At the moment, two key questions are being asked about bonds: First; what just happened to bonds? And second, is this a good time to be buying bonds? Related to these questions is a general atmosphere of concern around the implications of current bond market volatility for equities. In this note, we unpack our views on bonds and we attempt to answer these questions.

What happened to bonds?

There are currently three key global market drivers, these are China, the US bond taper, and the oil price.

Concerns around China

Recent market volatility started with Chinese property development company, Evergrande, announcing that it was under financial stress. The challenge is that Evergrande relies heavily on the shadow banking system in China for funding, essentially taking deposits from the man in the street to fund its development projects. A default by Evergrande could have a massive impact on the savings of thousands of households in China and could potentially negatively impact confidence in the entire US$12trn shadow banking system in that country. However, we note that the Chinese regulator is getting involved and seems to be playing for time to slowly defuse the situation. We think that this will likely work out well for the shadow banking system and that, in time, this storm cloud will pass. The issue here is that, without a doubt, there are many more Evergrandes out there, lurking within the system with the potential to explode into a full-blown crisis and therefore, in our view, this will be an on-again, off-again crisis in China.

Financial markets have responded to the above by placing China under a microscope, and global markets do not like what they are seeing. The country’s manufacturing purchasing manager’s index (PMI) slid to 49.6 in September (below 50 implies that the country’s manufacturing sector is contracting rather than expanding). In addition, China’s producer price inflation (PPI) has also pushed up to 9.5%, implying that higher commodity prices are becoming a problem and 44% of manufacturing businesses seem to be operating in an environment of loadshedding as the country grapples with disruptions of its energy supply. Coupled with this, we have seen a step up in regulatory activity often with draconian and unexpected actions. All these factors combined have global investors worried about the outlook for China.

It is there not surprising that markets are becoming negative on China and consequently on emerging markets (EMs) as a whole. EM currencies are down, EM shares are down, and EM bonds are down. This risk-off environment with regards to EMs has resulted in a difficult month for our portfolios. While it has been a difficult period, in our view, markets will recover and we have been using this as an opportunity to increase our market exposure in the portfolios as we believe that sentiment towards EMs is unduly negative at the moment.

The US bond taper

At its September 2021 meeting, the US Federal Reserve (Fed) signalled that a tapering of its bond purchasing programme was imminent. This was broadly expected, and we have been writing for nearly a year that we expect the Fed to slow down its bond-buying programme towards the end of 2021. We expect that the start of tapering will be announced at the Fed’s November meeting.

In assessing the impact on bonds, we look towards what previously happened when central banks tapered their bond-buying programmes.

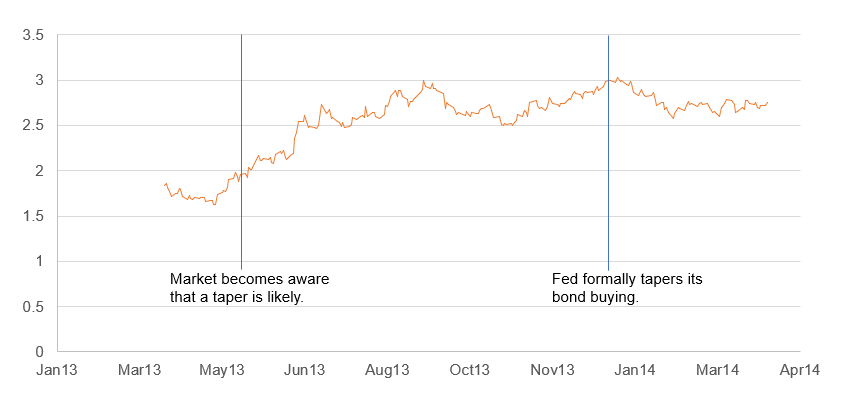

The taper tantrum, as it has become known, was sparked on 22 May 2013, when then-Fed Chair Ben Bernanke revealed the Fed’s plans to taper its bond-buying at his appearance before Congress. The US 10-year bond yield was at 1.92% at the time. The Fed eventually formally tapered its bond purchasing programme at its meeting held on 17 and 18 December 2013, at which point the US 10-year bond yield had risen to 2.90%. The bond sell-off started when the market was warned of the upcoming taper. Surprisingly, in the three months following the December taper, bond yields rallied to 2.70% (as at 18 March 2014) and continued to rally for a while thereafter. Bonds sell off on the expectation of a taper, although we note that when the taper is formally announced bonds seem to gradually recover again.

Figure 1: US 10-year bond yields, April 2013 to April 2014

Source: Anchor, Thomson Reuters

Looking towards the European taper of 2016, the same phenomenon occurred. German10-year bonds started October 2016 at a yield of -0.10%. Markets were jolted when the European Central Bank (ECB) announced that it was looking at tapering its bond buying. German bonds sold off to reach yields of 0.40% by 12 December 2016. The ECB reduced its bond buying from EUR80bn to EUR60bn at the December meeting. Four months later (in April 2017), German bond yields had dropped to 0.3% again and continued to slide lower over time.

US bond yields have again sold off in anticipation of the taper rising from 1.3% at the time of the September Fed meeting to c. 1.6% currently. We think the fact that the taper was far more broadly expected and that the bond buying, as a proportion of issuance, is far lower than last time means that the market reaction should be less pronounced than before. For now, however, the sell-off in US bonds has had a knock-on effect on bond yields across the globe.

Oil prices

Europe uses natural gas to heat many of its homes and the continent is going into the 2021 winter with critically low inventories of gas. Simultaneously, China and Europe are switching from coal generation of electricity to gas-powered plants, thus putting additional demand on already low inventories. The natural gas market is in a structural deficit, with low inventories and it is likely to remain in this position for a while. Gas prices have been increasing rapidly and countries are substituting gas with coal and oil for energy production. We have consequently seen the price of thermal coal and oil respond by moving markedly higher. The Organization of the Petroleum Exporting Countries (OPEC) has also increased its supply of oil by 400,000 barrels per day, which is still insufficient to meet additional demand and oil prices are likely to remain high.

In turn, oil prices feed into the petrol price, which is likely to rise markedly. Transport costs (either directly or indirectly) represent a significant portion of the inflation basket for EMs. The market expects that several EMs will need to hike interest rates as the inflation surge comes through. The market has, accordingly, increased the interest rate hikes expectations in South Africa (SA) and several EMs. Financial markets are prone to overreaction and, for now, are pricing in that the South African Reserve Bank (SARB) will hike rates at every meeting for the next two-and-a-half years. This pricing seems extreme to us and we think that the market is pricing more on sentiment than on fundamentals right now. Unfortunately, this has also pushed SA bonds weaker.

Summing up interest rate movements

Bond yields in SA have responded to the pressure from the above highlighted three factors by moving swiftly higher. On 23 September, the SA bond maturing in 2030 was trading at a yield of 9.09%. Eighteen days later, that same bond is trading at a yield of 9.55%. This has resulted in a stark reduction in bond prices. This is incredibly uncomfortable for us as the Flexible Income Fund returned a negative 0.07% last month and the bond fund lost 2.11%. These losses have extended into the first days of October, with the portfolios being down 0.3% and 0.7%, respectively, as at 10 October. However, as painful as the past 18 days have been, we caution against looking at the portfolios for a period of only 18 days. Over a longer period of, for example, six months, these portfolios have outperformed cash investments.

The nature of bonds is that they are mean-reverting. That means that yields tend to gravitate towards a central level. At times of extreme pessimism, as we are seeing now, the yields are above those levels, yet historically the yields have always recovered in time. Investors are still being paid their interest distributions which are not really impacted. Therefore, we advocate for investors to look through the volatility of the last few days as we expect that, in time, bonds will recover, and you will continue to earn your interest income while you wait.

Is this a good time to buy bonds?

Looking at the above factors, we think that EM sentiment will recover from current levels and we also believe that the bond taper will be announced in the next few weeks, which usually heralds a recovery in bonds. We are also of the view that the market is overexuberant as to the number of rate hikes that are being priced in. All of these factors seem to imply that sentiment has pushed bond prices weaker than fundamentals justify. Therefore, we do think that this is a reasonable time to be buying bonds or to slightly increase your bond allocation.

What about the impact of higher global bond yields on equities?

There is little doubt that lower bond yields have been a tailwind for equities. On an absolute basis like P/E ratios, global equities might appear expensive, yet on a relative basis (for example, a dividend yield vs bond yield basis or a risk premium above bonds basis), equities are still cheap relative to historic levels. This gives equities a breathing space before higher yields might become a problem. We highlight that over the weekend, Goldman Sachs estimated that 10-year bond yields need to rise to about 2.25% before equities look expensive vs bonds. That is still quite far from current levels. Perhaps it is not the absolute level of yields that are a problem for equities, but rather those periods of sharp, unexpected sell-offs of bonds, which tend to cause pressure on equity prices. Therefore, we should not be as focused on the absolute level of yields as we should be on the volatility of yields. If this is the case, then the fact that yields tend to recover and stabilise after a taper is formally underway means that next month’s taper announcement might indeed herald a period of supportive calm for both equities and bonds.