals. However, despite this, the performance of listed OTAs has exceeded that of global equity markets since the end of 1Q20. Nevertheless, companies in the industry continue to guide for their earnings to remain under pressure over the short term and we believe that the reason is that investors are looking past the length of the recovery and instead using shares of OTAs to gain exposure to the recovery theme. We also examine two longer-term trends in the industry. First, we find that the industry is relatively mature. Moderate annual growth in global travel spending and an already high penetration of travel spending occurring online, has driven this maturity, with travel experiences and alternative accommodations representing new growth opportunities. Second, we conclude that increased competition from Google, and subsequent declining returns on OTAs’ marketing spend, is pressuring margins for these companies. For these reasons, we remain cautious on online travel.

INTRODUCTION

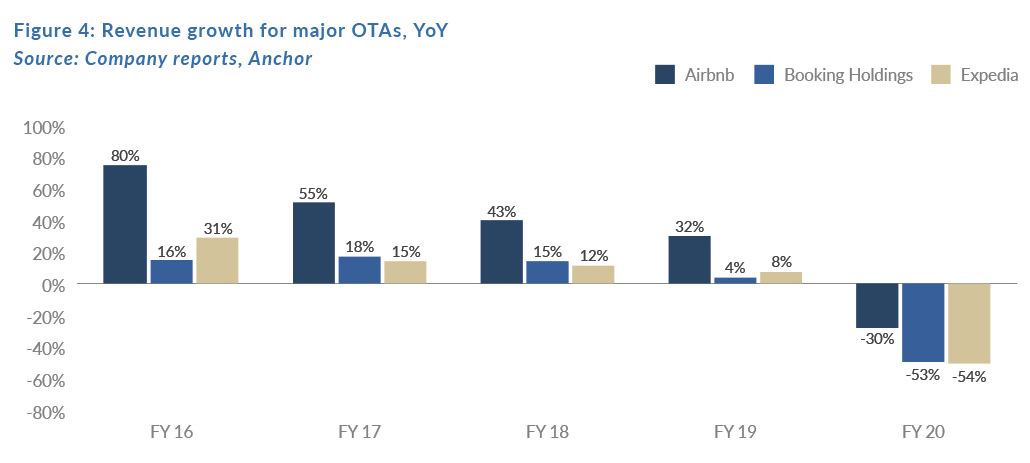

As mentioned, COVID-19 had a devastating effect on the fundamentals for OTAs and, from 1Q20 onwards, international travel across the world has declined dramatically. Global scheduled flights were down 69% YoY in May 2020 and, although slightly improved, they were still down 48% YoY in September 2020. Hotel occupancy rates in the US and Europe fell by 28% and 52% YoY, respectively. Lower travel activity also fed through into the OTAs’ financial results, with the average revenue decline for major OTAs standing at 46% YoY in 2020. After generating $7.1bn of free cash flow (FCF) in 2019, the major listed OTAs burned through $5.7bn in 2020. To deal with the cash burn, these major OTAs raised a net $12.3bn in debt and equity last year.

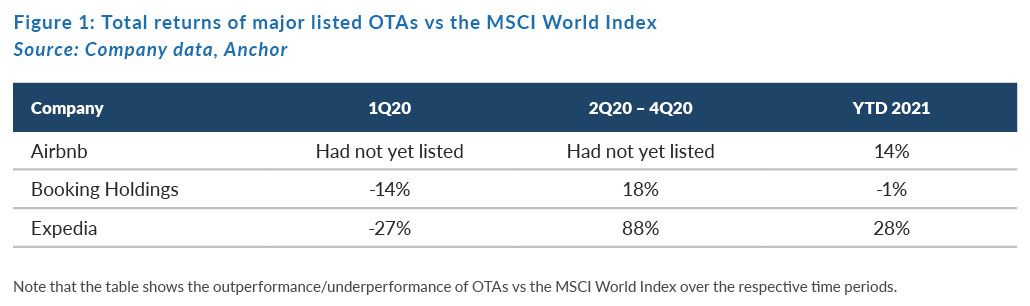

OTAs ARE OUTPERFORMING GLOBAL MARKETS

Still, the major OTAs have outperformed global equity markets since the end of 1Q20 (see Figure 1).

“We continue to believe it will be years and not quarters before travel returns to pre-COVID-19 levels.” – Glenn Fogel, Booking Holdings CEO, 4Q20 earnings call.

Major OTAs’ earnings have continued to be poor after 2Q20, so we note that the outperformance of their share prices has not been driven by earnings growth. Furthermore, several OTAs have either guided to continued losses in 2021 or have suggested that any recovery will take years rather than quarters.

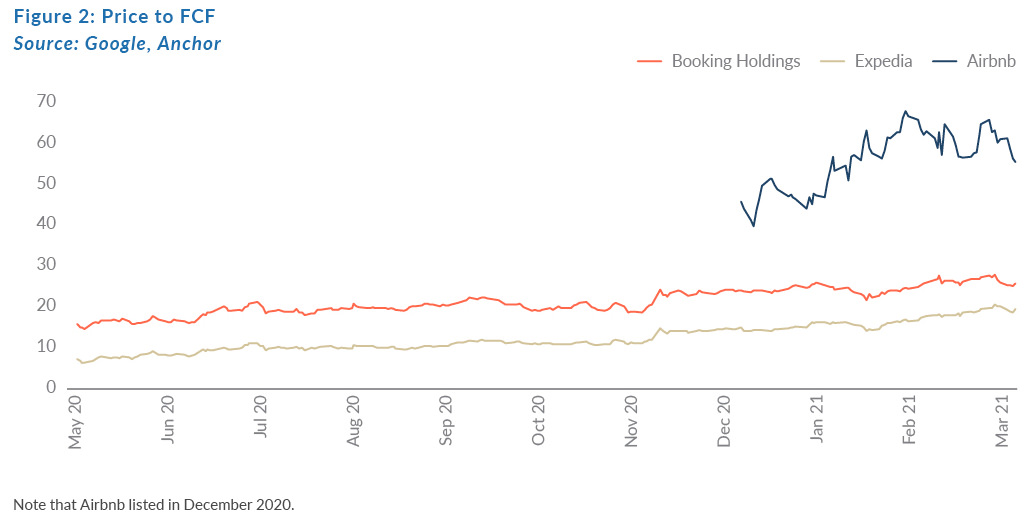

Given this poor short-term earnings outlook, we believe the sector’s outperformance in equity markets since 1Q20 has been mainly driven by investors using it to gain exposure to a recovery trade (buying into those industries that are especially sensitive to an economic recovery and/or return to “normal”). The combination of earnings remaining under pressure and strong share price performances has led to a re-rating in the valuation multiples placed on these businesses. In Figure 2, we measure OTAs’ share prices to FCF using 2019 FCF figures to avoid the effects of the pandemic in 2020. Price to FCF multiples have re-rated significantly and no longer appear cheap for the sector.

A MATURE INDUSTRY?

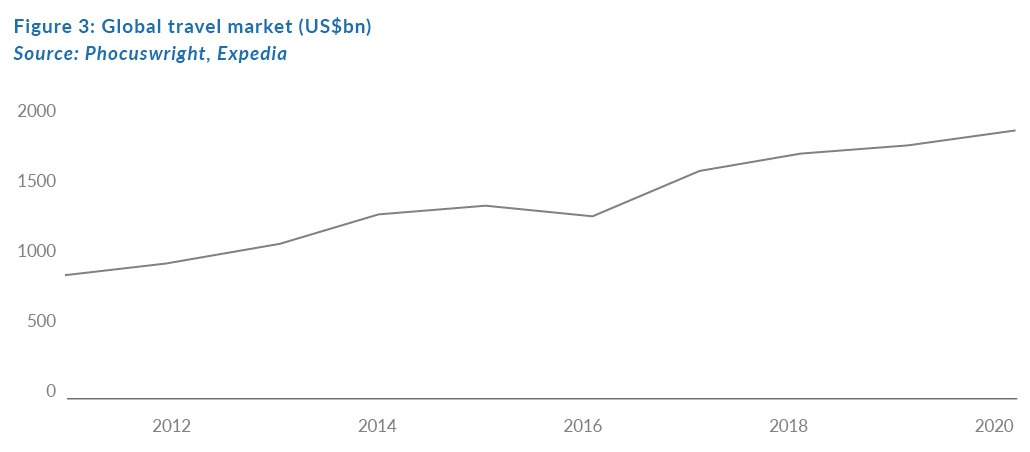

Online travel is also a relatively mature industry due to global travel spend typically growing moderately over time. Travel expenditures depend on population and discretionary income growth and both these data tend to grow moderately over time. We estimate that travel spend has grown by 3%, 7%, and 8% p.a. over the past three, five, and seven years, respectively.

Online travel is also a relatively mature industry due to an already high penetration of travel spend occurring online. In 2019, 45% of all travel spend in the US and Europe took place online, according to Phocuswright. The online travel industry has thus captured a meaningful proportion of its addressable market already.

However, booking travel experiences online is one possible future source of growth for the industry, although it is small in comparison to the accommodations business. The overall addressable market for travel is estimated to have been US$1.5trn in 2019. Most of that money goes towards short-term stays (less than 28 days), which accounts for $1.25trn. The remaining $250bn is paid towards travel experiences. The idea is for travellers to be able to book not only their accommodation for a trip online, but also the experiences that they will have on the trip. OTAs hope that travellers going to Paris, for example, will also book their accommodation in Paris and their tickets to tourist experiences such as a visit to the Eiffel Tower with them. Over time, the industry anticipates that experiences can provide growth to help offset the more mature short-term stay business.

Alternative accommodations are another source of growth for the travel industry. Alternative accommodations allow travellers to stay in the homes, or unique spaces, of hosts – typically individuals. Airbnb is the market leader in this category. The company’s higher growth relative to other major OTAs exemplifies the impressive growth being offered by this category.

Traditional OTAs are investing in the space both to defend their incumbent businesses and to benefit from the higher growth offered in alternative accommodations.

COMPETITION FROM SEARCH ENGINES

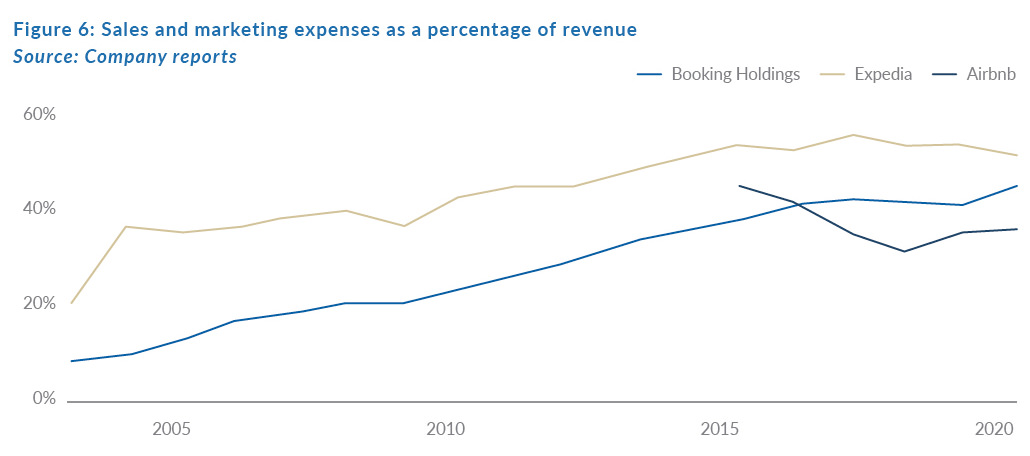

However, the profitability of OTAs faces headwinds from increased competition with prominent search engines such as Google, and declining returns on marketing spend. Sales and marketing expenses are typically the biggest expense for an OTA, ranging anywhere from 30% to 50% of their total revenue. It consists of performance and brand marketing. An OTA incurs performance marketing expenses to drive traffic to its websites and apps from popular search engines or social media platforms. Brand marketing expenses are incurred to increase the strength of an OTA’s brand, which hopefully leads to more unpaid, direct traffic (rather than paid traffic from performance marketing) over time.

Historically, OTAs were able to pay for traffic via performance marketing from large internet platforms (Google, in particular), at attractive rates. That dynamic has recently changed as Google launched its own metasearch products such as Google Flights, Google Travel, and Google Hotel Ads. These services provide potential customers with thorough travel planning and booking services comparable to those of OTAs.

As a result of Google’s travel offerings, OTAs’ offerings are now shown less prominently to potential customers in their Google search results. Over time, OTAs have had to spend increasing amounts to generate comparable traffic from performance marketing. Sales and marketing expenses as a percentage of revenue for these OTAs have also increased by an alarming rate over time as Figure 6 below shows.

HOW HAVE OTAs RESPONDED?

OTAs have responded to Google’s move by trying to drive more direct traffic to their platforms. However, doing so is a difficult balancing act – OTAs must balance the benefit of higher direct traffic over time, with the cost of performance marketing becoming more attractive to rivals as OTAs reduce their own performance marketing spend. We believe declining returns on marketing spend will continue to pressure the profitability of OTAs over time.

CONCLUSION

After the devastating impact of the COVID-19 pandemic on industry fundamentals, OTAs’ share prices have re-rated strongly. We believe that this has been driven by investors looking past an unknown length of time before a recovery happens and, instead, using the share price performances of OTAs to gain exposure to the recovery theme. However, it is also clear to us that the industry is relatively mature and that margins are being pressured by more competition from Google and the decline in returns from marketing spend that has resulted from this. So, in terms of our investment case for these companies, we remain cautious on online travel due to the longer-term industry trends, coupled with the impressive re-ratings already being enjoyed by these shares after 1Q20 vs global equity markets.