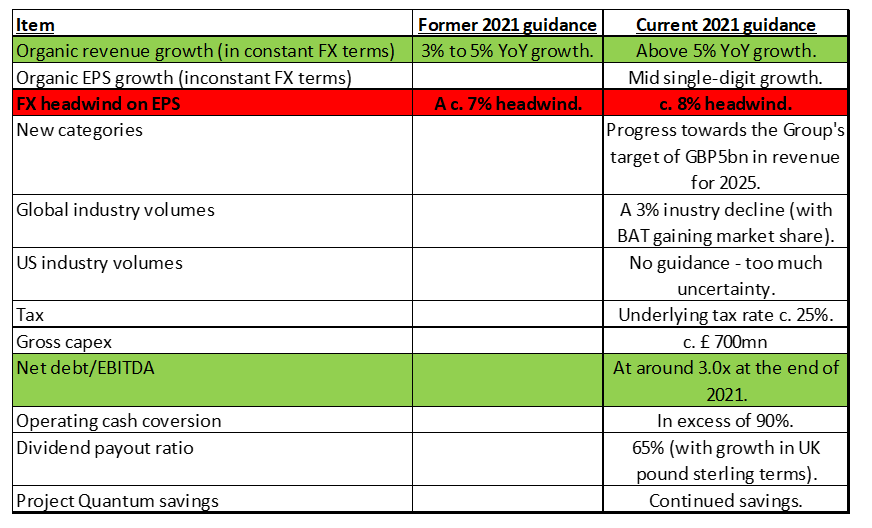

British American Tobacco (BTI) released a pre-close (its closed period commences on 28 June) trading update on Tuesday (8 June), which we summarise in Figure 1 below.

Figure 1: BTI trading update, latest vs previous guidance

Source: Anchor, BAT

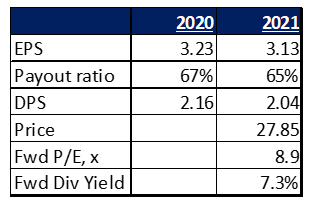

Assuming 5% constant foreign exchange (FX) EPS guidance and an 8% currency headwind (for an EPS decline of 3% YoY), the company’s metrics will look as follows (after the share price rallied c. 0.5% on 9 June):

Figure 2: BTI metrics 2020 vs 2021E, GBP/share (unless otherwise indicated)

Source: Anchor, Bloomberg

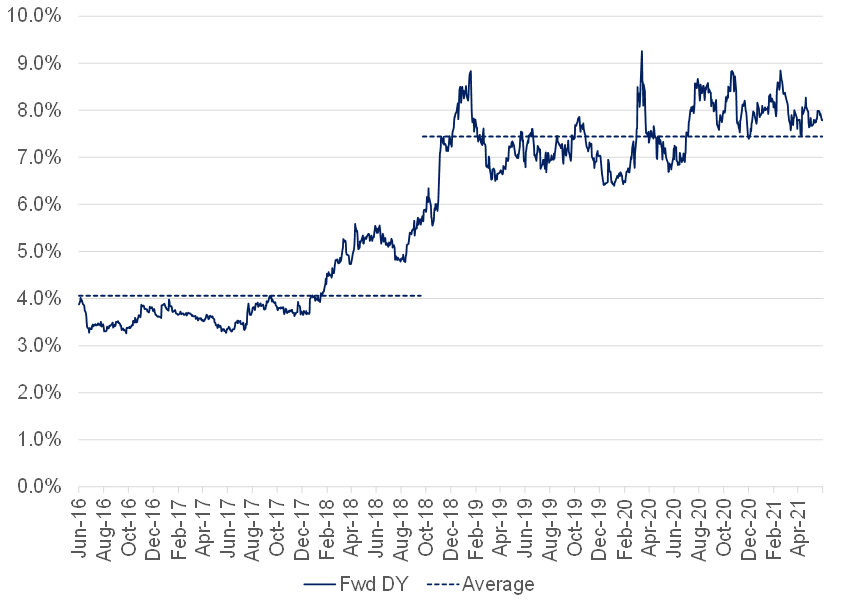

The forecast 2021 7.3% dividend yield (see Figure 2) is around the average of where BTI has traded since late-2018 when reports of a potential menthol ban in the US, started to scare investors (particularly given the significant leverage BTI took on in 2017 for the Reynolds purchase, which gave the Group c. 30% earnings exposure to US menthol smokers).

Figure 3: BTI forward DY, 2016 to date, %

Source: Anchor, Bloomberg

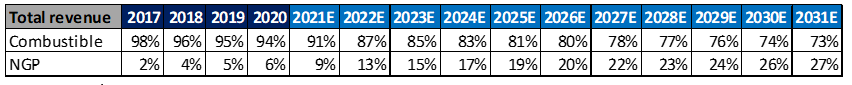

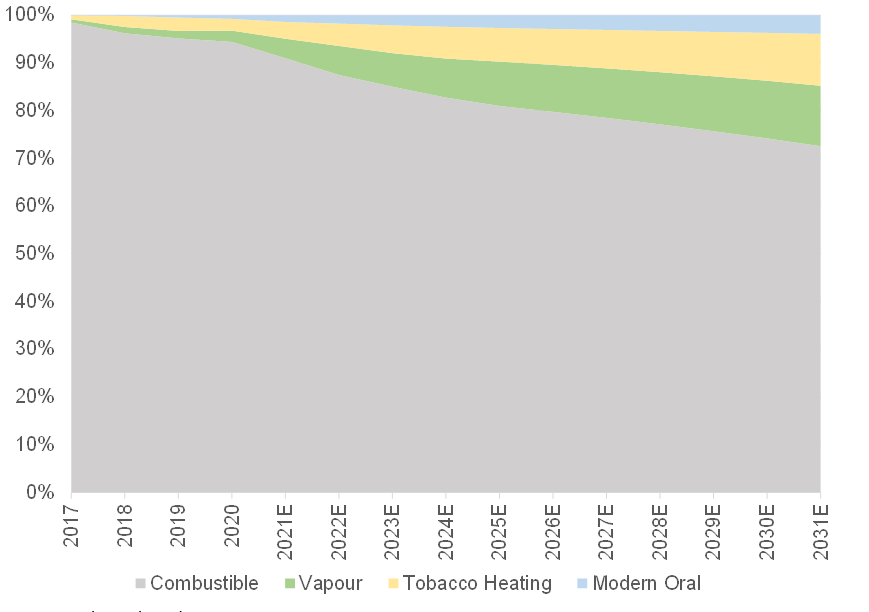

The trading update was positive for the Group’s Next Generation Products (NGP) segment, which recorded 10% QoQ user growth in 1Q21 (from 13.5mn to 14.9mn users). To provide some context, we note that NGPs account for c. 6% of Group net revenue, but this should increase to about 20% over the next 5 years:

Figure 4: BTI contribution to net revenue, combustible vs NGP segments, 2017 to 2031E

Source: Anchor, UBS

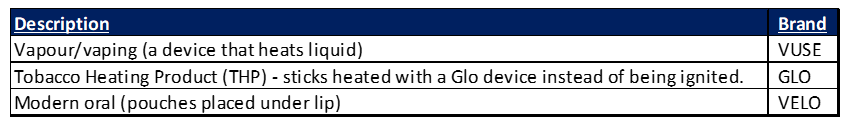

BTI’s NGPs are covered under three categories as per Figure 5 below.

Figure 5: BTI NGP categories/brands

Source: Anchor

The bulk of the growth in BTI’s NGP revenue is expected to come from vaping and tobacco heating products (THP).

Figure 6: BTI revenue contribution by category

Source: Anchor, Bloomberg, UBS

Figure 7: Consumers in BTI’s regions generally favour one particular NGP

Source: BTI company presentation

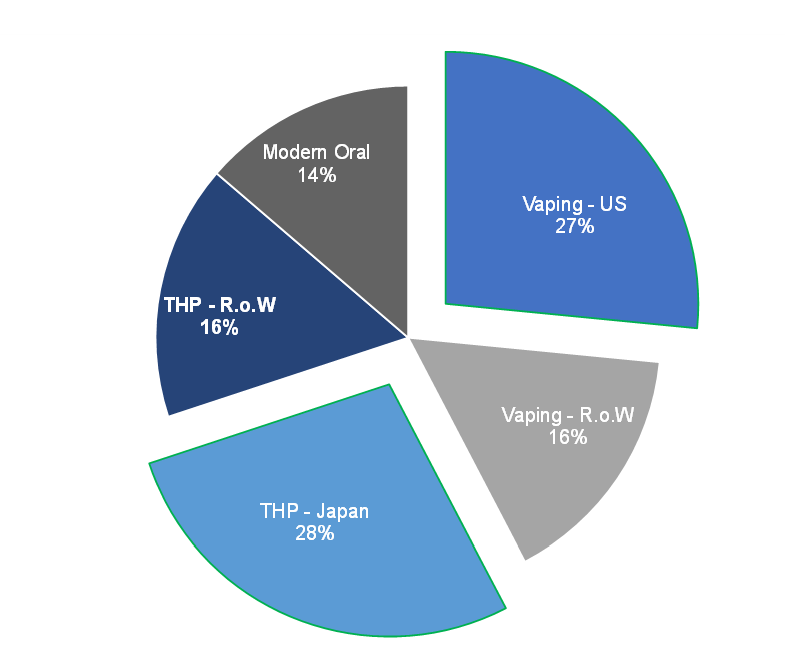

Currently, BTI’s NGP revenue is heavily skewed towards the US and Japan (as per Figure 8 below).

Figure 8: BTI’s 2020 NGP revenue breakdown

Source: Anchor, Bloomberg, company data

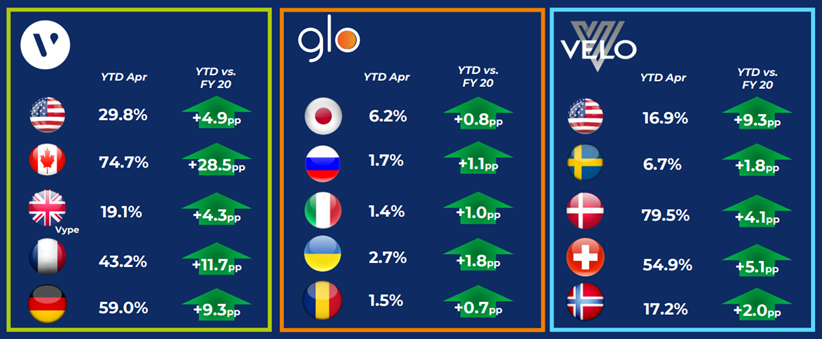

However, future revenue growth for THP looks set to come from Italy and Eastern Europe, which are starting to see their respective THP penetration growing fast off a low base. Importantly, BTI is also achieving market share gains in its key NGP markets.

Figure 9: BTI – strong market share growth across key NGP regions

Source: Company presentation Jun 2021

We note that BTI’s leverage guidance was also positive, with the Group’s net debt/EBITDA expected to reach c. 3x by the end of 2021 (most analysts which we follow had expectations for this to be c. 3.1x–3.4x by end-2021). In our view, this brings a potential re-rating catalyst closer, with BTI likely to reconsider share buybacks once its leverage drops comfortably below 3x.

Conclusion

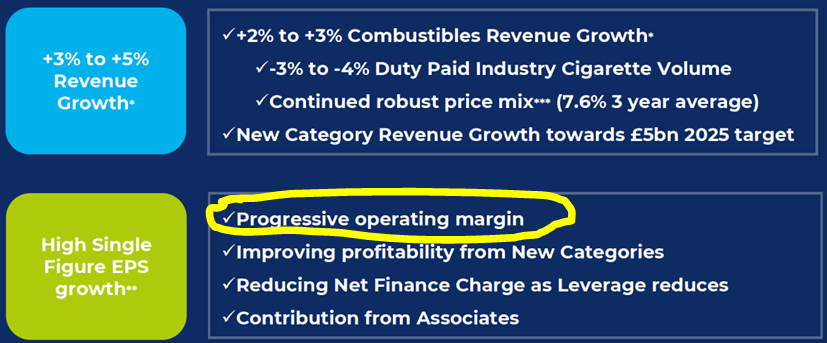

With constant FX revenue growth (5%-plus) likely tracking ahead of constant FX EPS growth (in the mid-single-digits) for FY21, the company’s progress on its operating margin seems to have stalled (likely because of the regional mix in combustibles, with stronger revenue growth in lower-margin emerging markets [EMs]). Hopefully, once those impacts are in the base, we will see a resumption of margin expansion, which is one of BTI’s keys to its goal of achieving high single-digit constant FX EPS growth.

Figure 10: BTI’s medium-term financial algorithm post-COVID-19

Source: Company presentation February 2021.

While we find it encouraging that the NGP segment is growing and taking market share – there is no update to the company’s previous guidance that this category will only become profitable in 2025. It would therefore appear to us that this progress is coming with incremental investment, which perhaps makes sense longer term but will likely become frustrating if it persists for the next couple of years.

We do not believe that any information provided in this trading update changes much about the company’s investment case and the Street’s earnings estimates are also largely unchanged in the wake of the conference call with management following the trading update.

While the share remains attractive to us from a yield perspective, catalysts for a re-rating seem to be a long way off, especially given that it is mostly likely to come from one of the following:

- A share buyback programme, which could start once BTI’s net debt gets comfortably below 3x EBITDA (which will probably only happen in late-2022).

- A significant legal victory in the US menthol ban (although this will likely only kick the can down the road).

- A rally in EM currencies (we note that this is more of a 1 PE event).

Until then, the total return for investors will likely come from the company’s DY and EPS growth, which is not a bad equation in our view (especially given that it is a largely hard currency equation), with a bit of FX and regulatory volatility thrown in to keep investors on their toes!